Rope Market Share, Size, Trends, Industry Analysis Report, By Product (Synthetic, Steel Wire, Cotton), By End-users (Industrial, Commercial, Residential), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3707

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

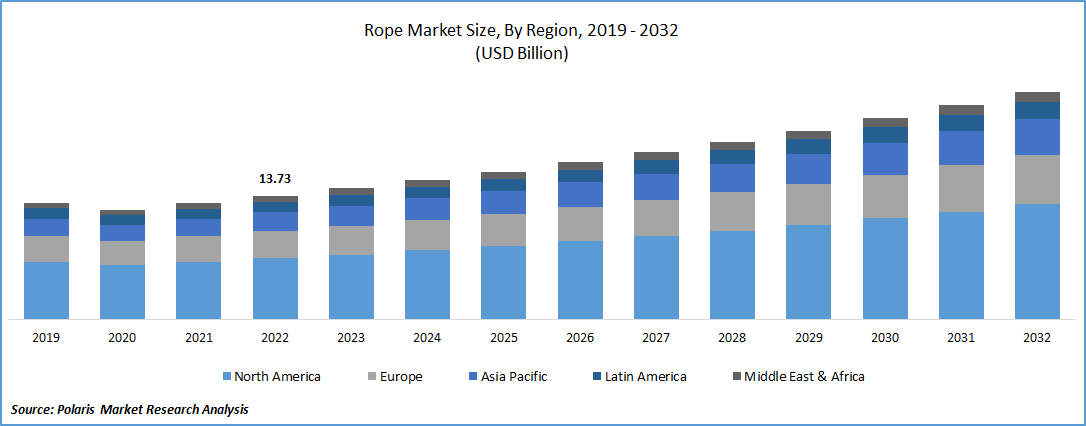

The global rope market was valued at USD 14.57 billion in 2023 and is expected to grow at a CAGR of 6.30% during the forecast period.

The global market is experiencing significant growth primarily due to the increasing demand for ropes used in residential and commercial applications to lift and secure loads and materials. As the global population continues to rise, the demand for residential housing will grow manifold. This, in turn, is expected to drive the demand for wire & synthetic ropes. According to the United Nations' World Population Prospects report, the world population is projected to reach 9.8 billion by 2050 and 11.2 billion by 2100. These population projections further highlight the potential for sustained growth in the demand for ropes in various sectors.

To Understand More About this Research: Request a Free Sample Report

The outbreak of the COVID-19 pandemic had a significant impact on various industries worldwide, including the engineering and construction sectors. However, as the world gradually recovers from the pandemic, the global rope industry is projected to experience robust growth in the coming years. This growth can be attributed to advancements in materials technology and manufacturing innovations that enhance the quality and performance of ropes. Additionally, the expansion of the real estate and construction industry is expected to positively impact the global rope market, driving increased demand for various applications.

However, there are significant challenges that hinder the market growth. These challenges include high prices, the need for frequent preventive maintenance, and the inevitable wear and tear of ropes over time. Moreover, the prices of raw materials required for rope manufacturing are likely to increase due to international trade dynamics and tariffs. As a result, the overall prices of ropes are expected to rise globally. This price increase may limit the demand for ropes among price-sensitive end-users and those operating on lower budgets in residential and industrial settings.

Industry Dynamics

Growth Drivers

Increased Spending on Construction and Mining Equipment

The global market is experiencing growth due to increased spending on construction and mining equipment, leading to a higher demand for ropes used in various applications within these industries. Major rope manufacturers are investing significantly in advanced manufacturing technologies and materials to remain competitive. For example, Teufelberger, a significant player in the industry, is actively researching to incorporate cutting-edge technologies like rope robots, 3D printers, and automation into their manufacturing processes.

Additionally, key players in the global market are innovating and launching new products to enhance their brand visibility and expand their consumer base. These efforts are expected to increase brand awareness and market reach. Leading players also focus on replacing traditional raw materials with cost-effective and environmentally friendly advanced variants during manufacturing. In October 2021, Jogani Impex launched poly-fiber 3S, a new generation of concrete fiber wire designed to provide crack-free and durable infrastructure for India's construction and infrastructure industry.

Report Segmentation

The market is primarily segmented based on product, end use, and region.

|

By Product |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product

Steel Wire Segment Held the Significant Market Share in 2022

The steel wires segment held a significant market share. The manufacturing process involves twisting wires, typically made of stainless steel and high-carbon steel, to create a rope structure that provides support and protection to the external strands, ensuring optimal functionality. The high strength-to-weight ratio of steel wire ropes makes them particularly suitable for various applications, notably in the marine and fishing sectors. These inherent properties of steel wire ropes are expected to drive the growth of this segment in the forthcoming years.

The synthetic segment is anticipated to grow at a considerable growth rate over the study period. Synthetic ropes are manufactured using artificial textile fibers that have been chemically treated and are employed as alternatives to natural fibers. They offer several advantages, such as a high strength-to-weight ratio, resistance to bend fatigue, and excellent spooling capabilities. Thanks to their desirable characteristics, synthetic ropes are increasingly being adopted in various applications, including crane operations.

By End-Use

Industrial Segment is Projected to Hold Substantial Market Share During Forecast Period

The industrial segment is projected to account for a substantial market share in revenue over the anticipated period. Ropes find extensive application across various industries, including construction, maritime and fishing, oil and gas, and mining. This widespread adoption is attributed to the advantageous properties of ropes, such as lightweight construction, quick and hassle-free preparation, ease of handling, and the absence of re-lubrication requirements. Synthetic ropes have gained significant popularity in the maritime and fishing sectors. These ropes are available in a wide range of shapes and colors and offer excellent insulation capacity, resistance to chemicals, prevention of moisture absorption, and environmental durability. Increased use of ropes for industrial purposes is a key driver fueling the market's growth.

The commercial segment is expected to grow at the fastest rate. Ropes find diverse applications in commercial settings, encompassing activities such as camping, rock climbing, agriculture, adventure sports, logistics, and more. In certain scenarios, ropes also serve as a means of fall protection. Commercial applications involve using various rope types, including nylon, polyester, hemp, and polypropylene, each suited for specific requirements and environments.

Regional Analysis

Apac Region Dominated the Global Market in 2022

APAC region dominated the global market with a substantial share. The region's robust growth can be attributed to the escalating commercial and residential construction activities, necessitating lightweight, durable, and waterproof ropes with excellent strength properties. The increasing demand for synthetic ropes is particularly notable in emerging economies like India and China, driven by their expanding infrastructure requirements. Additionally, countries such as China, South Korea, and India hold significant positions as leading exporters of twine and rope worldwide. According to the Observatory of Economic Complexity (OEC) data from 2020, these countries collectively accounted for over 36% of the total export value. This export prowess is anticipated to propel further market growth throughout the forecast period.

Europe will likely emerge as the fastest-growing region with a healthy CAGR during the projected period. This growth is primarily attributed to the increasing demand for synthetic ropes, driven by the expanding marine and fishing industries across various European countries. Furthermore, the construction sector's growth contributes to the rising demand for steel wire and synthetic ropes in the region.

According to Europa, there has been a notable increase in construction production, with a 4.1% rise in the euro area and a 4.8% increase in the EU when comparing January 2022 to January 2021. Additionally, the DIY interior decoration and home improvement trends in Germany have further boosted the usage of hemp, synthetic, and jute rope. These factors collectively contribute to the growing market opportunities in Europe for different types of ropes.

Competitive Insight

The Rope market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- van Beelen Group

- Bridon-Bekaert

- WireCo WorldGroup

- Yale Cordage

- TEUFELBERGER

- MAGENTO

- Cortland Limited

- Marlow Ropes

- Southern Ropes

- Dynamica Ropes

Recent Developments

- In June 2022, Bridon-Bekaert Ropes Group (BBRG) has developed a compact construction rope “Dyform 36LR PI+”. This innovative rope design incorporates an extruded plastic material that covers both the rope core and the 18 outer strands.

Rope Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 16.43 billion |

|

Revenue forecast in 2032 |

USD 25.32 billion |

|

CAGR |

6.30% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Mounting Orientation, By Application, By Sales Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global rope market size is expected to reach USD 25.32 billion by 2032.

Key players in the rope market are van Beelen Group, Bridon-Bekaert, WireCo WorldGroup, Yale Cordage, TEUFELBERGER.

Asia Pacific contribute notably towards the global rope market.

The global rope market is expected to grow at a CAGR of 6.3% during the forecast period.

The rope market report covering key segments are product, end use, and region.