Remote Weapon Station Market Share, Size, Trends, Industry Analysis Report

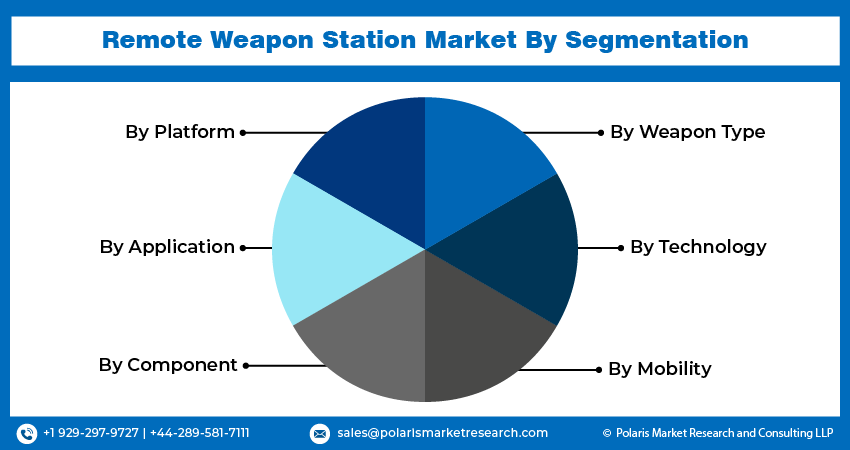

By Platform (Land, Naval, Airborne); By Application; By Component; By Weapon Type; By Technology; By Mobility; By Region; Segment Forecast, 2024-2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM3068

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

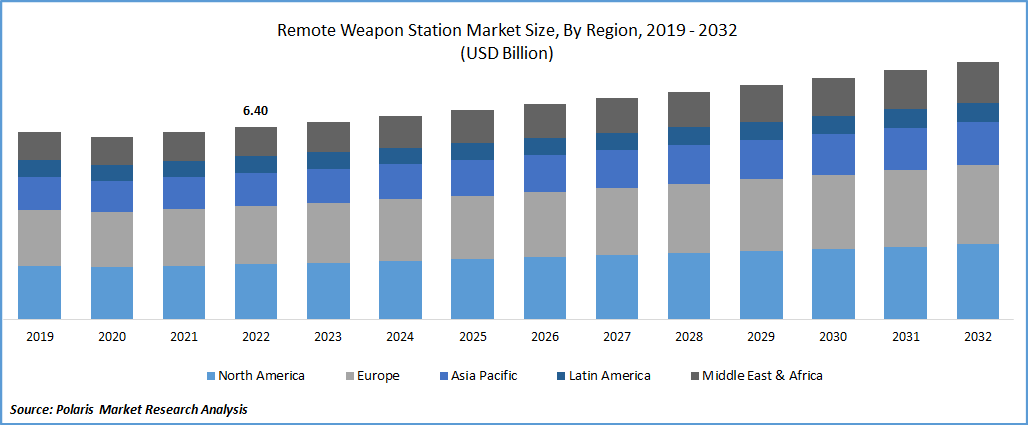

The global remote weapon station market was valued at USD 6.58 billion in 2023 and is expected to grow at a CAGR of 3.0% during the forecast period. The growing use of unmanned aerial and ground vehicles in military and civilian applications is driving the demand for RWS, as these systems require weapons that can be operated remotely. The development of new technologies such as smart sensors, advanced fire control systems, and improved ammunition have enhance the accuracy and effectiveness of RWS which is propelling market growth. For instance, in January 2023, General Robotics confirmed that Indian Army is planning to procure General Robotics' Pitbull remote-controlled weapon station (RCWS). The system has a Point & Shoot Technology which enables a touch-screen response and automatic designation of a weapon. Additionally, the device has dual axis high accuracy firmware that ensures precision shots on target even when the platform is moving.

Know more about this report: Request for sample pages

RWS is an appealing alternative for many nations and organizations because they are incredibly adaptable and may be utilised in a variety of settings, including close-quarters combat, urban warfare, and mob control. They are generally more cost-effective than other types of weapons, making them an attractive option for many countries and organizations that are facing budget constraints.

The increasing importance of surveillance and reconnaissance in military and homeland security operations with RWS systems that have advanced sensors and cameras to provide real-time intelligence is driving the remote weapon station market expansion. Furthermore, the rising use of robots in military and homeland security operations is driving the demand for RWS that can be integrated into these platforms to provide additional firepower and protection. In November 2022, Thales UK and Kongsberg Defense signed an agreement with the Thales on “PROTECTOR Remote Weapon Systems Programmes” in more military capability domains, both domestically & internationally.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Driver

The need for remote weapon system (RWS) that can be utilised to deliver more firepower and protection is being driven by the rising need to protect military personnel and civilians as well as by the growing usage of unmanned systems. The continued presence of regional conflicts and geopolitical tensions is responsible for the increased demand for RWS, as countries look to increase their military capabilities and protect their citizens from potential threats. RWS are highly versatile and can be used in a wide range of scenarios, including close-quarters combat, urban warfare, and crowd control, making them an attractive option for many countries and organizations.

Report Segmentation

The market is segmented based on platform, application, component, weapon type, technology, mobility, and region.

|

By Platform |

By Application |

By Component |

By Weapon Type |

By Technology |

By Mobility |

By Region |

|

|

|

By Caliber

|

|

|

|

Know more about this report: Request for sample pages

Land Segment is Expected to Grow at the Fastest CAGR During the Forecast Period

In 2022, the airborne segment held the highest market share globally. The need for unmanned aerial vehicles (UAVs) and cutting-edge technology are projected to boost the global remote weapon station market growth. With the help of these devices, it is possible to remotely control weapons from an aerial platform with greater safety and precision.

For instance, in September 2022, WITPiS, Stekop, Auto Podlasie, & AP Solutions introduced the Taero un-manned ground vehicle (UGV). The vehicle is based on the 6th Airborne Brigade of the Polish Army's next-generation Aero 44 Pojazdy Wojsk Aeromobilnych (PWA) light-weight all-terrain airborne vehicle. Taero is equipped with electro-optical sensors, a dual antenna, a GNSS receiver, which allow for the identification of obstructions and the computation of the best course of action.

Lethal Weapon Segment Dominated the Global Market in 2022

Lethal weapon segment registered the largest market share in 2022 and is expected to continue its dominance during the forecast period. Lethal weapons in remote weapon systems can range from small arms such as machine guns and grenade launchers, to more advanced systems like guided missiles and laser weapons. The need for increased firepower and protection for military personnel, as well as for civilians in conflict zones is driving the market growth.

This segment is also expected to grow at a high CAGR during the forecast period. Lethal weapons can be employed to disperse suspicious forces near the guarded perimeter and, if necessary, to eradicate the threat. The lethal weapons can be operated from inside the vehicle by using various controls provided. The increasing use of unmanned aerial and ground vehicles, which require weapons that can be operated remotely is driving market expansion.

Military Segment Dominated the Market Share in 2022

The military segment held the largest market share in 2022. Due to increasing border conflicts and disputes, countries are increasingly investing in their military expenditure and upgrading their arsenal with modernized weapons and armored vehicles which is resulting in the increasing demand for remote weapon systems. In January 2023, American Rheinmetall Systems and Kongsberg Defense signed a framework agreement to produce subsystems for the Common Remotely Operated Weapon Station (CROWS) programme of the US Army. The five-year framework agreement includes the provision of high-definition image-stabilized EO sensors (day cameras), weapon mounts, and other components.

The homeland security segment is expected to grow at a high CAGR during the forecast period. Remote weapon systems (RWS) are increasingly being used in homeland security applications, as they provide a high level of protection for law enforcement personnel and civilians, as well as increased firepower for addressing a wide range of security threats. RWS can be used to secure critical infrastructure such as power plants, water treatment facilities, and oil refineries, providing a high level of protection against potential terrorist attacks or other security threats.

North America Region Accounted for the Highest Market Share in 2022

North America region held the largest market share in the global market in 2022. The market growth in recent years is being led by the increased demand from military and law enforcement organizations for advanced technologies to improve the accuracy, speed, and safety of weapons systems. The United States is the largest market for remote weapon control systems in North America, accounting for the majority of sales in the region. Other countries in the region, such as Canada and Mexico, also have growing markets for these systems. Players offer a range of remote weapon control systems for various applications, like ground-based systems for military vehicles, aircraft-mounted systems for military aircraft, and ship-based systems for naval vessels.

Asia Pacific region is expected to grow at the fastest CAGR over the forecast period. The increasing military expenditure by countries like China, India, Japan and South Korea in this region and the rising needs for modernizing their weapons and armored vehicles is fostering the market demand. For instance, in December 2022, A multimillion dollar, 5-year deal for the sale of the Typhoon Mk30-C naval defense system to an Asian nation has been signed by the Israeli military company Rafael Advanced Defense Systems. The Typhoon is a stabilized naval remote control weapon system with the “Mk44 Bushmaster II 30 mm chain” cannon that can fire down unmanned aerial vehicles and is compatible with both explosive & air burst ammunition.

Competitive Insight

Some of the major players operating in the global remote weapon station market include Kongsberg Gruppen, Raytheon Company, Elbit Systems, ST Engineering, Saab, Leonardo., Thales, Electro Optic Systems, BAE Systems, Moog, IMI Systems, General Dynamics, Rheinmetall, ASELSAN, Norinco, FN Herstal, & Rafael Advanced Defense Systems.

Recent Developments

- In December 2022, Elbit systems announced that it will supply the “Skylark I LEX Unmanned Aerial Systems” to the Australian army. This is an electric based Skylark I-LEX is designed for the in-house operation by the moving forces & has a 40-km “Line Of Sight” range that makes it useful for a number of roles, including force protection and reconnaissance operations.

- In October 2022, the Grand Duchy of Luxembourg's Ministry of Defense chose Thales, FN Herstal, and General Dynamics European Land Systems (GDELS) to provide the Luxembourg Army with 80 Command Liaison and Reconnaissance Vehicles (CLRVs). The deFNder Medium Remote Weapon Stations, made by FN Herstal in Belgium, will be mounted atop the CLRVs. These stations offer the operators the highest level of safety and have a flexible design that may accommodate a variety of individual or group missions.

Remote Weapon Station Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.76 billion |

|

Revenue Forecast in 2032 |

USD 8.56 billion |

|

CAGR |

3.0% from 2024- 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019- 2022 |

|

Forecast Period |

2024- 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Platform, By Application, By Component, By Weapon Type, By Technology, By Mobility, By Region |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Kongsberg Gruppen, Raytheon Company, Elbit Systems, ST Engineering, Saab AB, Leonardo S.p.A., Thales, Electro Optic Systems, BAE Systems, Moog, IMI Systems, General Dynamics, Rheinmetall AG, ASELSAN A.S, Norinco, FN Herstal, and Rafael Advanced Defense Systems |

FAQ's

The global Remote Weapon Station (RWS) Market size is expected to reach USD 8.56 billion by 2032.

Key players in the remote weapon station market are Kongsberg Gruppen, Raytheon Company, Elbit Systems, ST Engineering, Saab, Leonardo., Thales, Electro Optic Systems, BAE Systems, Moog, IMI Systems, General Dynamics, Rheinmetall, ASELSAN.

North America contribute notably towards the global remote weapon station market.

The global remote weapon station market expected to grow at a CAGR of 3.0% during the forecast period.

The remote weapon station market report covering key segments are platform, application, component, weapon type, technology, mobility and region.