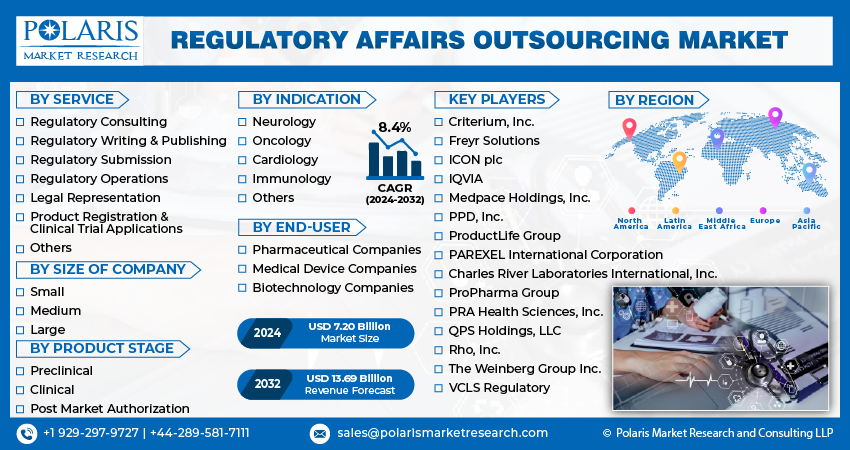

Regulatory Affairs Outsourcing Market Share, Size, Trends, Industry Analysis Report, By Service (Regulatory Consulting, Regulatory Writing & Publishing, Regulatory Submission, Regulatory Operations, Legal Representation, Product Registration & Clinical Trial Applications, Others); By Size of Company; By Indication; By Product Stage; By End-User; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4617

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

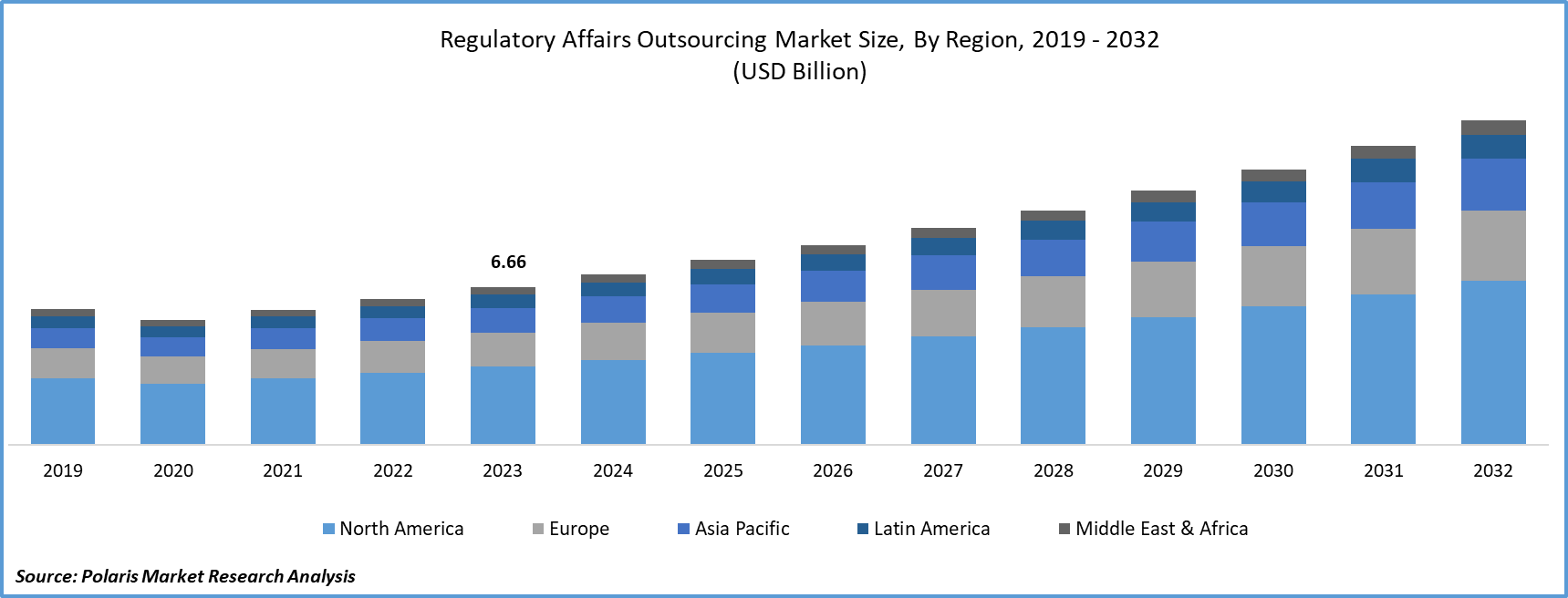

- Regulatory Affairs Outsourcing Market size was valued at USD 6.66 billion in 2023.

- The market is anticipated to grow from USD 7.20 billion in 2024 to USD 13.69 billion by 2032, exhibiting the CAGR of 8.4% during the forecast period.

Market Introduction

Regulatory affairs outsourcing refers to the services employed by pharmaceutical, biotech, and medical device manufacturing companies to expedite regulatory approvals from diverse organizations. The regulatory process primarily entails thorough testing of a specific product, ensuring public health protection, obtaining marketing authorization, managing import and distribution, and meeting product safety and performance standards. By outsourcing regulatory affairs services, market players ensure that their products adhere to all regulatory requirements, facilitating a smoother and faster approval process.

The primary driver for the regulatory affairs outsourcing market share is the substantial increase in fixed costs associated with in-house resources for regulatory affairs and operational activities, encompassing training, technology, specialized knowledge, and facilities. Another contributing factor is the escalating number of clinical trials. The market also presents an opportunity for improvements in processes related to pre-marketing and post-marketing activities, leading to reduced regulatory service costs.

To Understand More About this Research: Request a Free Sample Report

- For instance, in April 2023, PharmaLex agreed with Cpharm, which is a provider of pharmacovigilance services in Australia and New Zealand.

However, the regulatory affairs outsourcing market trends face significant challenges. One major concern is the risk associated with data security and system access. The potential loss of control and technological advances leading to pricing fluctuations pose key restraints for the growth of the market during the forecast period.

Industry Growth Drivers

- Increased fixed costs is projected to spur the product demand.

A significant driver for the regulatory affairs outsourcing market growth is the substantial increase in fixed costs associated with in-house resources for regulatory affairs and operational activities. The complexity and evolving nature of regulatory requirements demands continuous training, investment in technology, specialized knowledge, and facilities. Outsourcing regulatory affairs services helps companies navigate these challenges more efficiently, optimizing costs and resources.

Rising number of clinical trials is expected to drive regulatory affairs outsourcing market trends.

The increasing global count of clinical trials serves as a pivotal catalyst for the regulatory affairs outsourcing market growth. With a surge in research and development activities within the pharmaceutical and biotech sectors, there is a heightened need for regulatory support. The outsourcing of regulatory affairs services provides companies with the means to optimize approval processes, ensuring alignment with ever-evolving regulations across diverse regions.

Industry Challenges

Increasing data security risks is likely to impede the regulatory affairs outsourcing market growth opportunities.

A notable obstacle for the regulatory affairs outsourcing market forecast revolves around the inherent risk linked to data security and system access. Companies handling sensitive regulatory information encounter apprehensions related to the confidentiality and integrity of their data when opting for regulatory affairs outsourcing. It becomes imperative to establish robust security measures and ensure compliance with data protection regulations to navigate and address this constraint effectively.

Report Segmentation

The market is primarily segmented based on service, size of company, indication, product stage, end-user, and region.

|

By Service |

By Size of company |

By Indication |

By Product Stage |

By End-User |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Service Analysis

Legal representation segment is expected to witness highest growth during forecast period

The legal representation segment is projected to grow at a CAGR during the projected period in the market. Rising global demand for legal representatives, particularly due to the globalization of medical devices and pharmaceutical companies, drives the market. The regulatory landscape is intricate and constantly evolving.

By Size of Company Analysis

Medium size company segment is expected to dominate the market during forecast period

In 2023, the market share was predominantly influenced by medium size company, commanding a significant market share. The segment's share is expected to be influenced by the existence of numerous mid-sized established providers, particularly those privately held. Additionally, medium-sized pharmaceutical and medical device companies need more capital for establishing an in-house regulatory affairs team, thus amplifying the demand for regulatory affairs outsourcing within this sector.

By Indication Analysis

Immunology segment is expected to witness highest growth during forecast period

Immunology emerged as the dominant player in the indication segment. This is attributed to its potential in aiding the treatment of diverse cardiovascular, oncological, neurological, and inflammatory diseases. The strategic initiatives implemented by market players in the field of immunology are expected to support the growth of this segment.

By Product Stage Analysis

Preclinical segment is expected to witness highest growth during forecast period

The preclinical segment is projected to grow at a CAGR during the projected period in the market. The growth of the preclinical segment is driven by the escalating demand for novel treatments for diseases such as COVID-19, Zika virus, and Ebola, along with the increasing prevalence of existing conditions such as cancer, cardiovascular diseases (CVDs), and neurological disorders. Additionally, the stringent regulations pertaining to preclinical studies set by global regulatory bodies WHO, FDA, and others are fostering a heightened demand for regulatory affairs outsourcing agencies specialized in preclinical studies.

By End-User Analysis

Pharmaceutical companies segment is expected to dominate the market during forecast period

In 2023, the market share was predominantly influenced by pharmaceutical companies, commanding a significant market share. The expansion of this segment is attributed to the increasing focus on emerging areas like biosimilars, orphan drugs, and personalized medicines. These advancements generate a higher demand for regulatory services, consequently propelling the growth of this segment. Additionally, the substantial influx of new drugs into the pharmaceutical industry has further contributed to the positive momentum in segment growth.

Regional Insights

Asia-Pacific region dominated the global market in 2023

Asia-Pacific dominated the global market share in 2023 and is expected to continue to do so. The surge in clinical trials and the growing interest of companies in entering developing markets such as India and China contribute to this trend. Additionally, the presence of a skilled workforce in the region, offered at lower costs compared to the U.S., is another factor expected to drive growth in the regional market.

In the meanwhile, the North American regional market has also garnered a notable share in the global industry. The presence of major pharmaceutical and medical device companies, coupled with an increase in research and development (R&D) spending in the region, serves as key driving factors for the market in North America.

Key Market Players & Competitive Insights

The regulatory affairs outsourcing market companies is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Charles River Laboratories International, Inc.

- Criterium, Inc.

- Freyr Solutions

- ICON plc

- IQVIA

- Medpace Holdings, Inc.

- PAREXEL International Corporation

- PPD, Inc.

- ProductLife Group

- ProPharma Group

- PRA Health Sciences, Inc.

- QPS Holdings, LLC

- Rho, Inc.

- The Weinberg Group Inc.

- VCLS Regulatory

Recent Developments

- In May 2023, ProductLife Group (PLG), a worldwide provider of regulatory and compliance services for the life sciences industry, expanded its capabilities in supporting client Product Development activities. This is achieved through the merger of the Swiss-based company Cilatus BioPharma Consulting and the Irish-based entity Cilatus Manufacturing Services.

- In April 2022, VCLS entered into a collaboration with EC Innovations, a Chinese company providing global translation services with extensive experience in translating highly regulated life sciences and medical content. This strategic partnership aims to enhance the company's offerings and operational capabilities.

Report Coverage

The regulatory affairs outsourcing market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, service, size of company, indication, product stage, end-user, and their futuristic growth opportunities.

Regulatory Affairs Outsourcing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.20 billion |

|

Revenue forecast in 2032 |

USD 13.69 billion |

|

CAGR |

8.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in Regulatory Affairs Outsourcing Market are Freyr Solutions, ICON plc, IQVIA, Medpace Holdings, Inc., PAREXEL International Corporation

Regulatory Affairs Outsourcing Market exhibiting the CAGR of 8.4% during the forecast period.

The Regulatory Affairs Outsourcing Market report covering key segments are service, size of company, indication, product stage, end-user, and region.

key driving factors in Regulatory Affairs Outsourcing Market are Rising number of clinical trials is expected to drive regulatory affairs outsourcing market growth

The global regulatory affairs outsourcing market size is expected to reach USD 13.69 billion by 2032