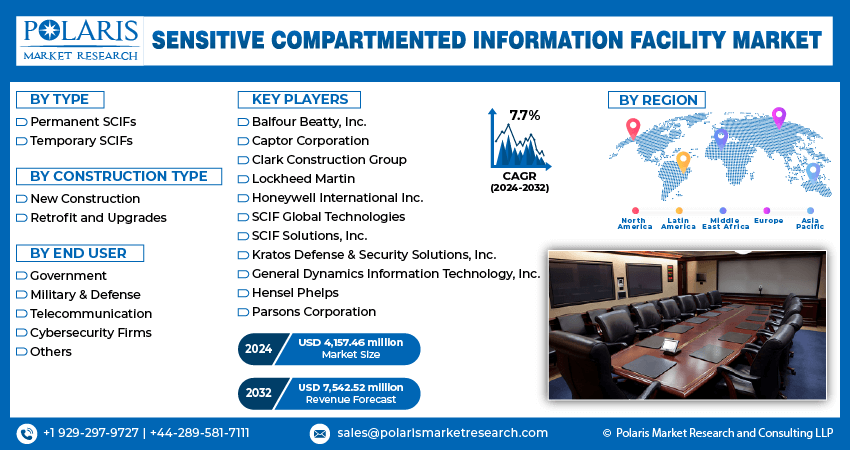

Sensitive Compartmented Information Facility Market Size, Share, Trends, Industry Analysis Report: By Type (Permanent SCIFs and Temporary SCIFs), By Construction Type, By End User, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast 2024–2032

- Published Date:Aug-2024

- Pages: 128

- Format: PDF

- Report ID: PM5028

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

The global sensitive compartmented information facility market size was valued at USD 3,872.09 million in 2023. The SCIF market is projected to grow from USD 4,157.46 million in 2024 to USD 7,542.52 million by 2032, exhibiting a CAGR of 7.7% during the forecast period.

The sensitive compartmented information facility (SCIF) market is centered around specialized facilities designed to handle and protect classified information. SCIFs are essential for ensuring the security of sensitive data, particularly within the defense, intelligence, and government sectors. These facilities are equipped with advanced physical and technical safeguards to prevent unauthorized access and ensure that highly classified information remains secure. The government's increased defense and intelligence spending in response to growing geopolitical tensions is driving demand for sensitive compartmented information facilities to handle classified information securely. Furthermore, advancements in secure communication systems, encryption, and surveillance technologies are boosting the capabilities of sensitive compartmented information facilities, thereby propelling market growth.

To Understand More About this Research:Request a Free Sample Report

The increasing number of organizations globally and the widespread adoption of remote work models is driving demand for sensitive compartmented information facilities to protect sensitive data, thereby fueling market expansion. Moreover, the increasing awareness of information security is driving the adoption of SCIFs in private sectors such as finance, healthcare, and critical infrastructure. Thus, the sensitive compartmented information facility market is expected to grow over the forecast period.

Sensitive Compartmented Information Facility Market Drivers and Trends

Rising Cybersecurity Threats is Driving Market Growth

The increasing number of cybersecurity threats is driving significant growth in the sensitive compartmented information facility market. For instance, the 2023 annual data breach report highlighted a 78% increase in data compromises in 2023 (3,205) compared to 2022 (1,801), setting a new record for the ITRC and representing a 72% increase from the previous high in 2021 (1,860). This surge in data breaches is leading to an increased demand for secure environments to protect classified and sensitive information, particularly in the government and defense sectors. SCIFs provide robust solutions by offering highly controlled and secure spaces that prevent unauthorized access and protect against potential breaches. This growing awareness of cybersecurity risks is encouraging significant investments in SCIFs by organizations, especially in national security and intelligence, to ensure the security of their most critical information. As a result, the expanding cyber threat is contributing to the growth of the sensitive compartmented information facility market.

Expansion of Urban Areas and Critical Infrastructure Projects

The expansion of urban areas and critical infrastructure projects, especially in emerging markets, is playing a significant role in the growth of the sensitive compartmented information facility market. Rapid urbanization and infrastructure expansion in the regions have increased the need to protect strategic assets such as government buildings, data centers, and military installations, which house sensitive information crucial to national security and economic stability. This has led to a growing demand for SCIFs to secure these environments from unauthorized access and cyber threats. Integrating SCIFs into the construction of new urban centers and the modernization of existing infrastructure presents opportunities for emerging markets to enhance their security in line with global standards. This trend fuels demand for sensitive compartmented information facilities, thereby driving the market demand.

Sensitive Compartmented Information Facility Market Segment Insights

Sensitive Compartmented Information Facility Market Breakdown by Type Insights

The global sensitive compartmented information facility market segmentation, based on type, includes permanent SCIFs and temporary SCIFs. In 2023, the permanent SCIFs segment experienced a significant growth in market shares due to the increasing need for long-term, secure facilities in government, military, and intelligence operations. The surge in cybersecurity threats prompted organizations to expand their classified operations, resulting in a rising demand for SCIFs that offer continuous, top-level protection for sensitive information. Permanent SCIFs, featuring robust construction and advanced security features, are well-suited to fulfill these needs, providing dependable, secure environments for storing and managing classified data over prolonged periods. Furthermore, the increase in infrastructure development, particularly in emerging markets, and the expansion of urban areas contributed to the demand for permanent SCIFs as these regions aimed to establish secure, centralized facilities for their strategic assets. This enhanced emphasis on long-term security solutions fueled the growth of the permanent SCIFs segment.

Sensitive Compartmented Information Facility Market Breakdown by End User Insights:

The global sensitive compartmented information facility market segmentation, based on end user, includes government, military & defense, telecommunication, cybersecurity firms, and others. The government category is expected to grow significantly over the forecast period due to the increasing stress on national security and the protection of classified information. Governments are also expanding their intelligence, defense, and cybersecurity operations, all of which require secure environments to ensure critical information to protected from unauthorized access. For instance, in January 2023, Hensel Phelps authorized to undertake the construction of the third phase of the U.S. Army Pacific’s (USARPAC) new Command and Control Facility (C2F) Complex located on Fort Shafter. This project encompasses the development of a sensitive compartmented information facility space. Therefore, the focus on securing national assets and maintaining information integrity is expected to propel significant growth in the government category, further driving the sensitive compartmented information facility market over the forecast period.

Sensitive Compartmented Information Facility Market, Segmental Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

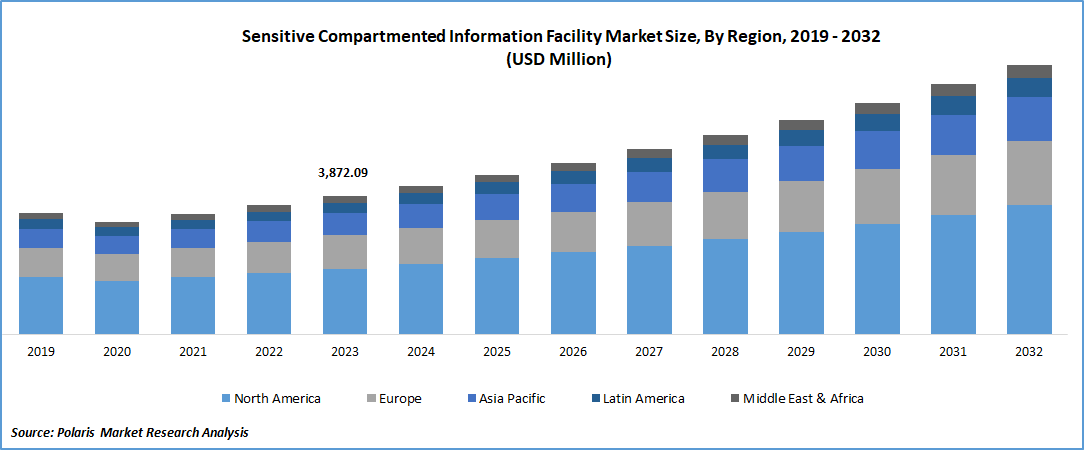

Regional Insights

By region, the study provides market insights into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The North America sensitive compartmented information facility market accounted for the largest market share in 2023 due to increased government investment in safeguarding critical information. The U.S. government, in response to rising cybersecurity threats and intelligence risks, has prioritized the development and maintenance of SCIFs to protect national security interests. This heightened focus has led to substantial federal budget allocations for bolstering cybersecurity, expanding intelligence operations, and ensuring compliance with stringent information security regulations, thereby fueling the demand for SCIFs across various government agencies. Furthermore, the presence of major defense contractors and technology firms in North America has highlighted the need for secure facilities, contributing to the sensitive compartmented information facility market growth in the region.

The U.S. sensitive compartmented information facility market had the largest market share in 2023 due to substantial government investments aimed at enhancing the security of classified information, driven by the growing need to protect against cyber threats and support expanding defense and intelligence operations.

Sensitive Compartmented Information Facility Market, Regional Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

The Asia Pacific sensitive compartmented information facility market is expected to register a highest CAGR during the forecast period due to countries such as China, India, and Japan expanding their defense and intelligence capabilities, which include the development of SCIFs to safeguard classified communications and data. Additionally, the rapid adoption of advanced technologies in the region, such as cybersecurity measures and secure communication systems, is further fueling demand for SCIFs. Economic growth and infrastructure development in the Asia Pacific are also contributing to the need for these facilities, particularly as nations seek to protect strategic assets and enhance their security infrastructure. This combination of heightened security concerns, technological advancements, and infrastructure expansion is driving the growth of the sensitive compartmented information facility market in the Asia Pacific.

The sensitive compartmented information facility market in China is expected to grow significantly during the forecast period due to the country's increasing focus on enhancing national security and intelligence capabilities. China continues to expand its military and defense infrastructure; therefore, there is a growing need for secure facilities to protect classified information from intelligence and cyber threats.

Sensitive Compartmented Information Facility Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the sensitive compartmented information facility market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the sensitive compartmented information facility industry must offer cost-effective items.

In recent years, the sensitive compartmented information facility industry has offered some technological advancements. Major players in the sensitive compartmented information facility market, including Balfour Beatty, Inc., Captor Corporation, Clark Construction Group, Lockheed Martin, Honeywell International Inc., SCIF Global Technologies, SCIF Solutions, Inc., Kratos Defense & Security Solutions, Inc., General Dynamics Information Technology, Inc., Hensel Phelps, and Parsons Corporation.

Honeywell International Inc. is a multinational conglomerate corporation headquartered in Charlotte, North Carolina. The company offers products of four areas, including building technologies, aerospace, safety & productivity solutions (SPS), and performance materials and technologies (PMT).

Honeywell Aerospace provides aircraft engines, avionics, flight management systems, and services to airlines, airports, manufacturers, space programs, and militaries. Moreover, in 2020, the company acquired Ballard Unmanned Systems to expand the product portfolio of aerospace segments. It operates for various industries such as aerospace and travel, commercial real estate, energy, healthcare, life sciences, logistics & warehouse, retail, and utilities.

Honeywell’s Vindicator Security Solutions offers a comprehensive security system with intrusion detection, video surveillance, and access control. The flexible, scalable solutions are easily customized to meet specific requirements at single or multiple sites, backed by military-grade technology and open network architecture for seamless connectivity.

Parsons Corporation provides integrated solutions and services in intelligence, defense, and critical infrastructure in North America, the Middle East, and internationally. The company operates through Federal Solutions and Critical Infrastructure segments, delivering essential technologies to various U.S. government agencies. In March 2024, Parsons Corporation received a USD 28 million contract to provide surveillance, intelligence, and reconnaissance command and control and space software for the Air Force Research Laboratory’s Global Application Research, Development, Engineering, and Maintenance (GARDEM) program. This three-year contract expands Parsons’ portfolio, supporting the Department of Defense and Intelligence Community with advanced software capabilities.

List of Key Companies in Sensitive Compartmented Information Facility Market

- Balfour Beatty, Inc.

- Captor Corporation

- Clark Construction Group

- Lockheed Martin

- Honeywell International Inc.

- SCIF Global Technologies

- SCIF Solutions, Inc.

- Kratos Defense & Security Solutions, Inc.

- General Dynamics Information Technology, Inc.

- Hensel Phelps

- Parsons Corporation

Sensitive Compartmented Information Facility Industry Developments

- May 2024: The Huntsville Center's Facility Repair and Renewal program completed its first project at the Pentagon, converting a decommissioned server room into a 2,100 square feet Sensitive Compartmented Information Facility suite for the U.S. Space Command.

- August 2020: The National Air and Space Intelligence Center awarded Messer Construction a USD 126.3 million contract to build the final phase of the Intelligence Production Center at Wright-Patterson Air Force Base in Ohio. The five-story complex, designed by Gensler and Black & Veatch Architects, offered collaboration spaces and workstations for 980 analysts, providing an additional 255,000 square feet of Sensitive Compartmented Information Facility (SCIF) space.

Sensitive Compartmented Information Facility Market Segmentation

Sensitive Compartmented Information Facility Market – Type Outlook

- Permanent SCIFs

- Temporary SCIFs

Sensitive Compartmented Information Facility Market – Construction Type Outlook

- New Construction

- Retrofit and Upgrades

Sensitive Compartmented Information Facility Market – End User Outlook

- Government

- Military & Defense

- Telecommunication

- Cybersecurity Firms

- Others

Sensitive Compartmented Information Facility Market – Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Sensitive Compartmented Information Facility Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 3,872.09 million |

|

Market Size Value in 2024 |

USD 4,157.46 million |

|

Revenue Forecast in 2032 |

USD 7,542.52 million |

|

CAGR |

7.7% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global sensitive compartmented information facility market size was valued at USD 3,872.09 million in 2023 and is projected to grow to USD 7,542.52 million by 2032.

The global market is projected to register a CAGR of 7.7% during the forecast period, 2024-2032.

North America had the largest share of the global market due to increased government investment in safeguarding critical information.

The key players in the market are Balfour Beatty, Inc., Captor Corporation, Clark Construction Group, Lockheed Martin, Honeywell International Inc., SCIF Global Technologies, SCIF Solutions, Inc., Kratos Defense & Security Solutions, Inc., General Dynamics Information Technology, Inc., Hensel Phelps, and Parsons Corporation.

The permanent SCIFs category dominated the market in 2023 due to the increasing need for long-term, secure facilities in government, military, and intelligence operations.

The government category had the fastest share in the global market due to the increasing stress on national security and the protection of classified information.