Security Paper Market Size, Share, Trends & Industry Analysis Report

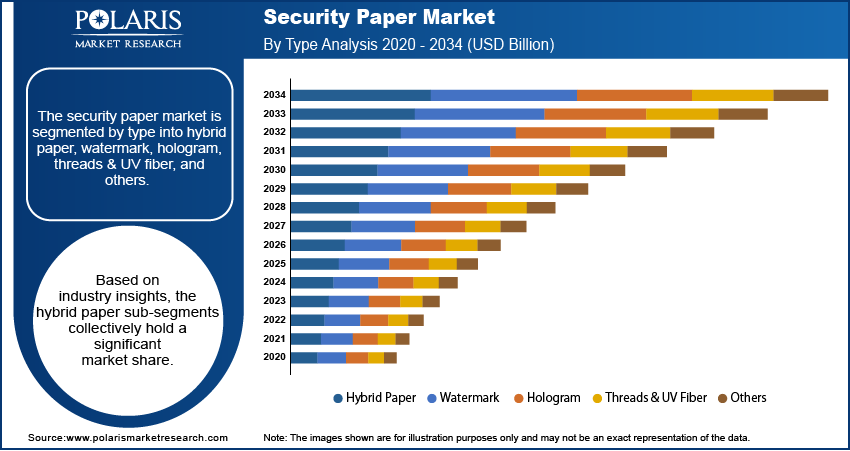

: By Type (Hybrid Paper, Watermark, Hologram, Threads & UV Fiber, and Others), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM3466

- Base Year: 2024

- Historical Data: 2020-2023

The security paper market size was valued at USD 17.98 billion in 2024, exhibiting a CAGR of 6.9% during 2025–2034. The security paper market is driven by increasing counterfeiting activities, heightened demand for secure documents in banking, government, and education sectors, and advancements in anti-counterfeiting technologies like holograms and watermarks.

Market Overview:

The security paper market pertains to the production and distribution of specialized paper designed with integrated security features. These features are incorporated to prevent counterfeiting, forgery, and unauthorized replication. Security paper and paper bags are employed in the printing of various important documents and instruments that require robust protection against fraud, such as banknotes, passports, certificates, legal documents, and identification cards. The inclusion of security elements helps to verify the authenticity of these documents, safeguarding them from tampering or unauthorized duplication.

A primary driver is the increasing global incidence of counterfeiting activities. The rise in fraud and forgery incidents across various sectors has amplified the demand for secure and tamper-evident document solutions. Furthermore, the growth of the banking and financial sectors, particularly in emerging economies, contributes to the heightened need for security paper in the production of currency, checks, and other financial instruments. The increasing use of security papers has enabled businesses, individuals, and regulatory authorities to limit the abuse of critical documents effectively.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics:

Increasing Counterfeiting and Fraud Activities

The persistent global challenge of counterfeiting and fraudulent activities acts as a significant market driver for security paper. As illicit actors become more sophisticated, the demand for highly secure documents with advanced anti-counterfeiting packaging features intensifies. For instance, in 2021, counterfeit and pirated goods constituted an estimated 2.3% of total global imports, amounting to approximately USD 467 billion, as reported by the Organisation for Economic Co-operation and Development (OECD) in their 2025 publication, "Mapping Global Trade in Fakes." This substantial economic impact underscores the critical need for robust security measures in various printed materials. Governments and businesses are compelled to invest in security paper to protect their economic integrity and prevent illicit trade. This escalating threat directly contributes to the increasing demand for security paper.

Growing Demand for Secure Government Documents

The continuous rise in the issuance of secure government documents globally is a core growth factor for the security paper market. Documents such as passports, visas, birth certificates, and national identification cards require specialized paper with embedded security features to ensure their authenticity and prevent identity fraud. The U.S. Department of State, for example, reported a notable increase in U.S. passports issued, from 15,496,590 in fiscal year 2021 to 24,515,786 in fiscal year 2024, demonstrating a clear upward trend in demand for such secure credentials. Similarly, Japan's Ministry of Foreign Affairs indicated that approximately 3.82 million passports were issued in 2024. These statistics reflect the ongoing need for secure physical documents in an increasingly interconnected world, thereby fueling the demand for security paper.

Expansion in Banknote Production

The consistent production and circulation of banknotes worldwide represent a fundamental drive for security paper. Central banks continuously issue new currency and replace worn notes, necessitating a steady supply of highly secure paper embedded with multiple anti-counterfeiting elements like watermarks, security threads, and holographic features. According to the Bank of England's banknote statistics published in April 2025, the volume of banknotes in circulation increased from 4,541 million in 2021 to 4,729 million in 2025, indicating sustained production levels. The European Central Bank also details significant annual production volumes for euro banknotes to meet circulation requirements and counter counterfeiting, such as commissioning 6,000 million banknotes across various denominations in 2024. This ongoing requirement for secure currency printing globally remains a primary driver for security paper development.

Segmental Insights:

Market Assessment By Type

The market is segmented by type into hybrid paper, watermark, hologram, threads & UV fiber, and others. Based on industry insights, the hybrid paper sub-segments collectively hold a significant share. Hybrid papers integrate multiple security technologies, often combining the tactile feel and printability of traditional paper with the durability and advanced security features typically found in polymer substrates. This convergence allows for the inclusion of highly sophisticated overt and covert security elements, such as advanced holograms, intricate threads, and multi-layered designs, making them extremely challenging to counterfeit. As the threat of sophisticated forgery continues to evolve, the demand for these multi-layered, robust security solutions is rising, significantly driving the development.

The threads & UV fiber sub-segment is demonstrating a notable increase in penetration and growth rate. These traditional security features have been fundamental to the authenticity of documents for centuries and remain widely adopted across various applications, including banknotes, passports, and legal certificates. Their established efficacy, recognition, and integration into existing printing infrastructures contribute to their pervasive use. The consistent global demand for basic yet effective anti-counterfeiting measures ensures that paper with these embedded features maintains a substantial presence in the market. These classic security elements continue to be a cornerstone driving the demand for security paper.

Market Evaluation By Application

The market is segmented by application into bank notes, passports, identity cards, certificates, legal & government documents, cheques & stamps, and others. The bank notes sub-segment consistently holds the largest share during the forecast period. This is primarily due to the vast global circulation of physical currency, where every banknote requires specialized security paper to prevent counterfeiting and ensure public trust in monetary systems. The sheer volume of banknotes produced, replaced, and circulated worldwide by central banks and monetary authorities far surpasses other applications. The criticality of currency integrity makes security paper an indispensable component in banknote production, firmly establishing this segment as a dominant force in the dynamics.

The identity cards and passports sub-segments are collectively demonstrating a significant growth rate. This upward trajectory is fueled by increasing international travel, the implementation of stricter identity verification protocols globally, and ongoing initiatives by governments to issue more secure and technologically advanced identification documents. As nations prioritize enhanced security features to combat identity fraud and facilitate more efficient border control, the demand for high-quality security paper for these personal identification documents is steadily rising. This continuous upgrade and expansion of secure identity infrastructure are key growth factors.

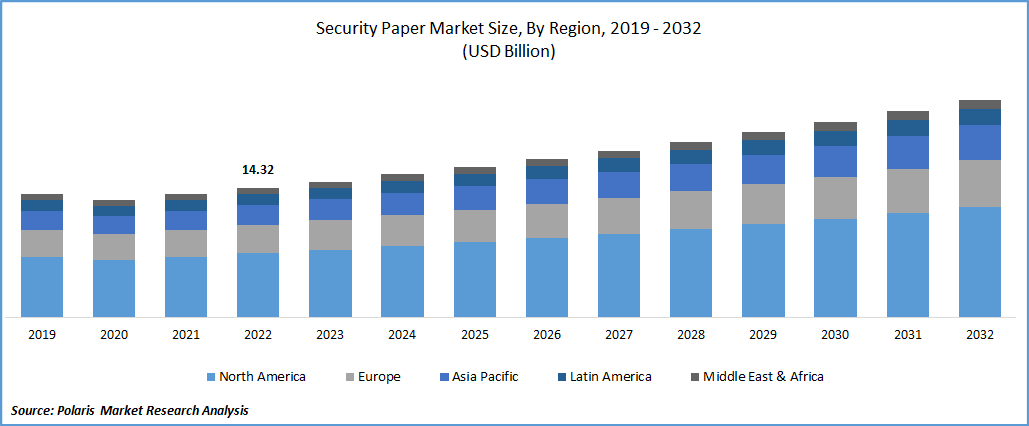

Regional Analysis

Asia Pacific security paper market consistently accounts for the largest share. This dominance is attributed to several factors, including the vast populations in countries like China and India, leading to high volumes of banknote production and circulation.

Furthermore, significant government initiatives in China to issue national identification cards, passports, and various other official documents contribute substantially to the market size. The China security paper market, in particular, is witnessing strong growth due to the government's emphasis on anti-counterfeiting measures and secure documentation. The region's expanding financial inclusion, coupled with a continued preference for cash-based transactions in many areas, ensures a sustained and robust demand for security paper.

In India, the rising awareness regarding counterfeiting threats, coupled with a proactive approach to implement advanced security solutions in new issuances of identity documents and banknotes, propels this significant growth. The India security paper market is gaining momentum as government and financial institutions increasingly adopt high-security substrates and technologies to safeguard sensitive documents. This robust environment fosters continuous innovation and adoption of security paper technologies, contributing to a strong forecast for the region.

Key Players and Competitive Insights

In the security paper market, several major players actively contribute to the global supply of secure substrates. Key entities include De La Rue plc, Giesecke+Devrient (G+D), Crane Currency (Crane NXT), Louisenthal (G+D), Security Printing and Minting Corporation of India Limited (SPMCIL), Real Casa De La Moneda (FNMT-RCM), Goznak, Drewsen Spezialpapiere GmbH & Co. KG, Fedrigoni Group, Landqart AG (Fortress Paper), and China Banknote Printing and Minting Corporation. These organizations specialize in developing and manufacturing advanced paper solutions equipped with various anti-counterfeiting features essential for official documents and financial instruments.

The competitive landscape is characterized by a strong emphasis on innovation, research, and development of new security features. Companies consistently invest in advanced technologies to counter evolving counterfeiting techniques, leading to the introduction of sophisticated watermarks, security threads, holograms, and hybrid substrates. Strategic collaborations with governments and central banks are crucial, as long-term contracts and certifications are vital for penetration and sustained growth. The industry is also shaped by stringent regulatory requirements for document security and the ongoing global demand for authentic and tamper-evident materials, fostering a continuous drive for product enhancement and reliability among participants.

List of Key Companies:

- China Banknote Printing and Minting Corporation (CBPMC)

- Crane Currency (Crane NXT)

- De La Rue plc

- Drewsen Spezialpapiere GmbH & Co. KG

- Fedrigoni Group

- Giesecke+Devrient (G+D)

- Goznak

- Landqart AG (Fortress Paper)

- Louisenthal (G+D)

- Real Casa De La Moneda (FNMT-RCM)

- Security Printing and Minting Corporation of India Limited (SPMCIL)

Industry Developments

- May 2025: Crane NXT completed the acquisition of De La Rue's Authentication division. This transaction was announced in October 2024 and finalized for £300 million in cash.

- January 2025: Drewsen Spezialpapiere GmbH & Co. KG announced its acquisition of high-security paper specialist Portals Paper Ltd. This strategic move sees the German manufacturer expand its capabilities and market presence in the security paper sector.

Security Paper Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Hybrid Paper

- Watermark

- Hologram

- Threads & UV Fiber

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Bank Notes

- Passports

- Identity Cards

- Certificates

- Legal & Government Documents

- Cheques & Stamps

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Security Paper Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 17.98 billion |

|

Market Size Value in 2025 |

USD 19.17 billion |

|

Revenue Forecast by 2034 |

USD 34.95 billion |

|

CAGR |

6.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The market has been segmented into detailed segments of type and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

To achieve growth in the market, companies primarily focus on continuous innovation in anti-counterfeiting features, developing more sophisticated watermarks, threads, and holographic elements. Strategic partnerships with governments, central banks, and printing authorities are crucial, as securing long-term contracts for banknotes and official documents is a key marketing strategy. Market players also emphasize the integration of advanced technologies like hybrid substrates and digital transaction management and authentication features, enhancing the robustness and traceability of secure documents.

FAQ's

The global market size was valued at USD 17.98 billion in 2024 and is projected to grow to USD 34.95 billion by 2034.

The market is projected to register a CAGR of 6.9% during the forecast period, 2024-2034.

Asia Pacific had the largest share of the market.

Key entities include De La Rue plc, Giesecke+Devrient (G+D), Crane Currency (Crane NXT), Louisenthal (G+D), Security Printing and Minting Corporation of India Limited (SPMCIL), Real Casa De La Moneda (FNMT-RCM), Goznak, Drewsen Spezialpapiere GmbH & Co. KG, Fedrigoni Group, Landqart AG (Fortress Paper), and China Banknote Printing and Minting Corporation.

The hybrid segment accounted for the largest share of the market in 2024.

Following are some of the market trends: ? Integration of Advanced Security Features: There is a growing focus on incorporating highly sophisticated anti-counterfeiting measures such as multi-layered holograms, advanced watermarks, micro-optics, and specialized security threads and fibers. ? Rise of Hybrid Substrates: The market is seeing an increasing adoption of hybrid papers that combine the properties of traditional paper with the durability and enhanced security of polymer or other advanced materials.

Security paper is a specialized type of paper engineered with embedded features to prevent counterfeiting, forgery, and unauthorized duplication of documents. Unlike regular paper, it incorporates various overt and covert security elements during its manufacturing process. These features can include watermarks, security threads, invisible fibers visible under UV light, chemical sensitizers that react to tampering, holograms, and microprinting. Its primary purpose is to authenticate documents and detect any attempts at alteration, making it essential for items such as banknotes, passports, identity cards, certificates, and other legal or government documents where integrity and trust are paramount.