Sealing and Strapping Packaging Tapes Market Size, Share, Trends, Industry Analysis Report: By Material (Paper, Polypropylene, Polyvinyl Chloride, and Other), Adhesive, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5485

- Base Year: 2024

- Historical Data: 2020-2023

Sealing and Strapping Packaging Tapes Market Overview

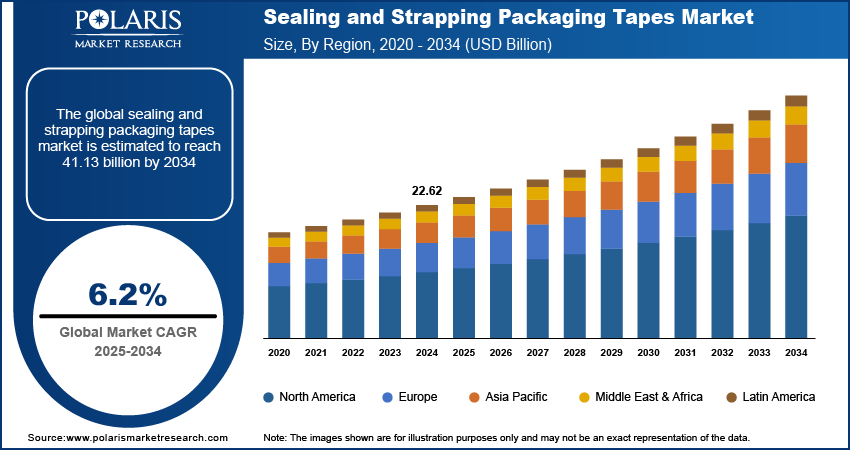

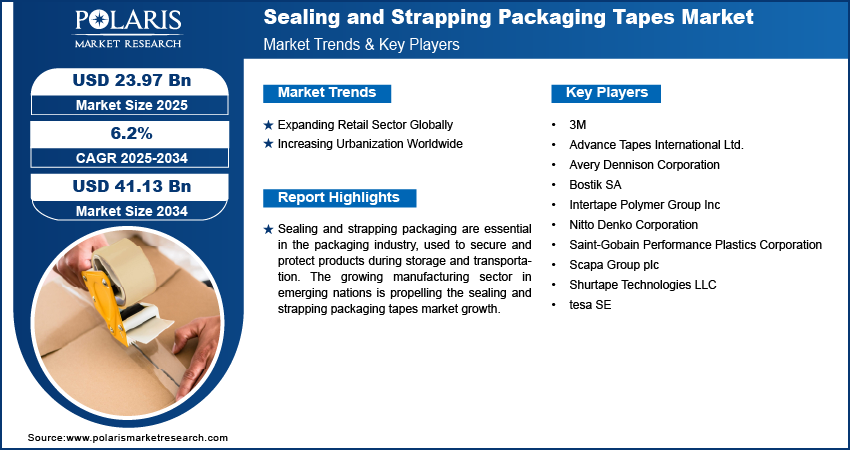

The global sealing and strapping packaging tapes market size was valued at USD 22.62 billion in 2024. The market is projected to grow from USD 23.97 billion in 2025 to USD 41.13 billion by 2034, exhibiting a CAGR of 6.2% during 2025–2034.

Sealing and strapping packaging are essential in the packaging industry, used to secure and protect products during storage and transportation. Sealing involves closing a package to ensure its contents remain intact and free from contamination. This process often uses heat, adhesives, or mechanical methods to create a tight seal. Strapping, on the other hand, involves binding items together or securing them to a pallet by using materials such as plastic or steel straps. This method provides additional stability and prevents movement or damage during transit.

The growing manufacturing sector in emerging nations is propelling the sealing and strapping packaging tapes market growth. Manufacturers in emerging nations like India and Brazil require efficient packaging solutions such as sealing and strapping to ensure their products remain secure, undamaged, and contamination-free during storage and transportation. Sealing protects items from environmental factors, while strapping provides stability for bulk shipments, both of which are critical for maintaining product quality and reducing losses. Additionally, emerging nations often rely on exports to fuel economic growth, which increases the need for robust packaging to meet international shipping standards. For instance, according to the India Brand Equity Foundation, India is the third most sought-after manufacturing destination in the world, with the potential to export goods worth USD 1 trillion by 2030. Sealing and strapping solutions help manufacturers comply with these requirements, ensuring products arrive in optimal condition. Therefore, as the manufacturing sector in emerging nations grows, the demand for sealing and strapping packaging tapes also continues to rise.

To Understand More About this Research: Request a Free Sample Report

The sealing and strapping packaging tapes market demand is driven by the growing popularity of e-commerce. E-commerce businesses handle a high volume of orders, often shipping products directly to customers' doorsteps. Sealing ensures that packages remain intact and protected from damage or tampering during transit, while strapping provides additional stability for bulk shipments or larger items. These packaging methods help maintain product quality and reduce the risk of returns or complaints, which are critical for customer satisfaction in competitive e-commerce logistics. Moreover, e-commerce companies usually deal with diverse product categories, from small electronics to bulky household items, necessitating versatile packaging solutions. Sealing and strapping accommodate these varying needs, offering flexibility and durability for different types of goods.

The emphasis on fast and efficient delivery in e-commerce demands quick and reliable packaging processes, which sealing and strapping systems facilitate. Furthermore, the rise in return shipments due to e-commerce policies encourages the use of resealable and durable packaging solutions such as sealing and strapping packaging tapes, boosting market demand.

Sealing and Strapping Packaging Tapes Market Dynamics

Expanding Retail Sector Globally

Retail businesses stock a wider variety of products, ranging from small consumer items to large appliances, all of which need proper packaging for storage, display, and transportation. Additionally, the retail sector's focus on enhancing the customer experience drives the need for durable and visually appealing packaging. Sealing and strapping packaging tapes help retailers maintain the integrity of their products, ensuring they arrive in perfect condition, whether on store shelves or at customers' homes. The growth of omnichannel retail, which integrates online and offline sales, further amplifies the demand for sealing and strapping packaging tapes as retailers must adapt their packaging to meet the requirements of both in-store displays and e-commerce deliveries. Therefore, the expanding retail sector globally is driving the sealing and strapping packaging tapes market demand.

Increasing Urbanization Worldwide

The rising urbanization worldwide is driving the sealing and strapping packaging tapes market expansion. For instance, according to the World Bank, urban population expected to more than double by 2050, at which point nearly 7 in 10 people will live in cities. Urban areas are experiencing rising demand for packaged products, which require secure and efficient packaging solutions for transportation and storage, leading to a high demand for sealing and strapping packaging tapes. Businesses operating in urban areas rely on sealing and strapping materials to protect goods and prevent tampering, especially in industries such as food, pharmaceuticals, and consumer electronics. Sealing and strapping tapes help these businesses stabilize bulk shipments and optimize logistics in densely populated regions with high distribution needs. Furthermore, the emphasis on sustainability in urban environments encourages the use of eco-friendly packaging materials, including recyclable sealing and strapping packaging tape options.

Sealing and Strapping Packaging Tapes Market Segment Insights

Sealing and Strapping Packaging Tapes Market Evaluation by Material Insights

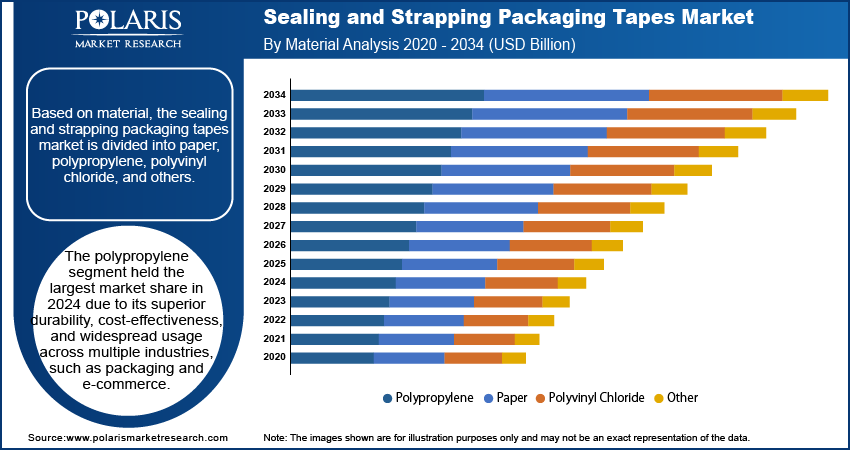

Based on material, the sealing and strapping packaging tapes market is divided into paper, polypropylene, polyvinyl chloride, and other. The polypropylene segment held the largest sealing and strapping packaging tapes market share in 2024 due to its superior durability, cost-effectiveness, and widespread usage across multiple industries, such as packaging, e-commerce, and others. Manufacturers favored polypropylene tapes for their high tensile strength, resistance to moisture, and excellent adhesive properties, making them ideal for securing shipments in logistics, e-commerce, and industrial applications. The material’s lightweight nature reduces transportation costs, further increasing its adoption among businesses seeking efficient and economical packaging solutions. Additionally, polypropylene tapes offered versatility, supporting both manual and automated sealing processes, which appeal to large-scale distribution centers and manufacturing facilities. The increasing focus on sustainable packaging also contributes to the segment’s dominance, as advancements in recyclable polypropylene formulations have made it a preferred choice over traditional plastic alternatives.

Sealing and Strapping Packaging Tapes Market Assessment by Application Insights

In terms of application, the sealing and strapping packaging tapes market is segregated into carton sealing & inner packaging and strapping & bundling. The strapping & bundling segment dominated the market in 2024 due to its critical role in securing heavy and bulk shipments across various industries. Businesses in logistics, construction, and manufacturing rely on strapping solutions to stabilize goods during transportation, ensuring product safety and minimizing damage risks. The increasing demand for large shipping has also driven the adoption of strapping tapes, as companies sought strong and reliable materials to keep large loads intact. Additionally, the rise of global trade and cross-border e-commerce has fueled the need for reinforced packaging, prompting businesses to invest in high-tensile strength tapes that can withstand long transit durations and rough handling. Industries such as food & beverage, automotive, and consumer electronics have also contributed to the segment's dominance, as they require secure bundling solutions for efficient storage and distribution.

Sealing and Strapping Packaging Tapes Market Regional Analysis

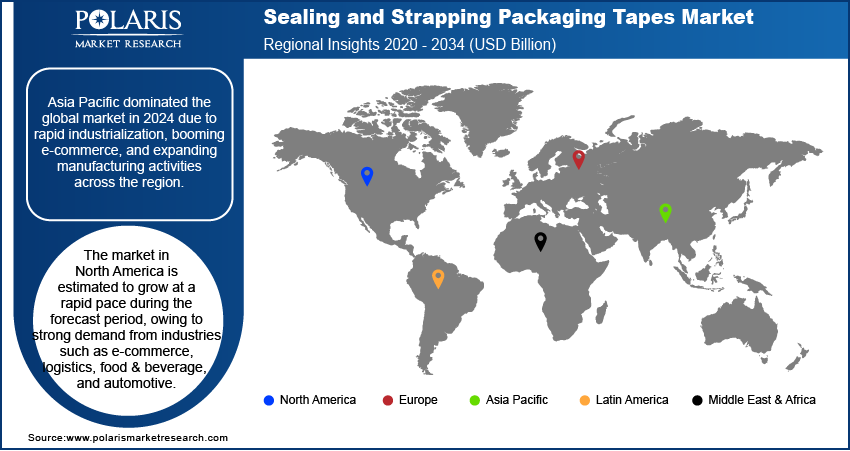

By region, the report provides the sealing and strapping packaging tapes market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the global market in 2024 due to rapid industrialization, booming e-commerce, and expanding manufacturing activities across the region. Countries such as China, India, and Japan drive demand for sealing and strapping packaging tapes as businesses in these nations rely on high-quality packaging solutions to support large-scale production and global exports. The surge in online retail and third-party logistics services has fueled the need for secure packaging, increasing the adoption of strapping and sealing solutions. Additionally, government initiatives promoting industrial growth and infrastructure development have created a higher demand for durable and cost-effective packaging materials. The rising presence of multinational corporations and regional manufacturers has further strengthened the market as companies seek reliable packaging solutions, including sealing and strapping packaging tapes, to ensure product safety during transportation and storage.

The North America sealing and strapping packaging tapes market is estimated to grow at a rapid pace during the forecast period, owing to strong demand from industries such as e-commerce, logistics, food & beverage, and automotive. The region’s highly developed supply chain infrastructure and widespread adoption of automation in packaging operations have increased the use of strapping and sealing packaging tapes. Businesses in the US and Canada are prioritizing secure and efficient packaging to meet the growing consumer demand for fast and reliable deliveries. The surge in online shopping, fueled by major retailers such as Amazon and Walmart, further accelerates the need for sealing and strapping packaging tapes that ensure package integrity during transit. Additionally, sustainability initiatives and regulatory policies have encouraged the adoption of eco-friendly and recyclable packaging materials, boosting innovation in the regional market.

Sealing and Strapping Packaging Tapes Market – Key Players and Competitive Insights

Prominent market players are investing heavily in research and development in order to expand their offerings, which will help the sealing and strapping packaging tapes market grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The sealing and strapping packaging tapes market is fragmented, with the presence of numerous global and regional market players. Major players in the market include 3M, Advance Tapes International Ltd., Avery Dennison Corporation, Bostik SA, Intertape Polymer Group Inc, Nitto Denko Corporation, Saint-Gobain Performance Plastics Corporation, Scapa Group plc, Shurtape Technologies LLC, and tesa SE.

Bostik SA, a subsidiary of the Arkema Group, stands as a prominent player in the global adhesive and sealant industry, specializing in innovative solutions for various applications, including sealing and strapping packaging tapes. Bostik has evolved from a local dye manufacturer into a leading force in adhesive technologies. The company’s commitment to innovation drives its development of smart adhesive solutions that cater to the dynamic needs of industrial, construction, and consumer markets. Bostik's extensive product portfolio includes a wide range of adhesives, sealants, and coatings designed to enhance performance and durability while promoting sustainability.

3M, originally known as Minnesota Mining and Manufacturing Company, is a global player in the fields of industrial, safety, and consumer products. Founded in 1902 in Minnesota, 3M has grown into a multinational conglomerate with operations in over 70 countries and a product portfolio exceeding 60,000 items. The company’s innovative spirit drives its development of advanced materials and solutions across various sectors, including healthcare, electronics, automotive, and consumer goods. Among its most recognized products are Scotch Tape, Post-it Notes, and Nexcare adhesive bandages. 3M's commitment to research and development has led to significant advancements in adhesive technologies, making it a trusted name in the industry.

List of Key Companies in Sealing and Strapping Packaging Tapes Market

- 3M

- Advance Tapes International Ltd.

- Avery Dennison Corporation

- Bostik SA

- Intertape Polymer Group Inc

- Nitto Denko Corporation

- Saint-Gobain Performance Plastics Corporation

- Scapa Group plc

- Shurtape Technologies LLC

- tesa SE

Sealing and Strapping Packaging Tapes Industry Developments

August 2024: Shurtape, a company that manufactures and sells adhesive tape, office supplies, and consumer goods, expanded its line of sustainable packaging tapes with the launch of rPET recycled packaging tapes.

November 2023: Monta, a company that specializes in providing outsourced packaging solutions for e-commerce businesses, introduced the rPET 873 self-adhesive packaging tape. The company stated that the packaging tape is made from 100% recycled PET, offering a durable and eco-friendly solution for packaging.

November 2022: Bostik, a major global adhesive specialist for industrial, construction, and consumer markets, unveiled two new tape and label adhesives in India to support the manufacturing industry and drive the shift toward a circular economy.

Sealing and Strapping Packaging Tapes Market Segmentation

By Material Outlook (Volume, Million Square Meters; Revenue, USD Billion; 2020–2034)

- Paper

- Polypropylene

- Polyvinyl Chloride

- Other

By Adhesive Outlook (Volume, Million Square Meters; Revenue, USD Billion; 2020–2034)

- Acrylic

- Rubber

- Silicone

- Others

By Application Outlook (Volume, Million Square Meters; Revenue, USD Billion; 2020–2034)

- Carton Sealing & Inner Packaging

- Strapping & Bundling

By Regional Outlook (Volume, Million Square Meters; Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Sealing and Strapping Packaging Tapes Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 22.62 billion |

|

Revenue Forecast in 2025 |

USD 23.97 billion |

|

Revenue Forecast by 2034 |

USD 41.13 billion |

|

CAGR |

6.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Million Square Meters, Revenue in USD Billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global sealing and strapping packaging tapes market size was valued at USD 22.62 billion in 2024 and is projected to grow to USD 41.13 billion by 2034.

The global market is projected to register a CAGR of 6.2 % during the forecast period.

Asia Pacific had the largest share of the global market in 2024.

Some of the key players in the market are 3M, Advance Tapes International Ltd., Avery Dennison Corporation, Bostik SA, Intertape Polymer Group Inc., Nitto Denko Corporation, Saint-Gobain Performance Plastics Corporation, Scapa Group plc, Shurtape Technologies LLC, and tesa SE.

The polypropylene segment dominated the sealing and strapping packaging tapes market in 2024.