SGLT2 Inhibitors Market Size, Share, Trends, Industry Analysis Report: By Indication (Cardiovascular, Chronic Kidney Disease (CKD), Type 2 Diabetes, and Others), Drug, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 – 2034

- Published Date:Nov-2024

- Pages: 118

- Format: PDF

- Report ID: PM5187

- Base Year: 2024

- Historical Data: 2020-2023

SGLT2 Inhibitors Market Overview

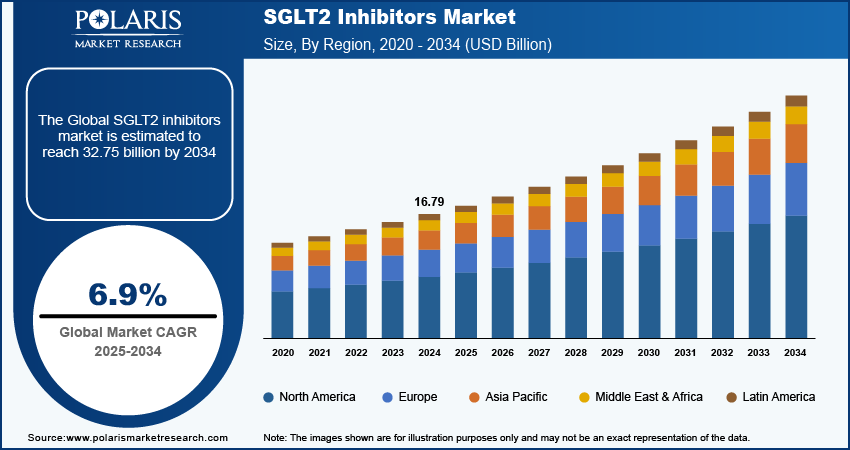

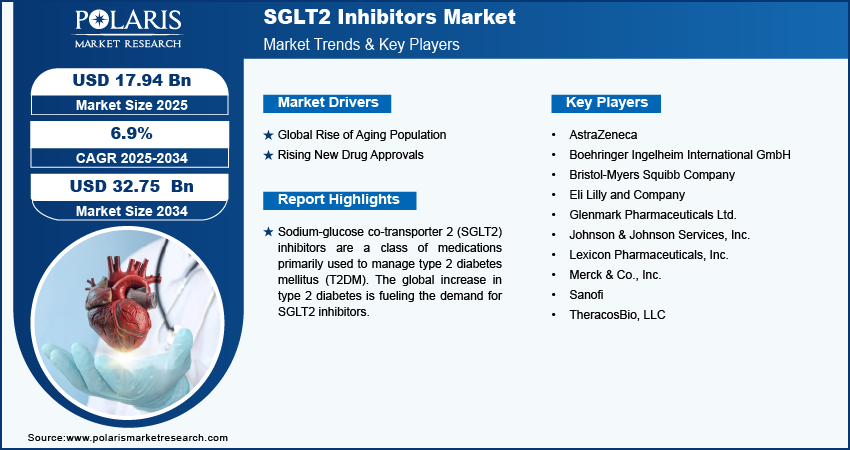

Global SGLT2 inhibitors market size was valued at USD 16.79 billion in 2024. The market is projected to grow from USD 17.94 billion in 2025 to USD 32.75 billion by 2034, exhibiting a CAGR of 6.9% during the forecast period.

Sodium-glucose co-transporter 2 (SGLT2) inhibitors are a class of medications primarily used to manage type 2 diabetes mellitus (T2DM). They work by inhibiting the SGLT2 proteins in the kidneys, which are responsible for reabsorbing glucose back into the bloodstream. SGLT2 inhibitors function by reducing the renal threshold for glucose, leading to increased urinary glucose excretion. This mechanism not only lowers blood glucose but also induces osmotic diuresis, which lead to weight loss and reduced blood pressure

The global increase in type 2 diabetes is fueling the demand for SGLT2 inhibitors. For instance, according to the International Diabetes Federation, approximately 537 million individuals were affected by diabetes worldwide in 2021, with more than 75% of adult diabetes cases occurring in low and middle-income countries. According to predictions, the number of new diabetes cases is expected to reach 643 million by 2030 and 783 million by 2045. Hence, the rising number of Type 2 diabetes patients is estimated to increase the SGLT2 inhibitors market share during the forecast period. Furthermore, heightened awareness and enhanced diagnostic techniques have resulted in a greater number of diabetes diagnoses, subsequently expanding the potential market for SGLT2 inhibitors.

To Understand More About this Research: Request a Free Sample Report

The clinical guidelines and recommendations of leading health organizations such as the American Diabetes Association (ADA) and the European Association for the Study of Diabetes (EASD) consistently support the use of SGLT2 inhibitors for specific patient groups. This endorsement has contributed to the increase of SGLT2 inhibitors. Moreover, ongoing research and development efforts are anticipated to lead to the introduction of advanced inhibitors. Innovations in drug formulations, synergistic combinations with other antidiabetic medications, and enhanced safety profiles are poised to propel market expansion further, leading to an increase in the SGLT2 inhibitors market share.

SGLT2 Inhibitors Market Drivers and Trends

Global Rise of Aging Population

The increasing geriatric population worldwide is contributing to the rising event of diabetes and related health conditions. Due to age-related factors, older individuals are at a higher risk of developing type 2 diabetes, resulting in a greater need for SGLT2 inhibitors.

For instance, according to the UN, the global population of individuals aged 65 years or older is expected to increase significantly, more than doubling from 761 million in 2021 to 1.6 billion in 2050. The demographic of those aged 80 years or older is expanding at an even faster rate. The increasing elderly population is at higher risk for future health issues such as type 2 diabetes. As a result, the market share of SGLT2 inhibitors is anticipated to experience substantial growth during the forecast period.

Rising New Drug Approvals

The expansion of the market is influenced by the approval of new drugs and expanded indications by regulatory bodies such as the FDA and EMA. SGLT2 inhibitors, known for their therapeutic applications, have gained increased approval for additional indications, including type 2 diabetes, heart failure, and chronic kidney disease.

For instance, in January 2023, bexagliflozin became the fifth orally administered SGLT-2 inhibitor to gain FDA approval for treating type 2 diabetes as an adjunct therapy to diet and exercise in the USA. The increase in drug approvals for the treatment and cure of various conditions has resulted in a rise in demand, thereby leading to an increase in the market share of SGLT-2 inhibitors.

SGLT2 Inhibitors Market Segment Insights

SGLT2 Inhibitors Market Breakdown by Indication Insights

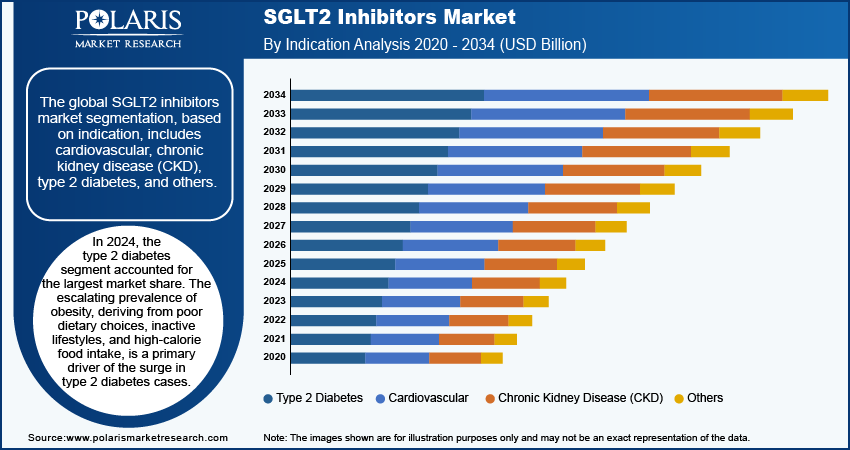

The global SGLT2 inhibitors market segmentation, based on indication, includes cardiovascular, chronic kidney disease (CKD), type 2 diabetes, and others. In 2024, the type 2 diabetes segment accounted for the largest market share. The escalating prevalence of obesity, deriving from poor dietary choices, inactive lifestyles, and high-calorie food intake, is a primary driver of the surge in type 2 diabetes cases. Modern lifestyles typically involve prolonged periods of physical inactivity driven by sedentary occupations, increased screen time, and reduced physical exertion. Physical inactivity is a notable risk factor for type 2 diabetes. Furthermore, a diet rich in processed foods, sugars, and unhealthy fats contributes to weight gain and insulin resistance, increasing the susceptibility to type 2 diabetes.

The widespread availability of cheap, energy-dense, and nutrient-deficient foods heightens this problem. The prevalence of type 2 diabetes exceeds that of type 1 diabetes and continues to rise due to global aging and increasing sedentary lifestyles. This trend highlights the heightened demand for effective treatments like SGLT2 inhibitors.

SGLT2 Inhibitors Market Breakdown by Distribution Channel Insights:

The global SGLT2 inhibitors market segmentation, based on distribution channels, includes hospital pharmacies, online pharmacies, and retail pharmacies. The online pharmacies category is expected to be the fastest-growing market segment. Online pharmacies provide unparalleled convenience to patients, especially those in remote or underserved areas. This expanded reach has contributed to the increased market penetration of SGLT2 inhibitors, making them more widely accessible. In addition to convenience, e-pharmacies often provide competitive pricing and discounts, particularly for long-term medications such as SGLT2 inhibitors. The global proliferation of e-commerce and digital health platforms has normalized the use of online pharmacies for healthcare needs, leading to greater trust and acceptance among patients.

SGLT2 Inhibitors Market Regional Insights:

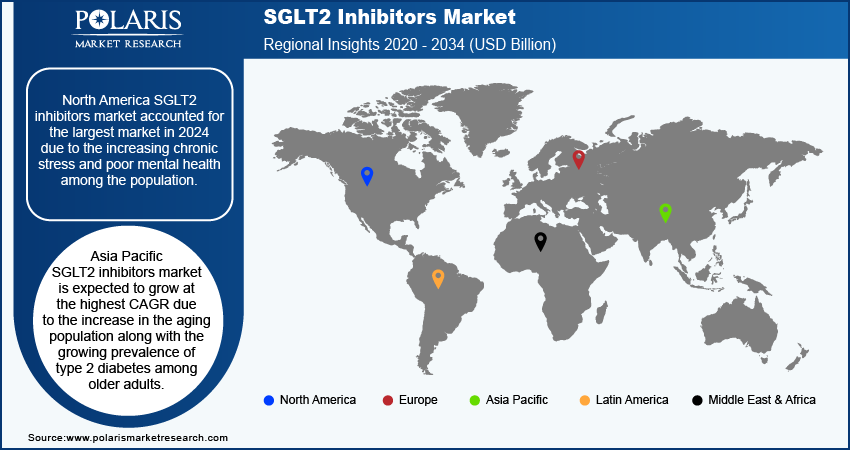

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America SGLT2 inhibitors market accounted for the largest market in 2024 due to the increasing chronic stress and poor mental. Additionally, the increasing prevalence of diabetes patients in North America has led to a higher demand for SGLT2 inhibitors in the region. For instance, in the US, 38.4 million people of all ages, or 11.6% of the population, had diabetes. Furthermore, 38.1 million adults aged 18 years or older, or 14.7% of all US adults, had diabetes. This surge in diabetes cases has driven a significant increase in the utilization of SGLT2 inhibitors, consequently boosting the market share in the North American region.

The US accounted for the largest market share in 2024 in the region due to the high obesity rates. Obesity is a major risk factor for type 2 diabetes. The substantial prevalence of obesity is directly linked to the increasing incidence of diabetes and the consequent demand for potent medications such as SGLT2 inhibitors.

Asia Pacific SGLT2 inhibitors market is expected to grow at the highest CAGR due to the region experiencing an increase in the aging population, leading to a heightened prevalence of type 2 diabetes among older adults. For instance, according to US Census Bureau, Asia's population surpassed 4.5 billion in 2020, including over one billion individuals in both China and India. The region is home to more than half of the world's population. In 2020, there were approximately 414 million Asians aged 65 and older, a number projected to exceed 1.2 billion by 2060. This demographic shift suggests that one in every ten people worldwide will be an older Asian individual. In this growing elderly population, the prevalence of health issues such as type 2 diabetes is expected to rise. Consequently, the market share of SGLT2 inhibitors is poised for significant expansion during the forecast period.

SGLT2 inhibitors market in China is also expected to experience significant growth over the forecast period due to the rising prevalence of diabetes patients. For instance, according to the International Diabetes Federation (IDF), in 2021, around 1.08 billion people suffered from diabetes in China. Among them, approximately 13% of the population were adults.

SGLT2 Inhibitors Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the SGLT2 inhibitors market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the SGLT2 inhibitors industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global SGLT2 inhibitors industry to benefit clients and increase the market sector. In recent years, the SGLT2 inhibitors market has offered some technological advancements. Major players in the market include AstraZeneca; Boehringer Ingelheim International GmbH; Bristol-Myers Squibb Company; Eli Lilly and Company; Glenmark Pharmaceuticals Ltd.; Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.); Lexicon Pharmaceuticals, Inc.; Merck & Co., Inc.; Sanofi; and TheracosBio, LLC.

Boehringer Ingelheim was established in 1885. The company operates in the Human Pharmaceutical and Animal Health sectors. The human pharmaceutical division focuses on therapeutic areas such as Heart Diseases, Metabolic Diseases, Chronic Kidney Diseases, Cancer, Lung Diseases, Skin and Inflammatory Diseases, Mental Disorders, and Retinal Diseases. In December 2023, Boehringer Ingelheim received European Commission approval for Jardiance (empagliflozin) 10mg and 25mg tablets to be used as an adjunct to diet and exercise for the treatment of inadequately controlled type 2 diabetes mellitus in children aged ten years and older in the European Union.

Glenmark Pharmaceuticals Limited is engaged in the development, manufacturing, and marketing of pharmaceutical products across various regions including India, North America, Latin America, Europe, Japan, and internationally. The company provides branded and generic formulations in therapeutic areas such as dermatology, respiratory, and oncology, along with a range of active pharmaceutical ingredients. In October 2023, Glenmark Pharmaceuticals Limited launched its first triple-drug fixed-dose combination (FDC) in India, which includes Teneligliptin, Dapagliflozin, and Metformin under the brand name Zita DM. This combination contains Teneligliptin (20mg), Dapagliflozin (10mg), and Metformin SR (500mg/1000mg) in a fixed dose.

Key Companies in SGLT2 Inhibitors Market

- AstraZeneca

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Glenmark Pharmaceuticals Ltd.

- Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.)

- Lexicon Pharmaceuticals, Inc.

- Merck & Co., Inc.

- Sanofi

- TheracosBio, LLC

SGLT2 Inhibitors Industry Developments

- June 2024: AstraZeneca’s drug Farxiga (dapagliflozin) received FDA approval for enhancing glycaemic control in pediatric patients aged 10 years and older with type-2 diabetes (T2D).

- April 2024: Boehringer Ingelheim International GmbH reported that its EMPACT-MI phase 3 clinical trial demonstrated a 10% decrease in the risk of hospitalization for heart failure in patients following the administration of Jardiance (empagliflozin).

- September 2023: Eli Lilly and Company and Boehringer Ingelheim International GmbH announced that the US FDA approved Jardiance (empagliflozin) for its efficacy in reducing the risk of cardiovascular mortality and hospitalization for heart failure in patients with chronic kidney disease.

SGLT2 Inhibitors Market Segmentation

By Indication Outlook (Revenue, USD Billion, 2020–2034)

- Cardiovascular

- Chronic Kidney Disease (CKD)

- Type 2 Diabetes

- Others

By Drug Outlook (Revenue, USD Billion, 2020–2034)

- Farxiga (Dapagliflozin)

- Inpefa (Sotagliflozin)

- Invokana (Canagliflozin)

- Jardiance (Empagliflozin)

- Qtern (Dapagliflozin/Saxagliptin)

- Other SGLT2 Inhibitors

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

SGLT2 Inhibitors Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 16.79 billion |

|

Market Size Value in 2025 |

USD 17.94 billion |

|

Revenue Forecast in 2034 |

USD 32.75 billion |

|

CAGR |

6.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global SGLT2 inhibitors market size was valued at USD 16.79 billion in 2024 and is expected to reach USD 32.75 billion by 2034.

The global market is projected to register a CAGR of 6.9% during the forecast period 2025-2034.

North America had the largest share of the global market in 2024.

The key players in the market are AstraZeneca; Boehringer Ingelheim International GmbH; Bristol-Myers Squibb Company; Eli Lilly and Company; Glenmark Pharmaceuticals Ltd.; Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.); Lexicon Pharmaceuticals, Inc.; Merck & Co., Inc.; Sanofi; and TheracosBio, LLC.

The type 2 diabetes category dominated the market in 2024.

The online pharmacy had the fastest share in the global market.