Research Antibodies Market Share, Size, Trends, Industry Analysis Report, By Product; By Type; By Technologies; By Source; By Application; By End-Use; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 111

- Format: PDF

- Report ID: PM2027

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

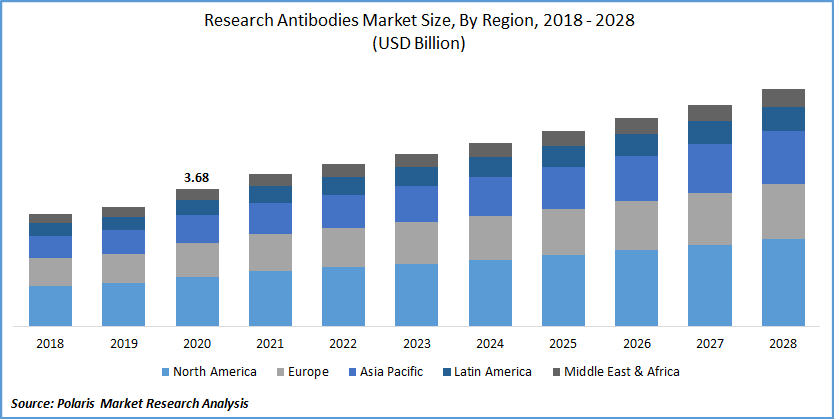

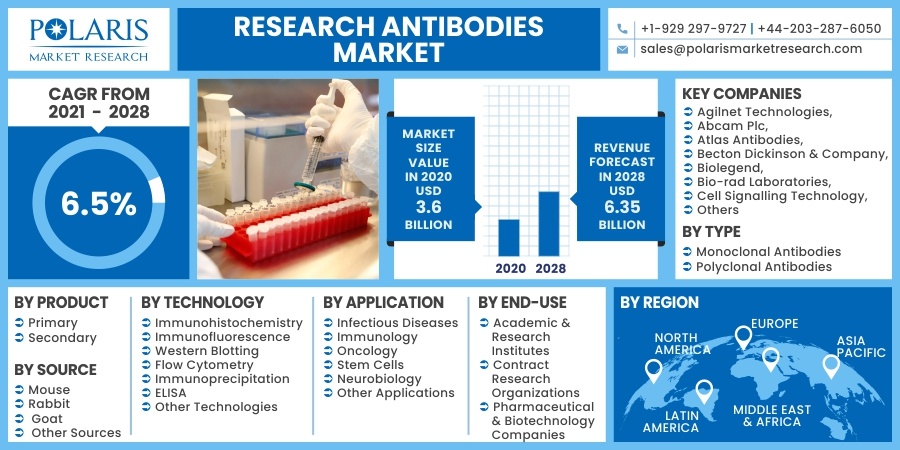

The global research antibodies market was valued at USD 3.68 billion in 2020 and is expected to grow at a CAGR of 6.5% during forecast period. The rising occurrence of neurodegenerative diseases like Parkinson’s disease, Multiple Sclerosis, and Huntington’s disease, coupled with the increasing fund availability by the government for genomics and proteomics research, is a chief driving factor for the research antibodies market. Also, changing lifestyle shows a major impact on human health along with the growing geriatric population further contributes to the market demand across the globe. Moreover, escalating requirements for the modified structure-based drugs patterns and therapeutics fuel the market growth for the research antibodies in the near future.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The widespread COVID-19 has a positive impact on the research antibodies industry because various pharmaceutical companies are working on research & development activities to develop testing kits, treatment, and novel vaccines against the coronavirus. These precise research & development activities across market considerably boost the market demand for research antibodies across the globe. Moreover, numerous governments, as well as private organizations, are actively participating and taking initiatives for the development of coronavirus therapeutics and vaccines.

For instance, in April 2020, Biosolutions came into a partnership with The U.S. government to develop the plasma-derived therapy for the COVID-19 patients. The company received 14.5 million funds from the government to carry out antibody-drug trials on COVID-19 patients. Therefore, the rapid development of therapeutics and vaccines has been encouraged during this period, which shows an upsurge in the global market demand for research antibodies.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The growing pharmaceutical R&D expenditures maintain to use cutting-edge analytical techniques and services to provide high-throughput drug-discovery capacity and objective valuation in drug development. These technologies are used in various aspects of drug discovery, such as drug efficacy and safety studies, patient stratification, drug repositioning, and others. Also, it improves potential developments and sustains drug development; thereby, it is driving market growth throughout the world. Accordingly, rising investment in R&D reflects a positive influence on the market demand.

For instance, the Association of the British Pharmaceutical Industry (ABPI) in 2016 anticipated that the biopharmaceutical companies globally spent approximately USD 156.7 billion on R&D activities, which exhibits an increase from USD 148 billion in 2015. However, it is projected to rise to nearly USD 181 billion by 2022. Similarly, the U.S. is the major country in terms of R&D expenditure in 2019 across the pharmaceutical sector, with about USD 83 billion, which grows from USD 59.6 billion in 2015. As a result, the increasing R&D spending across several pharma & biopharma companies and the pharmaceutical market are proficiently adopting complex analytical testing services to levy and monitor the quality attributes of drugs, which may foster the market demand around the world.

Report Segmentation

The market is primarily segmented on the basis of product, type, technology, source, application, end-use and region.

|

By Product |

By Type |

By Technology |

By Source |

By Application |

By End-Use |

By Region |

|

|

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Technology

The western blotting segment in research antibodies market has the largest share and dominates the global market owing to the growing prevalence of health diseases that have limited alternatives for treatment options. Western blotting is ideal in technologies such as flow cytometry and ELISA tests, among others, for the detection of HIV antibodies because the western blotting technique offers higher accuracy.

The immunohistochemistry segment is the second-leading segment in the antibodies market and is projected to show the fastest growth rate in the upcoming years. The increasing adoption of immunohistochemistry in the prognosis of tumors and cancer diagnosis acts as a major catalyzing factor for the segment growth. Other applications of immunohistochemistry consist of the classification of the tumor cell, enzymes, tumor suppressor genes, and antigens. Furthermore, emerging consciousness between patients and healthcare professionals and escalating healthcare investments and infrastructural developments are some of the prominent factors that fuel the growth of the segment.

Insight by Application

The oncology segment is exhibited with the highest shares and will lead the global market in 2020 due to the growing incidences of cancer worldwide. As per the International Agency for Research on Cancer, in 2018, the cancer prevalence was anticipated to be 18.1 million worldwide. Also, 9.6 million fatalities were also recorded likely to occur due to cancer in the same year. Moreover, it is expected that by 2022 cases will reach approximately 43.8 million globally. Consequently, increasing cases of cancer will boost the adoption of research antibodies to advance a wide range of diagnoses and treatment opportunities.

The stem cells segment is projected to show the highest CAGR in the foreseen years. The rising investments by the government for promoting the adoption of stem cell-based developments in numerous medical applications contribute to the segment growth. For instance, in March 2019, the University of Melbourne and Stem Cells South Korea received USD150 million in funding from the South Korean Federal Government for researching the new alternative for treating kidney disease, stroke, congenital heart disease, and dementia. As a result, these initiatives may impel segment growth in the approaching years.

Geographic Overview

Geographically, North America is leading the market in 2020. The rising investment for the introduction of novel structure-based drug patterns, along with the growing focus on cancer, biomedical, and stem cells, are the primary factors for the market growth. The increasing incidences of chronic diseases such as blood diseases and cardiovascular lead to the market demand of research antibodies for curing these diseases. The American Cancer Society, Inc. projected that nearly 1,735,350 new cases of cancer are occurring in 2018 across the U.S., with more than 609,640 cancer deaths.

Thereby, this rising prevalence propels the focus on stem cell research and cancer research activities. Stem cell therapy is a highly effective technique for curing major health conditions as well as cancer & blood diseases. Accordingly, escalating number of biopharmaceutical and biotechnology organizations prefer highly developed research antibodies products in stem cells research, which, in turn, leads to the dominance of the antibodies market across North America.

The Asia Pacific is projected to show a significant CAGR in the global market over the forecasting years owing to the increasing investments in the healthcare sector's development. The increasing number of research activities carried out by academic institutions and the introduction of novel therapeutics across the region is the major driving factor for market growth. For instance, in June 2019, China Medical University and the Vaccine Research Center collaborated with researchers at the Tsinghua University at NIH to start research on the classification of the HIV-1 strains with the effective and wide resistance against a large number of neutralizing antibodies. Therefore, these R&D activities for discovering novel antibodies may accelerate antibodies market growth across the region.

Competitive Landscape

Some of the major players operating in the global research antibodies market include Agilnet Technologies, Abcam Plc, Atlas Antibodies, Becton Dickinson & Company, Biolegend, Bio-rad Laboratories, Cell Signalling Technology, Danaher Corporation, F.Hoffman-La Roche, Genscript , Illumina , Immunoprecise Antibodies , Lonza Group, Merck Millipore, Perkin Elme Inc, Perkinelmer Roche Ltd., Thermo Fisher.

Research Antibodies Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 3.6 billion |

|

Revenue forecast in 2028 |

USD 6.35 billion |

|

CAGR |

6.5% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Type, By Technology, By Source, By Application, By End-use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Agilnet Technologies, Abcam Plc, Atlas Antibodies, Becton Dickinson & Company, Biolegend, Bio-rad Laboratories, Cell Signalling Technology, Danaher Corporation, F.Hoffman-La Roche, Genscript , Illumina , Immunoprecise Antibodies , Lonza Group, Merck Millipore, Perkin Elme Inc, Perkinelmer Roche Ltd., Thermo Fisher. |