Rigid Plastic Packaging Market Size, Share, Trends, Industry Analysis Report: By Product, Process (Extrusion, Injection Molding, Blow Molding, Thermoforming, and Others), Raw Material, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM3232

- Base Year: 2024

- Historical Data: 2020-2023

Rigid Plastic Packaging Market Overview

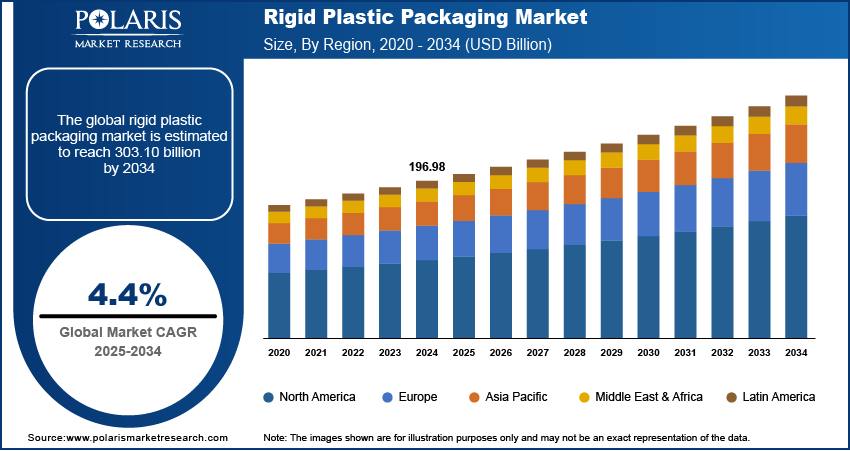

The global rigid plastic packaging market was valued at USD 196.98 billion in 2024. It is expected to grow from USD 205.46 billion in 2025 to USD 303.10 billion by 2034, at a CAGR of 4.4% during the forecast period.

Rigid plastic packaging comprises durable, non-flexible plastic materials widely used for product protection across industries. A primary market driver is its cost-effectiveness, offering manufacturers an optimal balance between affordability and durability. Compared to alternatives such as glass or metal, rigid plastics provide substantial advantages in production, transportation, and storage. Their lightweight properties reduce shipping costs, while high-volume manufacturing capabilities ensure lower per-unit expenses. Recent polymer advancements have further improved the strength-to-weight ratio, increasing economic viability for diverse applications. The industry is also addressing sustainability demands through innovation. In July 2024, Mondi launched FlexiBag Reinforced - a recyclable, mono-PE-based solution demonstrating how technological improvements maintain rigid plastics market relevance by combining environmental responsibility with improved functionality. These developments position rigid plastic packaging as a sustainable yet economical choice for future packaging needs.

To Understand More About this Research: Request a Free Sample Report

Another major driver of the rigid plastic packaging market growth is the strong demand from the food and beverage industry, which relies heavily on plastic containers, bottles, and trays for product preservation and convenience. The superior barrier properties of rigid plastics help extend shelf life by preventing moisture and contamination, ensuring product safety and quality. Additionally, rigid plastic packaging supports branding and consumer engagement through customizable shapes, sizes, and labeling options. The rising preference for on-the-go consumption and single-serve packaging formats further boosts demand, as these solutions offer convenience, durability, and improved product protection.

The industry is also evolving to address sustainability concerns while maintaining its functional advantages. Companies are increasingly incorporating recycled materials and improving recyclability to align with environmental goals. For instance, in November 2023, Amcor's sustainability report showed that 89% of its flexible packaging and 95% of its rigid packaging can be recycled. The company also purchased 30% more recycled materials for its products compared to the previous year, demonstrating its commitment to sustainable packaging solutions. These efforts highlight how the rigid plastic packaging market is adapting to meet both consumer preferences and regulatory expectations.

Rigid Plastic Packaging Market Dynamics

Rise in Global Consumption of Consumer Goods

Manufacturers across industries such as personal care, household products, and healthcare are adopting rigid plastic packaging for its durability and cost efficiency with growing consumer preferences for convenience, hygiene, and extended product shelf life. For instance, in October 2024, Unilever increased R&D investment to reduce virgin plastic use, focusing on recyclable and compostable flexible materials such as pouches and sachets. They aim to make 100% of flexible packaging reusable, recyclable, or compostable by 2035, exploring alternatives to plastic films in paper packaging while maintaining barrier protection and recyclability. Additionally, the expansion of e-commerce has further accelerated the need for strong and protective packaging solutions, as rigid plastics offer superior impact resistance during transportation and handling. This rising demand for consumer goods continues to drive the rigid plastic packaging market growth.

Improved Recycling Technologies for Packaging

Advances in mechanical and chemical recycling methods have made it increasingly feasible to reprocess rigid plastics, minimizing their environmental remediation. These technologies allow the recovery of high-quality materials, reducing reliance on virgin plastics and lowering carbon emissions. However, despite these improvements, the global waste crisis continues to rise. A February 2024 UNEP report projected that municipal solid waste will rise from 2.1 billion tonnes in 2023 to 3.8 billion tonnes by 2050, largely due to plastic waste. The hidden costs of waste management, such as pollution and health risks, were estimated at USD 361 billion in 2020 and could double to USD 640.3 billion by 2050 without immediate action. Governments worldwide are tightening waste management policies to promote circular economy principles. Initiatives such as India's Plastic Waste Management (Amendment) Rules, 2022, are pushing manufacturers to adopt recyclable packaging and invest in waste reduction. The rise of post-consumer recycled (PCR) plastics enables brands to meet sustainability goals without sacrificing durability or cost-effectiveness. These trends highlight the long-term viability of rigid plastic packaging while addressing environmental challenges.

Rigid Plastic Packaging Market Segment Analysis

Rigid Plastic Packaging Market Assessment by Product

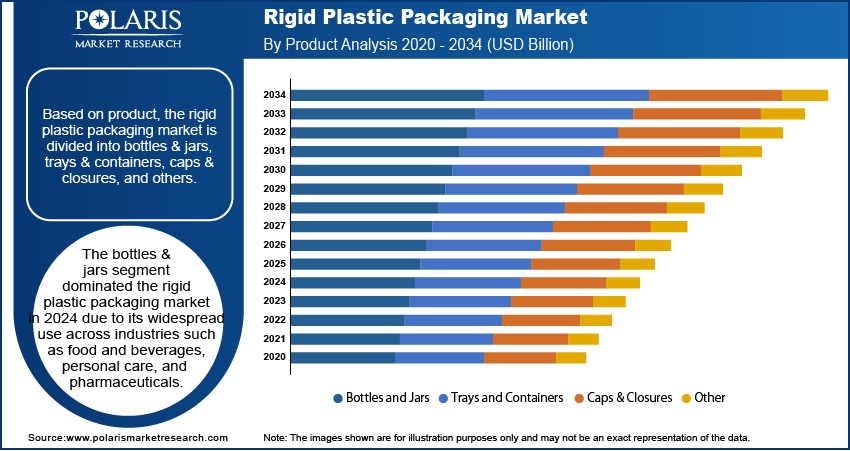

The global rigid plastic packaging market segmentation, based on product, includes bottles & jars, trays & containers, caps & closures, and others. The bottles & jars segment dominated the rigid plastic packaging market share in 2024 due to its widespread use across industries such as food and beverages, personal care, and pharmaceuticals. These packaging solutions offer durability, lightweight properties, and excellent barrier protection, making them ideal for storing liquids, powders, and semi-solid products. The rising demand for bottled water, soft drinks, and dairy products has further driven the adoption of rigid plastic bottles. Additionally, advancements in PET and HDPE materials have enhanced the recyclability and sustainability of plastic bottles & jars, reinforcing their dominance in the market.

Rigid Plastic Packaging Market Evaluation by Process

The global rigid plastic packaging market is segmented by process into extrusion, injection molding, blow molding, thermoforming, and others. The injection molding segment is expected to witness the fastest market growth during the forecast period due to its precision, cost efficiency, and ability to produce complex designs. This process enables manufacturers to create high-quality, lightweight, and durable packaging components, such as caps, closures, and intricate container designs. The increasing demand for customized and tamper-proof packaging in industries such as food, pharmaceuticals, and personal care is driving the adoption of injection molding. Additionally, improvements in injection molding technology, such as automation and multi-material molding, are enhancing production efficiency.

Rigid Plastic Packaging Market Outlook by Region

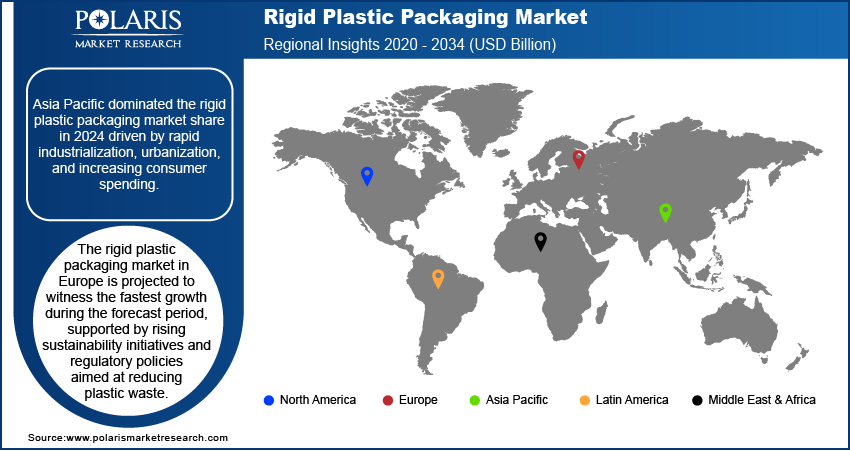

By region, the report provides the rigid plastic packaging market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market in 2024, driven by rapid industrialization, urbanization, and increasing consumer spending. The region's large and growing population, particularly in countries such as China and India, has fueled demand for packaged food, beverages, and personal care products, boosting the need for rigid plastic packaging. Additionally, the presence of major manufacturing hubs and cost-effective production facilities has enabled companies to scale operations efficiently. Government initiatives promoting sustainable packaging and advancements in recycling infrastructure have also contributed to the strong market presence in Asia Pacific. For instance, a report from the Ministry of Environment, Forest, and Climate Change in March 2023 highlighted that India's Extended Producer Responsibility (EPR) guidelines require sustainable plastic packaging, recycling targets, and the reuse of rigid plastics to reduce plastic waste. Additionally, a ban on single-use plastics, implemented in July 2022, is being enforced through online monitoring platforms. These efforts are supported by over 150 eco-alternative manufacturers and 201 certified compostable plastic producers.

The rigid plastic packaging market in Europe is projected to witness the fastest growth during the forecast period, supported by rising sustainability initiatives and regulatory policies aimed at reducing plastic waste. A report by the European Parliament in June 2024 stated that the total plastic waste produced in the EU in 2021 was 16.13 million tons, of which 6.56 million tons were recycled. European consumers and businesses are increasingly adopting recyclable and lightweight plastic packaging solutions to comply with strict environmental regulations. For instance, in June 2024, the European Parliament and the Council reached an agreement to reduce packaging waste. The new rules require EU countries to decrease packaging waste per person by 5% by 2030, 10% by 2035, and 15% by 2040. The growing demand for sustainable packaging in the food and beverage sector, along with innovations in biodegradable and post-consumer recycled (PCR) plastics, is driving market expansion. Additionally, strong investments in research and development, along with advancements in packaging design, are positioning Europe as a leader in next-generation rigid plastic packaging solutions.

Key Companies in Rigid Plastic Packaging Market

- Al Jabriplastic.

- Altium Packaging.

- Amcor plc

- Berry Global Inc.

- CCL Industries.

- Coveris

- DS Smith

- Mondi

- Pactiv Evergreen Inc.

- SABIC

- Sealed Air

- Silgan Holdings Inc.

- Sonoco Products Company

- Takween Advanced Industries

- Winpak LTD.

Rigid Plastic Packaging Key Market Players & Competitive Analysis Report

The competitive landscape features a mix of global leaders and regional players competing for rigid plastic packaging market share through innovation, strategic partnerships, and geographic expansion. Global companies such as Amcor, Berry Global, Mondi, and others leverage strong R&D capabilities and extensive distribution networks to offer advanced, sustainable packaging solutions, including recyclable and lightweight materials. The market trends highlight rising demand for eco-friendly packaging, such as mono-material designs and bio-based plastics, driven by increasing environmental regulations and consumer preferences for sustainability.

According to rigid plastic packaging market statistics, the market is projected to grow significantly, fueled by demand from industries such as food and beverage, healthcare, and personal care. Regional players focus on cost-effective, customized solutions, particularly in emerging markets such as Asia Pacific, which is expected to witness the fastest growth. The competitive intelligence strategies include mergers, acquisitions, collaborations with recycling firms, and the launch of innovative products to meet evolving industry standards. These developments underscore the importance of technological advancements, sustainability, and regional market adaptability in driving the rigid plastic packaging industry forward. A few key major players are Al Jabriplastic, Altium Packaging, Amcor plc, Berry Global Inc., CCL Industries, Coveris, DS Smith, Mondi, Pactiv Evergreen Inc., SABIC, Sealed Air, Silgan Holdings Inc., Sonoco Products Company, Takween Advanced Industries, and Winpak LTD.

Berry Global Group, Inc., is a global manufacturer and marketer of plastic packaging products. Headquartered in Evansville, Indiana. The company operates with three core divisions: Health, Hygiene, and Specialties; Consumer Packaging; and Engineered Materials. Berry Global offers a wide array of products, such as bottles, containers, closures, dispensing systems, and technical components. Originally known as Imperial Plastics in 1967, the company produced aerosol caps. The company expanded, acquiring over 40 plastics manufacturing companies between 1987 and 2017. In April 2017, Berry Plastics changed its name to Berry Global Group, Inc. Berry Global serves a diverse clientele across industries such as healthcare, personal care, and food and beverage. The company aims to provide material science knowledge and manufacturing capabilities to help customers achieve their business and sustainability goals.

DS Smith is a packaging business committed to providing sustainable packaging solutions, paper products, and recycling services. Founded in 1940 as a box-making business in East London, the company has grown to operate in over 30 countries. DS Smith focuses on offering innovative packaging solutions that improve transport and storage efficiency, boost retail presentation, and increase product sales. The company emphasizes a circular business model, designing out waste and pollution through circular design and helping customers remove problem plastics. DS Smith's product portfolio includes retail and shelf-ready packaging, transit cases, consumer boxes, corrugated packs, point-of-sale displays, and heavy-duty industrial products. While DS Smith specializes in paper and corrugated packaging, they are actively working towards reducing the use of problem plastics in packaging. Their commitment to sustainability is evident through their efforts to use renewable resources, minimize complexity, and optimize supply chains. The company aims to help customers adapt to changing shopping habits with sustainable packaging solutions.

Rigid Plastic Packaging Market Developments

April 2024: Amcor launched a one-liter carbonated soft drink stock bottle made from 100% post-consumer recycled material.

July 2024: Versalis and Forever Plast collaborated to launch REFENCE. This new line offers recycled polymers for food packaging, made using NEWER technology.

Rigid Plastic Packaging Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020 - 2034)

- Bottles & Jars

- Trays & Containers

- Caps & Closures

- Others

By Process Outlook (Revenue, USD Billion, 2020 - 2034)

- Extrusion

- Injection Molding

- Blow Molding

- Thermoforming

- Others

By Raw Material Outlook (Revenue, USD Billion, 2020 - 2034)

- Bioplastics

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Expanded Polystyrene (EPs)

- Others (PC, Polyamide)

By End Use Outlook (Revenue, USD Billion, 2020 - 2034)

- Food & Beverages

- Industrial Packaging

- Pharmaceuticals

- Personal & Household Care

- Others

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Rigid Plastic Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 196.98 billion |

|

Market Size Value in 2025 |

USD 205.46 billion |

|

Revenue Forecast in 2034 |

USD 303.10 billion |

|

CAGR |

4.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global rigid plastic packaging market size was valued at USD 196.98 billion in 2024 and is projected to grow to USD 303.10 billion by 2034.

The global market is projected to register a CAGR of 4.4% during the forecast period.

Asia Pacific dominated the rigid plastic packaging market share in 2024.

Some of the key players in the market are Al Jabriplastic, Altium Packaging, Amcor plc, Berry Global Inc., CCL Industries, Coveris, DS Smith, Mondi, Pactiv Evergreen Inc., SABIC, Sealed Air, Silgan Holdings Inc., Sonoco Products Company, Takween Advanced Industries, and Winpak LTD.

The bottles and jars segment dominated the rigid plastic packaging market in 2024.