Shared Mobility Market Share, Size, Trends, Industry Analysis Report

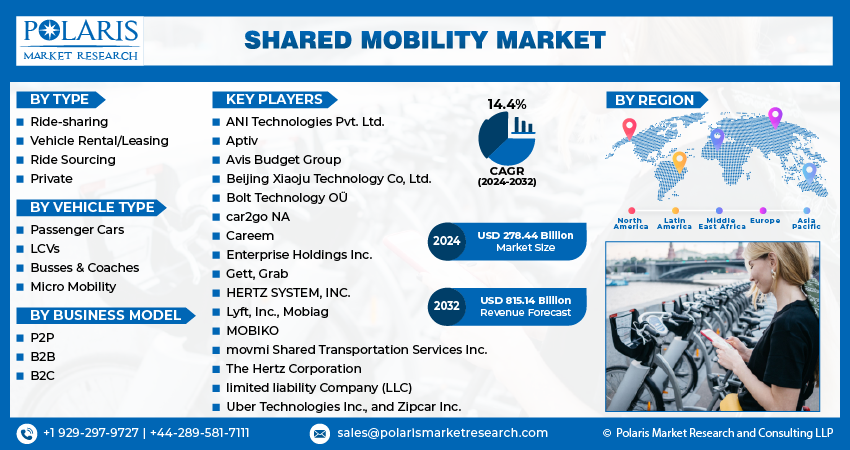

By Type (Ride-sharing, Vehicle Rental/Leasing, Ride Sourcing, Private), By Vehicle Type (Passenger Cars, LCVs, Busses & Coaches, Micro Mobility), By Business Model; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM2297

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

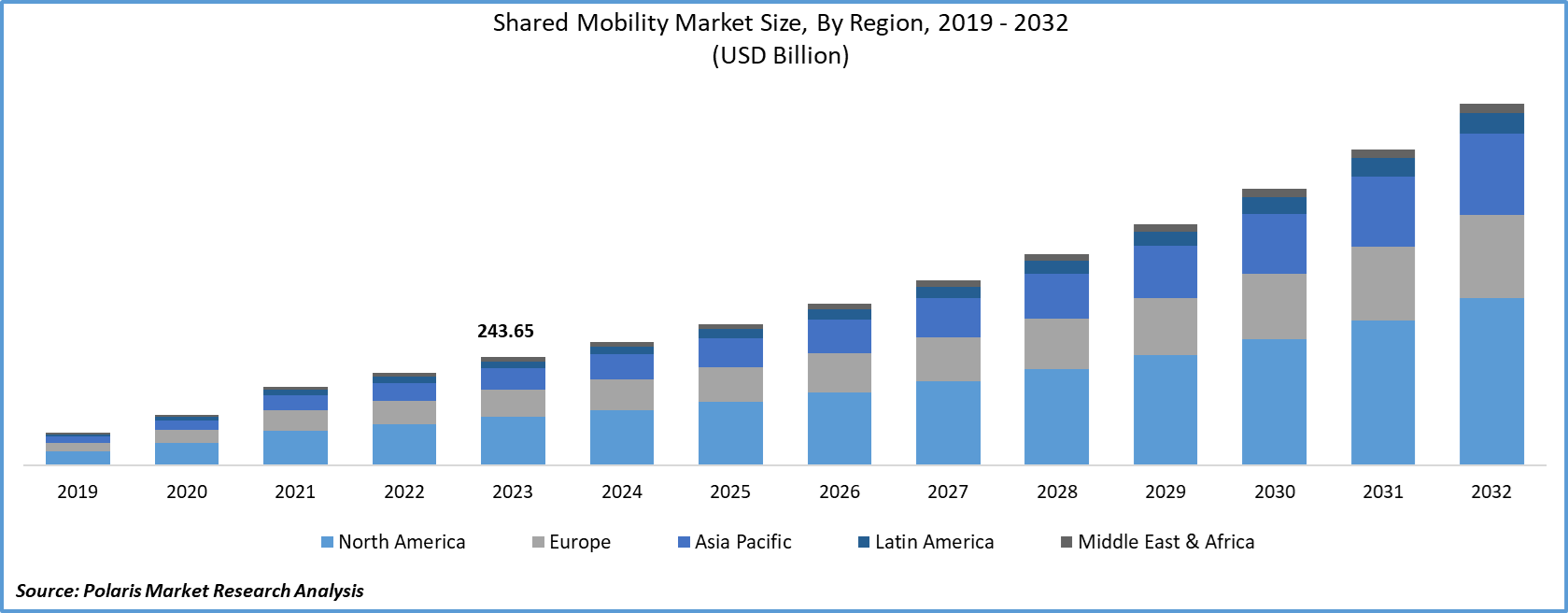

The global shared mobility market size was valued at USD 243.65 billion in 2023. The market is anticipated to grow from USD 278.44 billion in 2024 to USD 815.14 billion by 2032, exhibiting the CAGR of 14.4% during the forecast period.

The primary factors driving the market growth are rapid urbanization, increasing environmental concerns, and the high cost of vehicle ownership.

Know more about this report: request for sample pages

Shared mobility is a service offered by an organization, where they arrange the vehicle to enable commute for customers from one place to another. The organization owns a fleet of vehicles offering ride-sharing, vehicle rental, and others. The changing preference of the population towards more cost-effective travel solutions is further anticipated to drive the growth of the shared mobility market.

The spread of the COVID-19 reflects the downfall in the industry growth on account of the imposition of complete lockdowns across nations. The outbreak of the virus has negatively impacted the overall transportation industry. The lockdown measures and limited consumer and corporate spending are anticipated to hamper the shared mobility market development.

Further, customers are growing hesitant to use ride-sharing services even when lockdowns are lifted. Ride-sharing companies continuously retain customer trust by offering better sanitation and safety. However, the need for these is projected to bounce back as governments across nations are lifting lockdown restrictions.

Industry Dynamics

Growth Drivers

The primary factors contributing to the market's growth are increasing consumer awareness, growing government initiatives to promote the use of shared services, and the growth of the automobile industry, among others. Further, the increasing number of recent developments in the industry and the increasing funding raised by new startups in the industry are estimated to offer huge shared mobility market growth opportunities.

For instance, in July 2021, Zingbus, an intercity mobility startup, announced that they raised over USD 5.98 million to develop technology for a better traveler experience and expand their services in new locations. Further, in July 2020, Zoom car announced its partnership with ETO motors, boosting the electric transport services. In October 2021, Hertz Corp. ordered over 100,000 Tesla vehicles to include more electric vehicles in their car rental fleet. Additionally, In April 2021, Grab Holdings Inc., one of the leading Southeast Asia's sure apps offering shared mobility services, announced their intent to go public in the US and a partnership with Altimeter Growth, enabling the company to strengthen its strength its business momentum.

Report Segmentation

The market is primarily segmented on the basis of type, vehicle type, business model, and region.

|

By Type |

By Vehicle Type |

By Business Model |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

The ride-sharing segment holds the larger share in 2021 and is expected to lead the industry in the forecasting years. The segment's growth can be attributed to the changing customer preference as the majority of customers are opting for more cost-effective solutions globally. The ride-sharing services eliminate the need for individuals to own a vehicle and are convenient. Further, the increasing fuel prices and growing vehicle maintenance costs are anticipated to promote ride-sharing. The development of technologically advanced autonomous ride-sharing is expected to present huge growth opportunities to the segment.

The vehicle rental/leasing segment is projected to show the fastest growth rate in the forecasting years. The primary factor driving the segment's growth is the increase in the cost of vehicle ownership globally. According to AAA (American Automobile Association), the average cost for owning and operating a new vehicle increased to over USD 9,561 in 2020 compared to USD 9,282 in 2019. In this, depreciation contributes to over 43% of the ownership cost, while the other costs such as fuel & maintenance cost contribute to over 25% together. As the cities across nations are getting cramped on account of rising urbanization, owning a vehicle is becoming more of a liability than an asset. Further, the surge in international tourism is anticipated to drive the segment's growth.

Geographic Overview

Geographically, Asia Pacific is accounted for the highest shared mobility market shares in the global industry in 2021. This huge industry share can be attributed to the increasing demand for shared mobility services due to the increasing road traffic coupled with the huge costs of vehicle ownership in emerging countries such as India and China, among others. Further, the market's growth is fuelled by the rapid urbanization and improving living standards of the population in the emerging nations.

Moreover, North America shared mobility market is anticipated to exhibit progressive growth over the forecasting years. The fast growth of the industry in the Asia Pacific can be attributed to the rising demand for shared transportation solutions on account of the increasing number of corporate travelers in North America. The presence of key market players is estimated to offer huge market growth opportunities. Further, the growing developments in the North American shared mobility market is anticipated to boost the demand for shared mobility services.

For instance, In April 2021, Gett, a startup for ride-hailing, partnered with Curb Mobility to collaborate yellow taxis into Gett's application, which now covers over 65 cities across the United States. Further, in September 2021, Transdev, through RPTA (River Parishes Transit Authority) in Louisiana, the US and its subsidiary City way, is enhancing its services through the launch of innovative transit On-demand booking platform that enables the customers to book rides through the RPTA website, over the phone with customer service and mobile application.

Competitive Insight

Some of the major players operating in the global market include ANI Technologies Pvt. Ltd., Aptiv, Avis Budget Group, Beijing Xiaoju Technology Co, Ltd., Bolt Technology OÜ, car2go NA, Careem, Enterprise Holdings Inc., Gett, Grab, HERTZ SYSTEM, INC., Lyft, Inc., Mobiag, MOBIKO, movmi Shared Transportation Services Inc., The Hertz Corporation, limited liability Company (LLC), Uber Technologies Inc., and Zipcar Inc.

Shared Mobility Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 278.44 billion |

|

Revenue forecast in 2032 |

USD 815.14 billion |

|

CAGR |

14.4% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 - 2032 |

|

Segments covered |

By Type, By Vehicle Type, By Business Model, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ANI Technologies Pvt. Ltd., Aptiv, Avis Budget Group, Beijing Xiaoju Technology Co, Ltd., Bolt Technology OÜ, car2go NA, Careem, Enterprise Holdings Inc., Gett, Grab, HERTZ SYSTEM, INC., Lyft, Inc., Mobiag, MOBIKO, movmi Shared Transportation Services Inc., The Hertz Corporation, limited liability Company (LLC), Uber Technologies Inc., and Zipcar Inc. |