Self-Testing Market Share, Size, Trends, Industry Analysis Report, By Sample Type, By Product (Kits, Devices, Strips), By Application, By Distribution Channel, By Usage, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3934

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

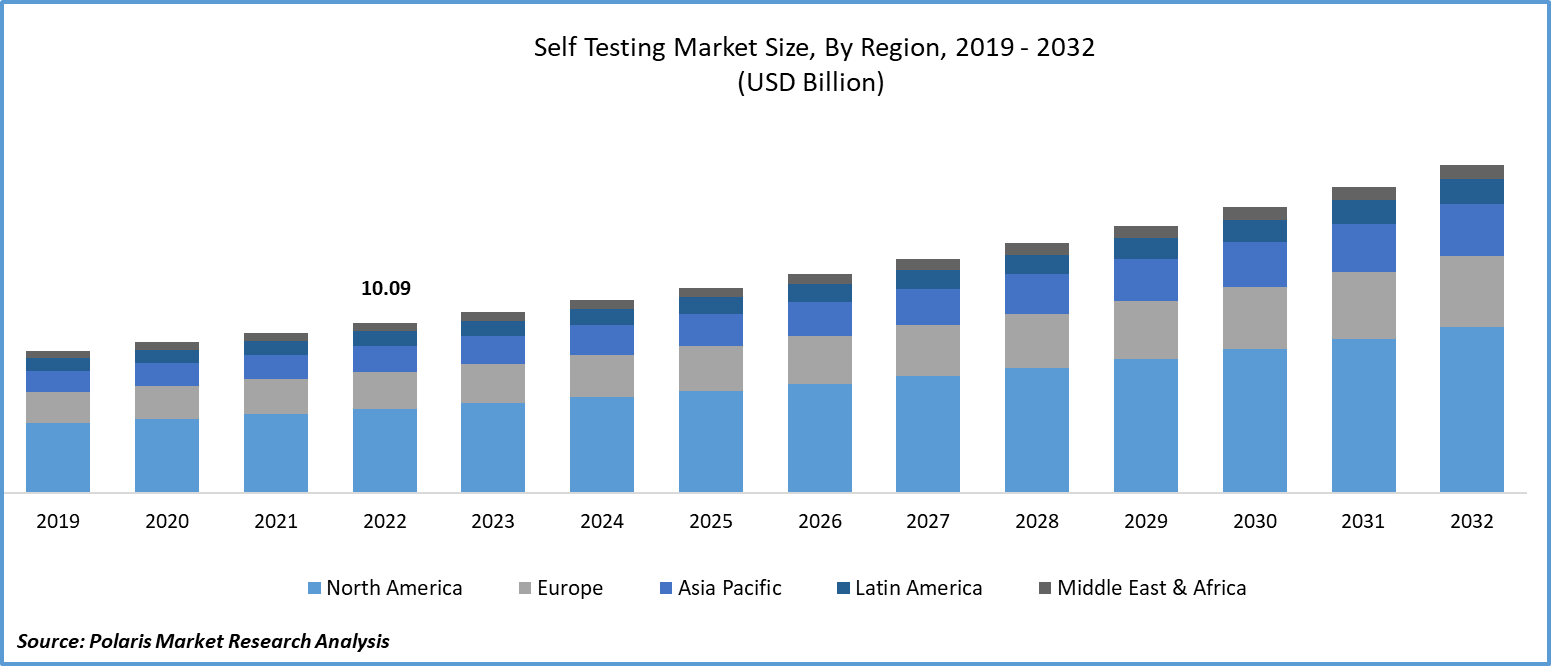

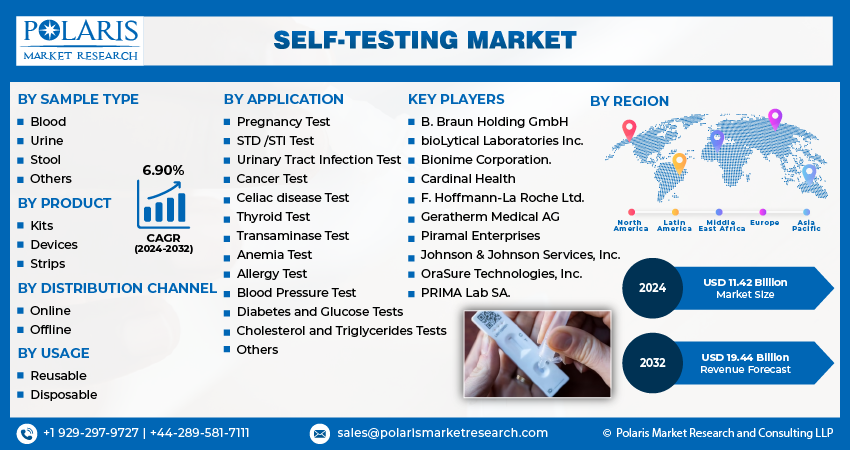

The global self-testing market was valued at USD 10.73 billion in 2023 and is expected to grow at a CAGR of 6.90% during the forecast period.

The growing focus on personalized healthcare has led to increased demand for self-testing options. Additionally, technological advancements in the development of rapid diagnostic kits have played a crucial role in the market's expansion. The convenience and speed offered by these diagnostic kits have further fueled their demand. Moreover, the continuous introduction of new products in this field is expected to contribute positively to the growth of the market.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with tracking the Self Testing Market on the basis of SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

To Understand More About this Research: Request a Free Sample Report

Various organizations have taken proactive measures to reduce the risk of severe illnesses, hospitalizations, and fatalities. For instance, the Administration for Strategic Preparedness and Response (ASPR) and the National Institutes of Health (NIH) joined forces to initiate the Home Test to Treat program in January 2023. This program is designed as a virtual community health intervention, offering free COVID-19 healthcare services, including telehealth consultations, home treatments, and at-home rapid tests, in select communities.

The self-testing market is set for continued expansion, driven by the growing demand for personalized healthcare and the advancements in rapid diagnostic kits. The convenience and accessibility of at-home testing options are attracting consumers and reshaping the healthcare landscape. With ongoing innovations and the introduction of new products, the market is poised for sustained growth. Government-supported programs, like Home Test to Treat, underscore the importance of self-testing and its role in improving healthcare outcomes, reinforcing the positive outlook for the market's future.

Industry Dynamics

Growth Drivers

- Increased funding and investments

Increased funding and investments in the self-testing market have created a dynamic landscape, driving significant advancements in diagnostic technologies. This influx of financial support stems from various organizations, both public and private, and market players. These investments aim to boost the development of innovative, reliable, and user-friendly self-testing solutions. This trend aligns with a broader shift towards personalized healthcare, where individuals actively participate in monitoring and managing their well-being.

For instance, in January 2022, Florida Atlantic University (FAU) allocated USD 1.3 million in funding from the National Institutes of Health (NIH) for the development of rapid and automated HIV self-testing kits. Additionally, in April 2023, the Indian startup Cervicheck received approval from the Central Drugs Standard Control Organization (CDSCO) for the commercial launch of its kit in India. This kit is designed for the detection of Human Papillomavirus (HPV). These initiatives reflect the growing opportunities in the sector.

The self-testing market has expanded substantially, encompassing various sectors such as home pregnancy tests, glucose monitoring for diabetes, DNA testing, and COVID-19 tests. The convenience and speed offered by these diagnostic kits have fueled their demand, with consumers increasingly opting for at-home diagnostics. Government initiatives and partnerships further promote self-testing, enhancing its role in public health and healthcare management. As funding continues to flow into the industry, the self-testing market is poised for continued growth, improving healthcare accessibility and outcomes.

Report Segmentation

The market is primarily segmented based on sample type, product, application, distribution channel, usage, and region.

|

By Sample Type |

By Product |

By Application |

By Distribution Channel |

By Usage |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Sample Type Analysis

- The blood sample segment accounted for the largest market share in 2022.

The blood sample segment held the largest revenue share in 2022. This segment's supremacy can be ascribed to the growing utilization of blood samples for diagnostic purposes, driven by their non-invasive nature and their capacity to provide comprehensive insights into various health conditions. Furthermore, the continuous advancement of diagnostic technologies and the introduction of products with advanced mechanisms are expected to create favorable growth prospects for this segment.

The urine sample is expected to register a steady growth rate. This can be attributed to the expanding utilization of urinalysis in diagnosing various diseases. Furthermore, the increasing capabilities of kits and devices to provide a wide range of diagnostic insights will favor its growth. For instance, in November 2021, funding of USD 6.0 million was received by Vivoo for the development of at-home urine test kits. These kits are seamlessly integrated with a mobile app and offer real-time insights, making diagnostics more convenient.

By Product Analysis

- The kits segment held a significant market share in 2022.

The kits segment held the majority of the market share in 2022. This growth can be attributed to the increased emphasis placed by key market players on research and development activities aimed at introducing innovative products. For instance, in February 2023, Abingdon Health signed a distribution agreement with Salignostics to expand the sales of saliva-based pregnancy test kits in Ireland, illustrating the industry's commitment to developing new testing solutions.

Testing strips will grow at a rapid pace. This growth is primarily due to the widespread use of testing strips and their cost-effectiveness. Moreover, the increasing elderly population, a rising number of chronic disease cases, and ongoing technological advancements in the healthcare sector will also favor the segment’s growth fortunes.

By Application Analysis

- The allergy test segment held the largest share in 2022.

The allergy testing segment garnered the largest share. This growth is fueled by the rising prevalence of allergic conditions, which continues to be a significant driver of market expansion throughout the forecast period. According to the Asthma and Allergy Foundation of America, in 2021, approximately 81 million individuals in the United States were suffering from hay fever. Additionally, the continuous introduction of new products in this segment contributes to the market's overall growth. For instance, in June 2022, Everlywell introduced affordable home tests for food allergies and celiac disease, complemented by virtual follow-up care services.

The cancer tests segment will grow at a substantial pace. This significant growth can be attributed to the escalating incidence of cancer cases, which is a primary driver of the segment's expansion. Moreover, the market is benefiting from the efforts of companies to introduce innovative products. For instance, in August 2022, Viome Life Sciences unveiled a self-testing kit for throat cancer aimed at consumers. These saliva-based tests have demonstrated an impressive 95% specificity and 90% sensitivity, contributing to the segment's growth.

By Usage Analysis

- The disposable segment held the largest share in 2022.

The disposable segment garnered the largest share and will also grow at the fastest growth rate. Self-testing has introduced novel opportunities for patient detection, diagnosis, and treatment. Disposable kits are particularly appealing due to their convenience and user-friendliness. They do away with the need for intricate preparation or cleaning, ensuring a clean and hassle-free experience. These advantages, combined with enhanced safety features, are poised to drive substantial growth in this segment over the forecast period.

Reusable kits also hold a significant share. Manufacturers are developing testing kits for various applications, including wellness and preventive measures, chronic disease management, and the diagnosis of acute infections, to detect potential health risks. The potential cost savings associated with reusable kits are expected to create favorable opportunities for segment growth in the coming years.

Regional Insights

- North America region dominated the global market in 2022

North America emerged as the largest region. The region's growth can be attributed to the increasing prevalence of chronic conditions demanding rapid diagnosis, continuous technological advancements in the healthcare sector, and the presence of major industry players. These factors are expected to contribute to revenue expansion in the region. Additionally, the growing number of FDA approvals for new products is a driving force for market growth.

Asia Pacific region will grow rapidly. This growth is primarily due to increased research and development activities focused on novel therapeutics for various infections, ongoing improvements in the healthcare sector, and government initiatives aimed at reducing the burden of diseases. Furthermore, healthcare reforms, expanding healthcare infrastructure, a growing population, rising instances of chronic diseases, and the entry of numerous local companies into the market are expected to contribute significantly to the growth of the self-testing market in the region.

Key Market Players & Competitive Insights

The global self-testing market is poised for substantial growth, driven by major players' strategic actions, including the introduction of new products, mergers and acquisitions, and expansion into different geographical regions.

Some of the major players operating in the global market include:

- B. Braun Holding GmbH

- bioLytical Laboratories Inc.

- Bionime Corporation.

- Cardinal Health

- F. Hoffmann-La Roche Ltd.

- Geratherm Medical AG

- Johnson & Johnson Services, Inc.

- OraSure Technologies, Inc.

- Piramal Enterprises

- PRIMA Lab SA.

Recent Developments

- In March 2022, Brain Chemistry Labs revealed its partnership with Arlington Scientific to create a user-friendly rapid self-testing kit designed for detecting β-N-methylamino-L-alanine (BMAA) in the human body.

- In May 2022, empowerDX introduced an at-home genetic risk test for celiac disease, utilizing molecular testing to deliver precise and accurate results.

Self-Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 11.42 billion |

|

Revenue Forecast in 2032 |

USD 19.44 billion |

|

CAGR |

6.90% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Sample Type, By Product, By Application, By Distribution Channel, By Usage, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the Self Testing Market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.

Browse Our Top Selling Reports

Pharmaceutical Gelatin Market Size, Share 2024 Research Report

Epilepsy Treatment Devices Market Size, Share 2024 Research Report

Diverticulitis Disease Market Size, Share 2024 Research Report

Placenta Market Size, Share 2024 Research Report

Virtual Visits Market Size, Share 2024 Research Report