Global Robot Operating System Market Size, Share, Trends, Industry Analysis Report: By Robot Type (Articulated Robots, Cartesian Robotics, Collaborative Robots, SCARA Robots, and Others), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 - 2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5177

- Base Year: 2024

- Historical Data: 2020-2023

Robot Operating System Market Overview

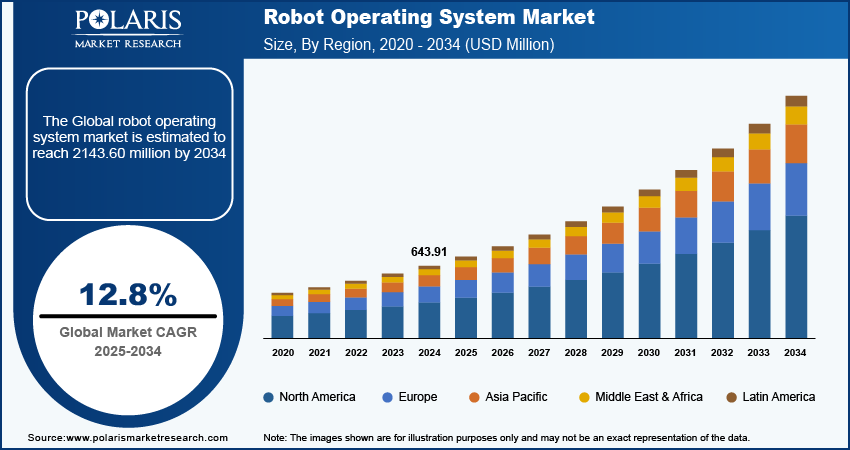

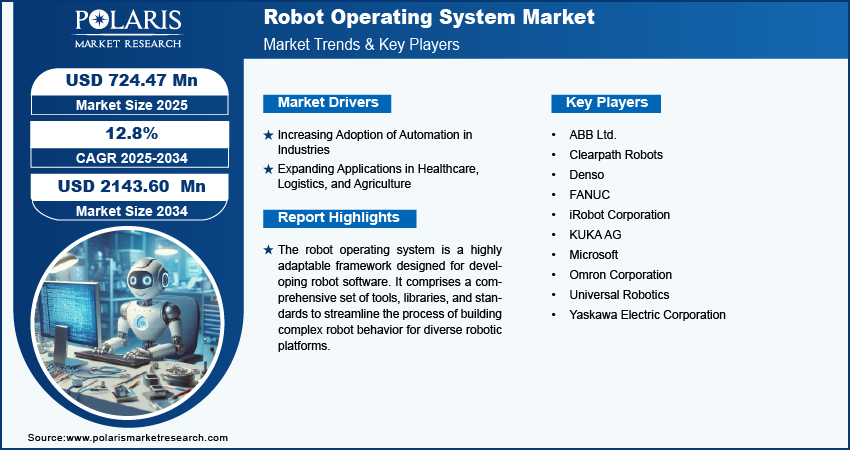

Global robot operating system market size was valued at USD 643.91 million in 2024. The market is projected to grow from USD 724.47 million in 2025 to USD 2143.60 million by 2034, exhibiting a CAGR of 12.8% during the forecast period.

The robot operating system is a highly adaptable framework designed for developing robot software. It comprises a comprehensive set of tools, libraries, and standards to streamline the process of building complex and tough robot behavior for diverse robotic platforms.

The increasing use of the robot operating system in schools and universities for teaching robotics and helping with projects is creating a skilled workforce, which is boosting its use in the education and training sector. Furthermore, advancement in robotics hardware and software, with AI and machine learning, highlights the necessity for advanced operating systems capable of effectively connecting these technologies. Therefore, the increasing demand for advanced operating systems has led to a growth in the robot operating system market share.

To Understand More About this Research: Request a Free Sample Report

Robot operating systems are pivotal in defense and security applications, empowering tasks such as bomb disposal, surveillance, and border patrol. These systems significantly boost situational awareness and operational capabilities for defense agencies. Moreover, the growing prevalence of collaborative robotics indicates a shift towards safer and more interactive human-robot interactions across different industries. Robot operating system developers are pioneering the development of customized solutions to enable seamless integration and control of collaborative robots across a wide range of operational environments. This fuels the growth of the robot operating system market during the forecast period.

Robot Operating System Market Driver Analysis

Increasing Adoption of Automation in Industries

The implementation of automation in manufacturing involves the utilization of robots for tasks such as assembly, welding, painting, and packaging. Major companies such as Tesla and Ford leverage automated systems to optimize production efficiency and ensure high product quality. This interoperability fosters increased adoption of robot operating systems by companies, thereby expanding the market for such solutions. For instance, in April 2024, Tesla manufactured more than 433,000 vehicles and delivered around 387,000 vehicles in the first quarter. The increased production capacity necessitated the adoption of a robot operating system, which contributed significantly to the expansion of market share.

Expanding Applications in Healthcare, Logistics, and Agriculture

The demand for versatile operating systems in robotics is growing as robots are increasingly being used in a wider range of applications such as healthcare, logistics, and agriculture. These operating systems need to support diverse functionalities to meet the expanding needs of the industry. For instance, in 2023, agriculture, food, and related industries significantly contributed approximately $1.530 trillion to the US GDP, capturing a 5.6-percent share. Hence, the increased use of robot operating systems in the agriculture and food industries for tasks such as packaging, pesticide application, and others has led to a significant increase in market share.

Robot Operating System Market Segment Analysis

Robot Operating System Market Breakdown by End Use Insights

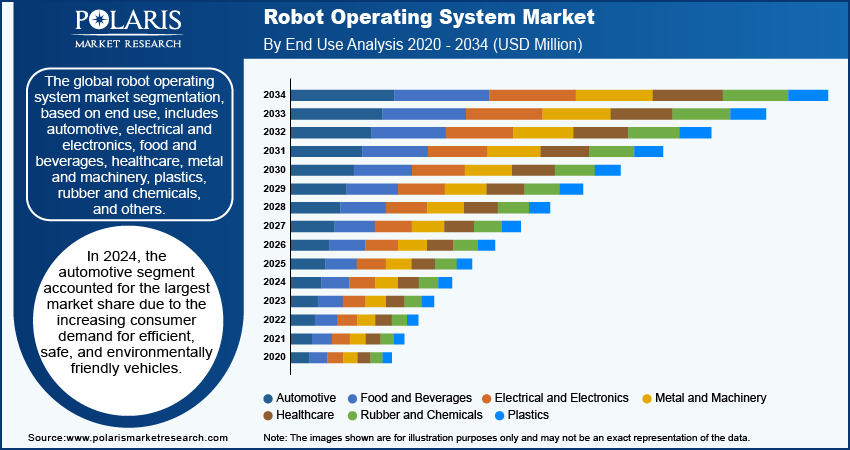

The global robot operating system market segmentation, based on end use, includes automotive, electrical and electronics, food and beverages, healthcare, metal and machinery, plastics, rubber and chemicals, and others. In 2024, the automotive segment accounted for the largest market share. The increasing consumer demand for efficient, safe, and environmentally friendly vehicles has led to a surge in sales of both conventional and electric cars. The automotive industry is at the forefront of utilizing automation and robotics in manufacturing. For instance, the sales of plug-in electric vehicles (PEVs) have seen a significant increase, with over 1.4 million units sold in 2023, marking a growth of over 50% from 2022. Battery electric vehicles (BEVs) contributed to 80% of the PEV sales. In June 2024, PEVs accounted for 9.1% of monthly sales, and in 2023, they represented 9.3% of all passenger vehicle sales, up from 6.8% in 2022. This surge in the automotive industry has resulted in a growing demand for the robot operating system, thereby driving significant market growth.

Robot Operating System Market Breakdown by Application Insights

The global robot operating system market segmentation, based on application, includes end of line packaging, home automation and security, inventory management, mapping and navigation, metal sampling and press trending, personal assistance, pick and place, plastic injection and blow molding, and testing and quality inspection. The home automation and security category is expected to be the fastest growing market segment. The current shift towards smart homes enables the utilization of interconnected devices and systems for automated processes, security, and energy regulation. The robot operating system plays a pivotal role in bolstering the development of advanced software solutions that support these smart home technologies. Homeowners are now seeking comprehensive security solutions that offer improved surveillance, access control, and monitoring functionalities. The robot operating system plays a critical role in integrating robotics and automation technologies to meet these security requirements effectively.

Robot Operating System Market Breakdown by Regional Insights

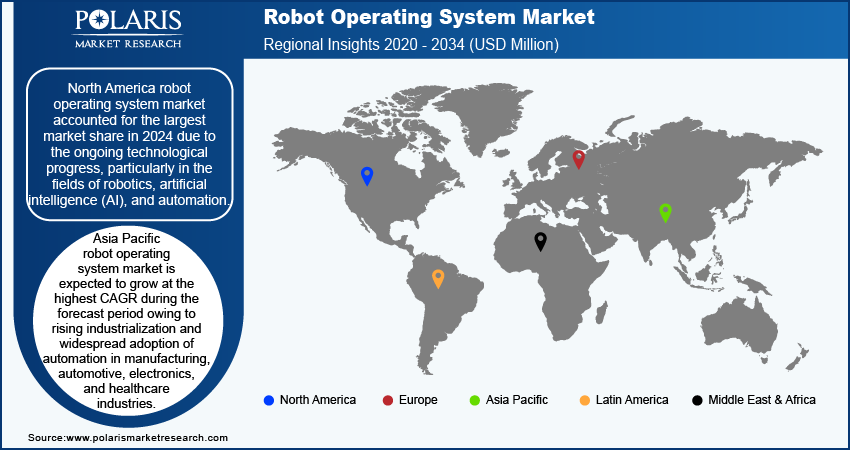

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America robot operating system market accounted for the largest market share in 2024. The region is at the forefront of technological progress, particularly in the fields of robotics, artificial intelligence (AI), and automation. The robot operating system is an adaptable framework for creating robotic applications and is benefiting from continuous technological progress and investments in these domains. Industries in North America, such as manufacturing and healthcare, are increasingly leveraging automation to enhance efficiency, cut costs, and boost productivity. The robot operating system is facilitating the integration of robotics into these sectors, thereby propelling market expansion.

US robot operating system market is expected to grow significantly during the forecast period. The government supports numerous R&D initiatives focused on robotics, which include collaborations between federal agencies, academic institutions, and private companies. These initiatives often leverage robot operating systems to develop innovative solutions for various industries, including defense, healthcare, and manufacturing. For instance, the US government has been developing ROS-M (Robotic Operating System-Military) to enable the rapid development and deployment of robotic and autonomous systems. ROS-M is based on ROS 1 and allows the department of defense to benefit from open source practices while maintaining control over community developed code. Hence, this development is significantly driving the US robot operating system market share.

Asia Pacific robot operating system market is expected to grow at the highest CAGR during the forecast period. The region, including countries such as China, Japan, South Korea, and India, has experienced significant industrialization and widespread adoption of automation in manufacturing, automotive, electronics, and healthcare industries. The robot operating system has played a vital role in driving robotic automation in these sectors, contributing to market growth. Moreover, the region is a dynamic center for the production and innovation of consumer electronics. The robot operating system has been instrumental in advancing robotics applications in electronics manufacturing, elevating efficiency and quality control processes. This drives the robot operating system market in Asia Pacific.

Robot operating system in China is also projected to experience substantial growth at a significant CAGR during the forecast period. This growth is attributed to the escalating investments in infrastructure development, particularly in logistics and transportation networks, which have considerably enhanced the efficiency and scale of manufacturing and distribution activities. As the movement of goods increases and infrastructure continues to improve, there is a corresponding rise in the demand for robot operating systems, leading to further growth in the market revenue. For instance, the State Council of the People's Republic of China reported that in 2022, the China Federation of Logistics and Purchasing observed a 3.4 percent year-on-year increase in social logistics, amounting to USD 50.4 trillion. This surge in logistics is primarily driven by the growing demand for e-commerce platforms in China, consequently fueling the adoption of robot operating systems and bolstering the market in China.

Robot Operating System Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the robot operating system market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the robot operating system industry must offer cost-effective items.

Major players in the robot operating system market include ABB Ltd., Clearpath Robots, Denso, FANUC, iRobot Corporation, KUKA AG, Microsoft, Omron Corporation, Universal Robotics, and Yaskawa Electric Corporation.

ABB operates as a technology company worldwide. The company operates through four segments: electrification, motion, process automation, and robotics & discrete automation. The electrification segment offers a product portfolio of switchgear under the distribution solution sub-segment. The motion segment offers drive products, system drives, services, traction, IEC LV Motors, generators, and NEMA motors. Moreover, process automation and robotics & discrete automation offers cater to various energy and process industries and also offer measurement analytics, machine automation, and robotics. In December 2021, ABB launched Omnicore robot controllers, which offer improved speed, precision, and autonomy, enhancing the overall efficiency of automation processes.

iRobot Corporation is a global leader in designing, building, and distributing robots and innovative home products across various regions, including the United States, Europe, the Middle East, Africa, and Japan. The company's product line includes advanced floor care solutions featuring the renowned Roomba floor vacuuming robots, along with a range of accessories and consumables. In May 2022, iRobot Corp., a consumer robotics company, launched iRobot OS, which represents the next stage in the development of its Genius Home Intelligence platform. iRobot OS offers enhanced customer experience, aiming to optimize home cleanliness, health, and automation.

List of Key Companies in Robot Operating System Industry Outlook

- ABB Ltd.

- Clearpath Robots

- Denso

- FANUC

- iRobot Corporation

- KUKA AG

- Microsoft

- Omron Corporation

- Universal Robotics

- Yaskawa Electric Corporation

Robot Operating System Industry Developments

June 2024: FANUC America launched the SR-12iA/C Food Grade SCARA robot, specifically designed for food packaging, processing, and cleanroom environments.

August 2022: Yaskawa launched the MOTOMAN-HC30PL, a human-collaborative robot designed for palletizing applications, featuring a payload capacity of 30 kg.

June 2022: PickNik Robotics and Optimax Systems Inc. partnered to develop a ROS2 driver specifically designed for ABB manipulators.

Robot Operating System Market Segmentation

By Robot Type Outlook (Revenue, USD Million, 2020–2034)

- Articulated Robots

- Cartesian Robotics

- Collaborative Robots

- SCARA Robots

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- End of Line Packaging

- Home Automation and Security

- Inventory Management

- Mapping and Navigation

- Metal Sampling and Press Trending

- Personal Assistance

- Pick and Place

- Plastic Injection and Blow Molding

- Testing and Quality Inspection

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Automotive

- Electrical and Electronics

- Food and Beverages

- Healthcare

- Metal and Machinery

- Plastics

- Rubber and Chemicals

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Robot Operating System Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 643.91 Million |

|

Market Size Value in 2025 |

USD 724.47 Million |

|

Revenue Forecast in 2034 |

USD 2143.60 Million |

|

CAGR |

12.8% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global robot operating system market size was valued at USD 643.91 million in 2024 and is expected to reach USD 2143.60 billion by 2034.

The global market is projected to grow at a CAGR of 12.8% during the forecast period 2025-2034.

North America had the largest share of the global market

The key players in the market are ABB Ltd., Clearpath Robots, Denso, FANUC, iRobot Corporation, KUKA AG, Microsoft, Omron Corporation, Universal Robotics, and Yaskawa Electric Corporation.

The automotive category dominated the market in 2024.

Home automation and security had the largest share of the global market.