Security Robots Market Share, Size, Trends, Industry Analysis Report

By Application (Patrolling, Explosive Detection, Rescue Operations, Others); By Type; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 119

- Format: PDF

- Report ID: PM2788

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

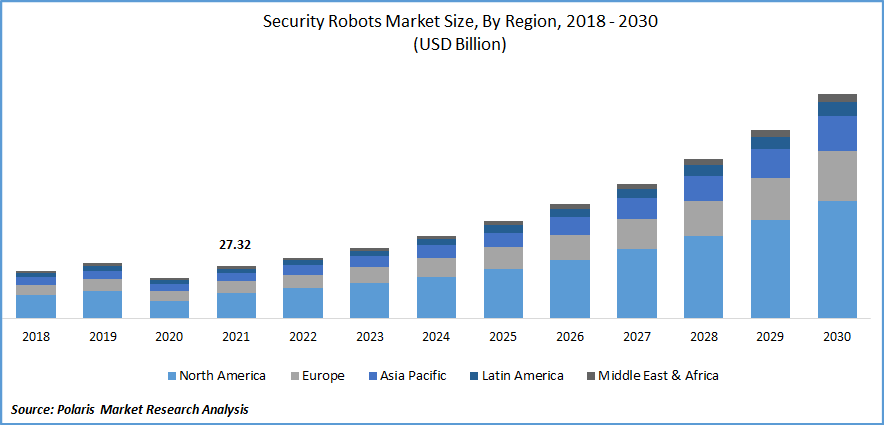

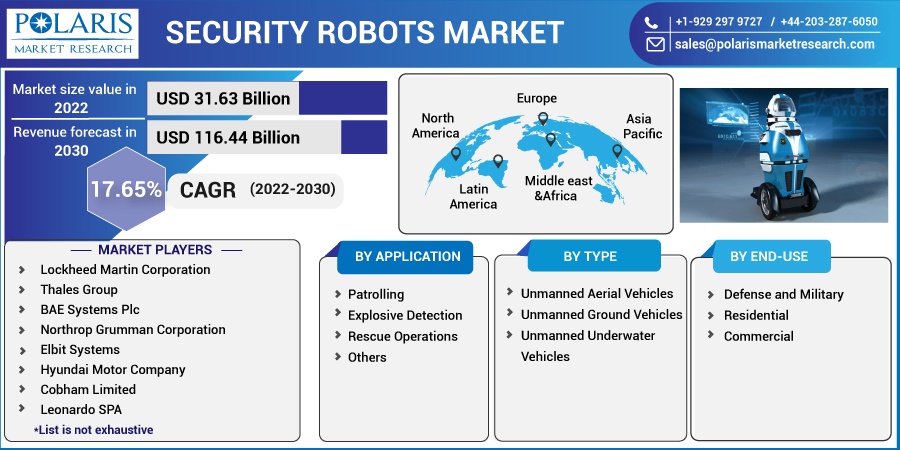

The global security robots market was valued at USD 27.32 billion in 2021 and is expected to grow at a CAGR of 17.65% during the forecast period.

Increasing demand for security robots because of several security concerns and growing penetration of advanced automation techniques across the globe are key factors expected to drive the growth of the global market during the forecast period.

Know more about this report: Request for sample pages

In addition, various companies in the value chain that are highly focused on the development of advanced security solutions which are capable of replacing the complete human intervention and reducing the average operational cost of security robots are anticipated to fuel the growth of the global market significantly in the coming years.

Furthermore, increasing expenditure on the defense and military sector, especially in developing countries like India, China, and Indonesia, development of autonomous and artificial intelligence-enabled robots coupled with the rising advancements in the advent of unmanned vehicles are some other factors projected to contribute positively to the growth and demand of the global market over the forecast period.

For instance, according to our findings, China, the world’s second-largest spender on defense services, allocated around USD 293 billion to its military and defense services in 2021, with an increase of 4.7% from 2020 and nearly 72% from 2012. Similarly, India’s total military expenditure increased by 0.9% in 2021, with a value of USD 76.6 billion over the 2020 figures.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Increasing geopolitical instabilities and high potential government investment in the development and advancement of security and reducing the risk of human intervention across are favoring the market growth. Moreover, the rising capabilities of security robots, such as deployers easily in changing terrains and dangerous environments for performing analytical-based surveillance and other types of actions, are likely to fuel the adoption of these robots among various countries rapidly.

In addition, improvements in sensor technology and high automation capabilities have resulted in higher adoption and usage in various applications along with the enhancements in neural technology, which gives the ability to learn over time and improve the functionality are also likely to have a positive impact on the growth of the global market over the coming years.

Report Segmentation

The market is primarily segmented based on application, type, end-use, and region.

|

By Application |

By Type |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Patrolling segment is anticipated to witness the fastest growth in 2021

The patrolling segment is anticipated to grow fastest owing to an increase in demand for the highest level of security on several premises to commercial guard facilities and increased government investment to set up improved and developed Managed Security Robotics Services. For instance, SEO, a South Korean company, announced the launch of its new security service robot named “ARVO,” which offers higher safety services, including patrol and inspection through the combination of CCTV and several types of sensors.

Furthermore, an increasing number of concerns associated with safety and security among borders of various nations, as well as residential security, is likely to create lucrative growth opportunities for the segment market. According to our findings, the United States has a total population of 325 million, and around 700,000 police personnel in federal, local, and state agencies are available to be tasked with safeguarding the general public. Hence, there is an insufficient force to work efficiently. Thus, the demand for security robots for the purpose of patrolling is anticipated to have a positive impact on the segment market.

The unmanned aerial vehicles segment accounted for the largest market share in 2021

High accessibility to a wide range of operators including both residential and commercial users, and the continuously growing adoption of unmanned aerial vehicles for better surveillance and reconnaissance and to protect the borders of several nations are also major factors expected to drive the growth of the segment during the forecast period. Furthermore, the high survivability and affordability of unmanned aerial vehicles providing by various large companies in the global market, such as Knightscope Inc., SMP Robotics, and Cobalt Robotics, is likely to provide significant growth to the market in the coming years.

Moreover, the increasing number of collaborations and partnerships among key players of the market to expand product offerings and market reach, coupled with the growing numbers of the latest products introduced to the global market, are fueling the growth and adoption of the segment extensively. For instance, in March 2022, BAE Systems announced the acquisition of Bohemia Simulations with capabilities in military simulation, and relevant training solutions will be added to the BAE Systems’ digital transformation.

Defense and Military sector held the significant market revenue share

The market for defense and the military sector was estimated to hold the largest market share in 2021 and is projected to maintain its dominance throughout the forecast period. This is attributed to the rising popularity and understanding of the significance of UAVs, rising military research, and heavy funding for the enhancement and development of advanced UAVs.

In addition, technological advancements to improve functionalities and capabilities for autonomic decisions of a security robot for various complex operations are other key factors expected to boost the adoption of these robots in defense and military sectors over the coming years.

According to our findings, the world’s expenditure on the military grown in 2021 to nearly USD 2.1 trillion. And, US funding for research & development activities rose by around 24% from 2012 to 2021. This rise in R&D spending in the last decade shows extensive growth in the focus on next-generation technologies, which is fueling the growth and adoption of the market significantly.

North America region is projected to witness highest growth

Globally, North American region is likely to grow at the fastest growth rate during the forecast period owing to the rise in usage of advanced weapons and robotics in the military & defense coupled with the growing investment in the development of the defense sector in the region. Moreover, numerous technological advancements and rising deployment of surveillance security robots in commercial sector with the presence of several large market players such as Lockheed Martin Corporation, Northrop Grumman Corporation, Knightscope Inc., and Cobalt Robotics is also likely to propel the regional market growth over the coming years.

Furthermore, Asia Pacific region dominated the security robots market with a holding of healthy market share in 2021 due to the presence of large numbers of security robot providers, increasing expenditure on the military & defense sector, and rising demand for real estate in countries like India, China, Singapore, and Japan. In addition, a high inclination towards the procurement of unmanned aerial vehicles for better security of borders is further likely to have a positive impact on the growth of the market in the region throughout the forecast period.

Competitive Insight

Some of the major key players of the global market are Lockheed Martin, Thales Group, BAE Systems, Northrop Grumman, Elbit Systems, Hyundai Motor, Cobham Limited, Leonardo, Endeavor Robotics, Kongsberg Maritime, Recon Robotics, AeroVironment., Knightscope Inc., DJI, L3 Harris Technologies, and QinetiQ Group.

Recent Developments

In August 2022, QinetiQ Group Plc, announced its acquisition of Avantus Federal, a space, cyber, and mission-focused data services and solutions company. With this acquisition, QinetiQ integrated business, customer relationships, and core capabilities to complement its high distinctive range of offerings. The acquisition will further allow the company to grow its services and solutions that would be beneficial for its global customers.

Furthermore, In November 2021, Elbit Systems introduced its new product to the global market named ROOK, an unmanned vehicle along with the Roboteam. The new vehicle comes with a built-in autonomy suite that offers greater capacity, field agility, and improved maneuverability for greater effectiveness of the mission.

Security Robots Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 31.73 billion |

|

Revenue forecast in 2030 |

USD 116.44 billion |

|

CAGR |

17.65% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Application, By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Lockheed Martin Corporation, Thales Group, BAE Systems Plc, Northrop Grumman Corporation, Elbit Systems, Hyundai Motor Company, Cobham Limited, Leonardo SPA, Endeavor Robotics, Kongsberg Maritime, Recon Robotics, AeroVironment Inc., Knightscope Inc., DJI, L3 Harris Technologies Inc., and QinetiQ Group Plc |