Rotary and RF Rotary Joints Market Size, Share, Trends, Industry Analysis Report: By Type (Single Passage and Multi Passage), Media (Air, Gas, Oil, Water, Steam, Coolant, and Others), Industry (Aerospace, Food & Beverages, Industrial Automation, Oil & gas, Semiconductors, Energy, and Medical), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 118

- Format: PDF

- Report ID: PM5253

- Base Year: 2024

- Historical Data: 2020-2023

Rotary and RF Rotary Joints Market Overview

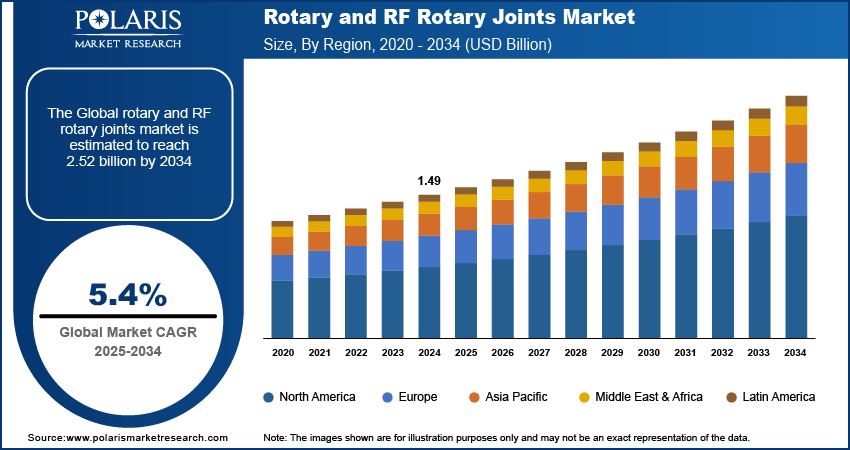

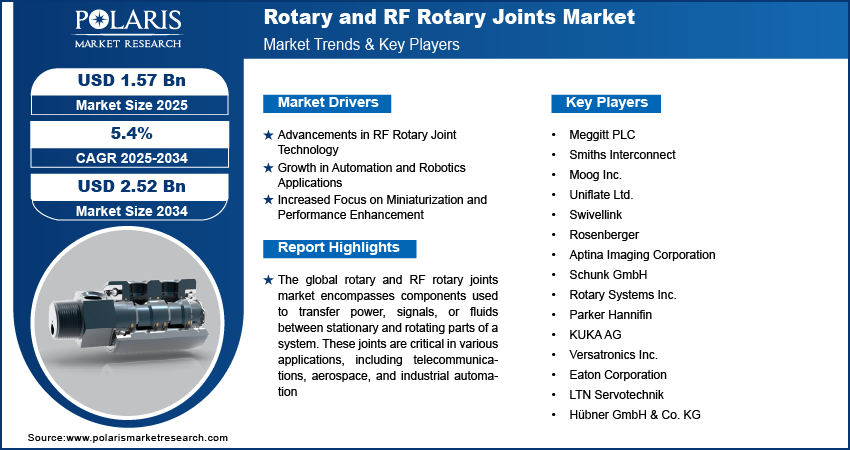

The rotary and RF rotary joints market size was valued at USD 1.49 billion in 2024. The market is projected to grow from USD 1.57 billion in 2025 to USD 2.52 billion by 2034, exhibiting a CAGR of 5.4% during 2025–2034.

The global rotary and RF rotary joints market encompasses components used to transfer power, signals, or fluids between stationary and rotating parts of a system. These joints are critical in various applications, including telecommunications, aerospace, and industrial automation.

The increasing demand for advanced communication systems and rising automation across industries drive market growth. Technological advancements such as the development of high-frequency RF components and rotary joints and improvements in materials for durability are expected to bring new trends in the market during the forecast period. The growing focus on miniaturization and enhanced performance further contributes to the market expansion.

To Understand More About this Research: Request a Free Sample Report

Rotary and RF Rotary Joints Market Drivers and Trends Analysis

Advancements in RF Rotary Joint Technology

Recent advancements in RF rotary joint technology have significantly enhanced their performance and capabilities. Innovations in materials and design have led to the development of rotary joints that support higher frequencies and offer improved signal integrity. The introduction of low-loss dielectric materials and precision manufacturing techniques has enabled RF rotary joints to handle frequencies up to 100 GHz or more. According to a 2023 study published in the Journal of Microwaves and Optical Technology, these advancements have resulted in a reduction of signal loss by ∼20% compared to previous models. This trend is expected to be driven by the increasing demand for high-frequency applications in telecommunications and aerospace industries, where high-performance rotary joints are essential.

Growth in Automation and Robotics Applications

The growing integration of automation and robotics in various industries is projected to become a new trend influencing the rotary and RF rotary joints market in the coming years. As industrial automation and robotic systems become prevalent, the need for reliable rotary joints to facilitate smooth and efficient power and signal transfer has increased. The International Federation of Robotics reported in 2022 that the number of industrial robots in operation worldwide reached over 3 million units, marking a 10% increase from the previous year. This surge in robotic applications drives the demand for rotary joints that can endure continuous rotation and harsh operational conditions. Additionally, the development of compact and high-torque rotary joints caters to the requirements of modern robotic systems, further accelerating market growth.

Increased Focus on Miniaturization and Performance Enhancement

Miniaturization and performance enhancement become pivotal trends in the rotary and RF rotary joints market during 2024–2032. As electronic devices become smaller and more sophisticated, there is a growing need for rotary joints that offer compact designs without compromising functionality. Advances in microelectromechanical systems (MEMS) and precision engineering have enabled the production of smaller, more efficient rotary joints. A 2023 report from the Institute of Electrical and Electronics Engineers highlights that miniaturized rotary joints now offer performance improvements, such as reduced size by up to 30% while maintaining similar or enhanced performance levels. This trend supports the increasing demand for miniaturized rotary joints in consumer electronics, aerospace, and medical devices, where space constraints and high performance are critical.

Rotary and RF Rotary Joints Market Segment Analysis

Rotary and RF Rotary Joints Market Breakdown by Type

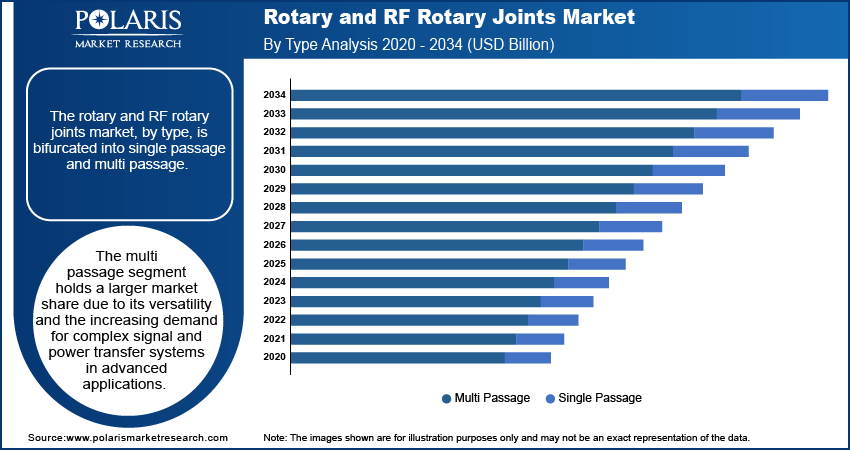

The rotary and RF rotary joints market, by type, is bifurcated into single passage and multi passage. The multi passage segment holds a larger market share due to its versatility and the increasing demand for complex signal and power transfer systems in advanced applications. Multi passage rotary joints are essential in applications requiring multiple simultaneous signals or power transfers, such as in aerospace and telecommunications. This segment is also experiencing the highest growth rate, driven by the rising complexity of modern systems and the need for more integrated solutions. The rapid advancement and demand for multi-functional rotary joints are propelling the growth of the multi passage segment, making it the leading contributor to the market's expansion.

The single passage segment remains significant due to its application in simpler systems where only a single signal or power line needs to be transferred. The segment is benefiting from its cost-effectiveness and simplicity, which make it suitable for a range of industrial and consumer electronics applications.

Rotary and RF Rotary Joints Market Breakdown by Media

The rotary and RF rotary joints market, based on media, is segmented into air, gas, oil, water, steam, coolant, and others. The oil segment holds the largest market share due to its widespread use in hydraulic systems and heavy machinery, where reliable and efficient fluid transfer is critical. Oil-based rotary joints are preferred for their ability to handle high pressures and their durability under extreme conditions, making them essential in industries such as automotive and manufacturing. This segment is also experiencing notable growth, driven by increased industrial activity and the demand for high-performance machinery.

The coolant segment is registering the highest growth rate, propelled by the expanding applications in electronic cooling and precision engineering. As electronic devices and systems become compact and generate more heat, effective cooling solutions are increasingly required, boosting the demand for coolant rotary joints. This growth is supported by technological advancements in cooling systems and the rising emphasis on maintaining optimal operating temperatures in various high-performance applications. Consequently, while the oil segment maintains the largest market share, the coolant segment is emerging as a key driver of market expansion.

Rotary and RF Rotary Joints Market Breakdown by Industry

The rotary and RF rotary joints market, by industry, is segmented into aerospace, food & beverages, industrial automation, oil & gas, semiconductors, energy, and medical. The aerospace segment holds the largest market share due to the critical role of rotary joints in aircraft and spacecraft, where they facilitate the transfer of signals and power under extreme conditions. Aerospace applications demand high reliability and performance, driving significant investment and adoption in this sector. The growth in aerospace activities, including the expansion of commercial aviation and space exploration, continues to boost the prominence of this segment.

The industrial automation segment is registering the highest growth rate, driven by the increasing integration of automated systems across various manufacturing processes. The demand for rotary joints in robotics and automated machinery is expanding as industries seek to enhance efficiency and precision. Advancements in automation technology and the rising adoption of Industry 4.0 principles contribute to the rapid expansion of this segment. The ongoing trend toward smart manufacturing and advanced automation systems is expected to sustain the high growth rate of the industrial automation segment in the market.

Rotary and RF Rotary Joints Market by Region

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share. This dominance is attributed to the region's advanced industrial infrastructure, high investments in aerospace and defense sectors, and significant presence of leading technology and manufacturing companies. North America's extensive adoption of automation technologies, coupled with its strong emphasis on research and development in high-performance rotary joints, solidifies its leading position. Additionally, the region's focus on innovation and the growing demand for sophisticated communication systems contribute to its substantial market share.

In Europe, the rotary and RF rotary joints market is fueled by the region's strong industrial base and significant investments in technology and automation. The aerospace and automotive sectors are major drivers of demand, with European countries such as Germany, France, and the UK leading in advanced manufacturing and high-tech applications. The region's focus on sustainable and efficient industrial practices also supports the adoption of rotary joints, particularly in sectors such as energy and semiconductors. Europe’s emphasis on research and innovation, coupled with supportive government policies for technological advancements, further fuels the growth of the market in this region.

The Asia Pacific rotary and RF rotary joints market growth is being driven by rapid industrialization and technological advancements. Countries such as China, Japan, and South Korea are at the forefront, with significant investments in automotive manufacturing, electronics, and industrial automation. The region’s expanding infrastructure projects and increasing demand for high-performance rotary joints in sectors such as telecommunications and consumer electronics contribute to its dynamic market growth. Additionally, the region's competitive manufacturing capabilities and cost advantages attract global companies, enhancing the market expansion in Asia Pacific.

Rotary and RF Rotary Joints Market – Key Players and Competitive Insights

Key players in the rotary and RF rotary joints market include companies such as Meggitt PLC, which offers a range of rotary joints for aerospace and industrial applications. Other notable companies are Smiths Interconnect, known for its RF rotary joints and connectors; Moog Inc., which provides solutions for aerospace and defense sectors; and Uniflate Ltd., specializing in rotary joints for fluid handling. Additionally, companies such as Swivellink, which focuses on industrial automation, and Rosenberger, providing RF rotary joint solutions, play significant roles. Other active players are Aptina Imaging Corporation, Schunk GmbH, and Rotary Systems Inc., all contributing to the market with their specialized rotary joint products. Furthermore, Parker Hannifin and KUKA AG offer rotary joint solutions within their broader industrial and robotics portfolios. Other key contributors include Versatronics Inc., and Eaton Corporation, known for their diverse range of rotary joint technologies.

In terms of competitive analysis, these companies compete based on factors such as technological innovation, product performance, and the ability to cater to diverse industry needs. Firms such as Meggitt PLC and Moog Inc. stand out for their advanced engineering capabilities and tailored solutions for high-demand applications. Meanwhile, companies such as Smiths Interconnect and Rosenberger are noted for their specialized RF rotary joint technologies, offering solutions that address high-frequency and signal integrity requirements. The focus on research and development to enhance product capabilities and meet evolving industry standards is a common strategy among these players, helping them maintain their position in the market.

Overall, the market's competitive landscape is characterized by a focus on technological advancements and the ability to provide customized solutions for various applications. Companies are investing in R&D to improve product performance and cater to specific industry needs, such as high-frequency signal transfer or robust fluid handling. This emphasis on innovation and specialization enables these companies to address the demands of sectors, including aerospace, industrial automation, and telecommunications, driving their ongoing presence and activity in the rotary and RF rotary joints market.

Meggitt PLC is a player in the rotary and RF rotary joints market, offering a range of products tailored for aerospace, defense, and industrial applications. The company is known for its advanced engineering and technology solutions that meet high-performance standards.

Smiths Interconnect is another significant company in this market, providing RF rotary joints and related technologies. The company serves various sectors, including telecommunications and industrial applications, with a focus on ensuring high signal integrity and performance.

Key Companies in the Rotary and RF Rotary Joints Market

- Meggitt PLC

- Smiths Interconnect

- Moog Inc.

- Uniflate Ltd.

- Swivellink

- Rosenberger

- Schunk GmbH

- Rotary Systems Inc.

- Parker Hannifin

- KUKA AG

- Versatronics Inc.

- Eaton Corporation

- LTN Servotechnik

- Hübner GmbH & Co. KG

Rotary and RF Rotary Joints Market Developments

- In August 2024, Smiths Interconnect unveiled a new series of RF rotary joints that feature improvements in signal transmission and durability, addressing the growing needs of high-frequency applications.

- In July 2024, Meggitt PLC announced a new rotary joint designed for enhanced reliability and durability in challenging environments aimed at improving performance in aerospace applications.

Rotary and RF Rotary Joints Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Single Passage

- Multi Passage

By Media Outlook (Revenue – USD Billion, 2020–2034)

- Air

- Gas

- Oil

- Water

- Steam

- Coolant

- Others

By Industry Outlook (Revenue – USD Billion, 2020–2034)

- Aerospace

- Food & beverages

- Industrial Automation

- Oil & gas

- Semiconductors

- Energy

- Medical

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Rotary and RF Rotary Joints Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.49 billion |

|

Market Size Value in 2025 |

USD 1.57 billion |

|

Revenue Forecast in 2034 |

USD 2.52 billion |

|

CAGR |

5.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global rotary and RF rotary joints market size was valued at USD 1.49 billion in 2024 and is projected to grow to USD 2.52 billion by 2034.

The global market is projected to register a CAGR of 5.4% during 2025–2034.

North America accounted for the largest share of the global market.

Key players in the rotary and RF rotary joints market include companies such as Meggitt PLC, which offers a range of rotary joints for aerospace and industrial applications; Smiths Interconnect, known for its RF rotary joints and connectors; Moog Inc., which provides solutions for aerospace and defense sectors; and Uniflate Ltd., specializing in rotary joints for fluid handling.

The multi passage segment accounted for a larger share of the global market.

The aerospace segment accounted for the largest share of the global market.