Rubber Processing Chemicals Market Share, Size, Trends, Industry Analysis Report, By Product (Anti-Degradants, Accelerators, Flame Retardants, Processing Aid/Promoters, Others), By Application, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 117

- Format: PDF

- Report ID: PM1842

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

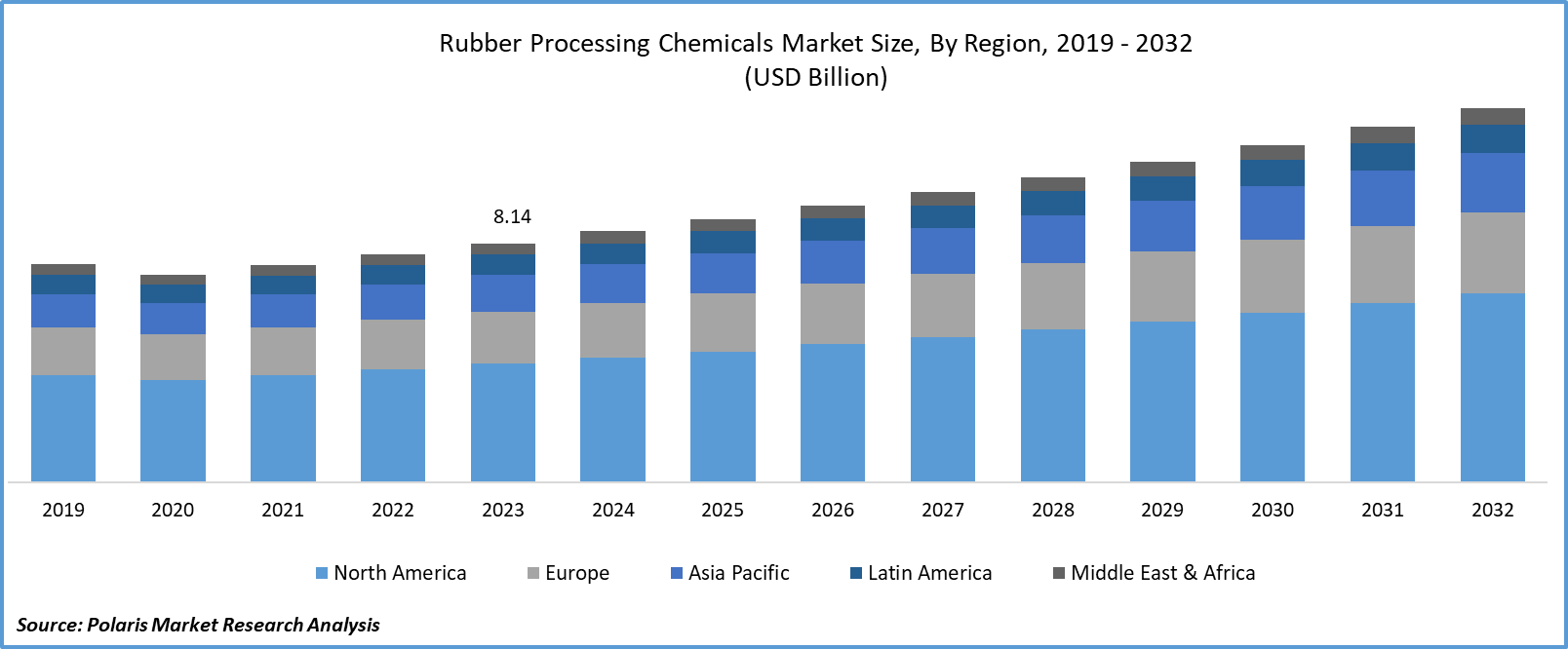

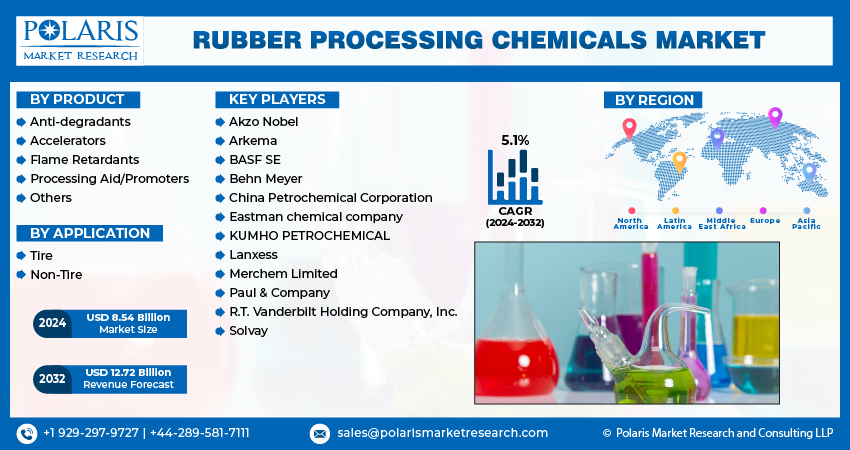

Global rubber processing chemicals market size was valued at USD 8.14 billion in 2023. The market is anticipated to grow from USD 8.54 billion in 2024 to USD 12.72 billion by 2032, exhibiting the CAGR of 5.1% during the forecast period.

Market Overview

Rubber-processing chemicals play a crucial role in enhancing the durability and performance of both natural and synthetic rubber by increasing resistance to heat, oxidation, & mechanical stresses. Additionally, they contribute significantly to the vulcanization process, optimizing properties like resilience, abrasion & flex resistance, hardness, & tensile strength for specific applications. The tire & automotive industries remain the key drivers of the rubber-processing chemical sector.

The increasing environmental consciousness and apprehensions regarding the ecological consequences of conventional chemicals have led to a significant movement towards sustainable and bio-based alternatives. Notably, processing chemicals derived from natural oils & biomass is gaining popularity owing to their diminished environmental impact and the potential to enhance the sustainability of rubber processing. Furthermore, the evolution of bio-based products creates prospects for collaboration between the rubber industry and the agricultural sector, fostering a more integrated and sustainable supply chain.

- For instance, Yokohama Tire Corporation in Japan utilizes oil extracted from modified natural rubber and orange peel in tire production. These environmentally friendly tires also offer improved braking and cornering grip.

European Union has enforced stringent regulations concerning the utilization of chemical products. These regulations encompass limitations on specific chemicals and the imposition of waste management practices to mitigate environmental contamination risks. Another critical facet of regulatory adherence in the market pertains to safety standards, which emphasize the secure handling, storage, and transportation of chemicals to safeguard both workers and the neighboring communities.

To Understand More About this Research: Request a Free Sample Report

Continuous advancements in rubber processing technologies and chemical formulations drive the rubber processing chemicals market dynamism. Innovations in additives, accelerators, and curing agents enhance the performance, durability, and processing efficiency of rubber compounds. Manufacturers are constantly developing new chemical formulations to meet evolving industry standards and customer requirements.

Further, ongoing advancements in rubber processing chemicals, including innovations in formulation, compounding, and manufacturing processes, offer opportunities for product enhancement and differentiation. Key players investing in research and development to improve the performance, durability, and sustainability of rubber products through innovative chemical additives stand to gain a competitive rubber processing chemicals market key trend.

Growth Factors

Use of automation and digitalization in rubber processing and to tackle rubber waste

Automation and digitalization are essential for streamlining rubber processing procedures. Sophisticated monitoring systems, machine learning algorithms, and real-time data analysis facilitate predictive maintenance, quality assurance, and process enhancement. These technologies not only boost productivity but also guarantee uniformity and dependability throughout production processes. To tackle the issue of rubber waste, the industry is actively adopting recycling strategies and embracing principles of the circular economy. Innovative techniques like devulcanization and pyrolysis are utilized to recover valuable resources from discarded rubber, thus mitigating landfill overflow and advancing sustainability efforts.

Surge in the automotive sector

The increasing adoption of EVs is a key factor fueling the automotive sectors and market growth, propelled by growing consumer interest and the commitment of global manufacturers. Furthermore, advancements in processing technologies, such as automation and precision engineering, have markedly improved the efficiency and quality of products in this sector.

A noteworthy trend in the global industry is the increasing demand for high-performance rubber products driven by the automotive sector. As the automotive industry undergoes continuous advancements, there is a rising requirement for advanced compounds that provide enhanced durability, fuel efficiency, & safety. This demand has prompted the creation of specialized chemicals tailored to meet the stringent performance standards of the automotive sector. For instance, the need for low rolling resistance tires, contributing to fuel efficiency and reduced carbon emissions, has stimulated the development and utilization of advanced chemicals and additives to improve the performance attributes of rubber compounds.

Restraining Factors

Health risks

Industry produces substantial volumes of wastewater, posing significant health risks if not properly managed. Furthermore, manufacturing techniques like extrusion and die casting are associated with increased incidences of hematopoietic, stomach, bladder, lung, and other forms of cancer. Consequently, regulatory bodies such as the New Source Performance Standards (NSPS) & the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) enforce stringent guidelines governing chemical usage and wastewater treatment in processing facilities. Increasing health and environmental considerations have prompted the adoption of alternatives such as strengthened natural fibers derived from processed vegetable oil plants and cellulose.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Insights

Anti-degradants segment accounted for the largest market share in 2023

Anti-degradants segment accounted for the largest share in 2023. This dominance is attributed to its increasing adoption within the tire industry, aimed at enhancing abrasion resistance, road grip, and load-bearing capacity. Chemicals are specifically engineered to shield materials from the degradation induced by exposure to oxygen & UV radiation, thereby improving the longevity and robustness of rubber goods. Moreover, the non-tire sector, encompassing industrial items like conveyor belts, hoses, gaskets, and seals, also relies on anti-degradants to augment the durability and functionality of components.

The Accelerators market indispensable segment is expected to grow at a rapid pace. This growth is due to the escalating need for top-notch products, especially in the automotive & construction domains, which stands out as a primary catalyst for the rubber processing chemicals market. These chemicals assume a pivotal role in the vulcanization process, which is indispensable in rubber product manufacturing. Vulcanization entails the interlinking of molecules to bolster their strength, resilience, and longevity. Accelerators serve as agents that expedite the vulcanization process, curtailing curing time and elevating product performance standards.

By Application Insights

The non-tire segment is projected to grow at the fastest CAGR over the forecast period.

The non-tire segment is projected to grow at the fastest CAGR over the forecast period. This segment's growth is propelled by the escalating need for environmentally friendly additives and the expanding utilization of chemicals in industrial applications. Rubber hoses and belting products serve diverse sectors, where they play vital roles in material conveyance and operational optimization across various industrial environments.

Conveyor belts enjoy extensive usage across diverse industries, including construction, excavation, bulk and package handling, food processing, and mining, underscoring their versatility and significance. The non-tire applications market is additionally strengthened by its utilization in various manufacturing sectors. For instance, in the paper industry, large-diameter rolls find prominence, while steel mills leverage rubber-covered rolls for chrome-plating and galvanizing processes.

Further, the tire segment accounted for a significant market share. The rising need for high-performance tires primarily fuels this substantial share. Additionally, the rubber processing chemicals market revenue growth is propelled by the increasing demand for eco-friendly tires. It also encompasses the escalating demand for improved abrasion resistance, superior road grip, and high load-bearing capacity. Moreover, the surge in demand for tires tailored to specific performance attributes, notably those essential for electric vehicles, further propels this market scope.

Regional Insights

Asia Pacific region accounted for the largest market share in 2023

In 2023, the Asia Pacific region accounted for the largest market share. This dominance is credited to the swift industrialization, urbanization, and economic expansion witnessed in the region, de to heightened demand for rubber products across diverse industries. The burgeoning automotive, construction, and manufacturing sectors in nations such as China, India, and Japan significantly propel growth in the region.

North America is expected to witness a significant CAGR During the forecast period.

North America is expected to witness a significant CAGR During the forecast period. This expansion is attributed to the robust presence of industries such as automotive, construction, and manufacturing, which are primary consumers of rubber products. The demand surge is fueled by the burgeoning industry landscape in the region, coupled with stringent guidelines enforced by regulatory bodies to ensure product safety and compliance. Consequently, there is a heightened need for top-tier chemicals that adhere to regulatory standards and ensure product quality.

Key Market Players & Competitive Insights

The market demonstrates a perpetual drive for innovation and product advancement. Companies within this sector allocate resources to research and development endeavors aimed at creating novel and upgraded products boasting improved performance, longevity, and environmental friendliness. These advancements involve the integration of additives that bolster the characteristics of rubber, including heightened elasticity, heat tolerance, and durability.

Some of the major players operating in the global market include:

- Akzo Nobel

- Arkema

- BASF SE

- Behn Meyer

- China Petrochemical Corporation

- Eastman chemical company

- KUMHO PETROCHEMICAL

- Lanxess

- Merchem Limited

- Paul & Company

- R.T. Vanderbilt Holding Company, Inc.

- Solvay

Recent Developments in the Industry

- In June 2023, Ecore International has announced its acquisition of 360 Tire Recycling Group. This strategic manoeuvre is anticipated to enable the company to tap into a wide range of recyclable rubber tires and bolster its production capacity.

Report Coverage

The rubber processing chemicals market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, products, application, and their futuristic growth opportunities.

Rubber Processing Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.54 billion |

|

Revenue forecast in 2032 |

USD 12.72 billion |

|

CAGR |

5.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global rubber processing chemicals market size is expected to reach USD 12.72 billion by 2032

Key players in the market are Akzo Nobel, Arkema, BASF, Behn Meyer, China Petrochemical Corp.

Asia Pacific contribute notably towards the global Rubber Processing Chemicals Market

Rubber processing chemicals market exhibiting the CAGR of 5.1% during the forecast period.

The Rubber Processing Chemicals Market report covering key segments are product, application, and region.