Restaurant Management Software Market Size, Share, Trends, Industry Analysis Report: By Type, Deployment (On-Premise and Cloud), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5483

- Base Year: 2024

- Historical Data: 2020-2023

Restaurant Management Software Market Overview

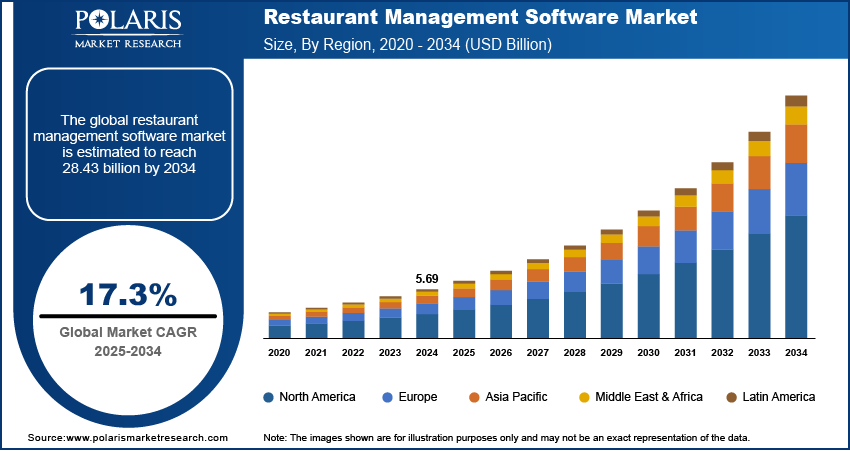

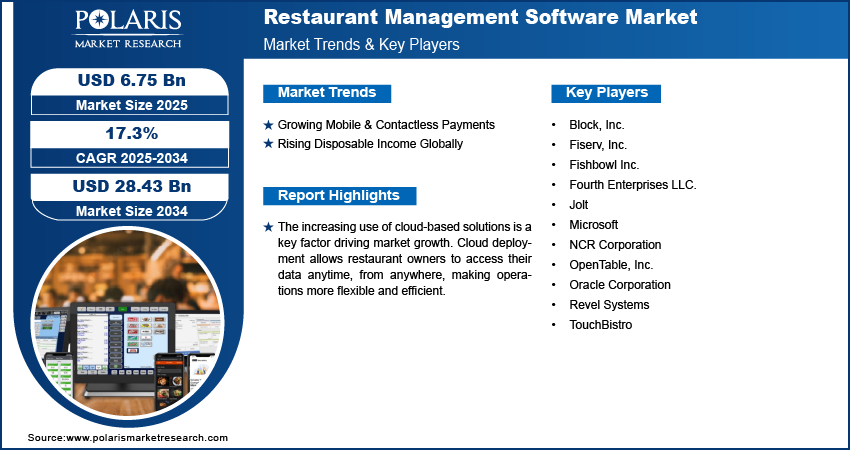

The global restaurant management software market size was valued at USD 5.69 billion in 2024. The market is projected to grow from USD 6.67 billion in 2025 to USD 28.03 billion by 2034, exhibiting a CAGR of 17.3% during 2025–2034.

The restaurant management software market encompasses digital solutions designed to streamline operations, enhance customer experience, and optimize business efficiency in the food service industry. These platforms integrate functionalities such as point-of-sale (POS) systems, inventory tracking, order management, analytics, and customer relationship management (CRM) to improve restaurant performance and profitability.

The restaurant management software market is growing as more restaurants adopt digital solutions to improve their operations. Restaurants are using advanced software to manage orders, track inventory, handle payments, and enhance customer service. This shift helps businesses run more smoothly, reduce errors, and save time. Another key factor driving market growth is the increasing use of cloud-based solutions. Cloud deployment allows restaurant owners to access their data anytime, from anywhere, making operations more flexible and efficient. It also improves data security, scalability, and system updates, ensuring businesses stay up to date with the latest technology. The demand for restaurant management software is expected to rise further in the coming years as restaurants look for ways to improve efficiency and customer experience.

Advanced software solutions tailored for personalized customer experiences are driving the restaurant management software market development. Additionally, strategic partnerships and mergers between software providers and restaurant chains are enhancing market outlook, boosting innovation, and expanding service capabilities to meet evolving industry demands and optimize operational efficiency.

To Understand More About this Research: Request a Free Sample Report

Restaurant Management Software Market Dynamics

Increasing Mobile & Contactless Payments

The growing consumer preference for digital transactions is accelerating restaurant management software market growth, with mobile and contactless payments becoming essential for enhancing customer convenience and operational efficiency. For instance, according to the Monetary Authority of Macao, in China, transactions via local mobile payment tools rose by 13.5% quarter-on-quarter, reaching 100 million in Q4 2024. The transaction value increased by 8.4%, totaling 8.2 billion. This growing demand for seamless, secure, and fast payment solutions is driving software adoption and expanding market size. Integrated payment processing capabilities are enabling restaurants to streamline transactions, reduce wait times, and improve overall customer experience, further fueling market demand.

Rising Disposable Income Globally

Rising disposable income has significantly contributed to the restaurant management software market expansion. For instance, according to the Ministry of Statistics & Programme Implementation, India's Gross National Disposable Income (GNDI) showed a growth of 14.5% for the year 2022-23. Increasing consumer spending power has led to a shift in dining preferences, resulting in more frequent visits to restaurants and a heightened demand for higher-quality service. This surge in consumer expectations drives the need for advanced software solutions that streamline operations, enhance customer experiences, and manage resources efficiently. Restaurants are adopting these technologies to improve order management, inventory tracking, and customer relationship management, thereby improving operational efficiency. Consequently, the rise in disposable income is fueling demand for dining services and expanding the market for restaurant management software solutions.

Restaurant Management Software Market Segment Insights

Restaurant Management Software Market Assessment by Deployment Outlook

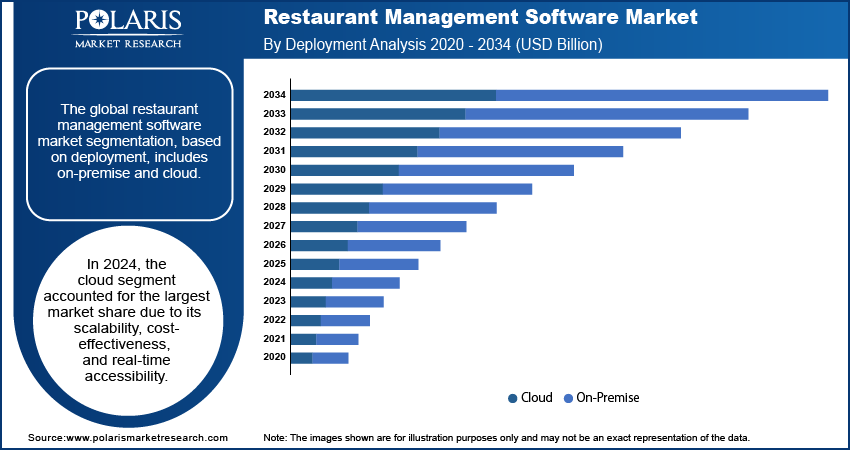

The global restaurant management software market segmentation, based on deployment, includes on-premise and cloud. In 2024, the cloud segment accounted for the largest market share due to its scalability, cost-effectiveness, and real-time accessibility. The rising adoption of software-as-a-service (SaaS) solutions among restaurant operators is driving growth, as businesses prioritize centralized data management, automated updates, and remote monitoring. Cloud deployment is streamlining multi-location operations, improving inventory control, and enabling seamless integration with third-party platforms. Additionally, the increasing reliance on digital transformation strategies and demand for contactless solutions has contributed to the segment’s dominance, with cloud-based systems offering enhanced security and compliance features.

The on-premise segment is expected to witness highest CAGR from 2025 to 2034 due to heightened data security concerns and the need for complete control over software customization. High-end restaurants and enterprise-level food service businesses are investing in dedicated servers and advanced security infrastructure. The demand for on-premise solutions is increasing in regions with limited cloud adoption or stringent regulatory requirements. Additionally, businesses operating in remote areas with unreliable internet connectivity are fueling segmental growth, as on-premise solutions provide uninterrupted operations without dependency on cloud access.

Restaurant Management Software Market Evaluation by End Use Outlook

The global restaurant management software market segmentation, based on end use, includes full service restaurant (FSR), quick service restaurant (QSR), institutional, and others. In 2024, the full service restaurant segment accounted for the largest market share due to the increasing need for advanced software solutions to manage reservations, table turnover, and personalized customer experiences. The demand for comprehensive restaurant management platforms is rising as operators seek to enhance operational efficiency, optimize workforce management, and streamline billing processes. The integration of artificial intelligence and machine learning for predictive analytics and menu optimization is contributing to the expansion of this segment, enabling full-service restaurants to enhance customer engagement and maximize revenue.

The quick service restaurant segment is expected to register the highest CAGR during the forecast period due to the growing demand for automation, digital ordering, and drive-thru efficiency. The increasing adoption of AI-powered self-service kiosks, mobile ordering apps, and automated kitchen workflows is boosting segmental growth. The rapid expansion of fast-food chains and franchise models is driving investment in data-driven restaurant management software to improve service speed, optimize staffing, and enhance inventory control. Rising consumer expectations for faster service and seamless digital interactions are further strengthening the outlook for quick service restaurant software solutions.

Restaurant Management Software Market Regional Analysis

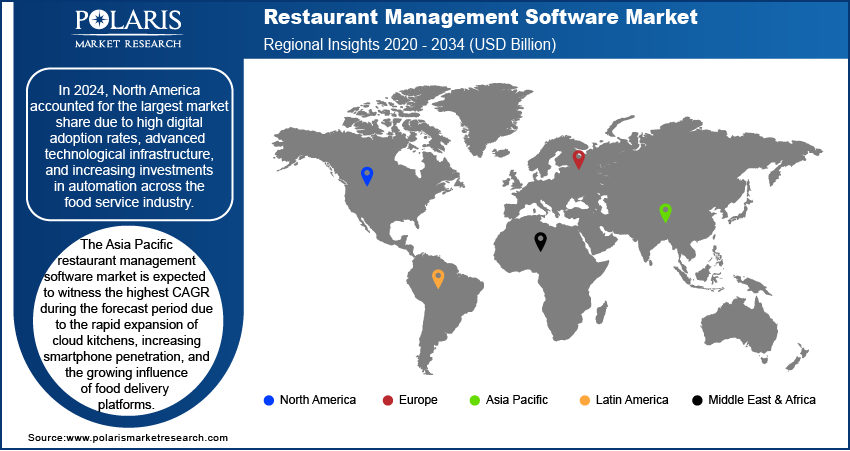

By region, the study provides the restaurant management software market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to high digital adoption rates, advanced technological infrastructure, and increasing investments in automation across the food service industry. The strong presence of major quick-service and full-service restaurant chains is contributing to market expansion, as businesses prioritize data-driven decision-making, AI-powered analytics, and cloud-based solutions to enhance operational efficiency. For instance, in October 2023, Starbucks significantly expanded its North American presence, reaching a total of 17,810 stores. This comprised 10,628 company-operated stores and 7,182 licensed stores. Stringent labor regulations and rising labor costs are further driving demand for automated workforce management and inventory tracking solutions. Additionally, the rapid integration of mobile ordering, contactless payments, and loyalty program management is strengthening market value across the region.

The Asia Pacific restaurant management software market is expected to witness the highest CAGR during the forecast period due to the rapid expansion of cloud kitchens, increasing smartphone penetration, and the growing influence of food delivery platforms. For instance, according to the Press Information Bureau, in 2022, the number of smartphone users has increased dramatically from 150 million to 750 million in the last eight years in India, showcasing the rapid adoption of mobile technology and the growing reliance on mobile internet services. The surge in urbanization and rising disposable income are accelerating market growth, as restaurants invest in AI-driven software solutions to optimize order management, enhance customer engagement, and streamline supply chain operations. Government initiatives promoting digital payments and smart city projects are further supporting market expansion. The competitive landscape is evolving with regional players leveraging advanced automation, IoT integration, and localized software customization to meet dynamic consumer preferences.

Restaurant Management Software Market – Key Players and Competitive Insights

The competitive landscape of the restaurant management software market is characterized by intense market penetration efforts, strategic alliances, and continuous technology advancements. Leading players are actively engaging in mergers and acquisitions to expand their product portfolios, enhance scalability, and strengthen their global footprint. Post-merger integration strategies are becoming a key focus, enabling companies to streamline operations and accelerate innovation. Joint ventures and partnerships between software providers and restaurant chains are driving the development of AI-driven analytics, cloud-based platforms, and integrated payment solutions, enhancing operational efficiency and customer experience. The evolving technological landscape is pushing market participants to invest heavily in automation, machine learning, and IoT-enabled restaurant solutions to gain a competitive edge.

Competition strategy revolves around customization, data-driven insights, and seamless omnichannel integration, catering to the diverse needs of full-service and quick-service restaurants. The rising adoption of SaaS-based platforms has further intensified market rivalry, prompting companies to refine their service models through subscription-based pricing and flexible deployment options. Additionally, global brands are prioritizing cybersecurity enhancements and compliance-driven innovations to address regulatory challenges. Businesses are leveraging strategic collaborations and ecosystem partnerships to drive sustained restaurant management software market expansion and long-term revenue growth.

Oracle Corporation provides products and services that address enterprise information technology environments globally. Oracle Fusion cloud enterprise performance management, Oracle Fusion cloud supply chain, as well as manufacturing management, enterprise resource planning (ERP), Oracle Advertising, NetSuite applications suite, Oracle Fusion cloud human capital management, and Oracle Fusion Sales, Service, and Marketing, are few of the cloud software programs included in the company's Oracle software as a service. The company also provides licensed cloud-based business infrastructure solutions, middleware (which contains tools for development and other purposes), and enterprise databases like Oracle and Java. Also, the company provides Generative AI powered by state-of-the-art LLMs from Cohere, ensuring unparalleled data security, trusted performance, and versatile deployment options for text generation. Oracle's four main business divisions – cloud, license, hardware, and services – provide its database management systems and cloud-engineering services and solutions. In addition, the company also offers cloud-based industrial solutions for numerous industries, support services for Oracle licenses, and licenses for Oracle application software. Oracle Corporation offers Oracle MICROS restaurant management software, providing POS systems, inventory management, online ordering, reporting, and analytics. Its cloud-based solutions help restaurants improve efficiency, enhance customer service, and streamline operations.

Microsoft is a multinational technology company headquartered in Redmond, Washington. Microsoft offers various products and services, including operating systems, productivity software, gaming consoles, and cloud-based solutions. Its flagship product, Microsoft Windows, is the world's most widely used operating system. Other popular products include Microsoft Office, Skype, and the Xbox gaming console. Microsoft has also developed several AI-based products and services, including the Azure Machine Learning platform, which allows developers to build, deploy, and manage machine learning models at scale. The company has also developed AI tools for healthcare, such as Microsoft Healthcare Bot, which helps patients get answers to their health-related questions. Microsoft offers restaurant management software solutions through Microsoft Dynamics 365, providing tools for POS systems, inventory management, customer engagement, analytics, and cloud integration, helping restaurants improve efficiency, streamline operations, and enhance customer experiences. Microsoft offers restaurant management software solutions through Microsoft Dynamics 365, providing tools for POS systems, inventory management, customer engagement, analytics, and cloud integration, helping restaurants improve efficiency, streamline operations, and enhance customer experiences.

List of Key Companies in Restaurant Management Software Market

- Block, Inc.

- Fiserv, Inc.

- Fishbowl Inc.

- Fourth Enterprises LLC.

- Jolt

- Microsoft

- NCR Corporation

- OpenTable, Inc.

- Oracle Corporation

- Revel Systems

- TouchBistro

Restaurant Management Software Industry Developments

In October 2024, Fiserv, Inc., a provider of payments and financial services technology solutions, partnered with Foodpanda. This collaboration extended across mobile, online, and digital wallets, establishing Fiserv as Foodpanda’s primary acquirer in Singapore and Hong Kong.

In September 2024, TouchBistro expanded its portfolio of back-of-house solutions for restaurants by launching Labor Management and Inventory Management software.

In June 2024, Revel Systems, an open-cloud order management platform for restaurant and retail brands, announced that BRIX Holdings implemented Revel across all locations for its brands. Revel operated with BRIX to design a custom plan that optimized the software and hardware design for each brand’s individual requirements.

Restaurant Management Software Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Front End Software

- Accounting & Cash Flow

- Purchasing & Inventory Management

- Table & Delivery management

- Employee Payroll & Scheduling

- Others

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- On-Premise

- Cloud

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Full Service Restaurant (FSR)

- Quick Service Restaurant (QSR)

- Institutional

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

-

North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Restaurant Management Software Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.69 billion |

|

Market Size Value in 2025 |

USD 6.67 billion |

|

Revenue Forecast by 2034 |

USD 28.03 billion |

|

CAGR |

17.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global restaurant management software market size was valued at USD 5.69 billion in 2024 and is projected to grow to USD 28.03 billion by 2034.

The global market is projected to register a CAGR of 17.3% during the forecast period

In 2024, North America accounted for the largest market share due to high digital adoption rates, advanced technological infrastructure, and increasing investments in automation across the food service industry.

Some of the key players in the market are Block, Inc.; Fiserv, Inc.; Fishbowl Inc.; Fourth Enterprises LLC; Jolt; Microsoft; NCR Corporation; OpenTable, Inc.; Oracle Corporation; Revel Systems; and TouchBistro.

In 2024, the cloud segment accounted for the largest market share due to its scalability, cost-effectiveness, and real-time accessibility.

In 2024, the full service restaurant segment accounted for the largest market share due to the increasing need for advanced software solutions to manage reservations, table turnover, and personalized customer experiences.