Global Robotic Platform Market Size, Share, Trends, Industry Analysis Report: By Robot Type, By Type (Fixed, Mobile), By Deployment, By End-User, and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Aug-2024

- Pages: 119

- Format: PDF

- Report ID: PM5014

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

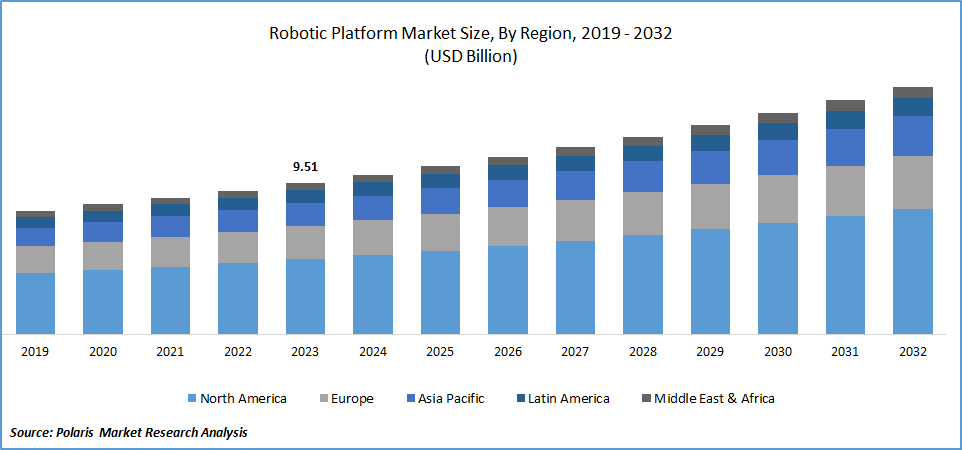

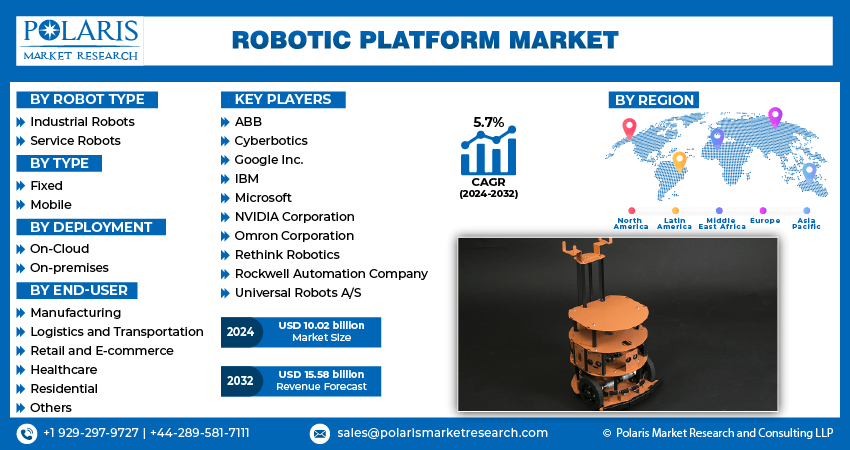

Global robotic platform market size was valued at USD 9.51 billion in 2023. The market industry is projected to grow from USD 10.02 billion in 2024 to USD 15.58 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.7% during the forecast period (2024 - 2032).

The robotic platform market refers to the industry focused on developing and selling versatile robot platforms, like delivery bots or exploration drones, for specific tasks or industries. Companies customize these platforms with sensors, actuators, and software to enhance their efficiency and output.

The robotic platform market is experiencing robust growth driven by the increasing need for automation in industries like healthcare, hospitality, logistics, and household settings to reduce labor costs and enhance productivity and scalability.

Additionally, government investments in robotics research and development are increasing. This is fostering innovation and advancements in robotic platforms as governments recognize the transformative potential of robotics in improving productivity, efficiency, and competitiveness across various industries. Consequently, this is boosting the growth of the robotic platform market.

To Understand More About this Research:Request a Free Sample Report

The advancement of technologies like computer vision, AI, and ML and their integration as essential components of sophisticated robotic software platforms have elevated standards, minimized expenses, heightened precision, and expanded production capacity. The ongoing development of innovative software solutions tailored to meet the changing demands of various industries is propelling the robotic platform market expansion.

For instance, in October 2023, NVIDIA introduced NVIDIA Isaac ROS robotics framework to cater to the growing demand for generative AI in the robotics platform for over 10,000 companies. These companies are leveraging the platform with the latest generative AI, APIs, and microservices to expedite industrial digitalization.

Robotic Platform Market Trends

Rising Investments in Robotic Platforms are Driving the Market Growth

Market CAGR for robotic platforms is being driven by rising investments in robotic platforms, owing to the surge in automation across various industries. Businesses seek to enhance efficiency, reduce costs, and improve productivity with the adoption of robotics platforms. Businesses are investing in research and development aimed at advancing robotic capabilities, including artificial intelligence (AI), machine learning, and sensor technologies.

These innovations enable robots to perform increasingly complex tasks with greater precision and autonomy, driving their integration into diverse sectors such as manufacturing, logistics, healthcare, and agriculture.

For instance, in June 2024, ABB Robotics launched a cutting-edge intelligent robotics automation platform, the OmniCore, with an investment of more than $170 million in next-gen robotics.

OmniCore provides increased speed and precision with integrated AI, sensors, cloud, and edge computing systems to enable advanced and autonomous robotic applications in various sectors. It delivers a 25% increase in operational speed and a 20% reduction in energy consumption.

Rising Adoption of Autonomous Mobile Robots (AMRs)

The market for robotic platforms is growing rapidly due to the increasing use of Autonomous Mobile Robots (AMRs). AMRs can navigate and perform tasks independently without following set routes or needing human help. They incorporate advanced technologies like sensors, mapping, and localization systems, enabling them to make decisions in real time and adjust their movements in different environments. AMRs have wide applications in various sectors, such as manufacturing, connected logistics, and healthcare.

In manufacturing facilities, AMRs optimize processes ranging from material handling to complex tasks such as assembly or welding, ultimately improving production efficiency. AMRs revolutionize inventory management and order picking in logistics and warehousing, leading to substantial reductions in processing times and errors, thereby driving the robotic platform market revenue.

For instance, in March 2024, Piaggio introduced Kilo smart, a robotic platform designed for industrial automation in manufacturing and logistics with a carrying capacity of up to 130kgs, equipped with advanced sensors and 4D radar imaging. The robot can autonomously follow operators and navigate pre-set paths, with the capability to store over 100 paths in its memory.

Robotic Platform Market Segment Insights

Robotic Platform Robot Type Insights

The global robotic platform market segmentation, based on robot type, includes industrial robots and service robots. In 2023, the industrial robots segment dominated the market attributed to their improved functionality, adaptability, and effectiveness in various industrial applications.

Moreover, the increasing utilization of industrial robots is being fueled by the need for automation to meet the demands of high-volume manufacturing and the shift to Industry 4.0. Industrial robots perform complex tasks with precision and offer advanced features such as machine learning and real-time analytics.

For instance, in 2023, according to a report published by the International Federation of Robotics (IFR), 553,052 industrial robots were installed in manufacturing facilities globally, showing a 5% increase in 2022 compared to 2021. Geographically, Asia accounted for 73% of the total new industrial robots’ installation, while Europe and America witnessed 15% and 10%, respectively.

Robotic Platform End-User Insights

The global robotic platform market segmentation, based on end-user, includes manufacturing, healthcare, logistics and transportation, retail and e-commerce, residential, and others. The manufacturing category dominated the market over the forecast period as robotic platforms ensure precise and consistent task execution by enhancing product quality and reducing defects during manufacturing processes.

Robotic platforms enable smooth integration with different manufacturing systems such as PLCs, SCADA systems, and MES. This aids data-driven decision-making and improves production processes. Manufacturers monitor robot performance, diagnose issues, and carry out software updates or calibrations remotely, reducing downtime and the need for on-site interventions.

For instance, according to a report published by the International Federation of Robotics (IFR) in December 2021, global robot density in manufacturing industries has almost doubled in the last five years, reaching an average of 126 robots per 10,000 employees.

Global Robotic Platform Market, Segmental Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Robotic Platform Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The North America region dominated the robotic platform market over the forecast period, owing to the integration of machine learning and artificial intelligence technologies in robotic platforms.

Additionally, the rise of technologies such as the Industrial Internet of Things (IIoT) has made robot software crucial for ensuring the optimal performance of robots with technological advancement. As robotics continues to expand in the industrial realm, the demand for robotic platforms is experiencing significant growth in the North American region.

For instance, in March 2024, Addverb, a global company in robotics and warehouse automation solutions, collaborated with DHL Supply Chain in North America. This collaboration encompasses the deployment of 52 sorting robots, known as Zippy, and an Addverb software solution at a DHL Supply Chain distribution center in Columbus, Ohio. These robots will be operated using Addverb's enterprise software platform, enabling DHL Supply Chain to enhance their facility's throughput and scalability.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Global Robotic Platform Market, Regional Coverage, 2019 – 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Further, the U.S. robotic platform market held the largest market share in the North American region owing to the transition from focusing on hardware to prioritizing software in various sectors. Major companies are developing and investing in adaptable service robots using a software platform to meet the needs of diverse settings, acknowledging the crucial significance of establishing standardized AI-driven autonomous robot platforms.

For instance, in March 2024, LG Electronics accelerated the development of its service robotics capabilities by investing USD 60 million in Bear Robotics. This leading Silicon Valley startup focuses on AI-driven autonomous service robots.

The Asia-Pacific robotic platform market is expected to grow at the fastest CAGR from 2024 to 2032. The Asia-Pacific region is rapidly adopting automation and robotic platforms in various sectors, especially in healthcare, owing to its advancements, safety, efficacy, and enhanced patient outcomes. The use of robotics in healthcare enables accurate diagnosis with real time monitoring, thereby fastening the processes.

For instance, in October 2023, MMI expanded its presence in the Asia-Pacific market by entering into partnerships with Device Technologies and TRM Korea to strengthen the introduction of the Symani Surgical System robotic platform in this region.

In 2023, China's robotic platform market held the largest market share. This was driven by the dynamic Chinese market, which attracted both local and global robot manufacturers to set up manufacturing facilities and constantly expand their production capabilities. Global companies also showcased their technological advancements in exhibitions held in China.

For instance, in September 2024, ABB showcased a comprehensive selection of cutting-edge robotics automation offerings, software, solutions, and services during the 2023 China International Industry Fair (CIIF).

Robotic Platform Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the robotic platform market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, the robotic platform industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global robotic platform industry to benefit clients and increase the market sector. In recent years, the robotic platform industry has witnessed some technological advancements. Major players in the robotic platform market include ABB, Cyberbotics, Google Inc., IBM, Microsoft, NVIDIA Corporation, Omron Corporation, Rethink Robotics, Rockwell Automation Company and Universal Robots A/S.

International Business Machines Corporation (IBM) is a technology company that provides integrated solutions and services to clients worldwide. IBM operates through four business segments, including software, financing, consulting and infrastructure. The software segment offers software solutions and a hybrid cloud platform to help businesses leverage cloud technology. It provides software for business automation, management, integration, and application servers. In March 2024, IBM launched the Robotic Process Automation version 23.0.15, comprised of time zone support in bot schedules, FIPS compliance and additional tools for UMS management.

NVIDIA Corporation is a computer hardware manufacturing company that offers a wide range of products in segments of gaming and entertainment, laptops and workstations, cloud and data centers, networking, GPUs, cloud and data center, and embedded systems, including research and development, sales, marketing, and operations. The company was founded in 1993 and is headquartered in the United States with its presence in 35 countries. In March 2024, NVIDIA collaborated with Teradyne Robotics, which includes cobot company Universal Robots (UR) and autonomous mobile robot company MiR. The collaboration aims to automate tasks in robotic platforms with the introduction of advanced AI features.

Key companies in the robotic platform market include

- ABB

- Cyberbotics

- Google Inc.

- IBM

- Microsoft

- NVIDIA Corporation

- Omron Corporation

- Rethink Robotics

- Rockwell Automation Company

- Universal Robots A/S

Robotic Platform Industry Developments

- June 2024: ANYbotics and Energy Robotics partnered to integrate robotic platforms in order to expand automated robot inspections for asset monitoring in the energy industry, offering complete end-to-end inspection solutions and data integration.

- May 2023: Alphabet introduced Intrinsic Flowstate, an online developer platform that enables businesses to develop robotic workflows to initiate the creation of robotic systems, along with simulation features for testing designs.

- March 2023: Dexterity, a software developer specializing in warehouse robotics, introduced the latest version, 3.0, of its Palletizing and Depalletizing software (PDP). The new version is designed to enhance pallet operations within the warehouse.

Robotic Platform Market Segmentation

Robotic Platform Robot Type Outlook

- Industrial Robots

- Service Robots

Robotic Platform Type Outlook

- Fixed

- Mobile

Robotic Platform Deployment Outlook

- On-Cloud

- On-premises

Robotic Platform End-User Outlook

- Manufacturing

- Pharmaceuticals & Cosmetic

- Plastic, Rubber, and Chemicals

- Automotive

- Electrical & Electronics

- Food & Beverages

- Metals & Machinery

- Others

- Logistics and Transportation

- Retail and E-commerce

- Healthcare

- Residential

- Others

Robotic Platform Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Robotic Platform Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 9.51 billion |

|

Market Size Value in 2024 |

USD 10.02 billion |

|

Revenue Forecast in 2032 |

USD 15.58 billion |

|

CAGR |

5.7% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global robotic platform market size was valued at USD 9.51 billion in 2023 and will be valued at USD 15.58 billion in 2032

The global market is projected to grow at a CAGR of 5.7% during the forecast period, 2024-2032.

North America had the largest share of the global market.

The key players in the market are ABB, Cyberbotics, Google Inc., IBM, Microsoft, NVIDIA Corporation, Omron Corporation, Rethink Robotics, Rockwell Automation Company, and Universal Robots A/S.

The industrial robot category dominated the market in 2023.

The manufacturing segment held the largest share of the global market.