Restaurant Delivery Robot Market Share, Size, Trends, Industry Analysis Report, By Type (Semi-Autonomous, Fully Autonomous); By Service Type; By Restaurant Type; By Load Capacity; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 114

- Format: PDF

- Report ID: PM4687

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

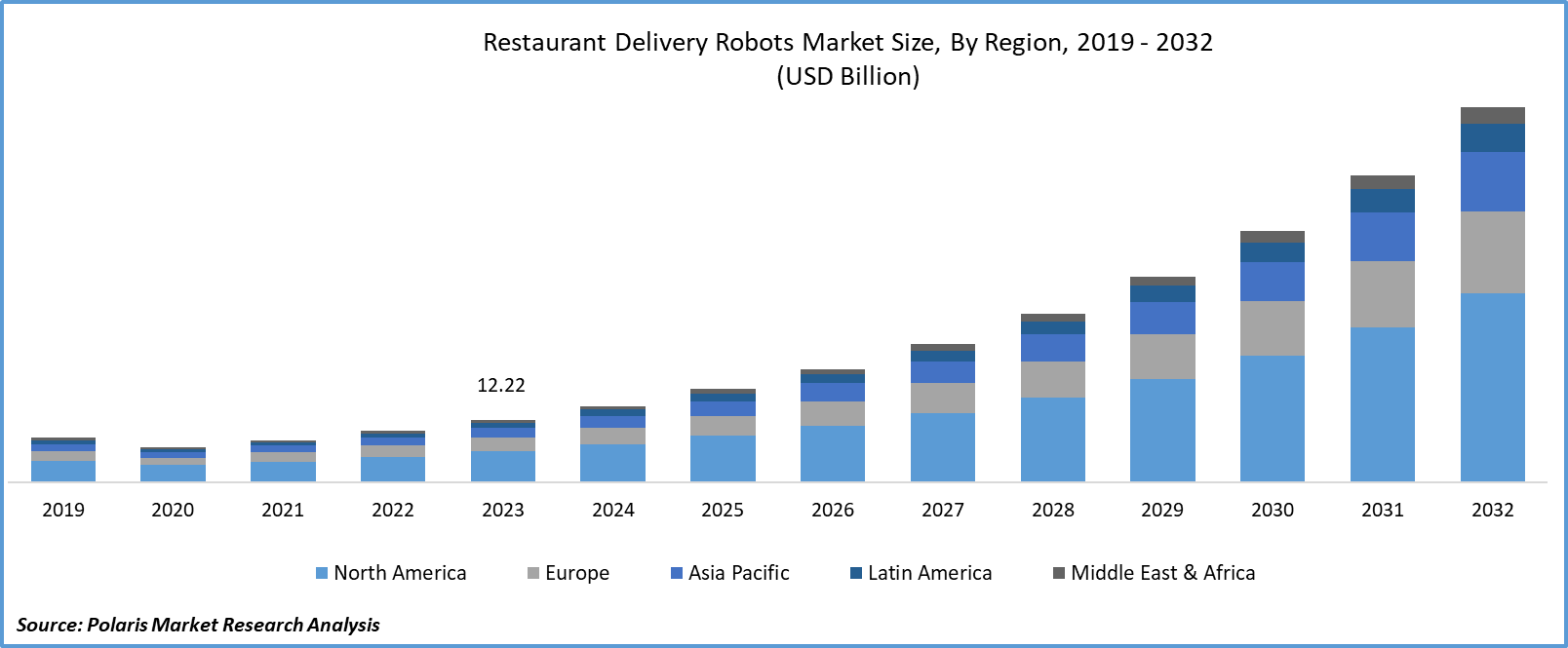

Restaurant Delivery Robot Market size was valued at USD 12.22 billion in 2023. The market is anticipated to grow from USD 14.87 billion in 2024 to USD 72.88 billion by 2032, exhibiting the CAGR of 22.0% during the forecast period.

Market Overview

Increased awareness about food delivery e-commerce platforms, rising labor costs and the growing working population are factors facilitating the need for on-time delivery of food, making restaurant management adopt autonomous and semi-autonomous delivery robots. The improved accessibility of food from multiple restaurants at the consumer's doorstep is a major factor driving the expansion of the food delivery business. Furthermore, a rising number of companies and universities are opting for restaurant delivery robots to mitigate their students' challenges in having food during lunch breaks.

- For instance, in April 2023, the University of Southern Indiana introduced a robotic delivery partnership with KiwiBot and Grubhub to enhance convenience for its students and employees.

To Understand More About this Research: Request A Free Sample Report

Additionally, the potential to navigate one place to another quickly, limiting the traffic disruptions is boosting their adoption by the food delivery companies. For instance, in March 2024, UberEats announced the introduction of robot deliveries in Tokyo, Japan, driven by increasing labor scarcity and government approval of self-driving delivery robots in the public roads in April 2023.

Moreover, the cost-effectiveness of restaurant delivery robots compared to labor costs is optimally influencing market growth. According to Kiwibot, the mean delivery time of robots is approximately 25–30 minutes, which is much lower than the traditional delivery man's adoption. The higher safety of food orders and no chance of asking for tips from customers are likely to stimulate its demand soon.

Growth Drivers

The rising investments by the major players

The rising investment activities by the companies offering delivery robots to the world market are playing a vital role in market expansion and meeting ongoing demand from restaurants. For instance, in February 2023, Kiwibot announced that it had secured $10 million from the finance partnership with Kineo Finance, which is planned to invest in the development of its robotic fleet. As more companies showcase their interest in adopting technological innovations to automate delivery tasks with reliability and within the shortest span of time, there will be significant market expansion possibilities in the years to come.

Increase in the labor costs

The growing labor costs, driven by the significant shortage in the global market, are forcing food service providers to opt for technological developments in their business operations, driving the demand for delivery robots in the market. Furthermore, the usage of delivery robots is assisting restaurant owners to cater to more customers, lowering wait times, and, in a way, enhancing the overall performance of business operations in the restaurants.

Restraining Factors

The need for prominent infrastructure to navigate safely to the destination

The restaurant delivery robot required compatible weather, as extreme atmospheric conditions can cause significant obstacles to navigation. The increasing robot theft activities in the marketplace are likely to limit the integration of robots in restaurant delivery operations by the owners, restraining global expansion.

Report Segmentation

The market is primarily segmented based on type, service type, restaurant type, load capacity, and region.

|

By Type |

By Service Type |

By Restaurant Type |

By Load Capacity |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Fully autonomous segment is expected to witness the highest growth during the forecast period

The fully autonomous segment will grow with rapid pace, primarily due to its superior performance & convenience, limiting the need for additional employees. Moreover, the increasing development of fully-autonomous restaurant is anticipated drive the adoption of delivery robots, with the rising online food orders. For instance, in December 2023, Cali Group, Miso Robotics, and PopID announced their plan to introduce fully-autonomous restaurant, CaliExpress by Flippy in Southern California.

By Service Type Analysis

Full-service segment accounted for the largest market share in 2023

The full-service segment accounted for the largest market share in 2023 and is likely to retain its market position throughout the forecast period. This is attributable to the rising emphasis on customer satisfaction among full-service restaurants, contributing to the significant demand for restaurant delivery robots due to their capability to automate several tasks with increased efficiency.

The limited segment is expected to grow at the fastest growth rate over the next few years on account of the rapid increase in demand for speedy delivery on food orders. As these restaurants basically offer cafes, fast-food chains, and other quickly made meals, there will be a significant necessity for restaurant delivery robots due to their cost-effectiveness and speedy delivery by the restaurants in the marketplace.

By Restaurant Type Analysis

Chained segment held the significant market revenue share in 2023

The chained restaurant segment held a significant market share in revenue in 2023, which is highly accelerated due to the continuous rise in the volume of orders for these restaurants as they operate in multiple locations, which requires a resilient food delivery system. The rising business strategies of chained restaurants to enhance consumer retention rates by lowering delivery times are likely to foster demand for restaurant delivery robots in the next few years.

By Load Capacity Analysis

10-50 KG segment is expected to register a dominant share

The 10-50 KG segment is anticipated to witness dominant growth during the forecast period, driven by its ability to minimize costs for the restaurant. In urban areas, most people are likely to order bulk amounts, weighing approximately 10–50 kg. This is making restaurants equip the robots with a carrying capacity of 10–50 kg, which assists in lowering the transportation costs for the company.

Regional Insights

North America region registered the largest share of the global market in 2023

The North America region held the global market with the largest market share in 2023 and is expected to continue its dominance over the study period. The growth of this region can be largely attributed to the rising incidence of labor insufficiency. According to the HungerRush Survey in May 2023, approximately 36% of the 1000 United States people said that restaurant chains do not have sufficient staff for handling food orders, deliveries, and food preparation. This is encouraging restaurant management to equip robots for their business operations.

The Asia Pacific region is expected to be the fastest-growing region with a healthy CAGR during the projected period, owing to the presence of a larger population in the region and the rising consumption of food through online platforms. According to Invest India, the food and grocery sector is likely to grow at a 10% CAGR in the coming years. Furthermore, in November 2023, Zomato announced that it had received a 29% rise in food delivery orders. The increasing disposable income in the region is stimulating the demand for food delivery services, fueling the installation of restaurant delivery robots in the marketplace.

Key Market Players & Competitive Insights

Strategic partnerships to drive the competition

The restaurant delivery robot market is fragmented in nature with the presence of several market players and likely to register competition with the rising research and development activities along with the rising adoption of strategic expansion principles among the major players. For instance, in February 2023, Kiwibot, a delivery company, joined forces with Aramex to test its drone and robotic delivery services system in the UAE.

Some of the major players operating in the global market include:

- Amazon Robotics (US)

- Bear Robotics, Inc. (US)

- Boston Dynamics (US)

- Cleveron (Estonia)

- Cyan Robotics (US)

- Eliport (US)

- Kitchen Robotics (Israel)

- Miso Robotics (US)

- Robby Technologies (US)

- Starship Technologies (US)

Recent Developments in the Industry

- In January 2023, GYRO, a technology giant, introduced its latest distribution robot at the Consumer Technology Association 2023 conference, which is specifically designed for hotels and restaurants.

- In February 2023, Talabat UAE announced the launch of a food delivery robot in Dubai in partnership with the Integrated Economic Zones Authority

Report Coverage

The restaurant delivery robot market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, service type, restaurant type, load capacity and their futuristic growth opportunities.

Restaurant Delivery Robot Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 14.87 billion |

|

Revenue forecast in 2032 |

USD 72.88 billion |

|

CAGR |

22.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global restaurant delivery robot market size is expected to reach USD 72.88 billion by 2032

Key players in the market are Amazon Robotics, Cleveron, Cyan Robotics, Miso Robotics

North America contribute notably towards the global Restaurant Delivery Robot Market

Restaurant delivery robot market exhibiting the CAGR of 22.0% during the forecast period.

The Restaurant Delivery Robot Market report covering key segments are type, service type, restaurant type, load capacity and region.