Retimer Market Size, Share, Trends, Industry Analysis Report: By Interface, Application (Servers, Storage Devices, Hardware Devices, Hardware Accessories, and Other Applications), End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 128

- Format: PDF

- Report ID: PM5381

- Base Year: 2024

- Historical Data: 2020-2023

Retimer Market Overview

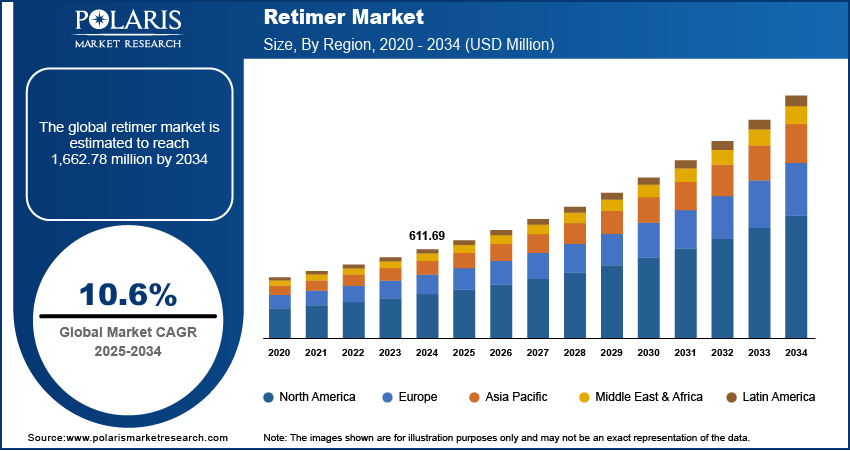

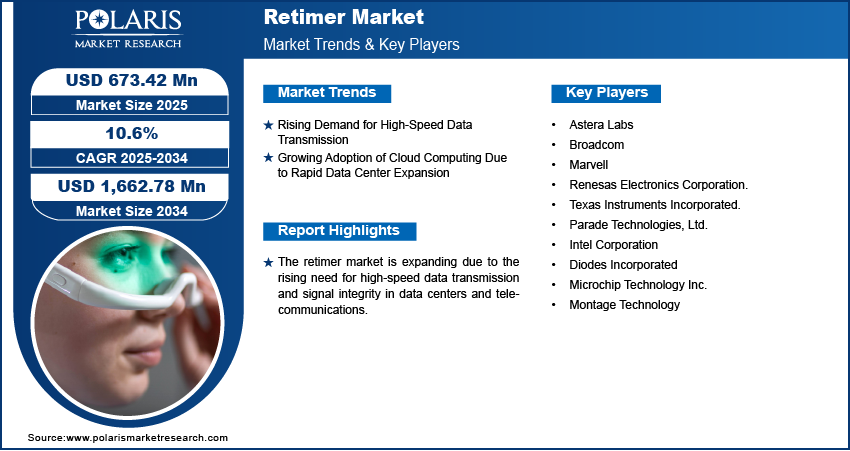

The global retimer market size was valued at USD 611.69 million in 2024. The market is projected to grow from USD 673.42 million in 2025 to USD 1,662.78 million by 2034, exhibiting a CAGR of 10.6% from 2025 to 2034.

A retimer is an integrated circuit that restores signal quality in high-speed data transmission by reconstructing and equalizing signals over long channels. The circuit helps reduce data errors and maintain performance. It is often used in applications like PCIe, USB, and Ethernet interfaces to support seamless connectivity across complex systems, especially in data centers and AI environments.

The retimer market is rapidly expanding, driven by increased demand for high-speed data transmission and enhanced signal integrity across sectors such as data centers, telecommunications, automotive, and consumer electronics. Retimers are crucial in maintaining signal quality over long transmission paths, especially as higher bandwidth requirements emerge for PCIe, USB, CXL, and Ethernet interfaces. In January 2023, for instance, Parade Technologies introduced the PS8936 retimer chip for PCI Express 5.0 and Compute Express Link (CXL), with sixteen bidirectional lanes and backward compatibility. The chip is aimed at enterprise systems such as servers and high-performance workstations, supporting up to 32 Gbps with advanced signal integrity features. These advancements highlight how retimers are essential for AI, cloud computing, and high-performance computing applications, enabling low latency and reliable connectivity. Additionally, trends toward miniaturized, low-power designs that improve efficiency and reduce system costs are expected to fuel market growth, positioning retimers as a critical component in the evolving connectivity landscape.

To Understand More About this Research: Request a Free Sample Report

Retimer Market Dynamics

Rising Demand for High-Speed Data Transmission

The rising demand for high-speed data transmission is a key driver for the retimer market, as industries increasingly rely on high-bandwidth applications such as AI, cloud computing, and high-performance computing. Retimers play a crucial role in ensuring signal integrity and error free data transmission over long distances, essential for meeting the data rate demands of advanced interfaces such as PCIe, CXL, and Ethernet. As these technologies scale to support faster speeds, such as PCIe 5.0 and PCIe 6.0, the need for retimers to mitigate signal degradation and ensure reliable data transmission becomes more critical. For instance, in May 2024, Marvell launched the Alaska P PCIe retimer product line, aimed at supporting high-speed data transmission in AI and server systems. The retimers, compatible with PCIe Gen 6, are designed to improve signal integrity over longer distances and lower power consumption, making them essential for data centers and cloud infrastructures. These products help ensure reliable communication between components like GPUs and CPUs, addressing challenges in modern server and AI workloads. Additionally, the ongoing miniaturization of electronic devices, along with the demand for low-latency, high-performance connectivity, further accelerates the adoption of retimer technologies.

Growing Adoption of Cloud Computing Due to Rapid Data Center Expansion

Businesses and services are increasingly relying on cloud-based infrastructure, which is driving the need for high-speed data transmission with minimal latency. Retimers help mitigate signal degradation over long distances, ensuring stable, high-bandwidth connectivity between various data center components such as GPUs and CPUs. For instance, in January 2023, Montage Technology began mass production of its PCIe 5.0/CXL 2.0 retimer, an updated version of its previous PCIe 4.0 retimer. This retimer supports high bandwidth, low latency interconnects for cloud services and high-performance computing, ensuring stable signal integrity across modern data centers and AI workloads. It aligns with the latest PCIe 5.0 and CXL 2.0 standards to meet the growing demands of next generation infrastructure. As data centers scale to accommodate increasing workloads from AI, machine learning, and streaming services, the demand for advanced retimer technologies that ensure reliable communication across faster interfaces, such as PCIe and CXL, continues to rise.

Retimer Market Segment Insights

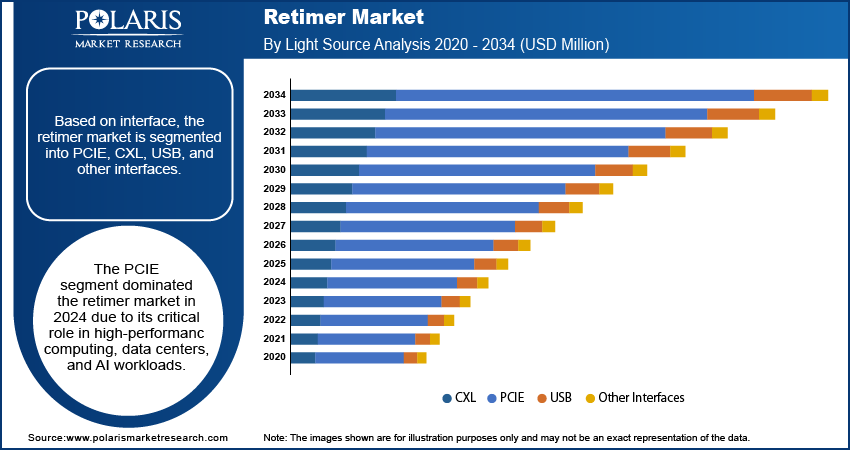

Retimer Market Evaluation by Interface Outlook

The global retimer market segmentation, based on interface, includes PCIE, CXL, USB, and other interfaces. The PCIE segment dominated the retimer market in 2024 due to its critical role in high-performance computing, data centers, and AI workloads. PCIe's evolving standards, such as PCIe 5.0 and PCIe 6.0, have increased data transfer speeds, making robust retimers essential to maintain signal integrity when interconnecting GPUs, CPUs, and memory within servers. The growing demand for PCIe arises from the high data rates required for modern data center applications, particularly in AI and cloud computing. Additionally, PCIe's widespread adoption across industries and its scalability to meet growing data demands solidify its importance.

Retimer Market Assessment by End User Outlook

The global retimer market segmentation, based on end user, includes IT & telecommunication, BFSI, government, healthcare, transportation, education, retail, and other end users. The IT & telecommunication segment is expected to witness the highest CAGR in the retimer market due to the growing demand for high-speed data transmission in networks and data centers. As 5G infrastructure expands and cloud computing grows, there is an increasing need for faster and more reliable communication systems. Retimers are essential in maintaining signal integrity over long distances, ensuring efficient data transfer in these high-bandwidth networks. They enable efficient data transfer across high-bandwidth interfaces such as PCIe, CXL, and Ethernet, making them essential for the scalability and performance of modern telecommunication networks.

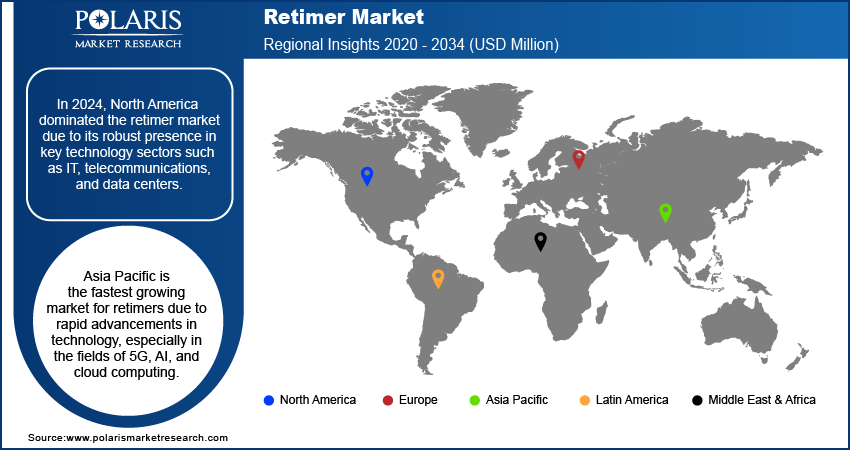

Retimer Market Regional Analysis

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the retimer market due to its robust presence in key technology sectors such as IT, telecommunications, and data centers. The region's advanced infrastructure, rapid adoption of 5G, and high demand for cloud computing services contribute significantly to this growth. Additionally, the presence of major semiconductor companies, strong research and development activities, and large-scale data center operations support the demand for retimers. For instance, in March 2024, Broadcom launched the industry's first 5nm PCIe Gen 5.0/CXL2.0 and PCIe Gen 6.0/CXL3.1 retimers. These advanced retimers, in combination with Broadcom's PEX series switches, create the first complete end-to-end PCIe solution. They offer several advantages, such as increased reach, lower power consumption, simplified interoperability, and comprehensive management, catering to the growing demands of high-performance data transmission. North America’s technological leadership in AI, high-performance computing, and enterprise-level networks also accelerates the need for high-speed, reliable data transmission, driving regional market expansion.

The Asia Pacific retimer market is expected to witness the fastest growth due to rapid advancements in technology, especially in the fields of 5G, AI, and cloud computing, which are driving the demand for high-speed data transmission across industries such as telecommunications, data centers, and automotive. The region also benefits from increased infrastructure investments, particularly in emerging markets such as China and India, which are expanding their data center capacities. Furthermore, the growing adoption of advanced manufacturing technologies across Asia Pacific, coupled with a high demand for consumer electronics, positions the region as a key player in the global market.

Retimer Market – Key Players and Competitive Insights

The competitive landscape of the retimer market is characterized by a mix of global leaders and regional players striving for market share through technological innovation, strategic collaborations, and regional expansion. Major companies, with their strong R&D capabilities, such as Broadcom, Marvell, and others, focus on advancing retimer technologies for high-speed data transmission across industries such as telecommunications, data centers, automotive, and cloud computing. These leaders prioritize enhancing signal integrity, reducing latency, and supporting high-bandwidth applications like PCIe 5.0/6.0 and CXL.

Smaller regional players are emerging with specialized retimer solutions tailored to specific regional markets, offering customized applications. Competitive strategies in this market include partnerships with technology firms, mergers and acquisitions, and expanding product portfolios to address the growing demand in key regions, such as North America and Asia Pacific. A few key major players are Astera Labs; Broadcom; Marvell; Renesas Electronics Corporation; Texas Instruments Incorporated; Parade Technologies, Ltd.; Intel Corporation; Diodes Incorporated; Microchip Technology Inc.; and Montage Technology.

Intel Corporation, an American multinational technology company, is engaged in the design and manufacturing of computer processors, chipsets, and various semiconductor components. Intel offers various products and services, including microprocessors, system-on-chip (SoC) products, chipsets, and memory and storage solutions. The company's processors are used in multiple devices, from personal computers and laptops to servers and data centers. Intel's chipsets connect processors and other components, while its memory and storage solutions include solid-state drives (SSDs) and other storage devices. In addition to its hardware products, Intel also offers a range of software and services. These include software development tools, operating systems, and security solutions. Intel also provides consulting and support services to help customers optimize their computing systems and applications. The company invests heavily in R&D to develop new technologies and improve its products. The company has also been at the forefront of several key technological advances in the industry, including developing the first microprocessor and introducing the x86 architecture, which has become the standard for most personal computers. It has also significantly contributed to advancing artificial intelligence and machine learning. Intel Corporation offers high-performance retimers for data centers, AI, and high-speed connectivity, enabling signal integrity in PCIe, USB, and Ethernet applications, enhancing efficiency and reliability in advanced computing and networking solutions.

Astera Labs, Inc. specializes in the semiconductor industry. The company deals in purpose-built connectivity solutions that serve the increasing demands of artificial intelligence (AI) and cloud infrastructure. It has made significant strides with its innovative Aries Retimer portfolio, which includes the world's first smart retimers designed for PCI Express (PCIe) 4.0 and 5.0 standards. This advancement is critical as data centers evolve to support more complex AI systems that require robust and efficient connectivity solutions. The Aries Retimer series is designed to overcome challenges in high-speed data transmission, ensuring signal integrity and extended reach for AI and cloud applications. These retimers optimize connectivity with features like low power consumption and built-in thermal management, reducing total cost of ownership (TCO) for data center operators. Astera's Intelligent Connectivity Platform combines PCIe, CXL, Ethernet semiconductor technologies, and the COSMOS software suite for scalable, customizable system architectures. This integration enables flexible, interoperable solutions, with the company becoming a key partner for hyperscalers and leaders in data-driven applications. Astera Labs, Inc. provides advanced retimers for PCIe, CXL, and Ethernet applications, ensuring signal integrity and low latency for data centers, AI, cloud computing, and high-performance connectivity solutions.

List of Key Companies in Retimer Market

- Astera Labs

- Broadcom

- Marvell

- Renesas Electronics Corporation.

- Texas Instruments Incorporated.

- Parade Technologies, Ltd.

- Intel Corporation

- Diodes Incorporated

- Microchip Technology Inc.

- Montage Technology

Retimer Industry Developments

In May 2024, Astera Labs enhanced its Cloud-Scale Interop Lab to support PCIe 6.x testing, enabling smooth interoperability between its Aries 6 PCIe/CXL Smart DSP Retimers and a wide range of PCIe 6.x devices. According to Astera, this development will help AI platform developers achieve high bandwidth and low latency connectivity, reduce development time, and scale deployment confidently.

In October 2024, Credo Technology Group launched its first set of advanced retimers, including the Toucan PCIe 6, CXL 3.x, and Magpie PCIe 7, CXL 4.x models. The company also introduced OSFP-XD 16x64GT/s (1Tb) PCIe 6/CXL HiWire AECs.

Retimer Market Segmentation

By Interface Outlook (Revenue – USD Million, 2020–2034)

- PCIE

- PCIE 1.0

- PCIE 20.

- PCIE 3.0

- PCIE 4.0

- PCIE 5.0

- PCIE 6.0

- CXL

- USB

- Other interfaces

By Application Outlook (Revenue – USD Million, 2020–2034)

- Servers

- Storage Devices

- Hardware Devices

- Hardware Accessories

- Other Applications

By End User Outlook (Revenue – USD Million, 2020–2034)

- IT & Telecommunication

- BFSI

- Government

- Healthcare

- Transportation

- Education

- Retail

- Other End Users

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Retimer Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 611.69 million |

|

Market Size Value in 2025 |

USD 673.42 million |

|

Revenue Forecast by 2034 |

USD 1,662.78 million |

|

CAGR |

10.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global retimer market size was valued at USD 611.69 million in 2024 and is projected to grow to USD 1,662.78 million by 2034.

• The global market is projected to register a CAGR of 10.6% during the forecast period.

• In 2024, North America dominated the retimer market due to its robust presence in key technology sectors such as IT, telecommunications, and data centers.

• A few key players in the market are Astera Labs; Broadcom; Marvell; Renesas Electronics Corporation; Texas Instruments Incorporated; Parade Technologies, Ltd.; Intel Corporation; Diodes Incorporated; Microchip Technology Inc.; and Montage Technology.

• The PCIE segment dominated the market in 2024.

• The IT & telecommunication segment is expected to witness the highest CAGR during the forecast period.