Saudi Arabia Halal Cosmetics Market Share, Size, Trends, Industry Analysis Report

By Product (Skin Care, Hair Care, Make-up & Color Cosmetics, and Others); By Distribution Channel; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 118

- Format: PDF

- Report ID: PM2151

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

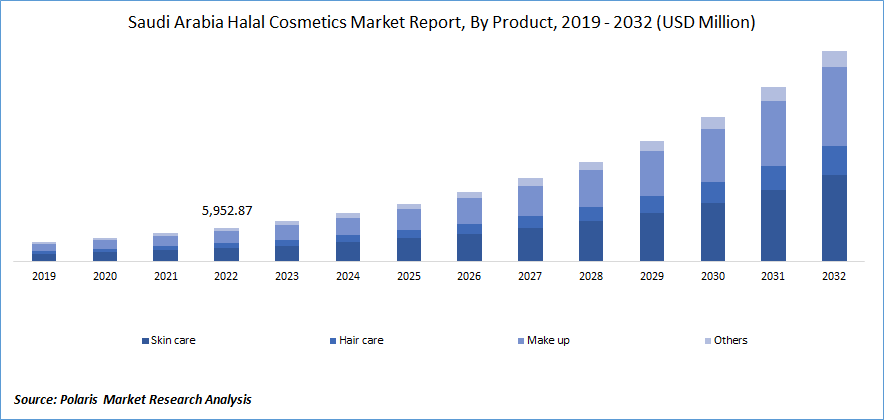

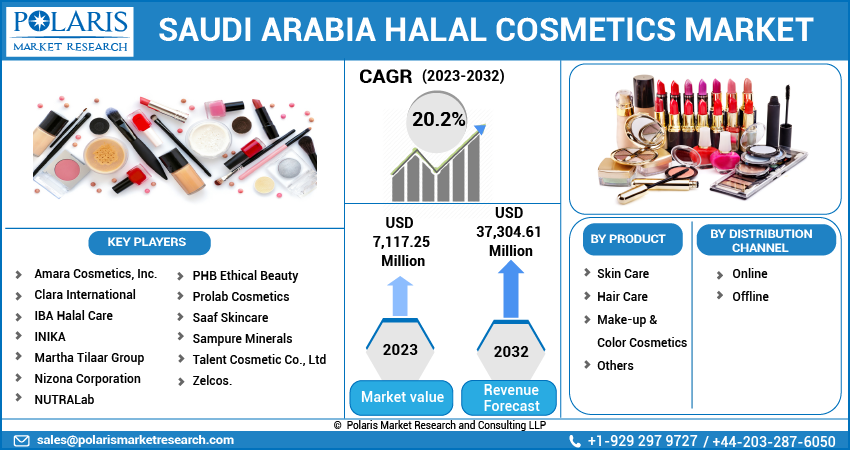

The saudi arabia halal cosmetics market was valued at USD 5,952.87 million in 2022 and is expected to grow at a CAGR of 20.2% during the forecast period.

The Saudi Arabia halal cosmetics market is expected to be accelerated by the rising internet penetration in the country, leading to increased options and easy product availability.Saudi Arabia’s halal cosmetics market is categorized based on applications and distribution channels. Major applications include skincare, make-up, and hair care. Other segments mainly include deodorants and perfumes. The rising number of Muslims gaining higher education is another factor for the shifting trends and increasing demand for safe, high-quality products. Though there is a rising demand for such products in Saudi Arabia, a robust regulatory system is absent compared to other regions of Saudi Arabia.

To Understand More About this Research: Request a Free Sample Report

The market is a niche with both large- and small-scale manufacturers. It has been reported that non-Muslim companies dominate the overall industry, which sometimes poses a serious threat to Saudi Arabia’s halal cosmetics industry participants. For instance, Brunei has an established regulatory system that produces these cosmetics. Several Muslim countries have adopted many initiatives to integrate the industry. Malay Chamber of Commerce Malaysia (MCCM) tried building a marketing center in Dubai. This would help the growth of Saudi Arabia’s halal cosmetics industries and pave opportunities for manufacturers to advertise their product portfolio in various parts of the globe, including Saudi Arabia.

Increasing awareness among Muslim consumers about the substances used in personal care products will positively affect Saudi Arabia’s halal cosmetics market growth over the next eight years. Since Muslims encompass a major part of Saudi Arabia, they thrive in the mainstream cosmetic industry to satisfy their needs. As a result, manufacturers started introducing Shariáh compliant products focusing mainly on the Muslim population.

The outbreak of the Covid-19 pandemic has negatively impacted Saudi Arabia’s halal cosmetics industry growth. Nationwide lockdown forced the manufacturers to shut down their manufacturing facilities which led to the decreased production of cosmetic products. Strict rules and regulations also restricted the movement of the workforce from one place to another within the country, hampering the manufacturing and output of cosmetic products.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The rising demand for Saudi Arabia halal cosmetics among consumers owing to product awareness and the ingredients used is anticipated to fuel industry growth over the forecast period. Muslim consumers are interested in shopping for personal care and cosmetic products that are halal-certified and Shariah-compliant. Such a factor would lead to an eco-ethical modern consumer and assist the overall industry growth over the forecast period.

The Saudi Arabia halal cosmetic market is expected to witness a significant growth rate owing to the rising preference towards strict adherence to the halal code and the increasing product portfolio of industry participants. In addition, the growing concern among consumers associated with using derived animal ingredients such as gelatin and collagen has led many cosmetic market participants to adopt halal certification.

Report Segmentation

The market is primarily segmented based on product and distribution channels.

|

By Product |

By Distribution Channel |

|

|

To Understand the Scope of this Report: Speak to Analyst

The skincare product segment holds the major share over the forecasted period.

Skincare products are likely to hold a major share shortly. The increased growth in the skin care segment can be attributed to the fact that women in the country perceive these skin care products as a means to achieve religious adherence. In addition, the younger population in the country is embracing skin care products due to their inherent advantages, such as no long-term side effects, animal welfare, lack of skin irritation, and others. Such trends are expected to benefit the segment’s growth.

The hair segment is also expected to account for a significant share over the forecast period. Developing and introducing novel hair care products benefit the segment’s growth. The story of advanced hair care products guarantees long-lasting fragrance and conditioning and also aids in maintaining hair volume, which has resulted in the demand for the segment.

A rising number of Saudi Arabia’s population is searching for such brand alternatives owing to their eco-friendly and cruelty-free characteristics. Lipsticks usually contain pig fat in normal personal care products. Such product usage by Muslims is against their law. Owing to their strict religious beliefs, Saudi Arabia’s halal cosmetics consumption is presumed to grow positively over the forecast period.

The online segment is expected to grow fastest over the forecast period.

The market is poised for rapid growth, with the online segment projected to outpace other channels over the forecast period. Increased internet penetration, rising smartphone usage, and the convenience of online shopping drive the shift toward e-commerce. Consumers' preference for Halal-certified products aligns with the comfort and accessibility offered by online platforms.

Online shopping provides a wide range of choices, easy product comparisons, and doorstep delivery, making it an attractive option for consumers seeking Halal cosmetics. Furthermore, the COVID-19 pandemic has accelerated the adoption of online shopping as consumers prioritize safety and social distancing measures. E-commerce platforms and dedicated Halal cosmetics websites are expected to witness significant growth in the Saudi Arabia market, meeting the increasing demand for Halal-certified products.

Competitive Insight

Some of the major players operating in the Saudi Arabia market include Amara Cosmetics, Inc., Clara International, IBA Halal Care, INIKA, Martha Tilaar Group, Nizona Corporation, NUTRALab, PHB Ethical Beauty, Prolab Cosmetics, Saaf Skincare, Sampure Minerals, Talent Cosmetic Co., Ltd, and Zelcos.

Recent Developments

- In April 2022, Inika Organic unveiled its latest cosmetics line, Pure with Purpose. The collection features various products, including the Lash & Brow Serum, Hydrating Toning Mist, Eyeshadow Quads, Brow Palette, and many others. With a strong emphasis on natural ingredients, these products are proudly labeled as 100% natural, vegan-certified, halal-certified, and cruelty-free, ensuring ethical and sustainable choices for beauty enthusiasts.

Saudi Arabia Halal Cosmetics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 7,117.25 million |

|

Revenue forecast in 2032 |

USD 37,304.61 million |

|

CAGR |

20.2% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Product, By Distribution Channel |

|

Key Companies |

Amara Cosmetics, Inc., Clara International, IBA Halal Care, INIKA, Martha Tilaar Group, Nizona Corporation, NUTRALab, PHB Ethical Beauty, Prolab Cosmetics, Saaf Skincare, Sampure Minerals, Talent Cosmetic Co., Ltd, and Zelcos. |

FAQ's

key companies in saudi arabia halal cosmetics market are Amara Cosmetics, Inc., Clara International, IBA Halal Care, INIKA, Martha Tilaar Group, Nizona Corporation

The saudi arabia halal cosmetics market is expected to grow at a CAGR of 20.2% during the forecast period.

The saudi arabia halal cosmetics market report covering key segments are product and distribution channels.

key driving factors in saudi arabia halal cosmetics market are Implementation of strict regulations and guidelines for Halal certification

The saudi arabia halal cosmetics market size is expected to reach USD 37,304.61 million by 2032.