Rockets and Missiles Market Size, Share, Trends, Industry Analysis Report

: By Speed (Subsonic, Supersonic, and Hypersonic), By Product, By Propulsion Type, By Launch Mode, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM2374

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The global rockets and missiles market size was valued at USD 63.20 billion in 2024 and is expected to reach USD 66.74 billion by 2025 and USD 109.91 billion by 2034, exhibiting a CAGR of 5.7% during 2025–2034.

The rockets and missiles market refers to the global industry involved in the research, development, manufacturing, and deployment of rocket systems and missile technologies. This market encompasses a wide range of products, including ballistic missiles, cruise missiles, guided rockets, air defense systems, and space launch vehicles. It serves both military and civilian applications, with major participants including government defense agencies, aerospace companies, and private defense contractors. Rising conflicts and territorial disputes across regions are prompting countries to modernize their collections of rockets and missiles. For instance, the US Department of Defense's 2023 Budget Request allocates over USD 816 billion to enhance military readiness and modernize defense systems, focusing on missile capabilities in response to global security threats.

To Understand More About this Research: Request a Free Sample Report

Innovations in space propulsion systems, guidance mechanisms, and materials are enhancing missile performance, contributing to the industry growth and encouraging new product development. Additionally, the shift toward minimizing collateral damage in combat operations is increasing demand for precision-guided rockets and missiles, contributing to the industry growth.

Market Dynamics

Expansion of Commercial and Government-Led Space Programs

Expansion of commercial and government-led space programs is significantly contributing to the market growth of rockets and missiles. Owing to the increasing interest in satellite deployment, space tourism, lunar missions, and Mars exploration in both public space agencies and private aerospace companies, there are heavy investments in launch vehicle technologies and reusable rocket systems. The surge in demand for advanced propulsion technologies, lightweight materials, and reliable launch infrastructure is leading to substantial industry expansion. Companies such as SpaceX, Blue Origin, and government organizations like NASA and ESA are pushing innovation boundaries, driving the need for next-generation systems. Additionally, international collaboration in deep space exploration is encouraging new entrants and fostering a competitive landscape, further boosting the overall growth of the rockets and missiles market.

Increasing Defense Spending

Rising global security threats and geopolitical tensions are prompting nations to raise their defense budgets. According to the Stockholm International Peace Research Institute, global military spending reached USD 2,718 billion in 2024, marking a 9.4% real-term increase from 2023. Strategic investments in modernizing military capabilities are increasing the procurement of long-range missiles, tactical rocket systems, and hypersonic weapons. Defense modernization programs in countries such as the US, China, India, and Russia are emphasizing the development and deployment of advanced missile technologies to ensure national security and military superiority. This consistent rise in demand is accelerating technological innovation, enhancing precision strike capabilities, and expanding the global defense manufacturing ecosystem. Consequently, the rockets and missiles market is witnessing sustained growth driven by heightened defense spending and strategic defense initiatives.

Segment Insights

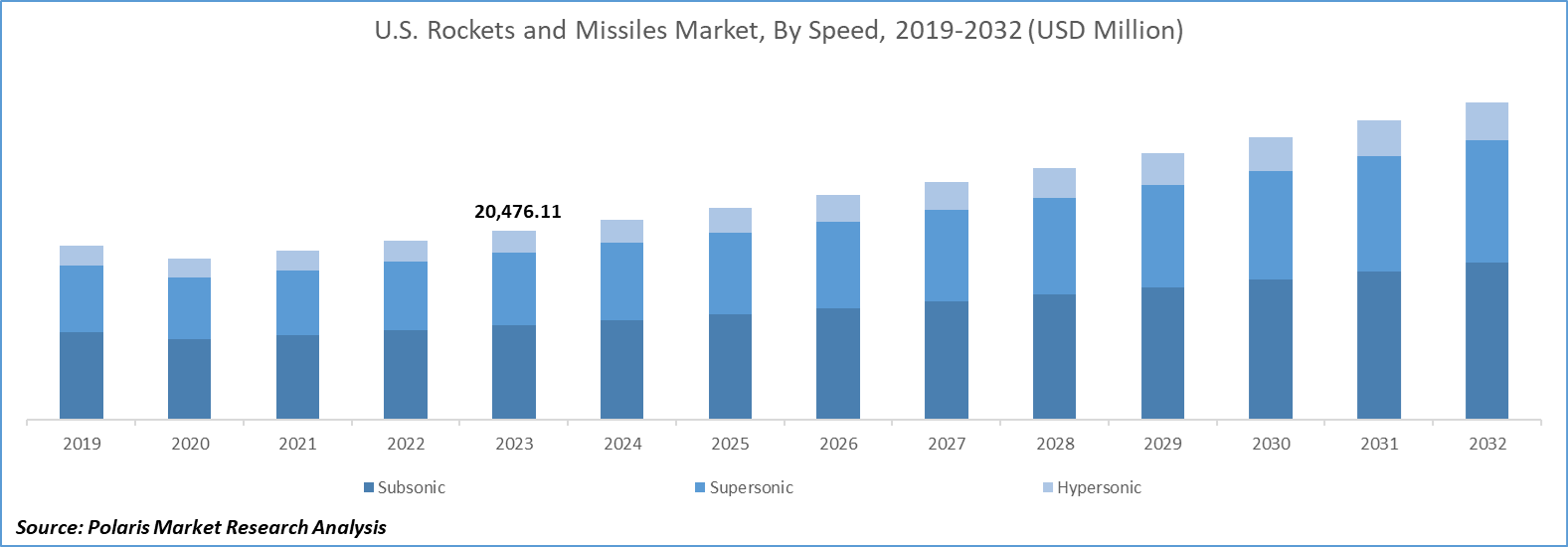

Market Assessment by Speed

The global rockets and missiles market segmentation, based on speed, includes subsonic, supersonic, and hypersonic. In 2024, the subsonic segment accounted for more than 45% of the market share due to its established integration across multiple defense platforms and proven effectiveness in tactical operations. These systems offer extended range, high payload capacity, and compatibility with a broad spectrum of delivery mechanisms, including ground-based and naval launchers. Their cost-efficiency and reliability make them particularly valuable for sustained conflict scenarios where affordability and operational flexibility are critical. Countries with legacy stockpiles and ongoing modernization programs continue to favor subsonic missile systems, reinforcing their dominance in long-range cruise missile deployments and precision-strike applications.

The supersonic segment is projected to witness the highest CAGR during the forecast period due to growing investments in mid-range high-speed strike capabilities that balance speed and maneuverability. Supersonic missiles provide enhanced target engagement time, making them ideal for both offensive and defensive missions, particularly in contested airspace. Emerging threats from advanced air defense systems are accelerating demand for faster, harder-to-intercept projectiles. Technological advancements in propulsion and thermal shielding are facilitating the development of compact, platform-agnostic supersonic systems, contributing to the segment's rapid growth. Strategic focus on deterrence and preemptive strike capabilities in regions such as Asia Pacific is further amplifying industry momentum.

Market Evaluation by Launch Mode

The global rockets and missiles market segmentation, based on launch mode, includes surface to surface, surface to air, air to air, air to surface, and subsea to surface. In 2024, the surface to surface segment accounted for more than 50% of the market share due to its central role in strategic deterrence and large-scale land-based operations. These systems form the backbone of conventional and nuclear arsenals, particularly in countries with expansive territorial defense requirements. High payload capacities, long-range targeting, and integration with mobile launch platforms make them essential for maintaining military readiness. Geopolitical rivalries and regional security dynamics have led to increased deployment and modernization of ballistic and cruise surface-to-surface missile systems. Their relevance in asymmetric warfare and capability to deliver precision strikes over extended distances solidify their commanding position in the market.

The surface to air segment is expected to register the highest CAGR of 5.6% during the forecast period, driven by heightened demand for layered air defense systems amid escalating aerial threats. Advancements in aerial platforms, including stealth aircraft and drones, are prompting military forces to strengthen their airspace denial capabilities. Modern surface-to-air missile systems offer enhanced radar evasion detection, multiple-target engagement, and rapid deployment features. Investments in integrated air defense networks and rising concerns over missile proliferation have spurred the procurement of advanced systems such as the S-400 and Patriot. This evolving threat landscape and the need for rapid-response defense architecture are driving robust segment expansion.

Regional Outlook

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for 40% of the market share due to sustained defense expenditure, continuous R&D investment, and active deployment of advanced missile systems across multiple domains. The US rockets and missiles strategic emphasis on hypersonic weapons, next-generation missile defense, and integrated strike capabilities underpins regional dominance. In April 2024, the US Army launched a hypersonic missile from Cape Canaveral Space Force Station. This operation showcases advancements in rapid-response strike capabilities and underscores the military’s commitment to enhancing its hypersonic technology portfolio. Ongoing programs such as the Long Range Hypersonic Weapon (LRHW) and expansion of the Aegis Ballistic Missile Defense System have fueled procurement volumes. Additionally, a mature defense industrial base and strong public-private collaborations among firms such as Lockheed Martin, Raytheon, and Northrop Grumman reinforce North America's lead in high-performance missile technology development and deployment.

Europe secured over 27.19% of the global market share in 2024, supported by escalating regional defense cooperation, modernization of legacy missile systems, and strategic autonomy initiatives. Rising geopolitical volatility, especially along the eastern flank, has prompted NATO-aligned nations to enhance their offensive and defensive missile capabilities. Investments in indigenous development programs such as the Franco-German Future Combat Air System (FCAS) and the British-led Team Tempest are creating momentum in the precision missile domain. Additionally, collaborative efforts through the European Defence Fund (EDF) are accelerating cross-border missile R&D, ensuring Europe remains competitive in next-generation multi-domain missile systems.

The Asia Pacific rockets and missiles market is expected to register the highest CAGR of 5.9% during the forecast period, driven by strategic rearrangement, rising defense budgets, and escalating cross-border tensions. In March 2023, Bharat Dynamics Limited signed a significant contract worth approximately USD 985 million with the Ministry of Defense, Government of India. The agreement was for the manufacturing and delivery of the advanced Akash Weapon System to the Indian Army. Regional powers such as China, India, and South Korea are intensifying investments in missile development, emphasizing hypersonic glide vehicles, anti-ship cruise missiles, and theater missile defense systems. Indigenous programs such as India’s Agni series and China’s DF missile families are expanding rapidly, aligned with broader policies of regional deterrence and force projection. Moreover, strategic collaborations and technology transfers, particularly between Southeast Asian nations and Western defense contractors, are accelerating regional production capabilities and fueling industry expansion.

Key Players and Competitive Analysis

The competitive landscape of the rockets and missiles market is shaped by robust industry analysis, revealing an environment defined by continuous innovation, strategic partnerships, and evolving defense requirements. Market expansion strategies are increasingly focused on joint ventures, technology transfer agreements, and co-development initiatives that enable stakeholders to enhance their product portfolios and regional footprints. Mergers and acquisitions are being leveraged for vertical integration and capability consolidation and for accelerating access to advanced propulsion systems, guidance technologies, and multi-domain launch platforms.

Companies are actively engaging in post-merger integration processes to streamline operations, align R&D pipelines, and reduce procurement cycle times. Strategic alliances between defense contractors and space agencies are fostering innovation in reusable launch systems, hypersonic glide vehicles, and autonomous targeting capabilities. Moreover, the rise in test launches and prototype demonstrations highlights a shift toward rapid iteration and agile development in missile systems. Technology advancements in telemetry, composite materials, warhead miniaturization, and AI-driven targeting are becoming central to competitive differentiation. The market is also witnessing a growing focus on interoperability, modularity, and multi-platform compatibility, especially as nations invest in integrated battle networks and next-generation warfare systems.

Lockheed Martin Corporation is a security and aerospace company formed by combining the businesses of Martin Marietta Corporation and Lockheed Corporation. The company is engaged in diverse sectors, including research, development, design, integration, and manufacture of advanced technology products, systems, and services.

The company provides a wide range of technical, scientific, engineering, management, information, and logistics services. Lockheed Martin serves the US and international markets with applications in civil, defense, and commercial industries. The multinational company has a strong presence across North America, Asia, Europe, and Australia. The company offers counter-drone solutions such as counter-drone swarms, Area Defense Anti-Munitions (ADAM) systems, and Lcarus. Lockheed Martin's business is divided into Aeronautics, Rotary and Mission Systems (RMS), Missiles and Fire Control (MFC), and Space. The Aeronautics segment is concerned with the study, planning, creation, production, installation, maintenance and support, service, and upgrading of sophisticated military planes, such as fighting and air transport aircraft, unmanned aircraft, as well as associated technologies.

L3 Technologies, in 2019, merged with Harris Corporation and was renamed to L3Harris Technologies. It is a US-based company and focuses on detection systems, security, image intensification equipment, night vision intensification equipment, training, simulation, aircraft sustainment, and Intelligence, Surveillance, and Reconnaissance (ISR) systems. The company delivers end-to-end solutions to meet commercial and government customer's critical needs in over 100 countries. The company operates its business in four segments, including integrated mission systems, space & airborne systems, communication systems, and aviation systems. Moreover, the company's integrated mission system comprises three sectors: marine, ISR, and electro-optical. Their ISR sector blends, creates, and sustains multi-mission ISR, fleet management support services, signals intelligence and communication systems, sensor development, modifications, and recurring depot maintenance for ISR and airborne missions. In contrast, the maritime sector is a producer, integrator, and sustainer of mission systems for naval platforms, specializing in signals intelligence and unmanned surface, multi-intelligence platforms, and autonomous underwater vehicles.

List of Key Companies in Rockets and Missiles Market

- BAE Systems

- Bharat Dynamics Limited

- Boeing

- Denel Dynamics

- L3Harris Technologies

- Lockheed Martin

- MBDA

- Northrop Grumman Corporation

- RTX

- Thales Group

Rockets and Missiles Industry Developments

In January 2024, Northrop Grumman-built GEM 63XL solid rocket boosters were provided to help launch the inaugural flight of United Launch Alliance’s Vulcan Centaur Rocket.

In October 2023, L3Harris Technologies, Leidos, and MAG Aerospace joined forces for the US Army's High Accuracy Detection and Exploitation System (HADES) program. The collaborative effort aims to provide a fleet of aerial intelligence, surveillance, and reconnaissance (ISR) aircraft for the swift collection of operational intelligence against the nation's most advanced adversaries.

In July 2023, L3Harris Technologies completely acquired Aerojet Rocketdyne, forming a new business segment, emphasizing innovation, competition, and strengthening the defense industrial base.

In February 2023, Bharat Dynamics Limited launched three new advanced missile technologies at the Aero India 2023 exhibition in Bengaluru, including Vertical Launched-Short-Range Surface-to-Air Missile (VL SR SAM), Semi-Active Laser Seeker Homing Anti-Tank Guided Missile for BMP-II, Drone Delivered Missile.

Rockets and Missiles Market Segmentation

By Speed Outlook (Revenue – USD Billion, 2020–2034)

- Subsonic

- Supersonic

- Hypersonic

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Cruise Missiles

- Ballistic

- Rockets

- Torpedoes

By Propulsion Type Outlook (Revenue – USD Billion, 2020–2034)

- Solid

- Hybrid

- Turbojet

- Others

By Launch Mode Outlook (Revenue – USD Billion, 2020–2034)

- Surface to Surface

- Surface to Air

- Air to Air

- Air to Surface

- Subsea to Surface

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Rockets and Missiles Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 63.20 billion |

|

Market Size Value in 2025 |

USD 66.74 billion |

|

Revenue Forecast by 2034 |

USD 109.91 billion |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 63.20 billion in 2024 and is projected to grow to USD 109.91 billion by 2034.

The global market is projected to register a CAGR of 5.7% during the forecast period.

In 2024, North America held the largest market share due to sustained defense expenditure, continuous R&D investment, and active deployment of advanced missile systems across multiple domains.

A few of the key players in the market are BAE Systems, Bharat Dynamics Limited, Boeing, Denel Dynamics, L3Harris Technologies, Lockheed Martin, MBDA, Northrop Grumman Corporation, RTX, and Thales Group.

In 2024, the subsonic segment accounted for more than 45% of the market share due to its established integration across multiple defense platforms and proven effectiveness in tactical operations.

In 2024, the surface to surface segment accounted for more than 50% of the market share due to its central role in strategic deterrence and large-scale land-based operations.