Sea Bream Market Share, Size, Trends, Industry Analysis Report, By Product Type (Red Bream, Gilt-Head Bream, Black Bream, Pandora Bream, and White Bream); By Nature; By Packaging Type; By End Use; By Region; Segment Forecast, 2023 – 2032

- Published Date:Oct-2023

- Pages: 116

- Format: PDF

- Report ID: PM3846

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

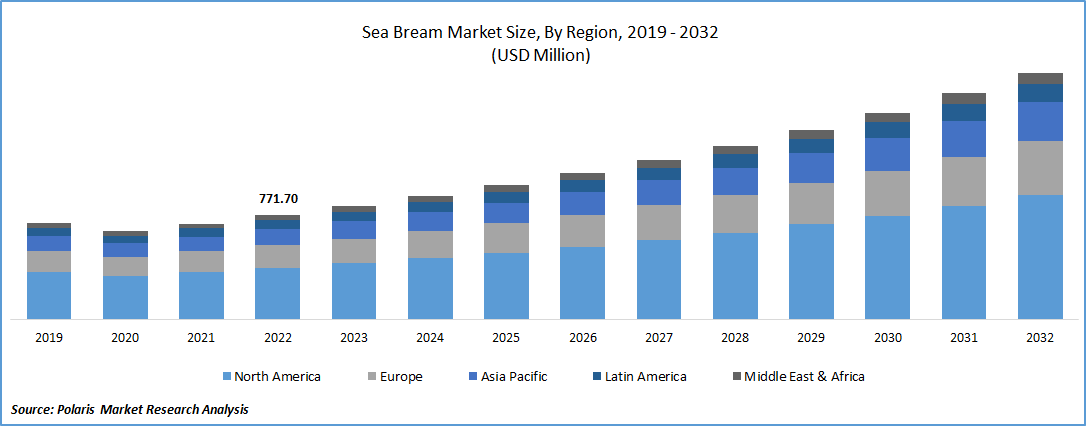

The global sea bream market was valued at USD 771.70 million in 2022 and is expected to grow at a CAGR of 9.0% during the forecast period.

The increasing emphasis on sustainable fishing practices and responsible aquaculture benefits across the globe and the exponential rise in the number of consumers becoming more aware of the environmental impact of their food choices and preferring seafood sourced from well-managed fisheries or responsible aquaculture operations are the primary factors boosting the market growth. In addition, the rising seafood consumption, including sea bream, due to several factors like changing dietary preferences, increasing disposable incomes, and a growing middle-class population in many countries, are likely to contribute significantly towards the market growth.

To Understand More About this Research: Request a Free Sample Report

For instance, in December 2021, INVE Aquaculture announced the launch of the first-ever rotifer substitution diet named Natura Pro and ExL, which is likely to be a game changer that enables hatcheries to reduce rotifer demands by over 50% effectively. This development is a result of several trials of rearing sea bream at the commercial scale in Europe.

Moreover, the introduction to technological innovations has aided in disease prevention and management in sea bream farming and growing advances in diagnostic techniques, including molecular testing, which enables timely disease management strategies such as vaccination programs, biosecurity measures, and targeted treatments, minimizing disease outbreaks and improving overall farm health, which in turn, positively influencing the growth of the sea bream market.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the sea bream market. The rapid spread of the deadly coronavirus across the globe forced countries and governments to take necessary actions like lockdowns and trade restrictions, which resulted in the temporary closure of manufacturing or processing facilities and huge disruptions in supply chains, leading to a significant decline in revenue and sales during the pandemic.

Industry Dynamics

Growth Drivers

Growing consumer awareness

Growing consumer awareness and higher preferences for seafood, including sea bream, and a significant increase in the number of consumers seeking out healthier protein sources and opting for sea bream due to its greater nutritional value, including high protein content and omega-3 fatty acids, are the leading factors driving the growth of the sea bream market. Also, the rising popularity of seafood in general, along with the unique taste and culinary versatility of sea bream, has led to increased demand from consumers all over the world.

Furthermore, a large number of businesses globally are focusing on the development of value-added seabream products such as pre-marinated or pre-cooked options, ready-to-eat meals, or frozen seafood mixes and emerging preference towards offering convenience and innovative product options, allowing them to cater to the evolving needs and preferences of consumers and expanding their customer base, are also the key among the key factors expected to create growth opportunities for the market.

Report Segmentation

The market is primarily segmented based on product type, nature, packaging type, end use, and region.

|

By Product Type |

By Nature |

By Packaging Type |

By End Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Analysis

Red bream segment accounted for the largest market share in 2022

The red bream segment accounted for largest global revenue share, which is highly attributable to rising consumer preferences, taste, and perception of red bream's quality and flavor and the increasing number of people looking for these breams due to its taste, texture, color, or regional culinary traditions. Additionally, increasing consumer awareness about the nutritional value and health benefits of seafood, including red bream, as it is a good source of lean protein, essential fatty acids, vitamins, and minerals, driving the segment market growth.

The black bream segment is anticipated to grow at a significant growth rate over the coming years, which is mainly accelerated by the growing popularity of black bream in many cuisines worldwide, including Mediterranean, Asian, and Middle Eastern cuisines, along with the influence of culinary trends and the growing prevalence of international flavors, that have led to increased demand for black bream in both domestic and international markets.

By Nature Analysis

Organic segment is projected to hold significant market share during forecast period

The organic segment is projected to account for a substantial market share in terms of revenue over the projected period, surging consumer awareness regarding the potential health and environmental benefits and a large number of people becoming more conscious of the potential health risks associated with conventional farming methods and are willing to pay a premium for organically produced fish.

Additionally, organic farming practices that promote sustainable and environmentally friendly techniques, such as responsible waste management, reduced chemical usage, and protection of aquatic ecosystems, significantly resonate with consumers who prioritize supporting eco-friendly practices and boosting the growth of the market.

By Packaging Type Analysis

Fresh segment led the industry market with noteworthy share in 2022

The fresh segment led the industry market with a substantial market share in 2022, which is highly attributable to the growing consideration of fresh products as a nutritious option due to their high protein content, low levels of saturated fats, and rich omega-3 fatty acids coupled with the rising penetration for improved distribution channels and logistics that have made fresh sea bream more accessible to consumers and enhanced transportation and cold chain infrastructure ensuring that the fish reaches consumers in a fresher state, encouraging its consumption.

By End-Use Analysis

Food industry is expected to witness highest growth over the projected years

The food industry is expected to gain the fastest growth during the anticipated period, mainly accelerated by constantly evolving and seeking new product offerings to meet consumer demands in the food industry, which includes value-added seabream products such as ready-to-cook meals, marinated fillets, and smoked sea bream, catering to rising demand for convenience-seeking consumers globally.

Moreover, sea bream is known to offer a versatile ingredient that can be prepared in various ways, including grilling, baking, steaming, and pan-frying, and its mild flavor and firm texture makes it suitable for a wide range of culinary applications, catering to diverse consumer preferences and culinary trends worldwide.

By Regional Analysis

North America region dominated the global market in 2022

The North America region dominated the global market with a considerable share in 2022 and is projected to maintain its dominance throughout the forecast period. The regional market growth can be mainly accelerated by growing interest among regional consumers towards exploring different types of seafood, including sea bream, along with the presence of improved transportation and distribution networks in countries like the US and Canada, which have made it easier to import and distribute sea bream throughout the region.

The Asia Pacific region is likely to exhibit the fastest rate of growth over the course of the study period, owing to the rapidly growing population and rising consumer disposable incomes in emerging economies like India, China, and Indonesia, leading to increased seafood consumption. Besides this, the rapid development and expansion of advanced aquaculture techniques and facilities contributing to increased production and availability of sea bream are also likely to have a positive impact on the market’s growth.

Competitive Insight

The Sea Bream market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- Ardag Seafood Company

- Beijing Tongzhou Fish Industry Group

- Cooke Aquaculture Inc.

- Corfy Sea Farm S.A.

- Cromaris, Avramar

- Gloria Maris Groupe

- Greig Seafood ASA

- HESY Aquaculture B.V.

- Mowi ASA

- Nireus Aquaculture S.A.

- Ozsu Fish

- Philofish S.A.

- Pinar Balik

- Selonda Aquaculture S.A.

- The Nissui Group

- The Scottish Salmon Company

Recent Developments

- In November 2021, Avramar, introduced new products including sea bream, sea brass, & pagrus, that comes with the ready-to-cook fish presented under a protective atmosphere packaging. These products will also be available in the private-label packaging across retail chains.

- In October 2021, Regional Fish along with the Kyoto University and Kinki University, & Ministry of Healthcare, developed a gene-edited sea bream named “Madai” a. It is developed using the CRISPR gene editing technology & improved feed utilization by around 14%.

Sea Bream Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 839.07 million |

|

Revenue forecast in 2032 |

USD 1,826.86 million |

|

CAGR |

9.0% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Product Type, By Nature, By Packaging Type, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The sea bream market report covering key segments are product type, nature, packaging type, end use, and region.

Sea Bream Market Size Worth $1,826.86 Million By 2032.

The global sea bream market is expected to grow at a CAGR of 9.0% during the forecast period.

North America is leading the global market.

key driving factors in sea bream market are growing consumer awareness.