Security Solutions Market Size, Share, Trends, Industry Analysis Report: By Offering (Product and Service), End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM5391

- Base Year: 2024

- Historical Data: 2020-2023

Security Solutions Market Overview

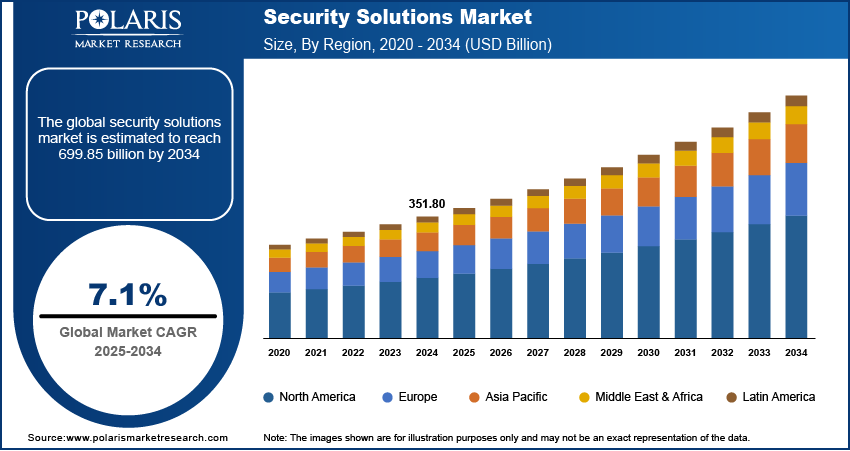

The global security solutions market size was valued at USD 351.80 billion in 2024. The market is projected to grow from USD 376.22 billion in 2025 to USD 699.85 billion by 2034, exhibiting a CAGR of 7.1 % during 2025–2034.

Security solutions encompass a broad range of strategies, tools, and services designed to protect individuals and organizations from various threats, including cyberattacks, data breaches, and physical security risks. These solutions include consulting services, hardware support, implementation of security measures, and ongoing IT outsourcing. Security solutions are categorized into application security, cloud security, and network security. They safeguard data in cloud environments and protect network infrastructure from unauthorized access and breaches.

The increasing incidence of cyber threats and data breaches globally is propelling the security solutions market growth. According to the Identity Theft Resource Center, in 2023, there were 3,122 publicly reported data breaches worldwide, representing a significant increase compared to previous years. Data breaches lead to financial, legal, and reputational damages for organizations and governments, driving them to invest in advanced security solutions such as firewalls, encryption, threat detection systems, and identity management tools. Furthermore, stricter regulatory requirements around data protection, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), have compelled organizations to enhance their cybersecurity frameworks, fueling demand for security solutions that ensure compliance and mitigate risks.

To Understand More About this Research: Request a Free Sample Report

The security solutions market demand is driven by the growing adoption of wireless technology. Businesses and individuals are now increasingly relying on Wi-Fi, Bluetooth, and other wireless technology to power IoT applications and remote operations. These wireless connections create new entry points for cyber threats, making networks more vulnerable to unauthorized access, data interception, and malware attacks. This encourages businesses and individuals to invest in advanced security solutions, such as secure access points, encryption protocols, and wireless intrusion detection systems, to address malware attacks within wireless environments.

Security Solutions Market Dynamics

Increasing Investments in Smart Cities Worldwide

Governments globally are making significant investments in the development of smart cities. For instance, the Government of India allocated USD 19.03 billion to develop 100 smart cities across the country. Smart cities integrate IoT devices, sensors, data analytics, and cloud platforms to manage critical infrastructure such as transportation, utilities, public safety, and healthcare. This creates a vast network of digital entry points, making smart cities attractive targets for cyberattacks and data breaches. Governments and city planners invest in advanced security solutions such as network monitoring tools to safeguard sensitive data, protect critical systems, and ensure the uninterrupted operation of smart city services. Therefore, as investment in smart city projects expands globally, the need for robust, scalable, and proactive security solutions continues to rise.

Growing Defense Spendings

Governments worldwide are investing more in their military capabilities to improve security. For instance, according to the Stockholm International Peace Research Institute (SIPRI), the total global defense budget increased by 6.8% in 2023. Increased budgets enable defense organizations to invest in advanced security solutions, including cyber defense systems, surveillance equipment, secure communication networks, and threat detection platforms to mitigate cybersecurity threats. Additionally, high defense spending leads to the adoption of AI-driven systems, unmanned vehicles, and interconnected devices in defense operations, which require protection against sophisticated attacks. This, in turn, drives the need for security solutions. Thus, rising global defense spending is driving the security solutions market revenue.

Security Solutions Market Segment Insights

Security Solutions Market Evaluation by Offering Insights

Based on offering, the security solutions market is divided into products and services. The product segment held the largest security solutions market share in 2024 due to the widespread adoption of advanced hardware solutions such as surveillance cameras, access control systems, and intrusion detection devices. Governments and businesses across various sectors are prioritizing the deployment of these products to enhance physical and digital security amid rising cyber threats and physical breaches. They are increasingly invested in these systems to ensure real-time monitoring, threat detection, and incident response, particularly in critical infrastructure, commercial spaces, and public safety applications. High demand for video surveillance systems, boosted by advancements in AI-powered analytics and facial recognition technology, further drives the segment’s leading position in the global market.

Security Solutions Market Assessment by End User Insights

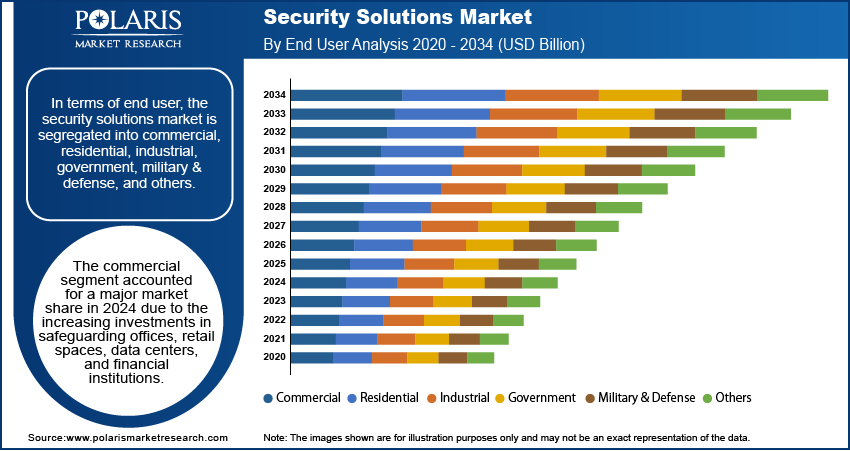

In terms of end user, the security solutions market is segregated into commercial, residential, industrial, government, military & defense, and others. The commercial segment accounted for a major share in 2024 due to the increasing investments in safeguarding offices, retail spaces, data centers, and financial institutions. The rapid growth of e-commerce and retail sectors has fueled the demand for advanced surveillance systems, access control solutions, and perimeter security technologies to prevent unauthorized access and inventory losses. Additionally, the financial and banking sectors have increased spending on security solutions to comply with stringent regulatory requirements and protect sensitive customer data, thereby contributing to the dominance of the commercial segment.

Security Solutions Market Regional Analysis

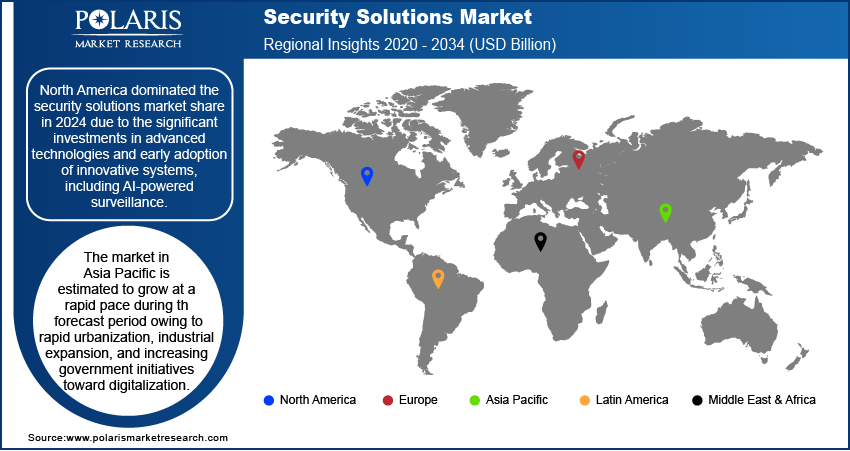

By region, the report provides the security solutions market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the security solutions market share in 2024 due to the significant investments in advanced technologies and early adoption of innovative systems, including AI-powered surveillance, biometric access control, and cybersecurity solutions. The US, as the dominating country in North America, accounted for the majority of the market share due to its robust infrastructure, high awareness of evolving threats, and substantial defense and commercial sector investments. The increasing frequency of cyberattacks, coupled with regulatory mandates such as CCPA and HIPAA, have further motivated organizations in the region to enhance their protective measures, thereby propelling the adoption of security solutions.

The Asia Pacific security solutions market is estimated to grow at a rapid pace during the forecast period owing to rapid urbanization, industrial expansion, and increasing government initiatives toward digitalization. Countries such as China and India drive market growth within the region with large-scale investments in smart cities, public safety projects, and digital infrastructure. The proliferation of IoT devices, increasing e-commerce penetration, and growing concerns over cyber and physical threats further support the security solutions market expansion in the region.

Security Solutions Market – Key Players and Competitive Insights

Major market players are investing heavily in research and development in order to expand their offerings, which will help the security solutions market grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The security solutions market is fragmented, with the presence of numerous global and regional market players. Major players in the market include Cisco Systems, Inc.; IBM Corporation; Intel Corporation; Infineon Technologies AG; Symantec Corporation; Gemalto NV; Allot; Fortinet, Inc.; ABB; Siemens AG; Honeywell International Inc.; Emerson Electric Co.; Yokogawa Electric Corporation; General Electric Company; Schneider Electric; and Rockwell Automation Inc.

Rockwell Automation Inc., headquartered in Milwaukee, Wisconsin, is a major American provider of industrial automation and digital transformation technologies. Established in 1903, the company has evolved from its origins as the compression rheostat company to become one of the largest industrial automation companies globally. Rockwell Automation is renowned for its flagship brands, including Allen-Bradley and FactoryTalk, which deliver a comprehensive range of hardware, software, and services aimed at enhancing productivity and sustainability across various industries. Rockwell Automation offers a suite of security solutions designed to protect both physical and digital assets. These solutions encompass risk assessments, network security measures, incident response planning, and ongoing monitoring services to safeguard against potential threats.

Honeywell International Inc., headquartered in Charlotte, North Carolina, is a prominent multinational company known for its advanced technology and manufacturing capabilities across various sectors, including aerospace, building automation, industrial automation, and energy solutions. Founded through the merger of Honeywell Inc. and AlliedSignal in 1999, the company has established itself as a key player in the Fortune 500. Honeywell operates through four primary business segments: Honeywell Aerospace Technologies, Building Automation, Safety and Productivity Solutions (SPS), and Performance Materials and Technologies (PMT). The company's security solutions offerings encompass a wide range of products and services designed to protect both physical and digital assets. These include advanced surveillance systems, access control technologies, intrusion detection systems, and integrated security management platforms. In October 2023, Honeywell launched Cyber Watch, an enterprise security solution designed to help organizations better identify, mitigate, and manage the latest operational technology (OT) cyber threats.

List of Key Companies in Security Solutions Market

- ABB

- Allot

- Cisco Systems, Inc.

- Emerson Electric Co.

- Fortinet, Inc.

- Gemalto NV

- General Electric Company

- Honeywell International Inc.

- IBM Corporation

- Infineon Technologies AG

- Intel Corporation

- Rockwell Automation Inc.

- Schneider Electric

- Siemens AG

- Symantec Corporation

- Yokogawa Electric Corporation

Security Solutions Industry Developments

May 2024: Palo Alto Networks, a cybersecurity company that provides network security platforms and cloud-based services to protect digital assets, launched new security solutions infused with precision AI to defend against advanced threats and safeguard AI adoption.

June 2024: Trend Micro Incorporated, a global cybersecurity company, unveiled its first consumer security solutions tailored to safeguard threats in consumer AI PCs.

March 2021: ESET, a global company in cybersecurity, announced the launch of its new endpoint security management solution, ESET PROTECT, in India for all businesses of all sizes.

Security Solutions Market Segmentation

By Offering Outlook (Revenue, USD Billion, 2020–2034)

- Products

- Fire Protection

- Video Surveillance

- Access Control

- Entrance Control

- Intruder Alarms

- Thermal Cameras

- Services

- Security Systems Integration

- Remote Monitoring Services

- Fire Protection Services

- Video Surveillance Services

- Access Control Services

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Commercial

- Residential

- Industrial

- Government

- Military & Defense

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Security Solutions Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 351.80 billion |

|

Revenue Forecast in 2025 |

USD 376.22 billion |

|

Revenue Forecast by 2034 |

USD 699.85 billion |

|

CAGR |

7.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global security solutions market size was valued at USD 351.80 billion in 2024 and is projected to grow to USD 699.85 billion by 2034.

• The global market is projected to register at a CAGR of 7.1% during the forecast period.

• North America had the largest share of the global market in 2024.

• Some of the key players in the market are Cisco Systems, Inc.; IBM Corporation; Intel Corporation; Infineon Technologies AG; Symantec Corporation; Gemalto NV; Allot; Fortinet, Inc.; ABB; Siemens AG; Honeywell International Inc.; Emerson Electric Co.; Yokogawa Electric Corporation; General Electric Company; Schneider Electric; and Rockwell Automation Inc.

• The products segment dominated the market in 2024.