Self-Healing Coating Market Size, Share, Trends, Industry Analysis Report: By Form (Extrinsic and Intrinsic), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 128

- Format: PDF

- Report ID: PM5225

- Base Year: 2024

- Historical Data: 2020-2023

Self-Healing Coating Market Overview

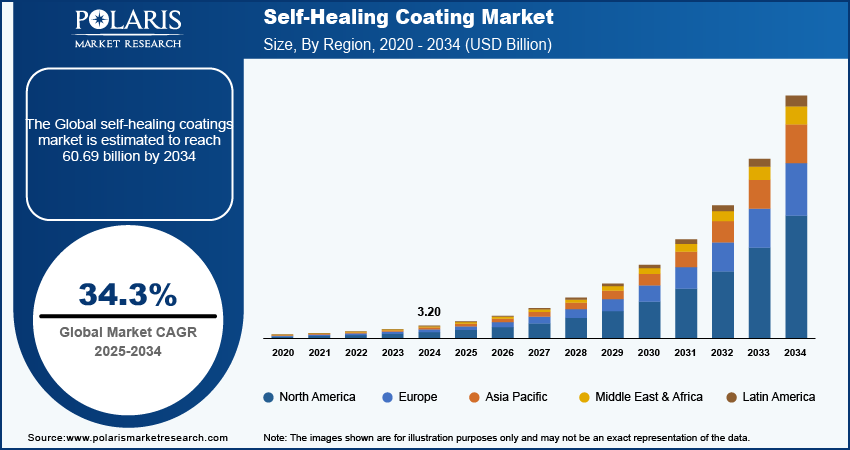

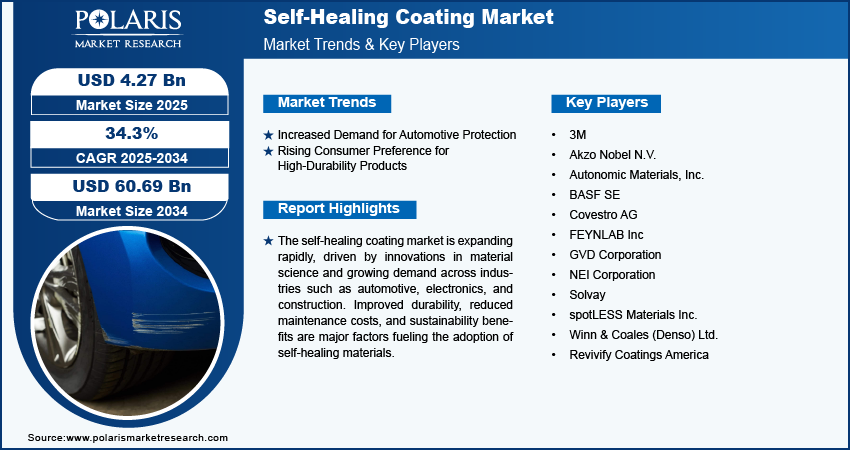

The global self-healing coating market size was valued at USD 3.20 billion in 2024. The market is projected to grow from USD 4.27 billion in 2025 to USD 60.69 billion by 2034, exhibiting a CAGR of 34.3% during 2025–2034.

Self-healing coatings are advanced materials designed to automatically repair damage, such as scratches or cracks, restoring their original properties without external intervention.

The self-healing coatings market is experiencing expansion, driven by the rising demand for advanced materials capable of autonomous damage repair and improved durability across diverse sectors, such as automotive, aerospace, and consumer goods. This technology operates in microcapsules or other related mechanisms within the coating matrix that release healing agents in response to scratches or damage, effectively facilitating surface restoration. Key market drivers include rising consumer awareness regarding sustainability, strict regulations promoting eco-friendly materials, and ongoing R&D initiatives that foster innovative formulations. Thus, this landscape has led to substantial investments from established industry leaders and emerging enterprises looking to leverage these advancements.

Researchers at the Korea Research Institute of Chemical Technology (KRICT) have developed a self-healing, transparent coating for the automotive industry that repairs scratches within 30 minutes. This durable coating, made from a commercial resin and urea structure, activates when exposed to sunlight and matches the performance of existing protective coatings. It also has potential uses in the electronics and construction sectors.

To Understand More About this Research: Request a Free Sample Report

Self-Healing Coating Market Dynamics

Self-Healing Coating Market Drivers Analysis

Increasing Demand for Automotive Protection

In the automotive sector, self-healing coatings leverage advanced smart materials that autonomously repair surface scratches upon exposure to stimuli such as heat or UV light. The self-healing property minimizes the need for manual touch-ups, effectively maintaining the vehicle's aesthetic appeal and structural integrity. These coatings improve protection against various environmental damages, thereby increasing the overall durability and lifespan of vehicles. The integration of self-healing technology is advantageous for vehicle owners and manufacturers, positioning the rising automotive industry as a significant driver in the growth of the self-healing coatings market.

Rising Consumer Preference for High-Durability Products

Self-healing coatings offer improved protection and longevity, especially for products exposed to wear and tear, such as electronics, vehicles, and consumer goods. The coatings help extend the lifespan of products by automatically repairing minor damages such as scratches, dents, and abrasions, which reduces the need for frequent repairs or replacements. The durability is appealing to consumers seeking long-lasting, low-maintenance products, particularly in industries such as automotive, electronics, and construction, where product longevity is crucial. Additionally, industries benefit from the cost-effectiveness of these coatings, as they minimize maintenance and extend product life, thereby attracting manufacturers to incorporate self-healing technologies into their offerings. Therefore, growing consumer preference for high-durability products is a significant driver for the self-healing coatings market growth.

Self-Healing Coating Market Segment Analysis

Self-Healing Coating Market Breakdown by Form Outlook

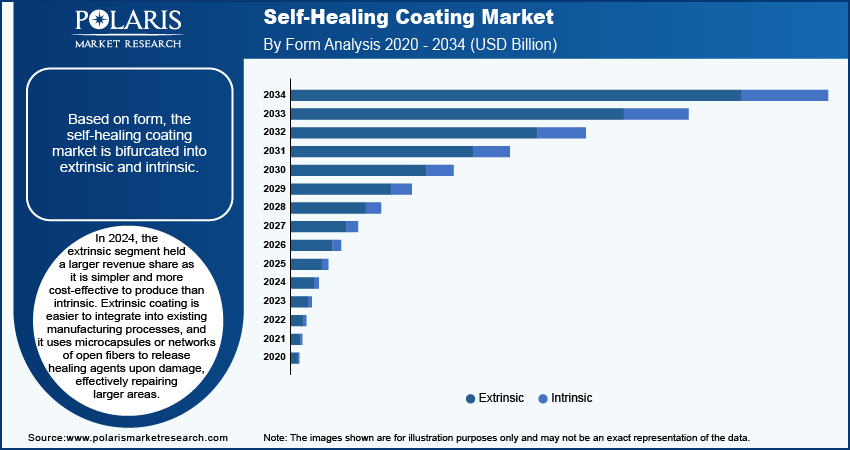

The global self-healing coating market, based on form, is bifurcated into extrinsic and intrinsic. The extrinsic segment accounted for a larger revenue share of the market in 2024 due to its simpler and more cost-effective production compared to intrinsic systems. Extrinsic self-healing coatings utilize microcapsules or networks of open fibers to release healing agents upon damage, enabling effective repair over larger areas and facilitating seamless integration into existing manufacturing processes. The rising demand for durable, low-maintenance products in the automotive, consumer goods, and electronics sectors propelled the adoption of self-healing coating technologies such as microcapsule-based healing and supramolecular.

The intrinsic self-healing coatings segment is expected to register a CAGR during the forecast period due to their ability to autonomously repair damage at the molecular level, which makes them highly effective for durability in various applications such as automotive, aerospace, and consumer electronics. The intrinsic form of coating offers more consistent and reliable healing properties compared to extrinsic methods.

Self-Healing Coating Market Breakdown by End Use Outlook

The global self-healing coating market, based on end use, is segmented into automotive, aerospace, building & construction, marine, and others. In 2024, the automotive segment dominated the market due to the rising demand for vehicle protection and aesthetics, as self-healing coatings effectively repair minor scratches and scuffs, maintaining the vehicle's appearance over time. Additionally, the automotive industry's emphasis on durability and lower maintenance costs aligns well with the advantages of self-healing technologies. As consumers increasingly demand for long-lasting and appealing products, automotive manufacturers are adopting self-healing coatings to meet market expectations. Further, segments such as electronics and consumer goods are growing. However, the automotive sector remains the most significant due to its extensive production and investments in protective coatings.

The self-healing coating market for the aerospace segment is expected to grow during the forecast period due to the use of advanced polymer composites in spacecraft to improve flexibility and thermal stability, as coatings and paints are crucial for protecting aerospace components from corrosion. Self-healing coatings, such as epoxy resin composites, can automatically restore protection after damage. For example, epoxy resin composite coatings with implanted urea-formaldehyde microcapsules can protect steel structures from corrosion, even after damage occurs and the coating has healed.

Self-Healing Coating Market Share by Region

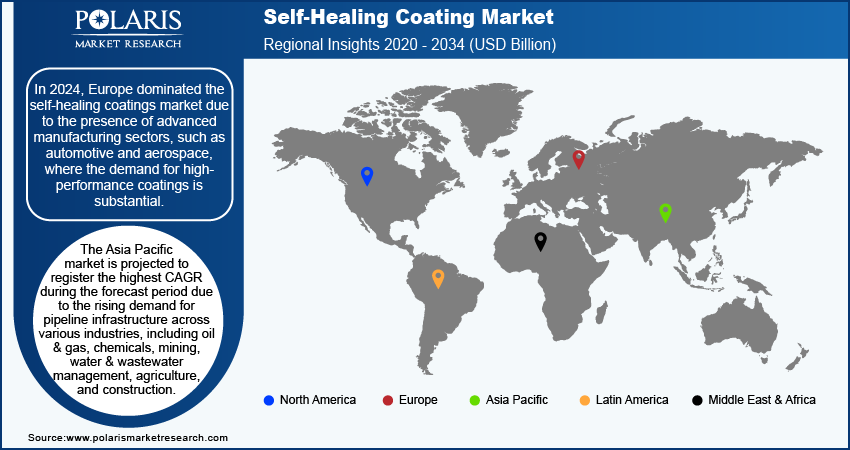

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Europe dominated the self-healing coatings market due to the region's advanced manufacturing sectors, such as automotive and aerospace, where the demand for high-performance coatings is substantial. European manufacturers are increasingly focusing on innovation and sustainability, which leads to the development and adoption of self-healing technologies that enhance the durability and longevity of products. Additionally, in the region, strict environmental regulations are driving investments in eco-friendly materials and self-healing coatings, which reduces maintenance costs and environmental impact. Collaboration between research institutions and industry players is leading to the development of advanced coating technologies, making Europe a leader in the self-healing coatings market.

The Asia Pacific self-healing coatings market is projected to register the highest CAGR during the forecast period due to the rising demand for pipeline infrastructure across various industries, including oil & gas, chemicals, mining, water & wastewater management, agriculture, and construction. Rapid industrialization, urbanization, and infrastructure development in countries such as China, India, Japan, South Korea, and Southeast Asian nations are significant factors driving the market growth in the region.

The adoption of self-healing coatings is increasing due to investments in infrastructure projects, environmental regulations, and the focus on cost-effective and sustainable solutions in the industrial landscape. Manufacturers are likely to invest more in research and development to create innovative self-healing products. In March 2020, researchers at the International Advanced Research Centre for Powder Metallurgy and New Materials (ARCI) in Hyderabad, India, developed environmentally friendly coatings using halloysite and montmorillonite clay minerals to improve the corrosion resistance of aluminum and magnesium alloys, as these coatings are designed to replace traditional hexavalent chromium-based coatings, which are toxic. The self-healing coatings can automatically repair scratches and damage, releasing corrosion inhibitors from encapsulated nano-containers to form a protective passive layer. This advancement holds promise for extending the lifespan of aircraft and machinery made from these alloys.

Self-Healing Coating Market – Key Players and Competitive Insights

The competitive landscape of the self-healing coatings market features a mix of regional and global players aiming to gain market share through innovation, strategic alliances, and geographical expansion. Major companies in the industry capitalize on their strong R&D capabilities and extensive distribution networks to deliver advanced self-healing solutions tailored for various applications, including automotive, aerospace, and consumer goods. The industry leaders prioritize product innovation, focusing on improving durability, aesthetics, and cost-efficiency to meet the changing demands of end users. Smaller regional firms are emerging with specialized offerings that address local or market needs. Common competitive strategies in this sector include mergers and acquisitions, partnerships with industrial entities, and investments in emerging markets, all aimed at enhancing market presence and widening product portfolios. 3M, Akzo Nobel N.V., BASF SE, Covestro AG, Autonomic Materials Inc., FEYNLAB Inc, Solvay, GVD Corporation, NEI Corporation, SpotLESS Materials Inc., Winn & Coales (Denso) Ltd, and Revivify Coatings America are among the self-healing coatings market key players.

BASF SE has six business segments—agricultural solutions, materials, industrial solutions, surface technologies, nutrition & care, and chemicals. The company's products are used in various industries worldwide, with more than 355 manufacturing facilities in over 90 countries. In August 2022, BASF launched its new RODIM Thermoplastic Polyurethane (TPU) Paint Protection Film (PPF) in Asia Pacific, offering long-lasting protection for automotive coatings. The film has self-healing capabilities, repairing light scratches and scuffs while resisting environmental damage such as UV exposure, tree sap, and bird droppings.

AkzoNobel, a Dutch multinational company, creates paints and performance coatings for industry and consumers worldwide. Headquartered in Amsterdam, the company has activities in more than 150 countries. In June 2020, AkzoNobel announced five key collaborations to enhance its paint and coating solutions. These include partnerships with Lonza for real-time microbial detection in production, IGM Resins for instant-drying hybrid paints, and ICL Group for safer, allergen-free formulations. AkzoNobel is also working with Croda to develop self-healing coatings that recover from scratches at room temperature. It collaborated with Wagner Painting on an intelligent spray system designed to reduce overspray and waste in industrial applications. These efforts reflect AkzoNobel's focus on innovation and sustainability.

Key Companies in the Self-Healing Coating Industry Outlook

- 3M

- Akzo Nobel N.V.

- Autonomic Materials, Inc.

- BASF SE

- Covestro AG

- FEYNLAB Inc

- GVD Corporation

- NEI Corporation

- Solvay

- spotLESS Materials Inc.

- Winn & Coales (Denso) Ltd.

- Revivify Coatings America

Self-Healing Coating Industry Developments

In September 2024, BASF Coatings launched the first ChemCycling products in the automotive refinish market, using advanced technology to create premium clearcoats from recycled waste tires.

In September 2024, Flexcon Global licensed two patented inventions from the Department of Energy's Oak Ridge National Laboratory to develop a self-healing barrier film. The purpose of the license is for research and development.

In October 2023, DuPont and US Steel introduced COASTALUME, the first GALVALUME solution for coastal environments. This product has the strength of US Steel's GALVALUME solution with DuPont’s Tedlar PVF film barrier to resist saltwater corrosion, cracking, UV damage, and impact.

Self-Healing Coating Market Segmentation

By Form Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Extrinsic

- Intrinsic

By End Use Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Automotive

- Aerospace

- Building & Construction

- Marines

- Other Applications

By Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Self-Healing Coating Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.20 billion |

|

Market Size Value in 2025 |

USD 4.27 billion |

|

Revenue Forecast by 2034 |

USD 60.69 billion |

|

CAGR |

34.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Kilotons; Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global self-healing coating market size was valued at USD 3.20 billion in 2024 and is projected to grow to USD 60.69 billion by 2034.

The global market is projected to register a CAGR of 34.3% during the forecast period.

In 2024, Europe dominated the self-healing coatings market due to the presence of advanced manufacturing sectors, such as automotive and aerospace, where the demand for high-performance coatings is substantial.

A few key players in the market are 3M, Akzo Nobel N.V., BASF SE, Covestro AG, Autonomic Materials Inc., FEYNLAB Inc., Solvay, GVD Corporation, NEI Corporation, SpotLESS Materials Inc., Winn & Coales (Denso) Ltd, and Revivify Coatings America.

In 2024, the extrinsic segment held a larger revenue share of the market as this type of coating is simpler and more cost-effective to produce than intrinsic systems. It is easier to integrate into existing manufacturing processes, as extrinsic uses microcapsules or networks of open fibers to release healing agents upon damage, effectively repairing larger areas.

The aerospace industry is expected to grow fastest during the forecast period due to the use of advanced polymer composites in spacecraft, improving flexibility and thermal stability, as coatings and paints are crucial for protecting aerospace components from corrosion and self-healing coatings.