Road Safety Market Size, Share, Trends, & Industry Analysis Report

By Service, By Technology, By Software, By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 122

- Format: PDF

- Report ID: PM2426

- Base Year: 2024

- Historical Data: 2020-2023

What is the road safety market size?

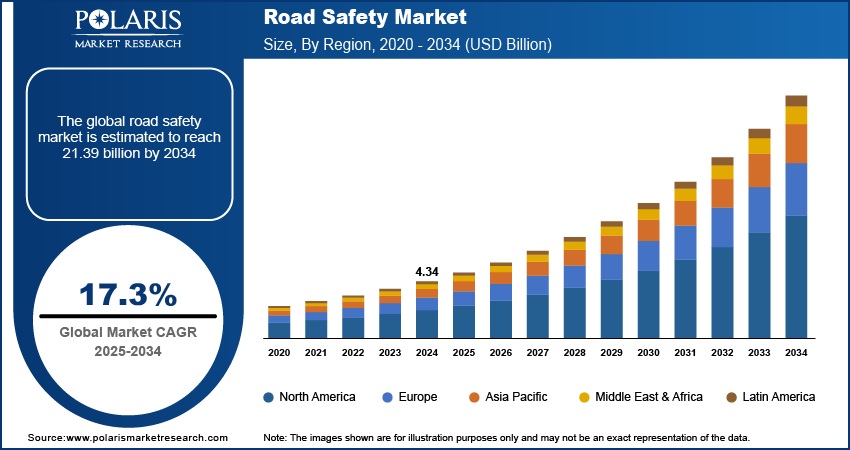

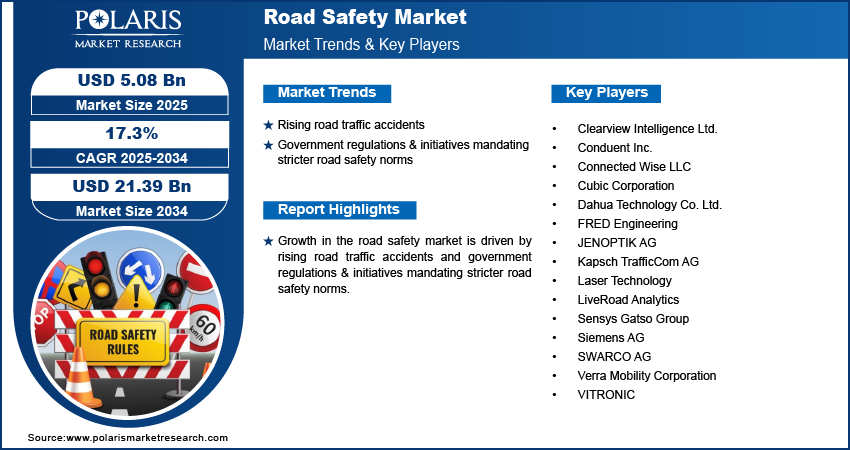

The road safety market was valued at USD 4.34 billion in 2024 growing at a CAGR of 17.3% from 2025-2034. Rising road traffic accidents and government regulations & initiatives mandating stricter road safety norms are driving the growth of road safety market.

Key Insights

- The consultation segment dominated the road safety market in 2024, driven by the increasing need for expert advisory, policy planning, and infrastructure assessment to ensure compliance with international safety standards.

- The management segment is projected to grow at the fastest CAGR during the forecast period, driven the rising adoption of outsourced traffic management and safety monitoring solutions.

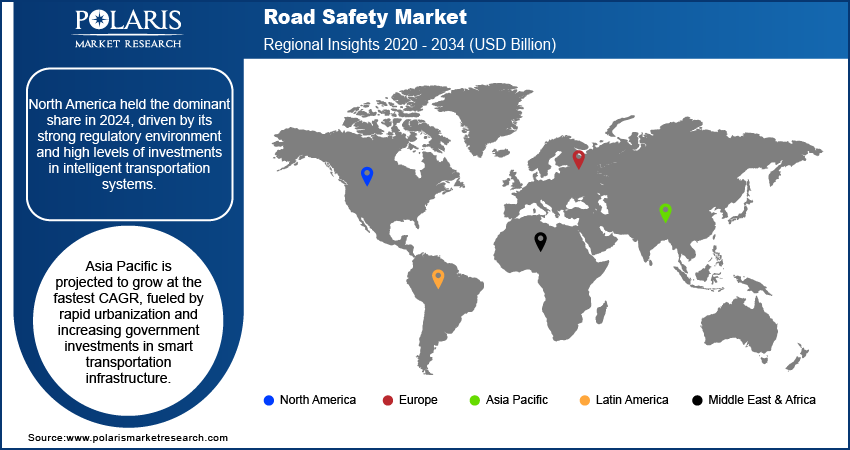

- North America road safety market dominated the global market in 2024. This is due to its strong regulatory environment and high levels of investments in intelligent transportation systems.

- The U.S. road safety market held a dominating market share in the North America region in 2024, driven by federal and state-level traffic regulations and high adoption of advanced road safety technologies.

- The Asia Pacific road safety market is projected to grow at the fastest CAGR during the forecast period, driven by rapid urbanization and increasing government investments in smart transportation infrastructure.

- The market in China is expanding due to rapid urbanization and large-scale infrastructure development that drives the demand for road safety concerns and advanced traffic management systems.

Industry Dynamics

- Rising road traffic accidents is driving the demand for road safety market.

- Increasing government regulations & initiatives mandating stricter road safety norms is driving the demand for road safety market.

- Expansion of smart city projects worldwide creates opportunity for road safety market.

- High implementation and maintenance cost of advanced road safety systems restrains the growth of road safety market.

Market Statistics

- 2024 Market Size: USD 4.34 Billion

- 2034 Projected Market Size: USD 21.39 Billion

- CAGR (2025-2034): 17.3%

- North America: Largest Market Share

What is road safety?

The road safety market is designed to prevent road accidents, reduce serious injuries and deaths, and manage traffic more safely and efficiently. Key product segments include speed and red-light enforcement systems, incident detection & response technologies, traffic management and signaling systems, pedestrian safety infrastructure, and safety signage & protective equipment. These solutions are used by a wide range of stakeholders such as municipal and urban road authorities, highway agencies, transport departments, enforcement agencies, commercial fleet operators, smart city programs, and infrastructure developers. These systems are applied across urban, suburban, rural, and work-zone road settings, in new construction and existing road networks to prevent road accidents.

In real-world practice, road safety systems integrate hardware with software to generate actionable insights from road traffic data. For example, automatic enforcement systems detect red-light violations or over-speeding, ANPR/ALPR systems monitor license plates for violations and tolling, incident detection systems rapidly detect crashes or hazards and trigger emergency responses, traffic lights and signaling are dynamically adjusted in some cities to ease congestion or reduce accident risk and infrastructures such as pedestrian crossings, dedicated cycle lanes, or smarter signage enhance safety for vulnerable road users.

The market for road safety is expanding at a fast pace with the exponential rise in road accidents and deaths leading to significant economic losses. Governments are imposing strict safety norms to stop accidents. With the rapid development of AI, IoT sensors, and V2X technologies, system accuracy and reaction are improved. Dahua Technology Co., Ltd. launched its Intelligent Traffic Solution in October 2023, featuring smart, eco-friendly, and safer transport through real-time detection and autonomous incident response.

Drivers & Opportunity

Which are the major factor driving the road safety market growth?

Rising Road Traffic Accidents: The world road safety market is on the rise owing to the growing rate of road traffic accidents. Speeding, inattention behind the wheel caused by mobile phone usage, and violation of traffic regulations greatly contribute to road accident rates. Based on an Organization for Economic Co-operation and Development (OECD) report, the number of road traffic accidents in Colombia rises to 530 people per 1000000 people in 2023 from 291 people per 1000000 people in 2021 which is 82% growth in 2 years. Furthermore, poor enforcement of safety regulations and improper road infrastructure also surges road accident rates that fuel the growth of road safety market in the future.

Government Regulations & Initiatives Mandating Stricter Road Safety Norms: Governments across the globe are adopting more stringent road safety laws to avoid the increasing rate of road traffic accidents and deaths. Some of the programs like the UN Decade of Action for Road Safety (2021–2030) focus on safer roads, vehicle and driver behavior that assist in reducing the rate of road traffic accidents. In India, the Motor Vehicles (Amendment) Act, 2019, brought in higher fines, enhanced vehicle licensing systems and mandatory safety aspects in vehicles to augment road safety compliances. Such rising government efforts towards road safety norms further propels the growth of road safety market.

Segmental Insights

Service Analysis

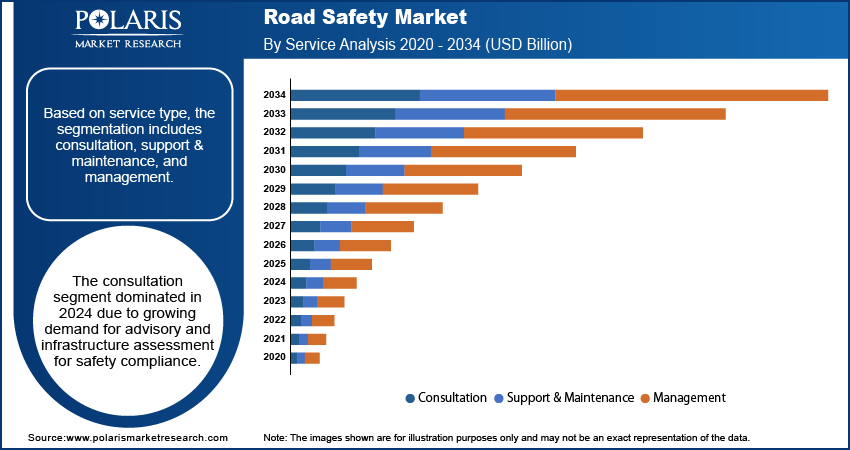

Based on service, the segmentation includes consultation, support & maintenance, and management. The consultancy segment led the road safety industry in 2024 due to the rise in demand for professional advisory, policy planning, and infrastructure evaluation to maintain international safety standards. The rising focus on strategic planning and risk assessment bolstered the demand for consultancy services among developing and developed economies.

The management segment is anticipated to expand at the highest CAGR over the forecast period due to the increasing usage of outsourced traffic management and safety monitoring systems. Growing smart city initiatives and growth of connected mobility systems fueling the demand for real-time data analytics, cloud-based platforms, and end-to-end operational monitoring.

Technology Analysis

Based on technology, the segmentation includes service & video analytics, sensor-based devices, communication technology, speed detection technology, incident detection & monitoring, enforcement system technologies, and others. The sensor-based devices segment led the road safety market in 2024, fueled by growing uptake of radar, LiDAR, and camera-based sensors for traffic flow monitoring, vehicle detection, and management of pedestrian safety. These sensors play a vital role in obtaining precise and real-time data that underpins intelligent traffic systems as well as accident prevention programs.

The service & video analytics market is expected to expand at the highest CAGR over the forecast period due to the growing use of AI-based analytics for traffic monitoring, incident forecasting, and behavior analysis. Growing importance in proactive monitoring and swift response to road accidents fueled demand for intelligent video systems offering actionable insights.

Software Analysis

Based on software, the segmentation includes enforcement software, incident detection & response system, traffic management system, driver assistance, accident data analysis, and others. The enforcement software segment led the road safety market in 2024, with the extensive use of automated violation detection and ticketing systems in urban and highway networks. The software solutions provide real-time monitoring of speeding, red-light running, and lane violations, allowing for effective law enforcement and compliance with road laws.

The incident detection & response system segment is expected to register the highest CAGR in the forecast period, driven by increasing demand for real-time traffic monitoring and instant emergency response systems. Urban congestion and accident hotspots escalated the demand for software that could instantly identify incidents and mobilize quick rescue or diversion efforts.

Application Analysis

Based on application, the segmentation includes highways, urban roads, rural roads, work zones, bridges, and tunnels. The highways segment led the road safety market in 2024, owing to the widescale installation of intelligent traffic systems, speed cameras, and lane management technologies to curb high-speed crashes and enhance mobility.

The urban roads market is expected to expand at the highest CAGR over the forecast period, driven by high growth in urbanization, mounting vehicle congestion, and the rising focus on smart city transport systems. Demand for adaptive traffic signals, video surveillance systems, and pedestrian safety management systems is propelling adoption in metropolitan regions.

End User Analysis

Based on end user, the segmentation includes government, municipal corporations, commercial fleet operators, construction & infrastructure companies, toll & road operators, and research & academic institutions. The government sector led the road safety industry in 2024, spurred by the widespread adoption of national safety initiatives, traffic policing projects, and road infrastructure upgradation schemes to decrease road deaths.

The commercial fleet operators segment is expected to expand at the highest CAGR over the forecast period, due to the rising use of telematics, driver behavior monitoring, and collision avoidance technologies among transportation and logistics fleets. Increasing focus on fuel optimization, operational efficiency, and driver safety compliance is motivating entities to deploy advanced road safety solutions.

Regional Analysis

North America road safety market led the market globally in 2024. It is due to its robust regulatory landscape and investments in smart transportation systems at a very high level. The government and local governments in the region focus on minimizing road deaths and making traffic more efficient, which resulted in the extensive adoption of intelligent transportation systems, automated enforcement technology, and sensor-based traffic monitoring systems.

The U.S. Road Safety Market Insights

The U.S. maintained a commanding market share for road safety in the North America region in 2024 due to traffic regulations at the federal and state levels as well as extensive use of advanced road safety technologies. The U.S. heavily invested in the advanced road safety technologies and intelligent transportation systems to upgrade traffic control and lower road deaths. In a report by the U.S., Department of Transportation, America witnessed its roadway deaths reducing from 43,230 fatalities in 2021 to 40,990 fatalities in 2023, a reduction of 5.18% over 2 years.

Europe Road Safety Market Assessments

The Europe road safety market is expected to account for a significant revenue share by 2034 as a result of increasing investments in intelligent mobility infrastructure and aggressive road safety regulation in key economies. In addition, increasing use of intelligent traffic management systems and automated enforcement technologies is also fueling growth in the market.

The Asia Pacific Road Safety Market Insights

The Asia Pacific road safety market is projected to grow at the fastest CAGR during the forecast period, driven by rapid urbanization and increasing government investments in smart transportation infrastructure. According to a report by Asian Development Bank, the annual budget for road safety grew from USD 57 billion in 2015 to USD 75 billion in 2025, it is a massive increase of 31.57% in the last decade. Countries such as China, India and Japan are increasingly adopting intelligent traffic systems and automated enforcement solutions to reduce accidents rates.

China Road Safety Market Insights

The market in China is expanding due to rapid urbanization and large-scale infrastructure development that drives the demand for road safety concerns and advanced traffic management systems. The Chinese government implemented strict regulations and invested heavily in intelligent transportation systems, automated enforcement cameras and AI-powered monitoring platforms to reduce road accidents and improve traffic efficiency.

Key Players & Competitive Analysis Report

The market for road safety is moderately competitive, with some global and local players concentrating on smart enforcement systems, traffic management systems, and connected infrastructure technology to optimize road efficiency and safety. Firms are broadening their product range with AI-based analytics, IoT-based monitoring systems, and cloud platforms to enhance data accuracy and response times in traffic management and accident prevention.

Who are the major players in road safety market?

Some of the major players in the road safety market are FRED engineering, VITRONIC, Siemens, Sensys Gatso Group, Laser Technology, Cubic Corporation, Conduent Inc., Clearview Intelligence Ltd., Verra Mobility Corporation, SWARCO AG, JENOPTIK AG, Dahua Technology Co. Ltd., Connected Wise LLC, Kapsh TrafficCom AG, and LiveRoad Analytics.

Key Players

- Clearview Intelligence Ltd.

- Conduent Inc.

- Connected Wise LLC

- Cubic Corporation

- Dahua Technology Co. Ltd.

- FRED Engineering

- JENOPTIK AG

- Kapsch TrafficCom AG

- Laser Technology

- LiveRoad Analytics

- Sensys Gatso Group

- Siemens

- SWARCO AG

- Verra Mobility Corporation

- VITRONIC

Industry Developments

- August 2025: FRED Engineering initiated a road safety audit and IRAP assessment in Burundi under a USD 0.12 billion World Bank Transport Resilience Project to design interventions improving safety and traffic management on a 29.2 km road network in Bujumbura.

- August 2024: Clearview Intelligence Ltd joined the Royal Society for the Prevention of Accidents (RoSPA) as a Full Member in order to tap into resources and advice promoting improved road safety and regulatory compliance.

Road Safety Market Segmentation

By Service (Revenue, USD Billion, 2020–2034)

- Consultation

- Support & Maintenance

- Management

By Technology (Revenue, USD Billion, 2020–2034)

- Service & Video Analytics

- Sensor-based devices

- Communication Technology

- Speed detection technology

- Incident Detection & Monitoring

- Enforcement System Technologies

- Others

By Software (Revenue, USD Billion, 2020–2034)

- Enforcement software

- Incident Detection & Response System

- Traffic Management System

- Driver Assistance

- Accident Data Analysis

- Others

By Application (Revenue, USD Billion, 2020–2034)

- Highways

- Urban Roads

- Rural Roads

- Work Zones

- Bridges

- Tunnels

By End user (Revenue, USD Billion, 2020–2034)

- Government

- Municipal Corporations

- Commercial Fleet Operators

- Construction & Infrastructure Companies

- Toll & Road Operators

- Research & Academic Institutions

By Region (Revenue, USD Billion, 2020–2034)

- North America

- The U.S.

- Canda

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherland

- Norway

- Sweden

- Switzerland

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- New Zealand

- Malaysia

- Thailand

- Singapore

- Indonesia

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Mexico

- Peru

- Middle East & Africa

- United Arab Emirates

- Saudi Arabia

- South Africa

- Egypt

- Qatar

- Kuwait

- Israel

- Nigeria

- Morocco

Road Safety Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.34 Billion |

|

Market Size in 2025 |

USD 5.08 Billion |

|

Revenue Forecast by 2034 |

USD 21.39 Billion |

|

CAGR |

17.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2025-2034 |

|

Forecast Period |

2025-2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Application |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions and segmentation. |

FAQ's

The global market size was valued at USD 4.34 billion in 2024 and is projected to grow to USD 21.39 billion by 2034.

The global market is projected to register a CAGR of 17.3% during the forecast period.

North America dominated the road safety market in 2024, driven by its strong regulatory environment and high levels of investments in intelligent transportation systems.

A few of the key players in the market are FRED engineering, VITRONIC, Siemens, Sensys Gatso Group, Laser Technology, Cubic Corporation, Conduent Inc., Clearview Intelligence Ltd., Verra Mobility Corporation, SWARCO AG, JENOPTIK AG, Dahua Technology Co. Ltd., Connected Wise LLC, Kapsh TrafficCom AG, and LiveRoad Analytics.

The consultation segment dominated in 2024 due to rising demand for expert advisory and policy planning for safety compliance.

The sensor-based devices segment is projected to grow at the fastest CAGR due to rising adoption of AI-based traffic surveillance and incident analysis.