Savory Snack Products Market Share, Size, Trends, Industry Analysis Report, By Distribution Channel (Retail, Foodservices); By Flavor (Barbeque, Spicy, Salty, Plain/Unflavored, Others); By Product; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 113

- Format: PDF

- Report ID: PM2448

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

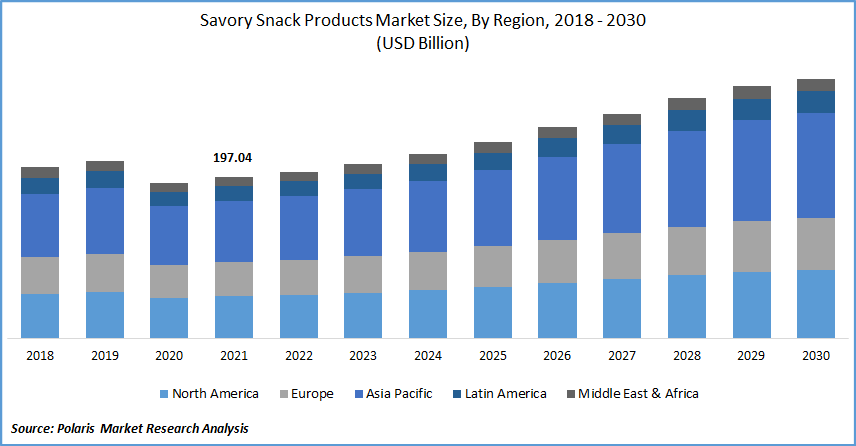

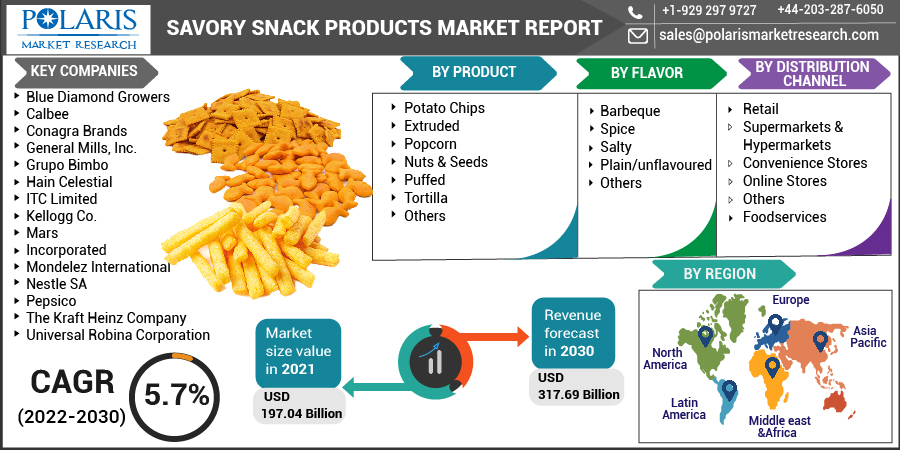

The global savory snack products market was valued at USD 197.04 billion in 2021 and is expected to grow at a CAGR of 5.7% from the forecast period. Consumer demand for meat-based refreshments is increasing as consumer awareness of healthy eating habits grows, bolstering the savory snack products market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Protein is required in their packs for several reasons, including satiety, muscle support, nutrition, and healthy aging. Meat appetizers have traditionally been found on the shelves of convenience stores, but as more consumers desire healthier and leaner refreshments, they are taking up more shelf space in a variety of retail formats.

The total demand for savory snack products market is likely to be driven by increasing market penetration and increased customer desire for meat appetizers. Furthermore, they are available in many flavors, including teriyaki, spicy, smoked, and hickory, giving consumers a variety of options. However, these health risks connected with major ingredients in savory foods, including wheat, corn, and other flours, vegetable oil, salt, sugar, chemical additives, and preservatives, constitute a serious threat to market expansion over the forecast period.

Snacking regularly adds extra calories to the body, perhaps leading to enormous weight gain and obesity. Obesity prevalence in the United States was 42.4 percent in 2017–2018, according to data from the Centers for Disease Control and Prevention (CDC). These major health concerns are creating a threat to the global savory snack products market.

Industry Dynamics

Growth Drivers

Due to increased urbanization levels and busier lifestyles, consumers' eating habits are being influenced by their choice of convenience items, particularly among middle-to-high-income customers. In recent years, as disposable incomes and busy lifestyles have increased, customers have increasingly replaced traditional meals with more flexible, convenient, and light refreshment options.

Furthermore, the worldwide GDP growth rate has been high, which has impacted consumer purchasing power to pick indulgent and luxury foods, boosting the savory snack products industry. In rising economies like China, India, Bangladesh, and Indonesia, the market for convenience meals is growing. Because of the infusion of Western culture, pretzels, extruded appetizers, and other refreshments have become popular in the world.

Furthermore, food retail is being driven by consistent government regulations and significant investments in the retailing industry, which is boosting the exposure of savory snack products. Continuing economic development is expected to drive demand for imported goods, while retail innovation will open up more options to display consumer-oriented, high-value goods on store shelves and e-commerce platforms.

For instance, the Indian economy has seen significant changes in the retail and e-commerce sectors. After negotiating a franchise contract with Indian retailer Future Group, 7-Eleven, the world's largest convenience store chain, announced its plans to open its first outlets in India.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on product, flavor, distribution channel, and region.

|

By Product |

By Flavor |

By Distribution Channel |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Insight by Flavor

Based on the flavor segment, the plain/unflavored segment is expected to be the most significant revenue contributor. Consumers increasingly prefer plain and unflavored savory snack products. Consumers are also searching for products with consumer-friendly ingredients, clean label claims, and regionally and ethically produced ingredients, which can assist companies in developing health and wellness products.

Insight by Distribution Channel

Based on the distribution channel, the retail segment held the highest share in 2021. Retail establishments sell a variety of goods from diverse brands, allowing customers to compare and make an informed purchase decision.

Furthermore, the importance of impulsive buying when purchasing a pack of savory snack products can be ascribed to retail establishments due to the enormous shelf space available in supermarkets and the importance of impulse buying when purchasing a pack savory snack products. Customers get greater value for money as a result of discount possibilities and a wider variety of selections, resulting in people all over the world choosing to buy or get groceries from offline retail outlets.

Geographic Overview

North America had the largest revenue share. This is due to the customers continuing to value the portability, convenience, and indulgence that savory snack products provide. Furthermore, the sanctification trend among consumers in the region is an all-day habit, with consumers of all ages nibbling at least once a day.

Chips/crisps and tortilla/corn chips are the two most popular savory snack products choices among Americans, with chips/crisps accounting for the most dollar value sales. Different preparation techniques, such as toasted coconut kale chips, oven-roasted sweet potato chips, and a wide variety of roasted almonds, are expanding the taste map and increasing the demand for savory snack products in the region.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market. This growth is primarily due to innovative ads and campaigns towards product adoption, consumer awareness regarding healthy munchies, and a booming upper middle class with high disposable income with changing lifestyles. South Asian nations have a wide range of savory snacks with a substantial population of millennials seeking healthier lifestyles. Moreover, the rising obese population and awareness regarding healthy eating favored the region’s growth.

Competitive Insight

Some of the major players operating in the global market include Blue Diamond Growers, Calbee, Conagra Brands, General Mills, Inc., Grupo Bimbo, Hain Celestial, ITC Limited, Kellogg Co., Mars, Incorporated, Mondelez International, Nestle SA, Pepsico, The Kraft Heinz Company, and Universal Robina Corporation, among others.

Savory Snack Products Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 197.04 Billion |

|

Revenue forecast in 2030 |

USD 317.69 Billion |

|

CAGR |

5.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Flavor, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Blue Diamond Growers, Calbee, Conagra Brands, General Mills, Inc., Grupo Bimbo, Hain Celestial, ITC Limited, Kellogg Co., Mars, Incorporated, Mondelez International, Nestle SA, Pepsico, The Kraft Heinz Company, and Universal Robina Corporation |