Safety Helmet Market Size, Share, Trends, Industry Analysis Report: By Product, Material, End User (Construction, Mining, Manufacturing, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 120

- Format: PDF

- Report ID: PM2576

- Base Year: 2024

- Historical Data: 2020-2023

Safety Helmets Market Overview

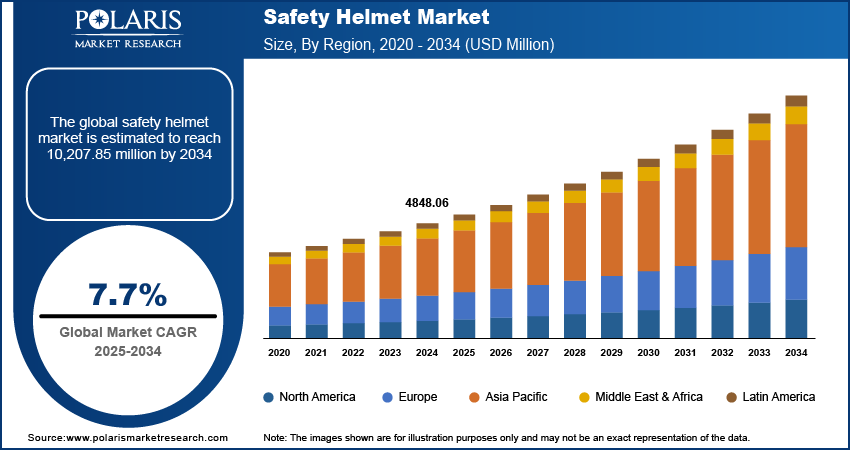

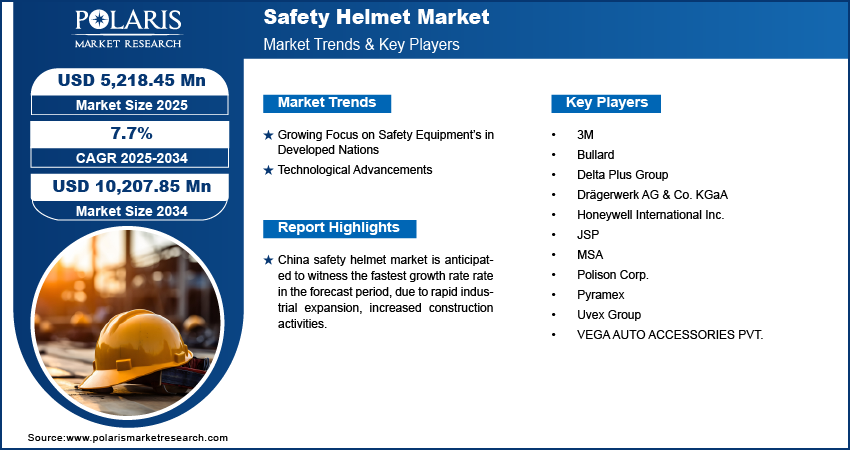

The safety helmet market size was valued at USD 4,848.06 million in 2024. The market is projected to grow from USD 5,218.45 million in 2025 to USD 10,207.85 million by 2034, exhibiting a CAGR of 7.7% from 2025 to 2034.

A safety helmet is a type of protective helmet designed to prevent injuries from falling objects, impacts, or electrical hazards. It is widely used in various settings, including construction, industrial work, driving, and sports, to promote safety.

The rising use of motorcycles and vehicles has heightened the demand for helmet, especially in response to stringent government safety regulations. Additionally, there is a growing participation in sports and recreational activities, which has further increased the need for athletic helmet. Furtermore, noticeable shift towards online sales, with manufacturers launching their own e-commerce platforms and collaborating with major retailers. This transition allows for direct sales to customers, eliminates intermediaries, reduces costs, and enhances the overall customer experience. Facilitating online sales, safety helmet become more accessible, enabling companies to reach international markets while also lowering overhead costs typically associated with physical retail spaces.

Increasing focus on personnel safety is a significant factor propelling the growth of the safety helmet market. Awareness of the risks related to head injuries in the workplace is rising among both employers and employees, supported by campaigns and educational programs that highlight the importance of safety equipment. For example, the FIA Safe & Affordable Helmet Programme in Mexico has distributed 2,600 UN-certified Helmet, highlighting the critical need for helmet safety to reduce accidents in sectors such as metal manufacturing and construction.

To Understand More About this Research: Request a Free Sample Report

Safety Helmets Market Trends and Drivers

Growing Focus on Safety Equipments in Developed Nations

The demand for safety helmet is rapidly increasing in developed nations, particularly within sectors such as welding, mining, chemicals, and construction. In the US, inadequate helmet usage in industries like manufacturing and construction has led to severe head injuries, further amplifying the need for safety helmet. For instance, according to the International Brain Injury Association, brain injuries are among the leading causes of death and disability worldwide. In the US alone, approximately one million individuals are treated for traumatic brain injury (TBI) annually, resulting in 50,000 fatalities and 5.3 million people living with related disabilities. The ongoing industrialization in emerging economies, combined with a heightened emphasis on worker safety, is expected to significantly boost the demand for safety Helmet.

Technological Advancements

Technological advancements are playing a crucial role in the growth of the safety helmet market. Recent innovations harness Industrial IoT and AI technologies, introducing multi-directional impact protection systems such as MIPS and twICEme, which enhance emergency response capabilities. Modern safety Helmet are now equipped with features such as front and rear cameras, voice controls, and Alexa integration, all of which greatly improve rider safety and functionality. For instance, in May 2024, JARVISH launched its X-Series Helmet, which boast features like heads-up displays (HUD), 360° cameras, voice controls, and Alexa integration. The X-AR model further enhances safety with augmented reality (AR) projections and a 2K rear camera. These helmet are certified and utilize military-grade batteries, ensuring reliability and performance in demanding environments.

Safety Helmets Market Segment Insights

Safety Helmet Market Assesment by Product Outlook

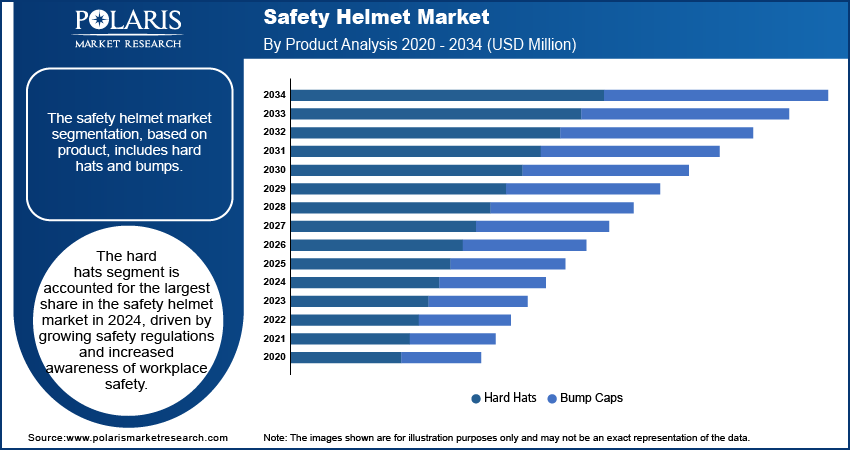

The safety helmet market segmentation, based on product, includes hard hats and bumps. The hard hats segment is accounted for the largest share in the safety helmet market in 2024, driven by growing safety regulations and increased awareness of workplace safety. Hard hats are essential for protecting workers in high-risk industries such as construction, manufacturing, and mining. For instance, the National Institute for Occupational Safety and Health (NIOSH) reported that hard hats prevent approximately 1,400 head injuries each year on construction sites. Head injuries account for nearly 20% of fatalities in the construction sector, and inadequate head protection can result in more days away from work due to injuries.

Safety Helmet Market Evaluation by End User Outlook

The safety helmet market segmentation, based on end user, includes construction, manufacturing, mining, and others. The construction segment is projected to experience fastest growth over the forecast period, driven by an increasing demand for improved public infrastructure, such as roads, airports, rail systems, and harbors. This rising demand is expected to fuel the safety helmet market sales in the coming years. Additionally, substantial investments in construction across Asia Pacific nations are contributing to the market expansion. For instance, in February 2024, India announced that 3.3% of its GDP was allocated to infrastructure development, with a focus on enhancing airports, railways, and urban transport. The government plans to expand the national highway network, develop new airports, and operationalize waterways as part of this initiative.

Safety Helmets Market Breakdown by Regional Insights

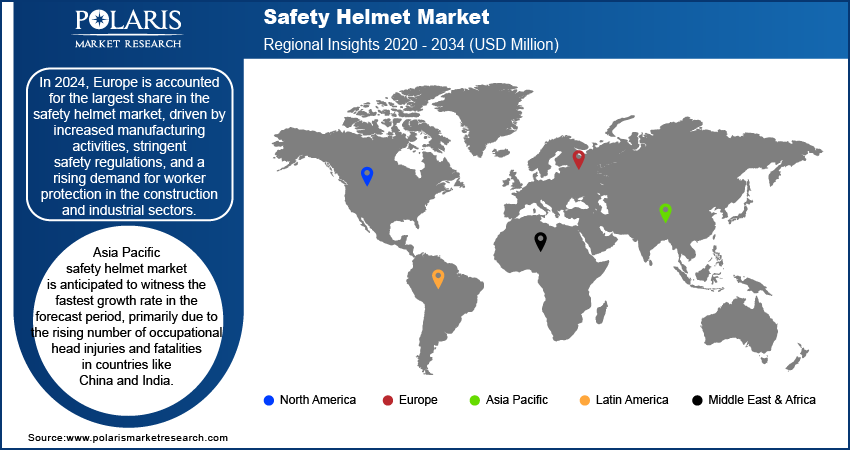

In 2024, Europe is accounted for the largest share in the safety helmet market, driven by increased manufacturing activities, stringent safety regulations, and a rising demand for worker protection in the construction and industrial sectors. These factors are enhancing safety standards and facilitating technological advancements. Additionally, the rapid growth of the automobile manufacturing industry is expected to further elevate the demand for products designed to prevent road accidents and improve worker safety. For instance, according to the European Commision, in 2023, Bulgaria and Romania exhibited the highest fatality rates on the roads, with number of 82 and 81 fatalities per million inhabitants, respectively.

Asia Pacific safety helmet market is anticipated to witness the fastest growth rate in the forecast period, primarily due to the rising number of occupational head injuries and fatalities in countries like China and India. The region's expanding industrial and construction sectors are expected to further boost helmet demand. For instance, in 2021, China embarked on ambitious infrastructure projects both domestically and internationally, with investments ranging from USD 4 to 8 trillion. Rapid industrialization and urbanization in countries like China, India, and Southeast Asian nations are driving construction activities, which, in turn, elevate the demand for safety equipment, including saftey and smart helmet. Additionally, stringent workplace safety regulations and rising awareness about worker safety are encouraging the adoption of personal protective equipment (PPE).

China safety helmet market is anticipated to witness the fastest growth rate rate in the forecast period, due to rapid industrial expansion, increased construction activities, and stringent enforcement of workplace safety regulations. The country's ambitious infrastructure projects, such as Belt and Road Initiative developments and urbanization efforts, significantly drive the demand for safety Helmet across industries like construction, manufacturing, and mining.

Safety Helmet Market – Key Players & Competitive Insights

The competitive landscape of the safety helmet market is marked by the presence of numerous global and regional players striving to capture market share through innovation, product differentiation, and strategic partnerships. Key manufacturers such as Honeywell International Inc., 3M Company, MSA Safety Incorporated, and Bullard focus on developing technologically advanced Helmet with features like lightweight materials, enhanced ventilation, and integrated communication systems. These companies leverage their global distribution networks to cater to diverse industries, including construction, manufacturing, and oil and gas. Regional players, particularly in high-growth markets like Asia-Pacific, are intensifying competition by offering cost-effective products tailored to local industry needs. Companies like Delta Plus Group and Uvex Safety Group emphasize ergonomic designs and compliance with international safety standards to attract customers in emerging economies. Additionally, advancements in smart Helmet equipped with sensors for monitoring environmental conditions and worker health are becoming a key differentiator in the market.

The market also sees frequent collaborations and mergers to strengthen product portfolios and expand geographic presence. Moreover, e-commerce platforms are playing a significant role in market expansion by improving the accessibility and affordability of safety Helmet for individual consumers and small-scale industries. . Major players in the safety Helmet market include Delta Plus Group, Bullard, Honeywell International Inc., 3M, MSA, JSP, Polison Corp., Drägerwerk AG & Co. KGaA, and Uvex Group, VEGA AUTO ACCESSORIES PVT.

Delta Plus Group is a global leader in designing and manufacturing safety Helmet for various industries. Leveraging 45 years of expertise and a network spanning 46 subsidiaries, Delta Plus delivers innovative helmet solutions that prioritize protection, comfort, and design. These solutions enhance safety across different sectors. In October 2023, Delta Plus showcased its latest offerings at the A+A trade fair in Düsseldorf with the "Enjoy Safety" stand, engaging industry professionals.

Honeywell International Inc. is a corporation that specializes in industrial goods and machinery. The company develops and manufactures technology to tackle challenges across a range of industries, including energy, security, safety, productivity, and urbanization on a global scale. Honeywell offers energy-efficient products and solutions, specialty chemicals, process technologies, electrical and advanced materials, as well as technologies for productivity, sensing, safety, and security. Additionally, the company provide spare parts to support their offerings. In April 2020, Honeywell made an agreement to acquire Norcross Safety Products, a top producer of personal protective equipment (PPE). This acquisition would provide Honeywell with a complete platform in a dispersed global segment.

List of Key Companies in Safety Helmet Market

- 3M

- Bullard

- Delta Plus Group

- Drägerwerk AG & Co. KGaA

- Honeywell International Inc.

- JSP

- MSA

- Polison Corp.

- Pyramex

- Uvex Group

- VEGA AUTO ACCESSORIES PVT.

Safety Helmet Market Developments

May 2024: 3M launched an advanced helmet designed to provide improved impact protection and comfort. This new model incorporates high-quality materials and advanced technology to enhance safety in high-risk environments.

February 2023: In July 2021, Pyramex Safety launched the Ridgeline XR7 safety helmet, the latest model in their Ridgeline helmet line. The helmet is made from lightweight polycarbonate/acrylonitrile butadiene styrene (ABS) material, offering increased strength and heat resistance.

August 2023: Bullard introduced the SIGHTLINE respirator hood, offering 320 degrees of uninterrupted viewing. This product is tailored for the life sciences sector to enhance visibility and protection.

Safety Helmet Market Segmentation

By Product Outlook (Revenue, USD Million; 2020–2034)

- Hard Hats

- Type I

- Type II

- Bump Caps

- Hard Bump Camps

- Soft Bump Caps

By Material Outlook (Revenue, USD Million; 2020–2034)

- Polyethylene (PE) Helmet

- Polycarbonate (PC) Helmet

- Acrylonitrile Butadiene Styrene

By End User Outlook (Revenue, USD Million; 2020–2034)

- Construction

- Manufacturing

- Mining

- Others

By Regional Outlook (Revenue, USD Million; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Vietnam

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Safety Helmet Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4,848.06 million |

|

Market Size Value in 2025 |

USD 5,218.45 million |

|

Revenue Forecast in 2034 |

USD 10,207.85 million |

|

CAGR |

7.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The safety helmet market size was valued at USD 4,848.06 million in 2024 and is projected to grow to USD 10,207.85 million by 2034.

The market is projected to grow at a CAGR of 7.7% from 2025 to 2034.

In 2024, Europe had the largest share in the safety helmet market, driven by increased manufacturing activities, stringent safety regulations, and a rising demand for worker protection in the construction and industrial sectors.

The key players in the market are Delta Plus Group, Bullard, Honeywell International Inc., 3M, MSA, JSP, Polison Corp., Drägerwerk AG & Co. KGaA, and Uvex Group, VEGA AUTO ACCESSORIES PVT.

The hard hats segment is accounted for the largest share in the safety helmet market in 2024, driven by growing safety regulations and increased awareness of workplace safety.

The construction segment is projected to experience fastest growth over the forecast period, driven by an increasing demand for improved public infrastructure, such as roads, airports, rail systems, and harbors