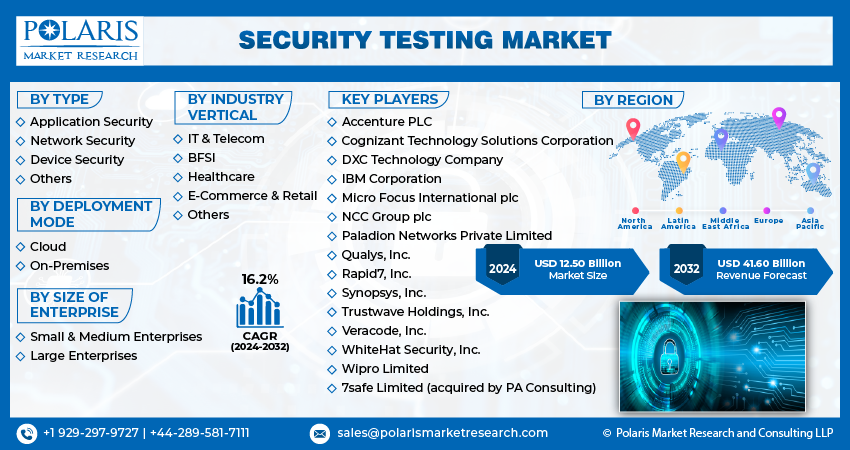

Security Testing Market Share, Size, Trends, Industry Analysis Report, By Type (Application Security, Network Security, Device Security, and Others); By Deployment Mode; By Size of Enterprise; By Industry Vertical; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4066

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

The global security testing market was valued at USD 10.78 billion in 2023 and is expected to grow at a CAGR of 16.2% during the forecast period.

Businesses and organizations face an increasing number of cyber threats and hackers who are becoming more sophisticated. As a result, there is a growing need to enhance their digital defenses. This has led to rapid growth in the security testing market, which has emerged as a vital and dynamic sector within cybersecurity.

The research report offers a quantitative and qualitative analysis of the Security Testing Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Security testing is a crucial facet of software testing concentrated on recognizing and tackling safety susceptibilities in a software application. It targets to ascertain that the software is safe from hostile ambush, unaccredited access, and data violation. Security testing includes confirming the software's conformance and security caliber, assessing the security attributes and apparatus, and executing penetration tests to recognize infirmity and susceptibilities that hostile actors might capitalize on.

Security testing is important as it safeguards sensitive data. Security testing helps guarantee that intimate and diplomatic information is safeguarded from unsanctioned approach, revelation, and theft. It is also important as it averts security violations. The security testing market demand is on the rise as by recognizing susceptibilities and infirmity in the system; security testing assists in prohibiting security violations and unaccredited passage to sensitive data.

To Understand More About this Research: Request a Free Sample Report

As cyber threats continue to evolve, organizations are realizing the importance of having strong security measures to protect their digital assets and maintain customer trust. The security testing market is keeping up with the changing threat landscape and driving the advancement of cybersecurity practices using innovative technologies and methodologies. This dynamic sector is set for sustained growth and will play a critical role in securing the digital future of businesses and organizations worldwide.

- For instance, in September 2023, Opus, a prominent figure in the realm of payment technology solutions worldwide, has recently sealed a strategic alliance with Checkmarx, a frontrunner in the field of application security testing. This dynamic partnership underscores Opus's steadfast dedication to fortifying security within the financial sector. It also marks a substantial stride toward furnishing unmatched safeguarding for its extensive roster of global clients.

Several trends are influencing the security testing market, including the integration of machine learning and artificial intelligence into security testing tools, which leads to more advanced threat detection and mitigation capabilities. Additionally, DevSecOps practices are becoming increasingly popular, with security testing integrated into the development process.

Moreover, blockchain technology is emerging as a significant factor in security testing methodologies, particularly in industries such as finance and healthcare, where secure transactions and data integrity are crucial. Specialized testing is required for blockchain-based applications to guarantee the security and integrity of distributed ledgers.

Growth Drivers

- Increased adoption of digital transformation

The market for security testing is growing because of the increasing frequency and complexity of cyber threats. This has made organizations prioritize their digital defense mechanisms. With high-profile data breaches and cyber-attacks on businesses and government entities, the vulnerabilities have been highlighted, making security testing an essential component of modern risk management.

As digital transformation, cloud computing, and IoT technologies are increasingly adopted, the attack surface is expanding, which necessitates the implementation of comprehensive security measures. This trend has further fueled the demand for security testing services and solutions.

Regulatory compliance is another driver, with data protection laws such as GDPR and industry-specific regulations mandating robust security measures and regular security assessments. Non-compliance can lead to severe financial penalties, so businesses are motivated to invest in security testing.

Report Segmentation

The market is primarily segmented based on type, deployment mode, size of enterprise, industry vertical, and region.

|

By Type |

By Deployment Mode |

By Size of Enterprise |

By Industry Vertical |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- Application security segment is expected to witness highest growth during forecast period

The application security segment is expected to experience a steady growth rate during the projected period. This growth is mainly due to the increasing use of software and applications in various industries. As a result, there is a significant demand for robust security measures. The application security segment is composed of crucial testing methodologies like penetration testing and code review, which help to fortify applications against potential vulnerabilities. As cyber threats become more sophisticated, businesses are investing heavily in securing their digital assets. This has led to the remarkable growth of Application Security testing. Furthermore, the integration of security into the development lifecycle has become more important as organizations prioritize proactive measures to safeguard their applications against potential breaches.

By Deployment Mode Analysis

- Cloud segment accounted for the largest market share in 2022

The cloud segment held the highest market share in 2022 and is expected to maintain its position throughout the forecast period. As businesses shift their sensitive data and operations to the cloud, the need to protect these assets becomes increasingly important. This segment focuses on identifying vulnerabilities in cloud-based infrastructure, platforms, and services. With the rapid increase in cloud adoption, companies are prioritizing stringent security measures against potential cyber threats. Moreover, the ever-changing nature of cloud environments requires specialized testing methods. This has resulted in an upswing in demand for cloud services, making it a crucial driver in the overall growth of the security testing market.

By Size of Enterprise Analysis

- Small & Medium Enterprises segment held the significant market revenue share in 2022

The Small and Medium Enterprises (SMEs) segment is emerging as a pivotal force in the growing security testing market. Recognizing the escalating cyber threats, SMEs are increasingly prioritizing robust security measures to safeguard their digital assets. This segment caters to the unique needs and budget constraints of smaller businesses, offering tailored security testing solutions. As SMEs become more digitally integrated, they are seeking comprehensive protection against potential breaches. This heightened awareness is propelling substantial growth in the SMEs segment, making it a significant contributor to the overall expansion of the security testing market.

By Industry Vertical Analysis

- BFSI segment accounted for the largest market share in 2022

The BFSI industry held the largest market share in 2022, and it is expected to maintain its position throughout the forecast period. This sector encompasses banking, financial services, and insurance, which is experiencing rapid growth in the security testing market. With the handling of vast amounts of sensitive financial data, the need for robust cybersecurity measures is essential. Regulatory bodies impose strict compliance standards, further driving the demand for comprehensive security testing. To strengthen their digital infrastructure, BFSI institutions are investing heavily in vulnerability assessments, penetration testing, and compliance testing. The BFSI sector continues to play a significant role in the growth of the security testing market, ensuring the security of financial transactions and data integrity against the backdrop of increasingly sophisticated cyber threats.

Regional Insights

- North America region dominated the global market in 2022

The North American region dominated the global market in 2022 with the largest market share. It is expected to maintain its leadership over the projected period. This is due to the extensive digitalization across various industries that has propelled the need for stringent security measures. High-profile breaches have forced organizations to invest heavily in security testing services. Moreover, North America is home to various tech giants and financial institutions, which are prime targets for cyber threats. This further drives the demand for advanced security testing solutions.

Regulatory frameworks such as HIPAA and GDPR, along with industry-specific compliance standards, mandate rigorous security testing. This compels businesses to prioritize their cybersecurity initiatives. Additionally, the region boasts a highly developed cybersecurity ecosystem, encompassing numerous specialized firms and research institutions. This fosters a fertile ground for innovation and drives the development of cutting-edge security testing technologies.

Europe is projected to be the second-largest region with a healthy compound annual growth rate (CAGR) during the forecast period. The security testing market in Europe is experiencing dynamic growth, driven by an evolving threat landscape and strict regulatory requirements. The region's diverse business landscape, ranging from multinational corporations to SMEs, is increasingly recognizing the critical importance of robust cybersecurity measures. Stricter data protection regulations, such as GDPR, have made it necessary to implement comprehensive security testing protocols, which have further fueled the market's expansion. Europe is investing heavily in advanced testing methodologies, such as penetration testing, code review, and compliance testing.

Additionally, the presence of numerous cybersecurity firms and research institutions fuels innovation, leading to the development of cutting-edge security testing technologies. Europe's security testing market is expected to grow steadily, reflecting the continent's commitment to strengthening digital resilience.

Key Market Players & Competitive Insights

The security testing market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Accenture PLC

- Cognizant Technology Solutions Corporation

- DXC Technology Company

- IBM Corporation

- Micro Focus International plc

- NCC Group plc

- Paladion Networks Private Limited

- Qualys, Inc.

- Rapid7, Inc.

- Synopsys, Inc.

- Trustwave Holdings, Inc.

- Veracode, Inc.

- WhiteHat Security, Inc. (acquired by NTT Ltd.)

- Wipro Limited

- 7safe Limited (acquired by PA Consulting)

Recent Developments

- In August 2023, Synopsys entered into a strategic partnership with NowSecure and Secure Code Warrior. These collaborations align with Synopsys's broader strategy to enhance its Software Integrity Group's array of application security testing (AST) solutions, further solidifying its position in the security testing industry.

- In April 2023, Noname Security, a leading API security solutions provider, disclosed a strategic partnership with IBM, aiming to enhance customer protection against vulnerabilities, misconfigurations, and design flaws. This collaboration signifies a joint commitment to bolstering cybersecurity measures for clients.

Security Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 12.50 billion |

|

Revenue forecast in 2032 |

USD 41.60 billion |

|

CAGR |

16.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Deployment Mode, By Size of Enterprise, By Industry Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

Browse Our Top Selling Reports

Endoscopes Market Size, Share 2024 Research Report

Intravenous Iron Drugs Market Size, Share 2024 Research Report

Fertility Test Market Size, Share 2024 Research Report

Digital Pathology Market Size, Share 2024 Research Report

Dental Laboratory Welders Market Size, Share 2024 Research Report