Service Robotics Market Share, Size, Trends, Industry Analysis Report, By Type (Professional and Personal); By Component; By Environment; By End Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM1594

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

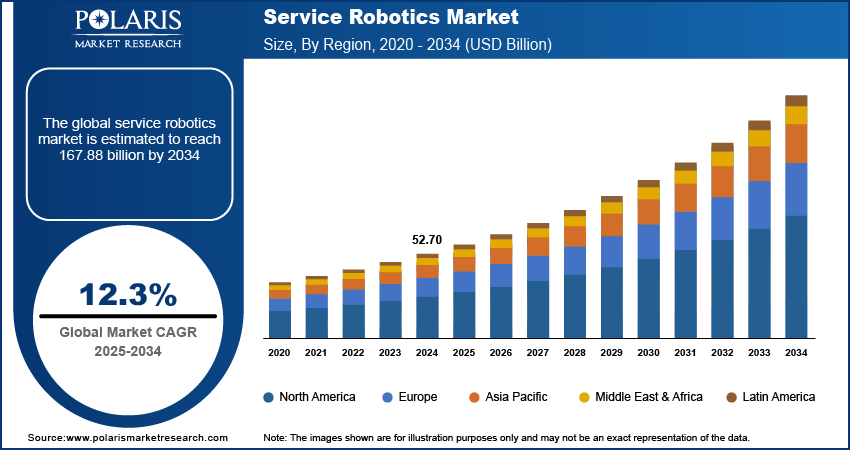

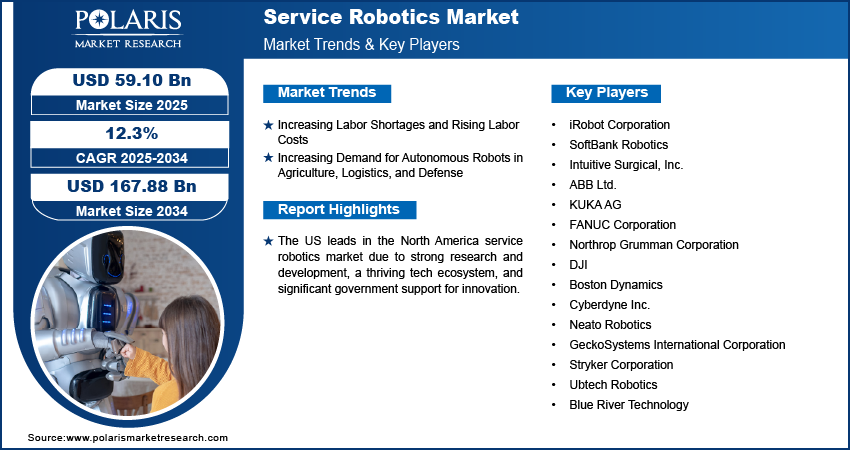

The global service robotics market was valued at USD 38.92 billion in 2023 and is expected to grow at a CAGR of 21.6% during the forecast period. Service robots can perform useful human tasks, excluding industrial automation Components. Service robots are designed to be partially or fully autonomous. Service robots are categorized into professional robots and personal robots. Professional service robots assist humans in commercial areas, including delivery, firefighting, rehabilitation, and surgical robots.

Know more about this report: Request for sample pages

The main features of a service robot needed in professional industries include a range of motion, accuracy, speed, force compliance, and safety. For commercial sectors, these robots require higher precision than personal usage. Some emerging Components of professional robots include national security Components, agriculture & dairy farming, construction, monitoring, and others.

Personal service robots are mainly used for domestic and entertainment purposes. Some latest offerings of domestic robots in the global market are Roomba, Pepper, Nao, Jibo, Leka social robot, AIBO, ASIMO, and others. These robots are equipped with advanced features such as emotional sensors, artificial intelligence, virtual reality, augmented reality, knowledge sharing, machine vision, force sensing, speech recognition, and artificial intelligence.

Due to the effects of the economic recession in various well-known nations, the growth of the worldwide market was significantly reduced. However, the expansion in the sales of service robots during the pandemic was supported by growing demand for automation and expanding social segregation practices globally. After the COVID-19 pandemic, adopting robot-based operations and developing automation enhanced the need for these robots to boost integrated automation across sectors.

The development of this technology and the use of Big Data and Artificial Intelligence (AI) in service robotics drive demand for these robots throughout the projected period. Additionally, it is anticipated that there will be high demand for technologically sophisticated robots with durable build quality after COVID-19, particularly from the healthcare and hospitality sectors.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The cost of manufacturing robots has greatly decreased due to the rapid development of technology and the increase in robot production. The average cost of a robot has reduced over the past 30 years by half in real terms and significantly more compared to workforce expenditures.

Additionally, it is projected that the production of robots would relocate to low-cost locations, further lowering the manufacturing cost due to the increased demand for robots from emerging nations. Major manufacturing economies' increased labor costs relative to the price of robots also contribute to an increase in the attractiveness of pricing dynamics, which supports service robotics market expansion.

Service robots are also anticipated to open up a wide range of industrial sectors in developing nations to enormous prospects. These nations need to catch up because of a need for more trained personnel. However, considerable opportunities will be made available in both the industrial and domestic sectors due to the advent of automation and the usage of robots. Robotics has been employed for a very long time, which has assisted in its maturation.

As a result, these gadgets are incredibly safe for workers and may add value to the industry’s operations. Due to the aging populations in these nations, the medical technology industry in the Asia Pacific area is expanding. As a result, service robotics is more in demand in this region. These service robots are used for domestic and private functions, which is quite helpful.

Report Segmentation

The market is primarily segmented based on type, component, environment, end-use, and region.

|

By Type |

By Component |

By Environment |

By End Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

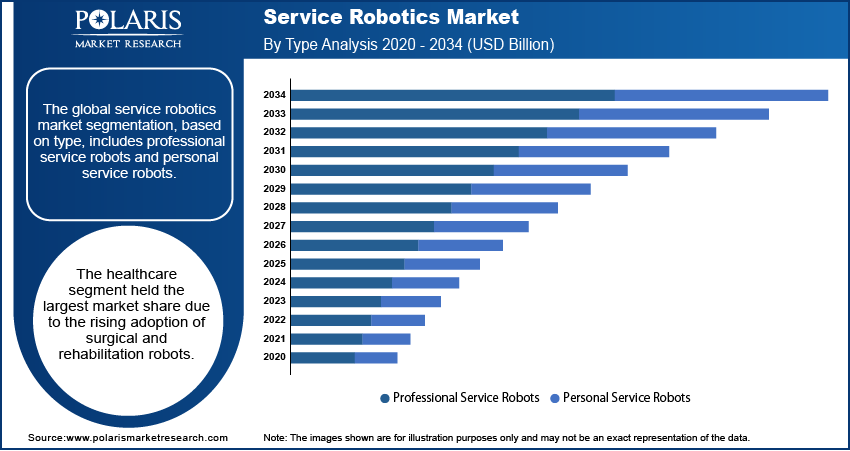

Professional Segment Held the Highest Market Share in 2022

The professional type has a larger market share. It is expected to expand quickly over the coming years, mostly due to the rising need for service robots in the logistics, construction, military, and medicine industries. In addition, the widespread use of automation and mobility in industrial sectors substantially influences market share overall. Increased labor costs, increased R&D expenditures, a lack of trained personnel, and growing public awareness of service robots and industrial automation all contribute to the segment's continued rise.

It is projected that the personal robot’s segment will expand significantly. These robots are often employed in homes to assist, educate, and tutor people. Personal robots are also helpful for entertainment, lawn mowing, pool cleaning, floor cleaning, and vacuuming. Over the projection period, it is anticipated that these sorts of robots will have a greater future in the European, ASEAN, and American areas. However, demand needs to be improved because of its operability and battery capacity.

Hardware Segment Dominated the Market in 2022

The hardware segment dominated the global service robotics industry. The hardware segment accounted for the highest share owing to the effective use of hardware equipment such as sensors, cameras, switches, relays, dimmers, storage devices, monitors, thermostats, valves, actuators, and pumps.

Defense Segment Accounted for a Considerable Market Share in 2022

Service robots used for defense accounted for a sizeable market share due to their application in uncrewed aerial vehicles, among other things. About 25% of the professional robotics industry was made up of field robots employed in agriculture, forestry, milling, mining, etc. Due to their assistance in rehabilitation and robot-assisted surgery, medical robots have become widely accepted.

However, medical robot systems are expensive, and their providers offer them leasing agreements. Additionally, service robots are employed in various fields, including mobile platforms, construction, cleaning, undersea, inspection, security, and rescue.

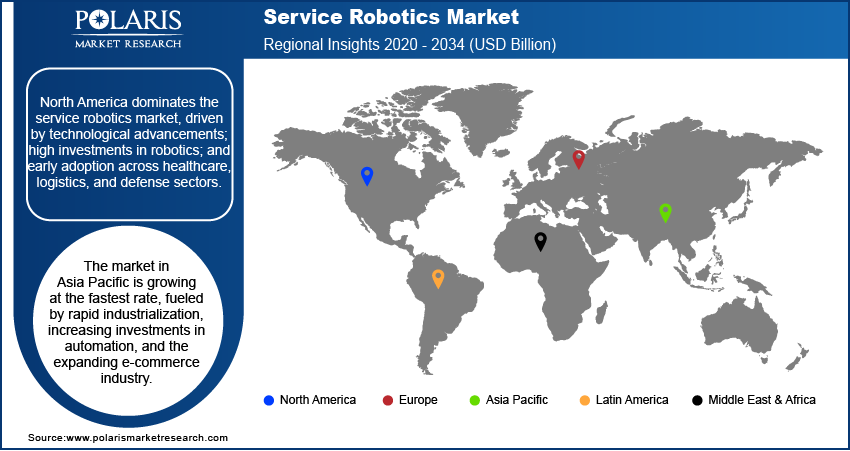

Asia Pacific is Projected to Show Major Growth in 2022

Asia Pacific is expected to have significant development because of the region's growing industrial production levels of automation and technology improvement. The driving drivers behind the Asia Pacific market are the substantial and influential economies of Japan, China, and India.

In addition, the two key growth drivers for industrial automation are encouraging government policies in the manufacturing sector and increasing attention to economic diversification in emerging economies. As a result, there is more demand for this kind of robot. The most encouraging driver of the market's significant expansion in the region can be found to be the rising robot density across the regional market.

Over the projection period, China is expected to develop significantly while also exhibiting the greatest CAGR. Due to significant expenditures made in the industrial sectors, the nation dominates the market. China is a manufacturing hub with cheap manufacturing costs, low labor costs, and low raw material costs. This helps them generate significant profit from other countries in the area.

However, domestic manufacturers with local consumers as their target audience have a relatively poor position in the market despite having a sustainable and lucrative production strategy that lets them create a significant manufacturing cluster in the country's market.

Competitive Insight

Some of the major players operating in the global market include Intuitive Surgical, Inc., Adept Technology Inc., Irobot Corporation, Kuka AG, Aethon Inc., Bluefin Robotics, and GeckoSystems Intl. Corp., Panasonic Corporation, Yujin Robot, Co., Ltd., Robert Bosch GmbH, Parrot SA, and Kongsberg Maritime.

Recent Developments

- In February 2022, Ricoh acquired Axon Ivy AG as part of a strategic investment to increase the capabilities of its digital process automation.

- In November 2021, KUKA AG and MHP worked together on the Smart Intelligence Robotic Project Cockpit (SIRPCO).

Service Robotics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 47.2 billion |

|

Revenue forecast in 2032 |

USD 225.56 billion |

|

CAGR |

21.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Component, By Environment, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Intuitive Surgical, Inc., Adept Technology Inc., Irobot Corporation, Kuka AG, Aethon Inc., Bluefin Robotics, and GeckoSystems Intl. Corp., Panasonic Corporation, Yujin Robot, Co., Ltd., Robert Bosch GmbH, Parrot SA, and Kongsberg Maritime. |

Explore the landscape of Service Robotics in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Subdural Electrodes Market Size, Share 2024 Research Report

Silica Flour Market Size, Share 2024 Research Report

Biophotonics Market Size, Share 2024 Research Report

Healthcare Data Integration Market Size, Share 2024 Research Report

AI in Telecommunication Market Size, Share 2024 Research Report

FAQ's

The global service robotics market size is expected to reach USD 225.56 billion by 2032.

Key players in the service robotics market are Intuitive Surgical, Inc., Adept Technology Inc., Irobot Corporation, Kuka AG, Aethon Inc., Bluefin Robotics, and GeckoSystems Intl. Corp., Panasonic Corporation, Yujin Robot, Co., Ltd., Robert Bosch GmbH, Parrot SA

Asia Pacific contribute notably towards the global service robotics market.

The global service robotics market expected to grow at a CAGR of 21.6% during the forecast period.

The service robotics market report covering key segments are type, component, environment, end-use, and region.