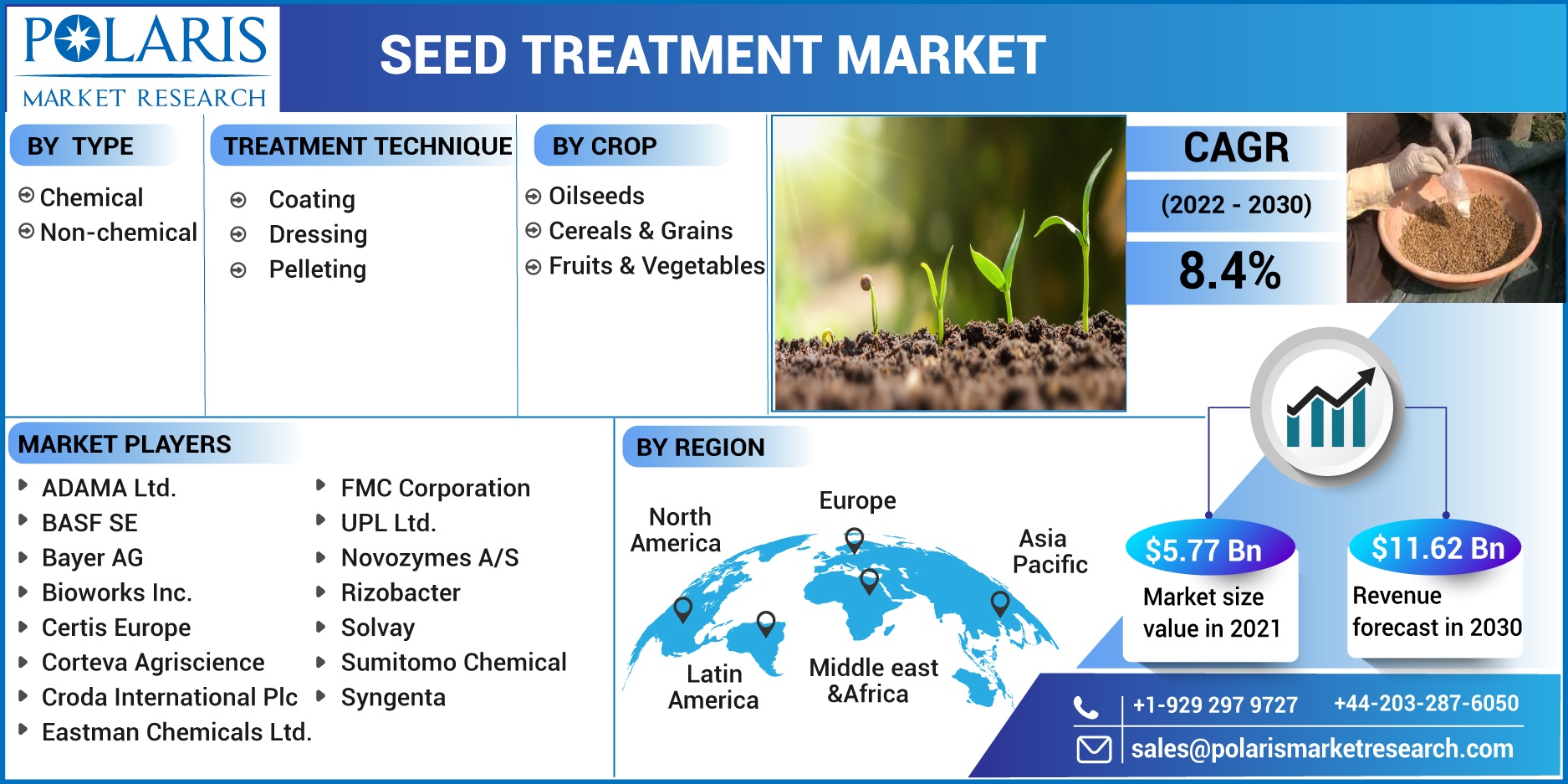

Seed Treatment Market Share, Size, Trends, Industry Analysis Report, By Type (Chemical, Non-chemical); By Treatment Technique (Coating, Dressing, Pelleting); By Crop Type; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jul-2022

- Pages: 114

- Format: PDF

- Report ID: PM2493

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

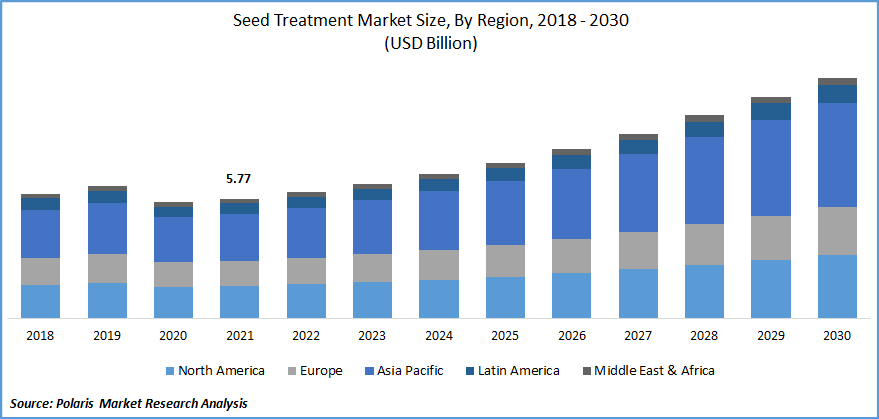

The global seed treatment market was valued at USD 5.77 billion in 2021 and is expected to grow at a CAGR of 8.4% during the forecast period. The market has gained a high level of popularity and acceptance due to the aggregated research and development efforts of key players in launching new & innovative products.

Know more about this report: Request for sample pages

This has empowered crop producers to achieve high efficiency in protecting the high-value gm seeds and further controlling the high loading rates of active chemical ingredients. The novel traits embedded in newly introduced varieties and sharply upward trajectory in the price of products in recent times have compelled farmers to protect them to ensure appropriate germination of productivity of the crops.

The increasing control of pests, insects, & diseases is generally being achieved traditionally by the application of synthetic pesticides through the method of foliar application. The efficacy and safety of the process act as a better alternative to conventional or traditional pest control methods along with the low cost, which can supplement the other control measures to achieve desired results in the field.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the global market due to disruption in the supply chain as a result of restrictions on the movement of vehicles and lockdown. Owing to market closures, prices of agriculture products such as pesticides and fertilizers have increased in the range of 10%-12%.

Due to the restrictions put forth on traveling by most governments across the globe, the industry witnessed challenges in the certification and production of products, along with barriers to international trade. This ongoing trend is expected to continue, which will further result in more challenges in terms of production and raw materials over the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

With the increasing awareness regarding innovative agricultural methods, farmers are shifting to modern farming methods from traditional farming methods. The primary shift is driven by the need for higher profits and gains with limited availability of resources. The farmers are progressively investing and consuming commercial seeds to leverage the benefits associated with them.

There has been increasing growth of high-value crops such as vegetables and fruits, along with ornamental plants, which have grown using the greenhouse cultivation method. The seeds of these crops are extremely small, which makes it problematic to plant them in the proper space.

The seed coating is also used to increase the seed shape and size using a coat to improve the sow ability and flowability of the seeds. The growing adoption of using the germination process across the various regions is expected to further grow the market in the forecasting period.

Report Segmentation

The market is primarily segmented based on type, treatment technique, crop, and region.

|

By Type |

Treatment Technique |

By Crop |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The Chemical Seed Protection Segment is Expected to Witness the Fastest Growth

The chemical treatment segment accounted for the larger revenue and volume shares in the seed treatment market and is expected to grow further in the forecast period. Chemical seed treatment protection can be attributed to the ability to improve the process of germination and maintain health. Moreover, seed treatment chemicals provide a stronger repelling ability against pests, insects, and microorganisms as compared to biological treatment products.

The non-chemical segment includes Penicillium bilaiae, Bacillus Firmus, Trichoderma fertile, and Rhizobium leguminiosarium are among the most popular biological seed treatment solutions being offered by most of the leading players. Biologicals will continue to grow in combination with chemical treatment products as an integrated pest management solution.

The factors such as growing awareness regarding organic farming, food safety, government policies and subsidies in developing countries including Japan, India, and China, resistance to a variety of abiotic and biotic stress offered by bio fungicides with minimum environmental impact, and quick resistance to chemical insecticides are proliferating the demand for biological protection. The increasing adoption of seed treatment owing to the availability of larger areas under organic farming is expected to grow the market in the forecasting period.

Fruits & Vegetables Accounted for the Second-Largest Market Share in 2021

The consumption and production of vegetables continue to play a major role in the nutrition of the global population. The production of fruit & vegetable has experienced a remarkable increase of 3% annually as per the data of FAO. The consumption of fruits & vegetables has also increased over the past few decades, and the trend is expected to continue during the forecast period.

Moreover, the rising demand for organic fruits and vegetables is driving the growth of the market in this segment. Furthermore, the growing production of high-value vegetable crops such as spinach, hydroponic tomato, lettuce, and bell pepper, has increased the scope for the development of this process treatment solutions to suit hydroponics and greenhouses. The demand for treatment products is increasing due to the rising awareness regarding healthy food consumption along with its minimum environmental impact among consumers.

Coating Application Is Expected to Hold the Significant Revenue Share

The coating application technique commanded the largest share of the overall seed treatment market in 2020 and is expected to grow further over the forecast period. The market growth is mainly attributed to the factors such as broad-spectrum usage of all crops along with increasing commercial value of seeds by enhancing their appearance of them. The pelleting application technique is also expected to witness significant growth during the forecast period.

The Demand in the Asia Pacific is Expected to Witness Significant Growth

The Asia-Pacific region is expected to be the largest and fastest-growing region during the forecast period owing to an increase in demand for fodder and forage crops. There has been a growing demand for crop protection chemicals from countries such as Japan, China, and India. APAC is accelerating the growth of the market, aiming to meet the huge demand, which is expected to further increase over the forecasting period.

Most recognized players are expanding their business in the APAC region, which will drive the increasing demand. The rising demand for high-value crops as well as raising awareness among farmers about the benefits of treatment solutions is expected to provide opportunities for market expansion.

Competitive Insight

Some of the major players operating in the global seed treatment market include ADAMA Ltd., BASF SE, Bayer AG, Bioworks Inc., Certis Europe, Corteva Agriscience, Croda International Plc, Eastman Chemicals Ltd., FMC Corporation, Marrone Bio Innovations, Inc., Novozymes A/S, Rizobacter, Solvay, Sumitomo Chemical, Syngenta, and UPL Ltd.

These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the market. The companies are also introducing new innovative products in the global solid oxide fuel cell market to cater to the growing consumer demands.

Recent Developments

- In March 2022, Syngenta extended its Seedcare portfolio by adding CruiserMaxx APX. The new product is going to provide protection against diseases including Phytophthora and Pythium.

- Furthermore, In December 2021, FMC Corporation and Corteva Agriscience signed an agreement for the supply of Cyazypyr and Rynaxypyr actives for Corteva’s seed treatment products.

Seed Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 5.77 billion |

|

Revenue forecast in 2030 |

USD 11.62 billion |

|

CAGR |

8.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Treatment Technique, By Crop, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

ADAMA Ltd., BASF SE, Bayer AG, Bioworks Inc., Certis Europe, Corteva Agriscience, Croda International Plc, Eastman Chemicals Ltd., FMC Corporation, UPL Ltd., Marrone Bio Innovations, Inc., Novozymes A/S, Rizobacter, Solvay, Sumitomo Chemical, Syngenta. |