Robo Advisory Market Size, Trends, Industry Analysis Report, By Product (Pure Robo Advisors, Hybrid Robo Advisors); By Provider; By Service Type; By End-Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4529

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

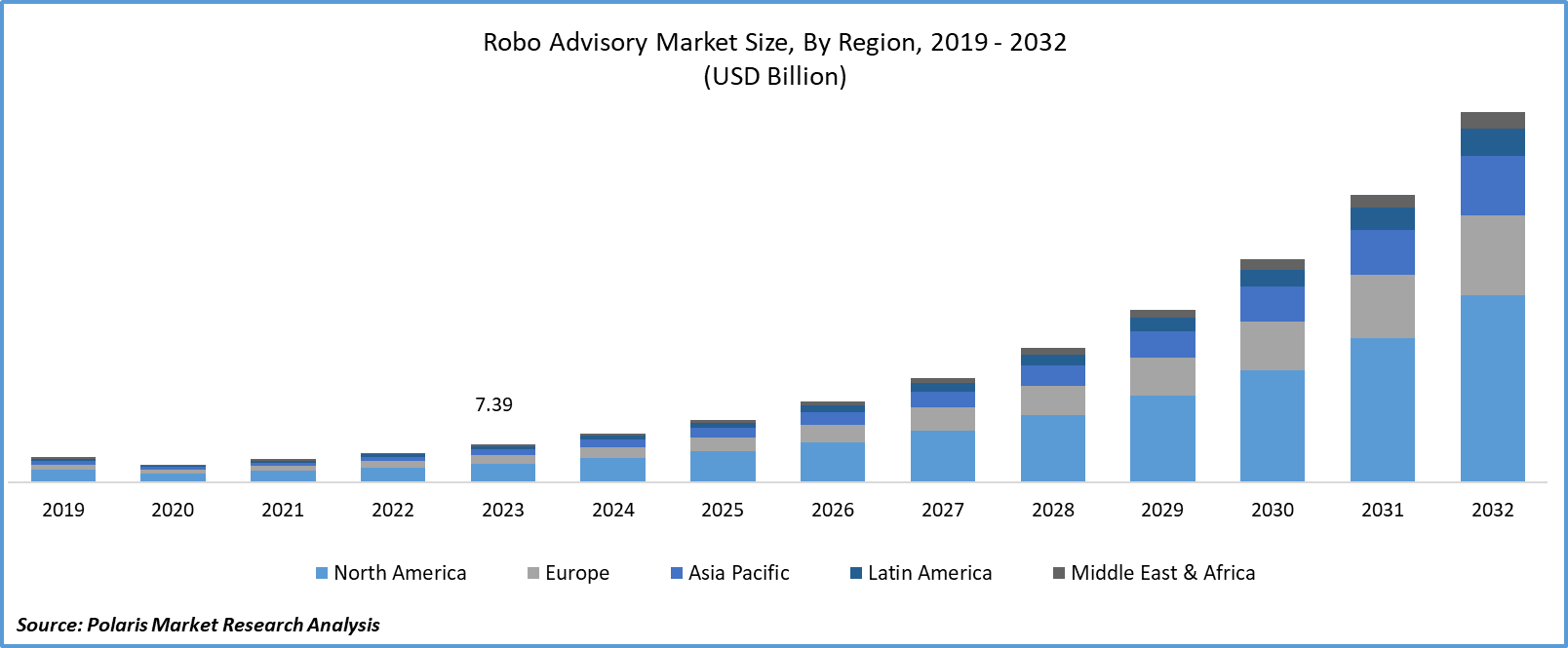

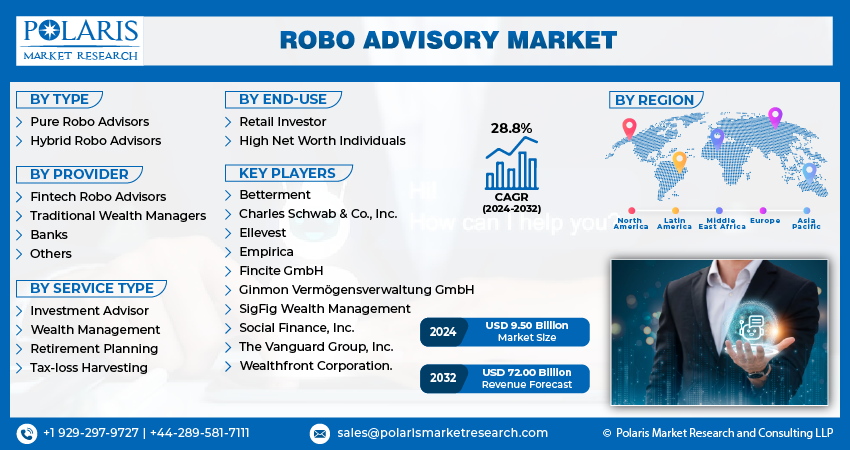

Robo Advisory Market size was valued at USD 7.39 billion in 2023. The market is anticipated to grow from USD 9.50 billion in 2024 to USD 72.00 billion by 2032, exhibiting a CAGR of 28.8% during the forecast period.

Industry Trends

Robo advisory involves the delivery of automated, algorithm-based financial guidance and investment services, leveraging a combination of technology and financial expertise. This approach eliminates the need for human intervention in providing investment recommendations and managing portfolios. Utilizing sophisticated algorithms, robo-advisors analyze an investor's financial situation, goals, risk tolerance, and other pertinent factors to deliver personalized investment strategies.

The continuous refinement of these technologies has enhanced the precision and efficiency of robo advisory platforms, resulting in increased appeal to investors. Consequently, these advancements contribute significantly to the expansion of the robo advisory market. The global financial sector has witnessed rapid expansion attributed to the growing adoption of digital technology. The infusion of Artificial Intelligence (AI) into investment processes has facilitated automated investing. Retail investors are increasingly adopting robo-advisors due to their accessibility and cost-effectiveness. Wealth managers traditionally charged high fees and demanded substantial minimum balances, leaving Generation X and Millennial generations underserved. Robo-advisors address this gap by providing retail investors with comparable services at a reduced cost, thereby fueling the robo advisory market growth.

The company has proactively strengthened its market presence by extending its distribution network through strategic partnerships and exclusive collaborations. This revolutionary strategy underscores the company's devotion to maximizing its availability. Through forming alliances with significant partners, the company not only expands its service offerings but also leverages the expertise and networks of established distributors.

To Understand More About this Research: Request a Free Sample Report

For instance, In November 2023, WealthKernel, a wealth tech firm specializing in digital investment services, unveiled a partnership with Bambu, a leading provider of digital wealth technology. This collaboration announced the launch of Bambu GO, a ready-to-use robo advisor solution tailored specifically for financial institutions.

With increased internet accessibility, low-cost financial assistance, and advancements in technology, the robo advisory market analysis is poised for significant growth. Heightened competition, coupled with diversified services, is expected to further boost demand for robo-advisors in the coming years and hence increase the robo advisors' market size.

The Robo Advisory Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Key Takeaways

- North America accounted for the largest market and contributed to more than 37% of share in 2023.

- The Asia Pacific region is expected to witness the fastest-growing CAGR during the forecast period.

- By type category, hybrid robo advisory segment held the largest market share in 2023.

- By End-use category, the retail investor segment is expected to grow at fastest CAGR during the projected period.

What are the Market Drivers Driving the Demand for Robo Advisory Market?

Increasing Internet Penetration

The expansion of internet connectivity, the appeal of low-cost investment advice, and the maturation of digital consulting technologies are propelling the robo advisory market's growth. The convenience of automated processes without the need for manual intervention from financial advisors is expected to fuel market expansion in the foreseeable future. Across industries worldwide, digital technology advancements are reshaping operations. Forces such as the emergence of new digital ecosystems, reduced barriers to entry, asset and infrastructure ownership reductions, and value chain decoupling are driving organizations to undergo digital transformations.

Financial advisory firms are embracing technologies like artificial intelligence (AI) due to their capacity to mimic human thinking and problem-solving abilities, thereby enhancing client service and advice provision. Small investors now have access to these services at affordable rates, boasting attractive returns, transparency, and innovation compared to traditional banking offerings. Analysts note that current and future generations in emerging economies favor digital tools, further driving demand. Financial advisory providers are also leveraging new technologies to serve a larger clientele base over time efficiently. This rising demand increases the robo advisory market share.

Which Factor is Restraining the Demand for the Robo Advisory?

Data Privacy Concerns

As Robo-advisors gather and manage sensitive consumer information like income security codes, bank account particulars, Personal Account Numbers (PANs), and assets, they pose a heightened security risk. These platforms house extensive data that may be vulnerable to cyberattacks, potentially due to unauthorized access to consumer accounts. Inadequate testing of algorithms, deficiencies in institutional compliance protocols, and insufficient record-keeping practices can exacerbate the risk of data breaches and theft. Consequently, security threats and concerns about data privacy emerge as significant factors that could make challenges in robo advisory market growth.

Report Segmentation

The market is primarily segmented based on type, provider, service type, end-use, and region.

|

By Type |

By Provider |

By Service Type |

By End-use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Type Insights

Based on type analysis, the market is segmented on the basis of pure robo-advisors and hybrid robo-advisors. The hybrid robo-advisors segment held the largest market share in 2023. Robotic algorithms power robo advisors, offering efficient and consistent investment strategies. These algorithms analyze vast amounts of data, identify trends, and execute trades swiftly. This automation streamlines the investment process, saving time and reducing the potential for human error. As a result, investors are drawn to the reliability and efficiency of these systems. Despite the advancements in technology, many investors still value the personal touch provided by human financial advisors. Human advisors bring empathy, understanding, and intuition to the table, factors that are often missing in purely automated systems.

By End-use Insights

Based on type analysis, the market has been segmented on the basis of retail investors and high-net-worth individuals. The retail investor segment is expected to grow at the fastest CAGR during the forecast period. Robo advisory platforms have democratized investment opportunities by making sophisticated financial advice and portfolio management accessible to retail investors. These platforms typically have lower minimum investment requirements and fees compared to traditional financial advisors, making them attractive to retail investors who may have limited resources.

Moreover, Retail investors increasingly seek personalized investment strategies tailored to their financial goals, risk tolerance, and preferences. Robo advisors leverage algorithms and data analytics to provide customized investment recommendations, portfolio allocations, and ongoing monitoring. This level of customization resonates with retail investors who value individualized solutions. Hence, the robot Advisory market is expected to grow during the forecast period.

Regional Insights

North America

The North American region accounted for the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. North America, particularly the United States, has a highly developed and mature robo advisory service. This ecosystem includes established financial institutions, robust regulatory frameworks, and a culture of innovation. As a result, North America is well-positioned to adopt and integrate robo advisory solutions into its financial landscape. Numerous financial institutions are currently in the developmental stages, aiming to innovate and create cutting-edge platforms that provide robo advisory services to their clientele. For example, the Vanguard Group is preparing to introduce a robo advisory service that is purported to replace human advisory entirely.

For instance, in May 2022, Ally Financial unveiled a fresh wealth management solution, bolstering its existing robo-advisor service by enlisting a team of human advisors. This initiative aims to complement the automated service by offering personalized wealth guidance to customers on an individual basis.

Furthermore, the North American region is home to many technological innovators and startups focused on financial technology (fintech). These companies leverage advanced technologies such as artificial intelligence, machine learning, and big data analytics to develop cutting-edge robo advisory platforms. The region's technological prowess contributes to the sophistication and competitiveness of its robo advisory market.

Asia Pacific

The Asia Pacific region is expected to witness the fastest-growing CAGR during the forecast period. The Asia Pacific region is experiencing rapid economic growth and wealth accumulation, driven by factors such as urbanization, rising disposable incomes, and a growing middle class. As more individuals in the region accumulate wealth, there is increasing demand for sophisticated financial services, including investment advisory solutions like robo-advisors.

Many companies in the Asia Pacific region are actively advocating for the adoption of robo advisory services, anticipating that this trend will drive regional growth. This indicates that there is a concerted effort among businesses in the region to promote and implement robo advisory platforms and services.

For instance, In July 2022, TradeSmart, an online discount brokerage firm in India, revealed its partnership with Modern Algos to launch AI-driven advisory services. This platform leverages AI to provide an efficient order management system and employs sophisticated algorithms to provide personalized advice tailored to users' age, investment preferences, and future objectives.

Competitive Landscape

The competitive landscape of the robo advisory market is characterized by a dynamic interplay of established financial institutions, emerging fintech startups, and technological innovators. Robo advisory services, powered by automation and algorithms, are revolutionizing the investment landscape by offering cost-effective, convenient, and personalized investment advice to a wide range of investors.

Some of the major players operating in the global market include:

- Betterment

- Charles Schwab & Co., Inc.

- Ellevest

- Empirica

- Fincite GmbH

- Ginmon Vermögensverwaltung GmbH

- SigFig Wealth Management

- Social Finance, Inc.

- The Vanguard Group, Inc.

- Wealthfront Corporation.

Recent Developments

- In June 2023, Revolut, a neo bank and fintech firm on a global scale, launched a robo advisor in the United States. This innovative offering aims to streamline the investment journey for customers by automating portfolio management. With Revolut's robo advisor, users can easily invest in one of five portfolios that match their risk preferences.

- In May 2022, HDFC Securities unveiled HDFC Money, a novel investment platform incorporating robo advisory services. This platform offers access to a wide array of mutual fund schemes and diverse financial products, eliminating the necessity for a demat account.

Report Coverage

The robo advisory market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments, and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis about various paradigm shifts associated with the transformation of these technology

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, provider, service type, end use, and their futuristic growth opportunities.

Robo Advisory Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 9.50 billion |

|

Revenue forecast in 2032 |

USD 72.00 billion |

|

CAGR |

28.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Provider, By Service Type, By End Use, By Region. |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Custom Market Research Services

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

Browse Our Top Selling Reports

Biobased Polycarbonate Market Size, Share 2024 Research Report

Demulsifiers Market Size, Share 2024 Research Report

Stress Relief Supplements Market: Size, Share 2024 Research Report

Gaze Detection Technology Market Size, Share 2024 Research Report

Desalination Technologies Market Size, Share 2024 Research Report

FAQ's

The Robo Advisory Market report covering key segments are type, provider, service type, end-use, and region.

Robo Advisory Market Size Worth $72.00 Billion By 2032

Robo Advisory Market exhibiting a CAGR of 28.8% during the forecast period.

North American is leading the global market

key driving factors in Robo Advisory Market are Increasing Internet Penetration