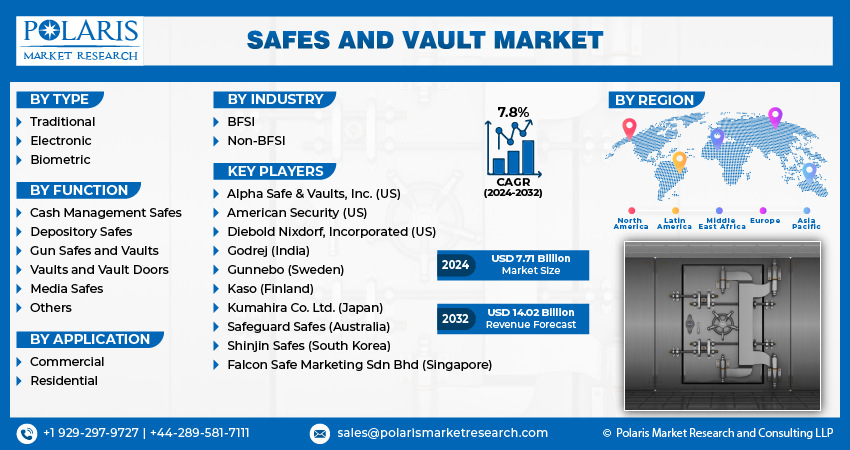

Safes and Vault Market Share, Size, Trends, Industry Analysis Report, By Type (Traditional, Electronic, Biometric); By Function; By Application; By Industry; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM4681

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

Safes and Vault Market size was valued at USD 7.25 billion in 2023. The market is anticipated to grow from USD 7.71 billion in 2024 to USD 14.02 billion by 2032, exhibiting the CAGR of 7.8% during the forecast period.

Market Overview

Growth in safes and vault market is attributable to the growing consumer concerns about the protection of valuable items. As the global market witnesses certain bank robbery, jewelry theft, and money theft activities, people, along with the banks, are showing interest in adopting advanced security safes and vaults. For instance, in December 2023, Axis Bank witnessed a bank robbery with a value of INR 16.5 lakh in Bihar, India. Furthermore, the rising offering of safes and vaults as a service model in the marketplace, with a lower cost of investment than a purchase, is expected to gain demand from cost-conscious consumers.

- For instance, in December 2023, Wing Bank announced the launch of new safe deposit box services in Phnom Penh with additional superior security features for the storage of valuable resources, including business documents, jewelry, and title deeds.

Moreover, the growing disposable income in the worldwide population is optimally boosting the demand for jewelry and other valuable metals, with a higher trust in their materialistic value. This is driving the demand for the adoption of vaults in housing settings to enhance security from unauthorized access. As this trend continues, there will be a huge demand for opportunities for safes and vault systems in the marketplace. According to the World Gold Council, in 2022, the demand for gold registered 4,471 tonnes, which is an all-time high for the past 11 years.

Growth Drivers

Rising crimes at the national level

The rising theft in the major countries is enabling their citizens to adopt safes and vault systems, contributing to the growth and expansion of the global safes and vault systems market. According to the available data, in December 2023, Washington witnessed an incidence of home burglaries, specifically in Indo-American households. These types of activities are enforcing the population to consume and equip effective safes and vault systems at their dwellings.

The increasing evolution of financial institutions

The growing development of financial institutions and commercial dwellings, including hotels and more, is positively influencing the demand for security storage equipment. As more banks establish themselves in the world, there will be a significant need for efficient locking systems, which will drive the demand for safes and vaults in the marketplace. The hotels and rental dwelling providers' interest in adopting locking systems to protect user valuables in one place with measures to promote consumer satisfaction is optimally boosting market growth.

Furthermore, the growing government initiatives to promote the safety of jewellery and precious metals consumption and export activities are positively influencing the adoption of safes and vault systems in the global market. For instance, in December 2023, Indian government introduced a center, Surat Diamond Bourse for international diamond and jewellery business. It has a clearance house, which manages import and export of Jewellery and a vault facility for international banking.

Restraining Factors

The adoption of digital vaults in the world

The technological progression is driving the rapid shift in the storage of valuable items from traditional vaults and safes to the digital vault system. The lower cost of investment for these digital features is likely to restrain the adoption of safes and vault systems to store currency and personal documents. For instance, in October 2023, the Development Bank of Singapore Ltd. (DBS/POSB) bank announced its plan to launch digiVault with a view to facilitating people to lock their money digitally.

Report Segmentation

The market is primarily segmented based on type, function, application, industry and region.

|

By Type |

By Function |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Biometric segment is expected to witness the highest growth during the forecast period

The biometric segment is projected to grow at a CAGR during the projected period, mainly driven by its potential to restrict access to other people rather than the owner. The growing research innovations in designing reliable secure storage systems by companies specializing in offering safes and vault systems are expanding the outreach of global consumers. For instance, in January 2023, Yale unveiled its new initial smart safe with the biometric verification process, voice assistance, and remote access features with the launch of the Yale Smart Safe and the Wi-Fi-based Yale Smart Safe.

By Function Analysis

Cash Management segment accounted for the largest market share in 2023

The cash management segment held the largest share. This can be attributable to the rising safety concerns about currency storage, specifically in banks, where the major problem is safeguarding cash storage securely. The rising cash deposits in the banks with the rising income level of the world population is making bank management replace their existing cash storage with advanced security features-based vault systems.

Moreover, the increasing companies’ initiatives to drive awareness about safes and vaults along with their brand coverage is significantly supporting the market growth. For instance, in July 2023, Gunnebo introduced new experience center to showcase their safe storage solutions to the customers in Jaipur, India.

By Application Analysis

Commercial segment held the significant market revenue share in 2023

The commercial segment held a significant market share in revenue in 2023, which is highly accelerated due to the continuous rise in the integration of reliable security systems at retail outlets, banking, and non-banking institutions. Retail companies are showing significant concern for storing official documents, cash, and other resources in vaults along with the vault doors, contributing to the significant demand for safes and vaults in the marketplace. For instance, in October 2023, Godrej Security Solutions introduced hotel safes to promote secure hospitality services.

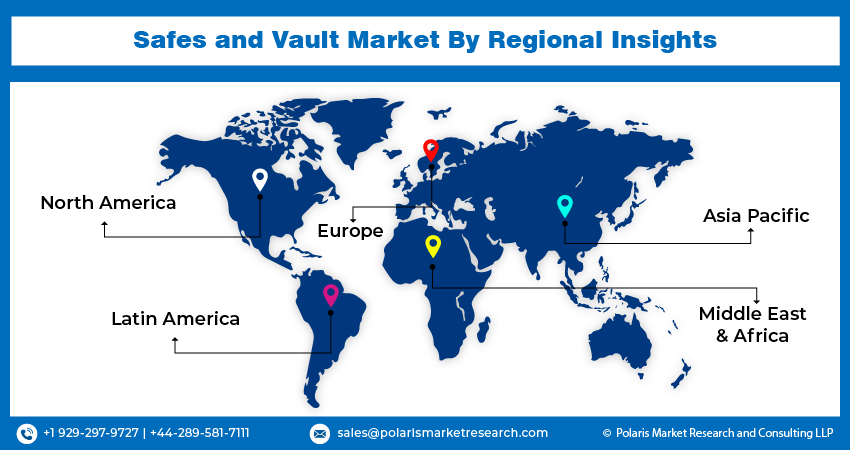

Regional Insights

North America region registered the largest share of the global market in 2023

The North America region held the global market with the largest market share in 2023 and is expected to continue its dominance over the study period. The growth of the market can be largely attributed to the presence of a larger population with a prominent income, specifically in the United States and Canada. This is encouraging citizens to equip security systems, contributing to market growth in the region. Furthermore, the rising residential security solutions offering by the major players is anticipated to fuel their demand in the coming years. For instance, in July 2023, Inkas Safes, a Canadian company announced the addition of new security solution, Residential Vault System to its product portfolio to cater households at the time of emergencies and store valuables in the region.

Additionally, the United States taking measures to promote the importance of gun protection with the increasing prevalence of unauthorized access to the guns among the school children. For instance, in January 2023, White House announced the new gun safety initiative to enhance safe firearms storage. Moreover, February 2023, the United States Attorney’s Office of the Veramont announced the campaign to raise awareness about gun safety storage.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the growing consumption of gold and other prominent metals in the region. Based on the existing data, the 2most populous nations, China, and India, consume 57% of global jewelry consumption across the globe. This is making citizens purchase safes and vaults to store their accessories and protect them from theft. This ongoing trend is likely to stimulate market expansion in the next few years.

Key Market Players & Competitive Insights

Strategic partnerships to boost the competition

The safes and vault market are characterized as fairly fragmented, with the presence of several market players with a lower share in the global market. The rising expansion activities, such as collaborations and partnerships to create prominent security features for the safes and vault systems, by the market players are widening the market expansion. For instance, in November 2023, Art de Finance joined forces with a safe manufacturer, Shinsung Safes.

Some of the major players operating in the global market include:

- Alpha Safe & Vaults, Inc (US)

- American Security (US)

- Caradonna (France)

- Diebold Nixdorf, Incorporated (US)

- Godrej (India)

- Gunnebo (Sweden)

- Kaso (Finland)

- Kumahira Co. Ltd (Japan)

- Safeguard Safes (Australia)

- Shinjin Safes (South Korea)

Recent Developments in the Industry

- In October 2023, Gunnebo Safe Storage AB expanded its market position in the high security locks business with the acquisition of Tecnosicurezza, an Italy-based security locking manufacturer.

Report Coverage

The safes and vault market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, function, application, industry, and their futuristic growth opportunities.

Safes and Vault Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.71 billion |

|

Revenue forecast in 2032 |

USD 14.02 billion |

|

CAGR |

7.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global safes and vault market size is expected to reach USD 14.02 billion by 2032

Key players in the market are Alpha Safe & Vaults, Inc., American Security, Diebold Nixdorf, Incorporated

North America contribute notably towards the global Safes and Vault Market

Safes and Vault Market exhibiting the CAGR of 7.8% during the forecast period.

The Safes and Vault Market report covering key segments are type, function, application, industry, and region.