Risk Analytics Market Share, Size, Trends, Industry Analysis Report

By Risk Type (Strategic Risk, Operational Risk, Financial Risk, Third Party Risk, and Others); By Component; By Deployment Mode; By Vertical; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 117

- Format: PDF

- Report ID: PM2796

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

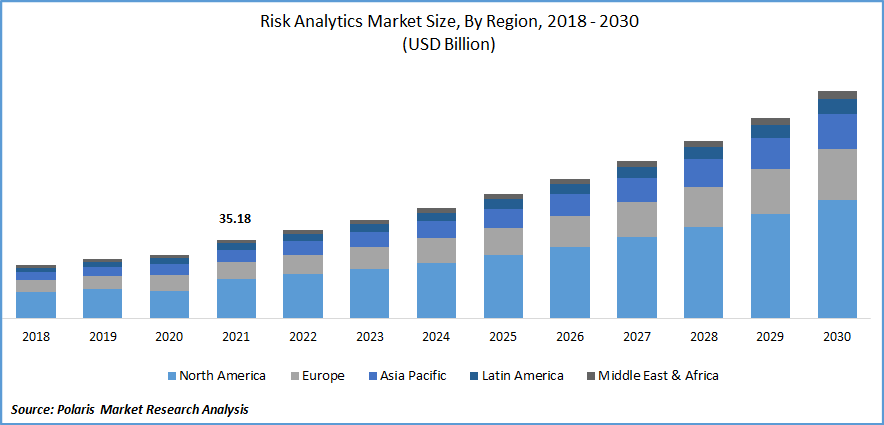

The global risk analytics market was valued at USD 35.18 billion in 2021 and is expected to grow at a CAGR of 12.54% during the forecast period.

Risk analytics can be used to compile the data into a single, comprehensive picture, acquire insightful data, and provide usable understanding. Aside from this, logistics firms around the world rely on risk analytics to efficiently address supply chain issues and business disruptions brought on by the development of the coronavirus disease globally.

Know more about this report: Request for sample pages

Additionally, it aids in improving decisions, reducing threats, and seizing opportunities. Organizations are concentrating on utilizing data from various external sources as well as data that has been locked up in silos. To acquire a thorough understanding of the difficulties related to many facets of corporate management, they are implementing advanced high-risk analytics solutions. Additionally, data management, decision assistance, compliance, and product and material regulatory studies are supported by risk analytics.

The regulatory and economic contexts, as well as risk management, have grown increasingly difficult as a result of the globalization of business operations and the increase in tasks, resources, deliverables, and stakeholders. The growing data protection regulations and laws are also anticipated to provide growth opportunities for the market in forthcoming years.

Furthermore, the HIPAA Security Rule requires covered entities and third-party business associates to implement specific procedures to prevent, detect, contain, and correct ePHI security violations. Thus, the various regulations by the government are released for data protection and security, which creates a lucrative opportunity for market growth during the forecast period.

COVID-19 impacted market demand, general growth, and risk analytics sales rates and revenues. The covid pandemic phase has seen increased market demand for risk management. These are used by a wide range of government institutions, including policymakers, to assess risk globally and forecast the future. The analyst uses data analytics techniques to comprehend risk elements and address business difficulties at the same time. Multiple obstacles to global business prospects for risk analytics are brought forth by the epidemic.

Further, organizations without adequate infectious risk policies and response plans may experience particularly difficult effects of a global pandemic of the disease. The COVID-19 incident highlights the necessity for businesses to modify and expand their risk management and business continuity policies with a focus on personnel, customers, partners in the supply chain, stakeholders, and company assets. As a result, the market has adjusted in the various ways that analysts and governmental forces have proposed.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising technological advancements are the factor boosting the market growth over the forecast period. By using a variety of methods and technology to extrapolate observations, quantify probable outcomes, and forecast potential accidents, risk analysis helps reduce potential business risks. Through the analysis of the volume of both structured and unstructured data, these technologies give businesses the ability to reduce the probability of a data breach. Risk analysis can be utilized to gather important data, offer actionable insights that can assist businesses in planning their strategies, and merge all data into a single, cohesive vision.

Machine learning has swiftly entered the mainstream and includes a range of algorithmic approaches, including mathematical methods like neural network regression. Data analytics will give leaders a forward-looking view of changing risks to assess potential dangers and locate and manage their sources. The adoption of a data-driven culture by businesses across industries is expected to bolster demand for these solutions.

Robotic process automation (RPA) and machine learning are powerful tools businesses can use to automate routine tasks like testing and evidence reviews. Automating frequent, manual, and repetitive tasks has several advantages: reducing costs, eliminating human errors, and allowing teams to focus on higher-value activities. AI-based technologies may also reduce risks in a few crucial areas. Similarly, companies that use cognitive technology and AI to anticipate and proactively manage dangers will gain a competitive edge and use risk to boost organizational effectiveness. Machine learning can be used in more complex processes as it can mimic human cognitive and problem-solving abilities and improve them over time.

However, the technological advancements in risk management technology, such as the installation of robotic process automation, integrated technology, and cloud-based platform technology, are the factors driving the market's growth during the forecast period.

Report Segmentation

The market is primarily segmented based on component, risk type, vertical, deployment mode, and region.

|

By Component |

By Risk Type |

By Vertical |

By Deployment Mode |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

BFSI segment is expected to witness fastest growth

An increasing number of vulnerabilities are consuming the banking and financial industries, and banks all over the world understand that they need a more logical strategy for controlling them. As a result, they have realized the importance of risk management. The need to monitor more transactions is expanding exponentially in operational risk management (ORM), placing strain on the financial industry's infrastructure and creating a demand for risk analytics.

Financial organizations are under great pressure to grow their businesses while reducing fraud and adhering to tight regulatory compliance standards. Using machine learning-based risk assessments, a type of AI, risk analytics systems can guard against various other fraudulent actions across online and mobile platforms. As a result, organizations must become more resilient by effectively anticipating and mitigating such risks. Therefore, in the BFSI sector, such trends fuel the demand for risk analytics solutions.

Software and Solutions segment industry accounted for the highest market share in 2021

During the projection period, the software category is anticipated to gain a sizable market share. Complex technological systems that can handle complex situations and dynamic scenarios are included in risk software. Along with human reasoning and traditional analytics, this software has begun to enhance company assessments and manage efficiency. Organizations in the private and public sectors have progressed in utilizing vast amounts of internal and external data to adopt a more reactive risk approach. Across such expansive data sets, the tools and software components are used to more precisely establish metrics of known and unknowable dangers. The decision-makers can use this tool to define, assess, comprehend, and manage the risks associated with the brand openly and transparently.

The cloud-based segment is expected to hold the significant revenue share

Cloud-based solutions offer several characteristics, such as a framework for mining, an effective platform for data storage, and software for risk assessment that aid firms in streamlining their operations. A contemporary trend for businesses wishing to update their current solutions is a cloud-based solution. Compared to on-premises systems, these solutions offer several advantages, including better user interfaces, regular product updates, improved surveillance and analysis, and others.

The demand in North America is expected to witness significant growth

The market is expanding in the North American region as a result of the increased risk that is emerging from the current business environment, the increased competition among regulatory agencies, the most recent technological advancements in risk management, and the expanding growth and investment opportunities in business organizations. Organizations in the region are more inclined to alter their current risk management plans to reduce risks and redundancy. Vendors of analytics solutions implement cutting-edge technology, including robotic process automation (RPA), machine learning, and cognitive analysis. Businesses are focusing on altering risk assessment frameworks with these technological integrations.

Further, because of its high internet penetration and lack of cybersecurity regulations, Asia Pacific (APAC) is a home for cybercriminals. Cybersecurity data travels across borders, corporate activities, and law enforcement. Companies in the region have started implementing analytics solutions as a result of rapidly expanding networking and accelerating digital transformation. Regardless of their cybersecurity endeavors, businesses in all sectors of the nation are subject to information threats since cyber susceptibility and data protection violations are ingrained in their operations. These attacks frequently result in significant losses, including losses from harmed customers, business interruptions, or damages to credibility.

A sophisticated and well-established industry with a trend toward technological advancements exists in the Asia Pacific area, offering a range of prospects for risk management businesses and service providers.

Competitive Insight

Some major players operating in the global market include Accenture plc, AxiomSL, BRIDGEi2i Analytics, Capgemini, Fidelity National Information Services, IBM Corporation, Oracle Corporation, OneSpan, Provenir, Recorded Future, Risk Edge Solutions, SAP SE, SAS Institute, and Verisk Analytics.

Recent Developments

In February 2022, IBM recently announced the purchase of Neudesic, a US-based cloud services consultant with a focus on the Microsoft Azure platform. The hybrid cloud and AI mission of the corporation will be furthered by this acquisition, which will greatly broaden IBM's range of hybrid multi-cloud solutions.

In May 2021, the definitive deal between Moody's Corporation and RMS for Moody's to purchase RMS for about $2.0 billion was announced. As a result of the purchase, Moody's insurance information and analytics business will see an immediate boost in revenue to close to $500 million, and the industry's efforts to build out its worldwide integrated risk capabilities for the next wave of risk evaluation will be sped up.

Risk Analytics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 39.30 billion |

|

Revenue forecast in 2030 |

USD 101.12 billion |

|

CAGR |

12.54% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Component, By Deployment Mode, By Risk Type, By Vertical, and Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Accenture plc, AxiomSL Ltd., BRIDGEi2i Analytics, Capgemini SE, Fidelity National Informatio Services, Inc., International Business Machines Corporation, Moody's Analytics Inc., Oracle Corporation, OneSpan Inc., Provenir, Inc., Recorded Future, Inc., Risk Edge Solutions Private Limited, SAP SE, SAS Institute Inc. and others. |