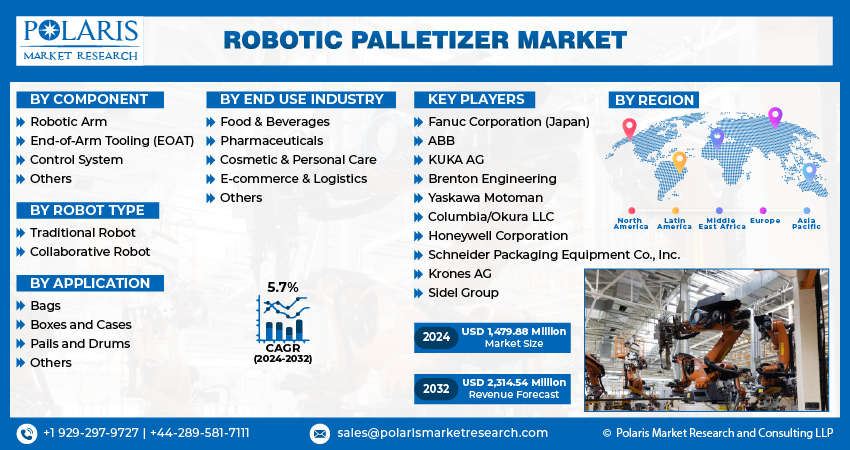

Robotic Palletizer Market Share, Size, Trends, Industry Analysis Report, By Component (Robotic Arm, End-of-Arm Tooling (EOAT), Control System, Others); By Robot Type; By Application; By End-Use Industry; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 118

- Format: PDF

- Report ID: PM4950

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

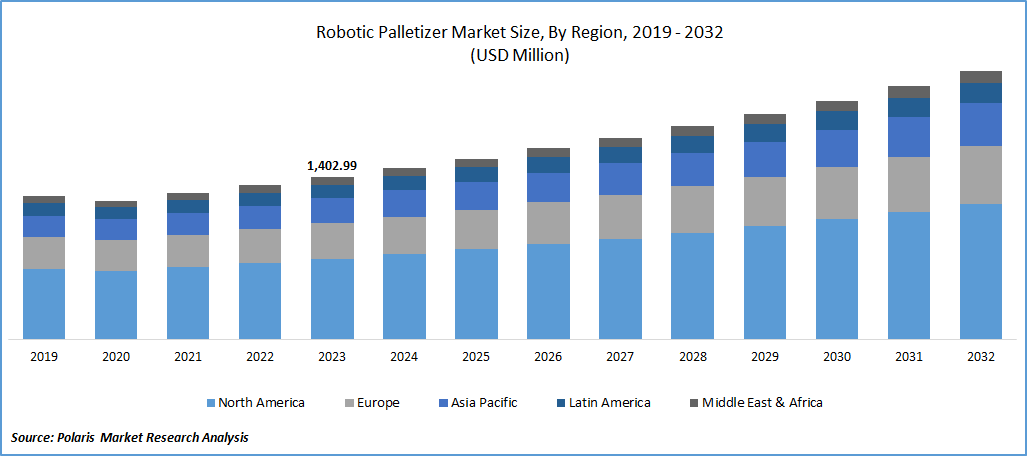

Robotic Palletizer Market size was valued at USD 1,402.99 million in 2023. The market is anticipated to grow from USD 1,479.88 million in 2024 to USD 2,314.54 million by 2032, exhibiting the CAGR of 5.7% during the forecast period.

Market Overview

The global robotic palletizer market is experiencing significant growth, driven by the increasing adoption of automation in various industries. Robotic palletizers are advanced industrial machines designed to automate the palletizing process by stacking and organizing products or materials onto pallets efficiently. These robotic systems offer numerous advantages, including higher productivity, improved workplace safety, and enhanced efficiency in warehouse and distribution operations. As industries strive to optimize their supply chain processes and reduce labor costs, the demand for robotic palletizers continues to rise.

To Understand More About this Research:Request a Free Sample Report

Several driving factors contribute to the expansion of the robotic palletizer market. Firstly, the growing e-commerce sector and the need for faster order fulfillment are driving the adoption of automation solutions, including robotic palletizing systems, to handle increased volumes of goods. Additionally, advancements in robotic technology, such as improved flexibility, precision, and speed, make robotic palletizers more attractive for a wide range of applications across industries like food and beverage, pharmaceuticals, consumer goods, and logistics.

Furthermore, the increasing focus on sustainability and energy efficiency encourages companies to invest in robotic palletizers, which offer optimized material handling processes and reduced environmental impact. Overall, the robotic palletizer market is poised for continued growth as industries embrace automation to improve productivity and competitiveness in the global market.

Growth Drivers

Increasing Labor Cost and Availability

Increasing labor charges and demanding situations associated with labor availability are major driving factors for the adoption of robotic palletizers in numerous industries. Labor expenses can be a massive portion of operational costs, mainly in industries with high-volume palletizing necessities, including manufacturing, logistics, and distribution. Robotic palletizers have become popular due to nonstop trends in the robotics era, including progressed sensors, vision systems, and software that make them extra adaptable to diverse production scenarios.

Companies are looking for alternate ways to automate labor-intensive processes like palletizing to stay competitive and lower total operating costs. The cost of labor keeps rising owing to factors like minimum wage regulations, benefits, and other labor-related expenses.

Increasing Demand for Automation

Robotic palletizers increase operational efficiency by automating repetitive and bodily demanding responsibilities, main to higher throughput and reduced operational expenses. Automation guarantees regular palletizing patterns and accuracy, minimizing mistakes in comparison to guide managing. Scaling up or down robotic palletizers in response to production demands is a simple process.

They provide flexibility to adjust to shifting market demands since they can handle a wide range of product types and pallet configurations. Robots can palletize goods with exact uniformity and accuracy, which minimizes mistakes and lessens product damage during handling. This consistency enhances client satisfaction and overall product quality. For instance, in May 2023, BOBST acquired a majority share in Ducker Robotics to help fulfill its vision for the future of packaging production.

Restraining Factors

High Initial Investment Cost

The robotic palletizer market is witnessing steady growth, driven by the increasing adoption of automation in material handling processes across various industries. However, one significant restraining factor for market expansion is the high initial investment cost associated with implementing robotic palletizing systems. The upfront costs involved in acquiring and installing robotic palletizers, along with the expenses for training personnel and integrating the systems into existing operations, can be substantial for many companies. This financial barrier poses a challenge, particularly for small and medium-sized enterprises (SMEs), limiting their ability to invest in robotic palletizing technology despite its long-term benefits in terms of efficiency and productivity gains.

Report Segmentation

The market is primarily segmented based on component, robot type, application end-use industry, and region.

|

By Component |

By Robot Type |

By Application |

By End Use Industry |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Component Analysis

Robotic Arm Segment Held the Significant Market Revenue share in 2023

The robotic arm segment held a significant market share in revenue in 2023. Continuous enhancements in robotic arm layout, along with more advantageous flexibility, payload ability, and precision, can drive market growth. Increasing adoption of robotic palletizers across industries like food & beverage, e-commerce, and automotive, where-in efficient material handling is critical, can increase demand for robotic arms.

By Robot Type Analysis

Collaborative Robot Segment is Expected to Witness the Highest Growth During the Forecast Period

In the Robotic Palletizer Market, the Collaborative Robot segment is projected to experience the most substantial growth throughout the forecast period. This surge in demand is attributed to several driving factors. Firstly, the increasing focus on workplace safety and efficiency encourages the adoption of collaborative robots that can work alongside human operators without the need for safety barriers. Secondly, advancements in robotic technology, including improved sensors and artificial intelligence capabilities, enhance the performance and versatility of collaborative robots, making them more appealing for palletizing tasks. Additionally, the scalability and flexibility offered by collaborative robots make them well-suited for businesses seeking adaptable and cost-effective automation solutions.

By End-Use Analysis

Food & Beverages Segment Held the Significant Market Revenue share in 2023

The food & beverages segment held the significant market revenue share in 2023. The food & beverages industry involves high-quantity production and packaging of products, requiring efficient palletizing solution to deal with large quantities of products. Robotic palletizers can deal with a variety of packaging formats utilized in food & beverage manufacturing, including cartons, trays, bottles, cans, and pouches.

Regional Insights

Asia Pacific Region Registered the Largest share of the Global Market in 2023

The Asia Pacific region held the dominant share in 2023. Automation technologies are becoming more widely used due to the fast industrialization and growth of manufacturing in nations like China, Japan, South Korea, and India. The region's emerging economies are investing in the modernization of their manufacturing and logistical infrastructure, which is increasing demand for robotic palletizers to boost productivity.

For instance, in October 2020, Yaskawa launched 4 Models of a New Palletizing Robot, Series MOTOMAN-PL-Improvement of energy saving performance & maintainability, applied to the robot controller "YRC1000".

North America is expected to witness significant growth over the forecast period. The demand for robotic palletizing systems is fueled by the region's robust manufacturing presence in sectors like consumer products, automotive, pharmaceuticals, and the food and beverage industry. Robotic palletizer use has expanded in the region because companies are placing a higher priority on workplace safety, labor cost reductions, and efficiency.

For instance, in October 2020, Yaskawa Started Selling Its PL800 Palletizing Robot in North and South American Markets. The robot was designed for "palletizing applications, layer picking, & ancillary logistical tasks for distribution automation." The PL800 features an 800 kg (1,763 lb.) payload capacity, a horizontal reach of 3,159 mm (124 in), and a vertical reach of 3,024 mm (119 in.).

Key Market Players & Competitive Insights

Product Launch to Drive the Competition

The Robotic Palletizer market is fragmented. In the robotic palletizer industry, introducing novel goods is essential to generating competitiveness and gaining market share. One of the main factors driving the rivalry will be the introduction of collaborative robotic palletizers, or cobots, with cutting-edge safety features that enable safe human-robot interaction in shared workspaces. For instance, OMRON launched cobot palletizing solution. To fulfill the need for more flexible production processes while, reducing programming time. The PLC-based cobot palletizing solution is created on the OMRON’s NX1 series modular controller, equipped with the specialized “Palletizing Function Block”.

Some of the major players operating in the global market include:

- Fanuc Corporation (Japan)

- ABB

- KUKA AG

- Brenton Engineering

- Schneider Packaging Equipment Co., Inc.

- Yaskawa Motoman

- Columbia/Okura LLC

- Honeywell Corporation

- Krones AG

- Sidel Group

Recent Developments in the Industry

- In April 2019, Yaskawa introduced MOTOMAN-HC30PL, a human cobot that can be used for the palletizing applications, with a pay-load capacity of nearly, 30 kg.

Report Coverage

The Robotic Palletizer market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, component, robot type, application, end-use industry, and their futuristic growth opportunities.

Robotic Palletizer Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1,479.88 million |

|

Revenue forecast in 2032 |

USD 2,314.54 million |

|

CAGR |

5.7% from 2024 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Robotic Palletizer Market report covering key segments are component, robot type, application end-use industry, and region.

Robotic Palletizer Market Size Worth $ 2,314.54 Million By 2032

Robotic Palletizer Market exhibiting the CAGR of 5.7% during the forecast period

Asia Pacific is leading the global market.

The key driving factors in Robotic Palletizer Market are Increasing Demand for Automation.