Robotic Process Automation in BFSI Market Share, Size, Trends, Industry Analysis Report, By Type (Software and Services); By Services; By Organization Size; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM1648

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

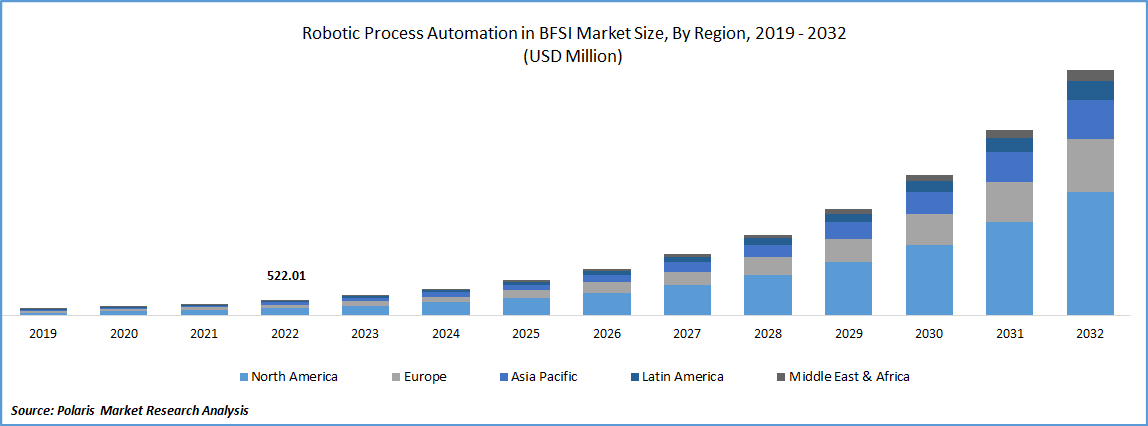

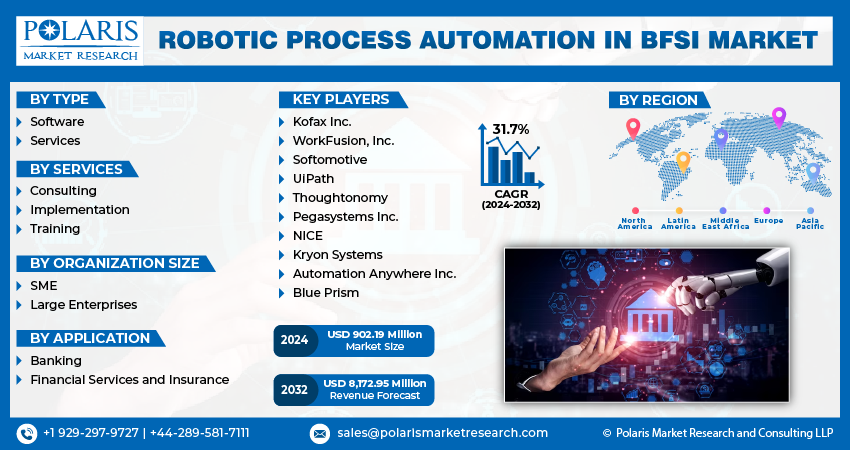

The global robotic process automation in BFSI market was valued at USD 686.13 million in 2023 and is expected to grow at a CAGR of 31.70% during the forecast period. The widespread and rapid adoption of virtual banking tools to enhance the overall user experience ability of robotic process automation (RPA) to increase efficiency and accuracy while still being cost-effective, along with guaranteeing high security, are some of the reasons driving the overall market growth.

The research report offers a quantitative and qualitative analysis of the Robotic Process Automation in BFSI Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Know more about this report: Request for sample pages

Banking and other financial institutions have to deal with a variety of processes, documents, and transactions at the same time and have to use sensitive information from multiple sources. Initially, the whole process had to be done manually, thus requiring a longer time and resulting in a less positive customer experience.

However, RPA, due to its inherent advantages, is being used in these industries for various purposes such as customer service, KYC verification, automation of reports, account closure, general ledger management, fraud and other discrepancy detection, compliance, collection, and account receivables among others. The wide applicability of the process, along with the global growth of the banking and finance industry, is benefitting the overall robotic process automation (RPA) in BFSI market growth.

The ability to play a critical role and completely revolutionize mundane tasks in finance and the banking sector benefits the overall RPA in BFSI market growth. The ability to reduce clerical error and rate, turnaround time, and increase overall productivity has spurred a high adoption rate of the technology, primarily in the banking sector. Due to this RPA technology, employees can thus utilize their saved time for other important tasks. Such trends are benefitting the overall market growth.

Employee productivity, processing time, overall operational cost, and customer experience are the key areas of interest for banking and financial institutions. These institutes are trying to improve their performance to ensure they are ahead of their competition. High buying power is a primary reason for this scenario. Therefore, to sustain market competition and customer attraction and retention, companies are turning towards RPA as they can save up to 50-60% of their time and resources due to its implementation.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising desire to increase productivity while expanding the penetration of cutting-edge technologies in the BFSI industry is one of the key reasons driving the worldwide robotic process automation market. BFSI businesses are progressively implementing artificial intelligence and robotic process automation to improve their efficiency in a fiercely competitive industry.

Growth in the market will also be fueled by a growing demand to enhance customer satisfaction and work agility. Mechanical process automated bots may accomplish a wide range of duties in various organizational verticals to harvest data from digital platforms. Moreover, these services improve the user experience while reducing manual intervention.

Recently, BFSI firms have become more and more popular using RPA. RPA adoption in the BFSI industry has expanded due to the integration of RPA into service offerings offered by robot orchestration, Business Process Organizations (BPO), enterprise-level robot deployments, and centralized robot dashboard administration.

Additionally, the BFSI industry has provided future development possibilities for RPA providers due to minimizing time-consuming and repetitive manual processes. Banks and other financial institutions can use RPA to remain competitive in the BFSI industry.

Report Segmentation

The market is primarily segmented based on type, services, organization size, application, and region.

|

By Type |

By Services |

By Organization Size |

By Application |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The services segment accounted for the largest market share in 2022

the market has been bifurcated into two types, namely, software as well as services. In 2022, RPA services emerged as the largest segment and were expected to continue their dominance. It is also expected to register a higher growth rate than the software segment. Service providers have integrated and optimized their overall value chains to offer a one-stop solution to all client requirements. Service providers are also taking concrete steps to educate the end users regarding the benefits of RPA to gain untapped market revenue.

Identifying implementation areas in the overall banking and financial institution is another important task that service providers must undertake. As service providers provide end-to-end solutions, companies usually prefer them to software providers as the former offers better customer support throughout the installation process and after that. Software providers typically thrive on the reseller orders received.

Training services are anticipated to register a higher growth rate in 2022

Among the service segments, it is anticipated that training services are expected to register a higher growth rate than other service segments over the forecast period. In 2022, Consulting occupied a major market share, and this trend is expected to continue over the next eight years. High demand from application industries such as banking to provide excellent customer service is primarily driving the consulting segment growth.

Efficient identification and management of operational risks and cost reductions in the overall day-to-day operations also contribute to the overall consulting segment market growth. Companies are offering training programs to make companies more efficient in RPA implementation. Numerous companies and entrepreneurs are now providing training solutions, and this trend is forecasted to boost overall Robotic Process Automation in the BFSI market growth.

The large enterprises segment dominated the market in 2022

Large enterprises occupy more than half the overall market share and will likely maintain dominance over the next eight years. The expenses of RPA purchase, implementation, and operations are suitable for large-scale operations with a high revenue stream, thus resulting in large-scale enterprises dominating the overall market.

Large-scale enterprises have a rising need for processes, software, and practices that will streamline and optimize their overall operations. At the same time, it still maintains high productivity at low costs. All these parameters can be achieved through RPA implementation. Such trends are benefitting the market growth. The high price of RPA, limited and fewer human resources of SMEs, and budget restrictions are some of the restraints SME industries face.

The banking segment accounted for the largest market share in 2022

In 2022, the banking segment held the largest market share. The adoption of RPA in the banking industry is primarily driven by a lack of qualified resources, high labor expenses, and the desire to boost productivity. Also, the increased market pressure is forcing banks to look for alternatives to lower operating costs, increase efficiency, and hasten productivity growth. RPA in banks has contributed to organizational transparency by making it possible to record, categorize, and preserve every transaction and making it simple to review records.

The financial services & insurance category is expected to have the greatest CAGR. RPA suppliers are prioritizing identifying and automating numerous financial services industry operations. Financial services companies have used RPA systems to assign staff members to tasks that offer value to the firm. Modernizing legacy systems becomes difficult in terms of data accessibility and data migration because structured legacy systems in BFSI firms are difficult to combine with sophisticated RPA solutions. RPA services, which allow for a smooth transfer, are employed in these circumstances. By realigning organizational resources, RPA enables firms to automate a time-consuming process so that a person may concentrate on providing client services.

North America emerged as the largest region in 2022

North America emerged as the largest region and is expected to maintain the same trend. The strong presence of banking, and other financial institutions, strong industry participant presence, and high awareness regarding RPA need and usage are some of the factors catering to the industry growth in the region. Several banking institutions in the area have used RPA due to the increasing complexity of regulatory monitoring, KYC compliance, fines, and the increased danger of security attacks.

Among regions, Asia Pacific is forecasted to register the highest growth rate. Companies are focusing on opportunities in countries such as China, South Korea, Singapore, and Japan and are trying to improve their regional footprints in these parts. Industry participants also provide customized solutions to banks, further driving regional growth. The usage of RPA for back-office solutions is a key industry trend in the region.

Competitive Insight

Some of the major players operating in the global market include Kofax Inc., WorkFusion, Inc., Softomotive, UiPath, Thoughtonomy, Pegasystems Inc., NICE, Kryon Systems, Automation Anywhere Inc., Blue Prism

Recent Developments

- In May 2021, UiPath Inc. launched UiPath Platform 21.4, which uses artificial intelligence to replace human business processes in organizations. The platform offers security safeguards and streamlines data-related business procedures.

- In January 2021, Nice System Ltd. launched an AI-based RPA solution to accelerate automation prospects. Even in the face of volatile market conditions, this solution helped organizations to increase organizational effectiveness and streamline current business procedures.

Robotic Process Automation in BFSI Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 902.19 million |

|

Revenue forecast in 2032 |

USD 8,172.95 million |

|

CAGR |

31.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Services, By Organization Size, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Kofax Inc., WorkFusion, Inc., Softomotive, UiPath, Thoughtonomy, Pegasystems Inc., NICE, Kryon Systems, Automation Anywhere Inc., Blue Prism |

In today’s hyper-connected world, running a business around the clock is no longer an option. And at Polaris Market Research, we get that. Our sales & analyst team is available 24x5 to assist you. Get all your queries and questions answered about the Robotic Process Automation in BFSI Market report with a phone call or email, as and when needed.

Browse Our Top Selling Reports

Monitor Arm Market Size, Share 2024 Research Report

Operating Room Management Software Market Size, Share 2024 Research Report

Veterinary Endotracheal Tubes Market Size, Share 2024 Research Report

Self-Drilling Screws Market Size, Share 2024 Research Report

Traction Transformer Market Size, Share 2024 Research Report

FAQ's

Key companies in robotic process automation in BFSI market are Kofax Inc., WorkFusion, Inc., Softomotive, UiPath, Thoughtonomy, Pegasystems Inc., NICE, Kryon Systems, Automation Anywhere Inc., Blue Prism.

The global robotic process automation in BFSI market expected to grow at a CAGR of 31.7% during the forecast period.

The robotic process automation in BFSI market report covering key segments are type, services, organization size, application, and region.

Key driving factors in robotic process automation in BFSI market are high prevalence of advanced technology in the BFSI sector and growing deployment of robot in various BFSI sectors.

The global robotic process automation in BFSI market size is expected to reach USD 8,172.95 million by 2032.