Shell and Tube Heat Exchanger Market Size, Share, Trends, Industry Analysis Report: By Material, End Use (Power Generation, Petrochemicals, Chemical, Food & Beverages, HVAC & Refrigerator, Pulp & Paper, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 117

- Format: PDF

- Report ID: PM5226

- Base Year: 2024

- Historical Data: 2020-2023

Shell and Tube Heat Exchanger Market Overview

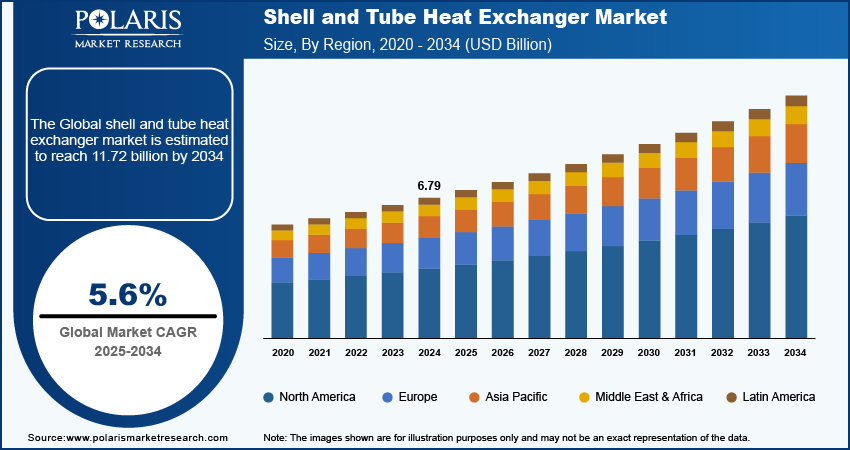

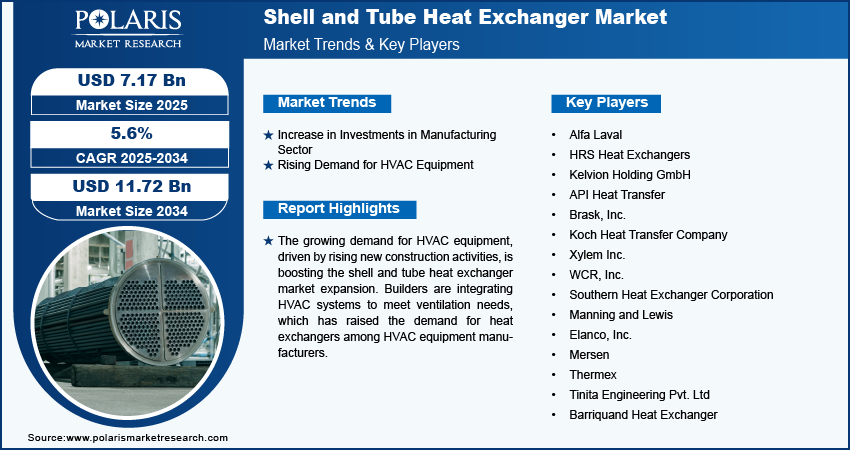

The shell and tube heat exchanger market size was valued at USD 6.79 billion in 2024. The market is projected to grow from USD 7.17 billion in 2025 to USD 11.72 billion by 2034, exhibiting a CAGR of 5.6% during 2025–2034.

A shell and tube heat exchanger consists of a series of tubes, one set carrying the hot fluid and another carrying the cold fluid, allowing heat transfer between them while keeping the fluids separate. This design is commonly used in various industries for its efficiency and ability to handle high pressures and temperatures.

The shell and tube exchanger market growth is attributed to rapid industrialization in major economies. This rapid expansion of industries is driving the demand for shell and tube exchangers among manufacturers for better energy efficiency. According to the Indian Ministry of Commerce and Industry, the Indian manufacturing sector grew by 11.8% in 2022, highlighting a robust growth in industries. Additionally, growing government initiatives in manufacturing are propelling this industrialization, leading to the shell and tube exchanger market expansion.

To Understand More About this Research: Request a Free Sample Report

The shell and tube heat exchanger market is experiencing growth due to the rising demand for energy efficiency. Industries and businesses are aiming to reduce energy costs and minimize their environmental impact, due to which they are increasingly adopting technologies that improve energy use. Shell and tube heat exchangers are ideal for various applications in power generation and manufacturing due to their energy-saving benefits. The imposition of stringent regulations on energy consumption further drives this demand, pushing companies to invest in more efficient equipment. This growing focus on sustainability and cost savings boosts the shell and tube heat exchanger market expansion.

Shell and Tube Heat Exchanger Market Dynamics

Shell and Tube Heat Exchanger Market Driver Analysis

Rising Investments in the Manufacturing Sector

The rising inflow of capital is supporting manufacturers to spend more on advanced equipment and cut down operation costs. According to the Indian Ministry of Commerce and Industry, foreign direct investment in the Indian Manufacturing sector has risen by 69% from 2014 to 2024, highlighting growth in investments in the manufacturing sector. This increase in investments is driving the demand for shell and tube heat exchanger systems, leading to the growth of the shell and tube heat exchanger market.

Growing Demand for HVAC Equipment

The demand for heating, ventilation, and air conditioning (HVAC) equipment is driven by a rise in the number of new constructions worldwide. Builders worldwide are integrating HVAC equipment in their projects to meet the demand for ventilation from buyers. Additionally, the growing disposable income of the general population is propelling the demand for HVAC equipment in residential. Growing demand for HVAC equipment is leading to the increase in procurements of shell and tube heat exchanger systems by HVAC equipment manufacturers, positively impacting the shell and tube heat exchanger market growth.

Shell and Tube Heat Exchanger Market Segment Insights

Shell and Tube Heat Exchanger Market Breakdown by Material Outlook

The shell and tube heat exchanger market, based on material, is segmented into haste alloy, titanium, nickel & nickel alloys, tantalum, steel, and others. In 2024, the steel segment experienced significant growth, with the highest CAGR in the global market. The cost-effectiveness of steel material drives this growth. Industries worldwide are increasingly looking out for efficient and cost-effective materials for production processes, due to which steel has become the preferred choice among manufacturers, thereby leading to market growth for the steel segment.

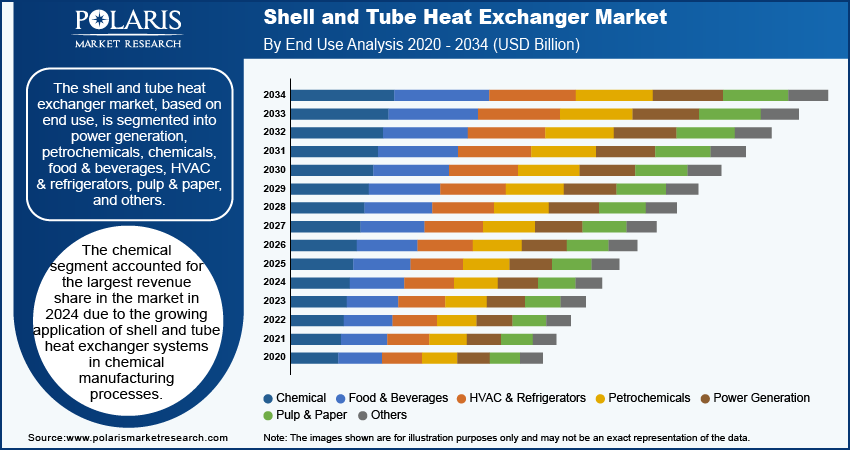

Shell and Tube Heat Exchanger Market Breakdown by End Use Outlook

The shell and tube heat exchanger market segmentation, based on end use, includes power generation, petrochemicals, chemicals, food & beverages, HVAC & refrigerators, pulp & paper, and others. The chemical segment accounted for the largest revenue share of the market in 2024 due to the growing application of shell and tube heat exchanger systems in chemical manufacturing processes. These systems are primarily employed for distillation, evaporation, and condensation during the manufacturing process. This increase in application propels the demand for shell and tube heat exchanger systems.

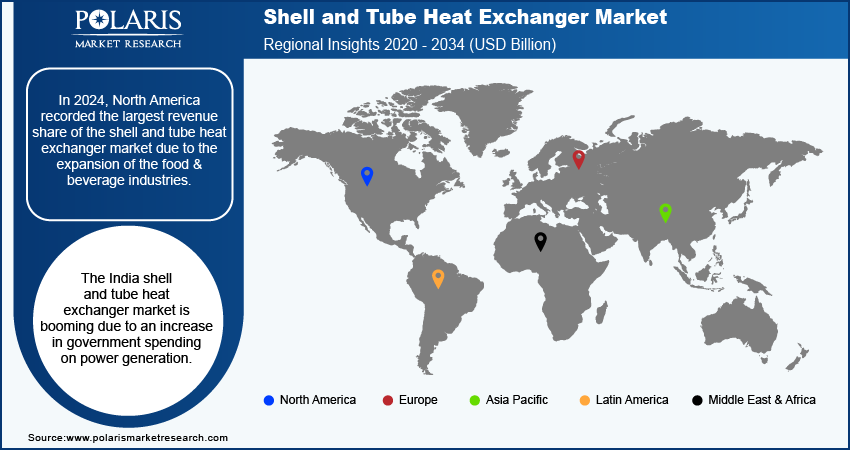

Shell and Tube Heat Exchanger Market Breakdown by Regional Outlook

By region, the study provides the shell and tube heat exchanger market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest revenue share of the market due to the expansion of the food & beverage industries. Food and beverage manufacturers are expanding their production capacities, which is driving the demand for shell and tube heat exchanger systems for pasteurization, sterilization, and food preservation processes. For instance, in February 2024, Döhler, a food processing company, doubled its manufacturing capacity in the Cartersville plant. Additionally, the entry of new players is propelling the growth of the food & beverage industry in the region, leading to an increase in the procurement of shell and tube heat exchanger systems. Therefore, the expansion of the food & beverage industry is fueling the shell and tube heat exchanger market growth in North America.

The Asia Pacific shell and tube heat exchanger market is experiencing significant growth due to an increase in strategic mergers and acquisitions between manufacturers. These partnerships help companies expand their market reach, improve production capabilities, and enhance technological innovations. As a result, the region is seeing stronger competition and a more efficient supply chain, leading to greater demand for heat exchangers in industries such as power generation, oil and gas, and chemical processing, thereby leading to the growth of the shell and tube heat exchanger market in the Asia Pacific.

The shell and tube heat exchanger market in India is experiencing substantial growth due to increased government spending on power generation. The country is investing more in its energy infrastructure. For instance, according to the Indian Ministry of New and Renewable Energy, in 2023, the Indian government allocated USD 420 million to power generation plants. This increase in government investment supports the expansion of the energy sector, driving the demand for heat exchangers and contributing to the shell and tube heat exchanger market expansion in India.

Shell and Tube Heat Exchanger Market – Key Players and Competitive Insights

The shell and tube heat exchanger market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demands of specific markets. This competitive environment is amplified by continuous progress in product offerings. Major players in the shell and tube heat exchanger market are Alfa Laval; HRS Heat Exchangers; Kelvion Holding GmbH; API Heat Transfer; Brask, Inc.; Koch Heat Transfer Company; Xylem Inc.; WCR, Inc.; Southern Heat Exchanger Corporation; Manning and Lewis; Elanco, Inc.; Mersen; Thermex; Tinita Engineering Pvt. Ltd; and Barriquand Heat Exchanger.

Alfa Laval AB, founded in 1883, is a Swedish multinational company headquartered in Lund, Sweden. Alfa Laval operates in heat transfer, separation, and fluid handling technologies. The company serves a diverse range of industries, including energy, food, marine, and pharmaceuticals, with a product portfolio that includes centrifuges, pumps, heat exchangers, and valves for optimizing processes related to heating, cooling, separating, and transporting liquids such as oil, water, chemicals, and food products. Alfa Laval operates through three primary business divisions—energy (which focuses on solutions for energy efficiency and sustainability), food & water (for food safety and water treatment), and marine (which provides equipment for shipbuilding and offshore operations). The company has a geographic presence in ∼100 countries, with a strong foothold in key markets such as the US, China, Denmark, and India.

Koch Heat Transfer operates in the design and manufacture of heat transfer equipment. The company's headquarters are located in Cypress, Texas, with additional facilities in Beaumont, Texas, and international operations in regions, including Europe, North America, and Asia Pacific. It focuses on optimized thermal, hydraulic, and mechanical solutions for a variety of industrial applications, particularly in refineries and chemical processing plants. The company provides tank heaters for heating liquids in storage tanks for industrial needs. Koch serves multiple sectors, including refining, petrochemical, power generation, gas processing, and food production. Recently, the Company's North American operations were acquired by Metalforms LLC, which will continue to manufacture Koch's products under the new brand Metalforms Heat Transfer. Koch's key offerings in heat exchangers are the TWISTED TUBE heat exchangers, which are designed to improve thermal efficiency while minimizing flow-induced vibrations, and hairpin heat exchangers, known for their compact design and suitability for various process conditions.

Key Companies in the Shell and Tube Heat Exchanger Industry Outlook

- Alfa Laval

- HRS Heat Exchangers

- Kelvion Holding GmbH

- API Heat Transfer

- Brask, Inc.

- Koch Heat Transfer Company

- Xylem Inc.

- WCR, Inc.

- Southern Heat Exchanger Corporation

- Manning and Lewis

- Elanco, Inc.

- Mersen

- Thermex

- Tinita Engineering Pvt. Ltd

- Barriquand Heat Exchanger

Shell and Tube Heat Exchanger Market Developments

August 2022: Alfa Laval launched a new heat exchanger series, Packinox+. Designed for demanding industrial applications, it enhances heat transfer efficiency and reduces energy consumption. The technology allows for diverse applications, including petrochemicals and carbon capture.

Shell and Tube Heat Exchanger Market Segmentation

By Material Outlook (Revenue USD Billion, 2020–2034)

- Haste Alloy

- Titanium

- Nickel & Nickel Alloys

- Tantalum

- Steel

- Stainless Steel

- Duplex Steel

- Carbon Steel

- Super Duplex Steel

- Others

- Others

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Power Generation

- Petrochemicals

- Chemical

- Food & Beverages

- HVAC & Refrigerators

- Pulp & Paper

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Shell and Tube Heat Exchanger Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.79 billion |

|

Market Size Value in 2025 |

USD 7.17 billion |

|

Revenue Forecast by 2034 |

USD 11.72 billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report End User |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The shell and tube heat exchanger market size was valued at USD 6.79 billion in 2024 and is projected to grow to USD 11.72 billion by 2034.

The global market is projected to register a CAGR of 5.6% during 2025–2034

North America held the largest market share in 2024.

A few key players in the market are Alfa Laval; HRS Heat Exchangers; Kelvion Holding GmbH; API Heat Transfer; Brask, Inc.; Koch Heat Transfer Company; Xylem Inc.; WCR, Inc.; Southern Heat Exchanger Corporation; Manning and Lewis; Elanco, Inc.; Mersen; Thermex; Tinita Engineering Pvt. Ltd; and Barriquand Heat Exchanger.

The steel segment is expected to experience significant growth with the highest CAGR in the global market due to the cost-effectiveness of steel material.

The chemical segment recorded the largest market share in 2024 due to the growing application of shell and tube heat exchanger systems in chemical manufacturing processes.