Revenue Cycle Management (RCM) Market Size, Share, Trends, Industry Analysis Report: By Type (Integrated RCM and Standalone RCM), Function, Deployment, Component, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 118

- Format: PDF

- Report ID: PM1879

- Base Year: 2023

- Historical Data: 2019-2022

Revenue Cycle Management Market Overview

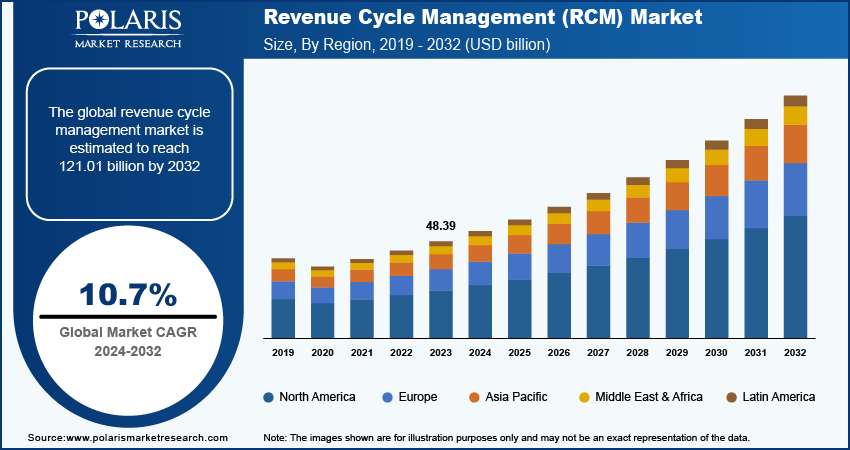

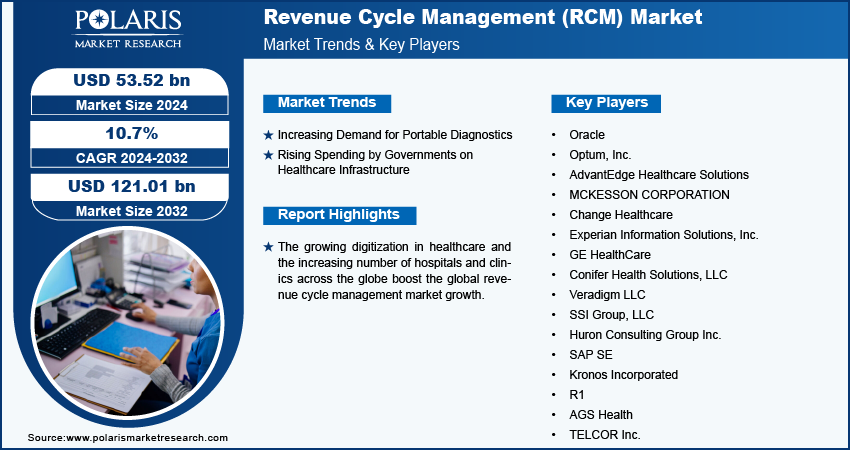

The revenue cycle management market size was valued at USD 48.39 billion in 2023. The market is projected to grow from USD 53.52 billion in 2024 to USD 121.01 billion by 2032, exhibiting a CAGR of 10.7% during 2024–2032.

Revenue cycle management (RCM) begins when a patient makes an appointment and ends when the account balance is resolved through contractual adjustments, insurance payments, write-offs, or patient payments. Healthcare organizations widely use RCM to manage the administrative and clinical functions associated with claims processing, payment, and revenue generation. RCM aims to increase accurate revenue through various processes by identifying and improving deficiencies.

The growing digitization in healthcare drives the revenue cycle management market. The complexity of billing and claims processes increases as healthcare organizations adopt electronic health records (EHRs), telemedicine platforms, and other digital tools. According to a published report by OECD, on average, 93% of primary care practices use electronic medical records (EMRs) across 24 OECD countries in 2021. Managing these processes efficiently requires sophisticated RCM systems to handle various data sources and ensure accurate and timely billing. Therefore, the rising digitization in healthcare is expanding the market.

The increasing number of data silos in healthcare settings fuels the revenue cycle management market. Data silos create significant challenges in integrating and accessing comprehensive patient and financial data. RCM systems help address these challenges by consolidating data from disparate sources, ensuring that billing, coding, and claims processes are based on complete and accurate information.

For Specific Research Requirements: Request a Free Sample Report

The market for revenue cycle management is driven by the growing number of hospitals and clinics across the globe. As per published data by WHO, 165,000 hospitals were there in the world in 2021. A larger number of hospitals and clinics often leads to increased administrative tasks related to billing, coding, and collections. RCM systems streamline these administrative processes, reducing the manual workload, minimizing errors, and improving the efficiency of revenue cycle operations. This increases the adoption of RCM systems in a large number of hospitals and clinics.

Revenue Cycle Management Market – Opportunity and Drivers

Increasing Demand for Portable Diagnostics

Portable diagnostics generate data that needs to be integrated with other patient information and electronic health records (EHRs). RCM systems help consolidate this data to ensure that billing is accurate and reflects the diagnostic services provided, reducing the risk of errors and claim denials. Therefore, the increasing demand for portable diagnostics is expected to create an immense opportunity in the market during the forecast period.

Rising Spending by Governments on Healthcare Infrastructure

Government investments typically include funding for medical technology and advanced diagnostic equipment. These upgrades introduce new billing codes, services, and procedures, increasing the need for RCM systems to manage these changes and ensure accurate and timely claims processing. According to data published by the Institute for Health Metrics and Evaluation, 62% of the total global health spending came from governments in 2021. Therefore, the rising spending by governments on healthcare infrastructure fuels the global RCM market.

Revenue Cycle Management Market Segment Insights

Revenue Cycle Management Breakdown – by Type Insights

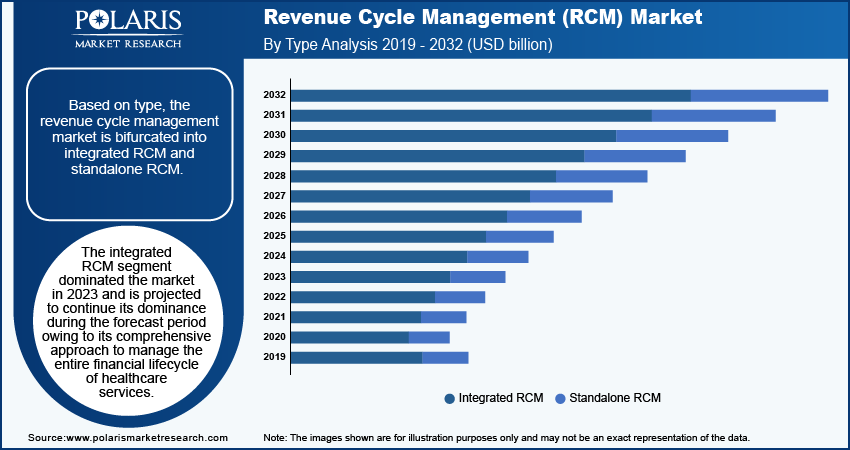

Based on type, the revenue cycle management market is bifurcated into integrated RCM and standalone RCM. The integrated RCM segment dominated the market in 2023 and is projected to continue its dominance during the forecast period owing to its comprehensive approach to manage the entire financial lifecycle of healthcare services. Integrated RCM solutions seamlessly merge clinical and administrative processes, offering enhanced efficiency and accuracy in billing and coding, claims management, and patient collections. These systems facilitate real-time data integration and analysis, which improves operational workflows and ensures compliance with regulatory standards. The rising complexity of healthcare regulations and the push for value-based care have driven healthcare organizations to adopt integrated systems, as they provide a unified platform to handle the multifaceted nature of financial and operational challenges.

Revenue Cycle Management Breakdown – by Function Insights

In terms of function, the revenue cycle management market is segmented into claims and denial management, medical coding and billing, electronic health records (EHR), clinical documentation improvement (CDI), insurance, and others. The medical coding and billing segment accounted for a major market share in 2023 due to its critical role in ensuring accurate claims submission and reimbursement. Medical coding and billing systems are essential for translating healthcare services into standardized codes that insurance companies use to process claims. The complexity of coding systems, coupled with the need for accurate and timely billing, has driven significant demand for robust solutions such as coding and billing systems that minimize errors and optimize revenue capture. These solutions help reduce claim denials, streamline reimbursement processes, and improve overall operational efficiency, contributing to their market dominance in 2023.

The electronic health records (EHR) segment is estimated to grow at a robust pace in the coming years owing to its ability to streamline and integrate patient information, enhancing the overall efficiency of healthcare operations. EHRs facilitate better data access and sharing across different healthcare providers, improving coordination of care and reducing administrative burdens. The need for comprehensive patient data to support clinical decision making accelerates the adoption of EHR systems..

Revenue Cycle Management Market Regional Insights

By region, the study provides the revenue cycle management market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2023, with the US being the dominant country in the regional market. The extensive healthcare infrastructure of the US, coupled with high levels of technology adoption, significantly contributed to this dominance. Healthcare providers in the country increasingly rely on advanced solutions such as RCM to streamline financial processes, manage claims, and improve billing accuracy. Additionally, significant investments in healthcare and innovation contributed to the region's dominant position. As per published data by California Health Care Foundation, the US spent $4.3 trillion, more than $12,500 per person, on healthcare in 2021.

The Asia Pacific revenue cycle management market is expected to register a significant CAGR during the forecast period due to rapid economic development, increasing healthcare expenditures, and expanding healthcare infrastructure in countries such as India and China. The push toward digital transformation and improvements in healthcare access are driving the adoption of sophisticated solutions that enhance billing accuracy and operational efficiency. Moreover, the region's large and growing population, along with the rising prevalence of chronic diseases, fuels the demand for efficient and scalable financial management tools such as RCM. For instance, Asia Pacific is home to 60% of the world's population, some 4.3 billion people. This creates a demanding requirement for scalable solutions that can adapt to the complexities of a growing patient base, ultimately enabling better resource allocation and improved patient care across the region.

Revenue Cycle Management Market – Key Players and Competitive Insights

Key market players are investing heavily in research and development to expand their offerings, which will fuel the revenue cycle management market growth in the coming years. Market participants are also undertaking a variety of strategic activities, including innovative launches, international collaborations, higher investments, and mergers and acquisitions, to expand their global footprint. To expand and survive in a more competitive and rising market environment, the revenue cycle management industry must offer innovative solutions.

The revenue cycle management market is fragmented, with the presence of numerous global and regional market players. Major players in the market are Oracle; Optum, Inc.; AdvantEdge Healthcare Solutions; MCKESSON CORPORATION; Change Healthcare; Experian Information Solutions, Inc.; GE HealthCare; Conifer Health Solutions, LLC; Veradigm LLC; SSI Group, LLC; Huron Consulting Group Inc.; SAP SE; Kronos Incorporated; R1; AGS Health; and TELCOR Inc.

Oracle, founded in 1977, is a multinational computer technology corporation that specializes in developing and marketing database software and technology. Oracle offers comprehensive RCM solutions for healthcare organizations to streamline financial processes, optimize financial outcomes, and improve patient experience. In July 2024, Odyssey House, a community-based mental health and substance abuse treatment provider in Utah, implemented Oracle Health to enhance patient care and improve revenue management.

MCKESSON CORPORATION, a healthcare services and IT company established in 1833 in New York City, US, offers comprehensive RCM solutions to help healthcare organizations optimize financial performance and patient experience. McKesson's RCM solutions are built on a clinically integrated foundation, connecting clinical, financial, and operational data to streamline workflows and enhance patient care.

List of Key Companies in Revenue Cycle Management Market

- Oracle

- Optum, Inc.

- AdvantEdge Healthcare Solutions

- MCKESSON CORPORATION

- Change Healthcare

- Experian Information Solutions, Inc.

- GE HealthCare

- Conifer Health Solutions, LLC

- Veradigm LLC

- SSI Group, LLC

- Huron Consulting Group Inc.

- SAP SE

- Kronos Incorporated

- R1

- AGS Health

- TELCOR Inc.

Revenue Cycle Management Industry Developments

July 2023: TELCOR Inc., a healthcare software company that provides products and services to hospitals and laboratories in the US and Canada, announced the release of version 21.3 of TELCOR Revenue Cycle Management (RCM). The new version allows expanded use of the report designer, as well as many other features that continue to improve laboratory productivity and collections.

September 2022: AGS Health, a prominent RCM solutions provider and strategic growth partner to some of the largest healthcare systems in the US, introduced an artificial intelligence (AI) platform for end-to-end revenue cycle management.

June 2022: R1, a US-based RCM company, announced the acquisition of Cloudmed to deliver a RCM platform for healthcare providers and drive further digital transformation through automation and AI.

Revenue Cycle Management Market Segmentation

By Type Outlook (Revenue, USD billion, 2019–2032)

- Integrated RCM

- Standalone RCM

By Function Outlook (Revenue, USD billion, 2019–2032)

- Claims and Denial Management

- Medical Coding and Billing

- Electronic Health Record (EHR)

- Clinical Documentation Improvement (CDI)

- Insurance

- Others

By Deployment Outlook (Revenue, USD billion, 2019–2032)

- Web-Based

- On-Premise

- Cloud-Based

By Component Outlook (Revenue, USD billion, 2019–2032)

- Software

- Services

By End User Outlook (Revenue, USD billion, 2019–2032)

- Hospitals

- General Physicians

- Labs

- Others

By Regional Outlook (Revenue, USD billion, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Revenue Cycle Management Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 48.39 billion |

|

Market Size Value in 2024 |

USD 53.52 billion |

|

Revenue Forecast by 2032 |

USD 121.01 billion |

|

CAGR |

10.7 % from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global revenue cycle management market size was valued at USD 48.39 billion in 2023 and is projected to grow to USD 121.01 billion by 2032.

The global market is projected to register a CAGR of 10.7 % during the forecast period.

North America accounted for the largest share of the global market in 2023

Oracle; Optum, Inc.; AdvantEdge Healthcare Solutions; MCKESSON CORPORATION; Change Healthcare; Experian Information Solutions, Inc.; GE HealthCare; Conifer Health Solutions, LLC; Veradigm LLC; SSI Group, LLC; Huron Consulting Group Inc.; SAP SE; Kronos Incorporated; R1; AGS Health; and TELCOR Inc. are among the key players in the market.

The electronic health record segment is projected for significant growth in the global market during the forecast period

The integrated RCM segment dominated the market in 2023.