RegTech Market Size, Share, Trends, Industry Analysis Report: By Deployment Type (Cloud and On-Premises), Application, Organization Size, Component, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Sep-2024

- Pages: 118

- Format: PDF

- Report ID: PM2919

- Base Year: 2023

- Historical Data: 2019-2022

RegTech Market Overview

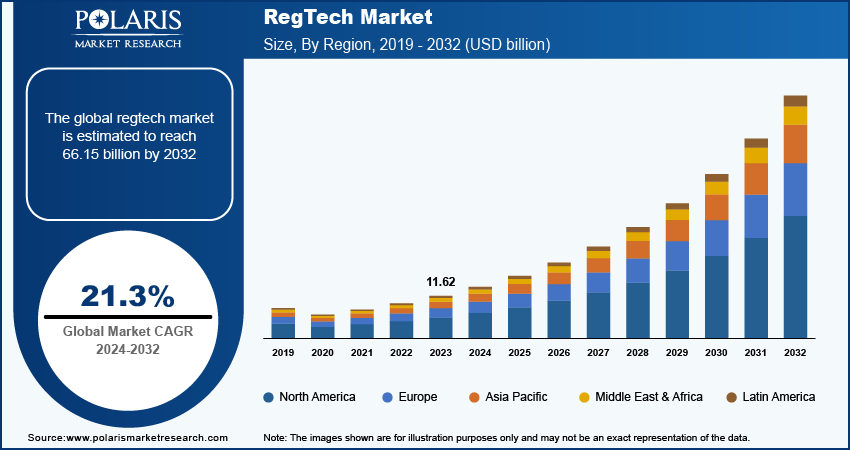

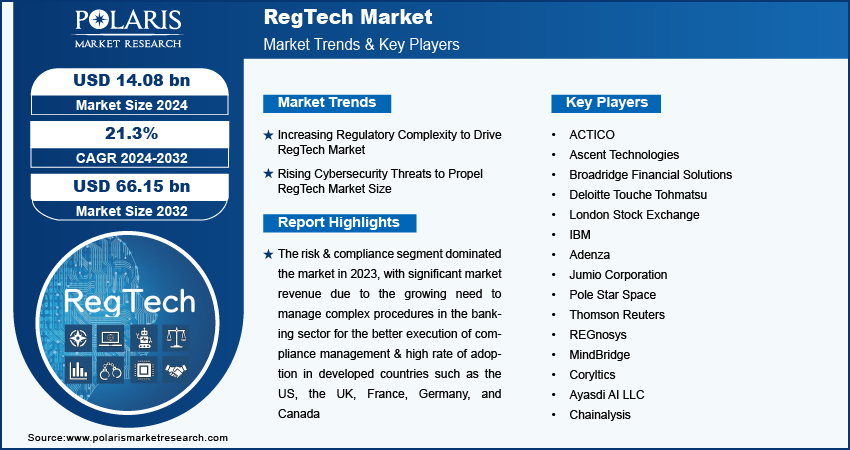

The RegTech market size was valued at USD 11.62 billion in 2023. The market is anticipated to grow from USD 14.08 billion in 2024 to USD 66.15 billion by 2032, exhibiting the CAGR of 21.3% during 2024–2032.

RegTech solutions provide automation, real-time monitoring, and fraud prevention, enabling companies to effectively manage risks and ensure compliance. The digital transformation of financial markets, accelerated by the COVID-19 pandemic, along with a heightened focus on Environmental, Social, and Governance (ESG) compliance, has driven demand for RegTech tools. Strong venture capital funding and regulatory support, including sandboxes for testing innovations, have further bolstered the market's expansion, making RegTech essential for businesses navigating complex regulatory landscapes.

Several key factors fuel the growth of the RegTech market, including the increasing complexity of regulatory compliance and the rising adoption of technological advancements such as artificial intelligence (AI), machine learning (ML), blockchain, and cloud computing. As evolving financial markets face mounting pressure to meet stringent global regulations, manual compliance processes are becoming increasingly expensive and inefficient. The automation of various operations, such as personnel monitoring, fraud prevention, compliance data management, and anti-money laundering, is expected to positively contribute to market growth in the coming years. In April 2024, Dot Compliance, a prominent RegTech startup, disclosed that it had secured USD 17.5 million in Series B funding round. The investment round was led by current investors IGP Capital and Vertex Ventures, with additional contributions from TPY Capital.

To Understand More About this Research:Request a Free Sample Report

Data security and privacy concerns are critical challenges in the RegTech space, since these solutions often handle a vast amount of sensitive financial and personal data. Capita, a UK-based outsourcing company that offers a range of services such as RegTech solutions, experienced a major cyberattack in April 2023. In the attack, they lost more than USD135.5 million. The breach compromised client data, including sensitive financial and regulatory information. This incident raised concerns about the security of third-party data as Capita collaborates with various financial institutions. The breach underscored the risks associated with depending on external vendors for compliance and data management services. Thus, to mitigate these concerns, RegTech providers and users are required to implement robust cybersecurity measures, adhere to data protection regulations, and continuously monitor for vulnerabilities since data security and privacy will remain central as RegTech market grows and evolves.

RegTech Market Drivers

Increasing Regulatory Complexity Drives RegTech Market

There is a rise in regulatory requirements and compliance standards across the world, which is driving the demand for RegTech solutions. Businesses face growing challenges related to anti-money laundering, know-your-customer (KYC) regulations, data privacy, and financial reporting. RegTech solutions that leverage technologies such as AI, ML, and blockchain are essential for automating compliance processes, reducing risks, and ensuring adherence to evolving regulatory practices. In February 2024, NAPIER AI secured USD 56 million in funding from Crestline Investors to support its ongoing expansion in AI-driven financial crime compliance. Napier unveiled the investment from Crestline Investors, an alternative asset manager based in the US, to further propel its growth momentum. This underscores the transformative period in the industry for KYC and AML solutions.

Increasing Cybersecurity Threats Propel RegTech Market Size

The rise in cyber threats in 2023 increased the demand for robust compliance and risk management solutions within the RegTech sector. Cyberattacks, including ransomware, phishing, and data breaches, became more advanced, posing serious risks to sensitive financial and personal data. Organizations prioritize RegTech platforms with advanced security features and real-time monitoring to guard against threats. For instance, ComplyAdvandage, an AI-driven fraud and anti-money laundering (AML) risk detection firm, introduced new security enhancements to its AML and Know-Your-Customer (KYC) solutions in January 2023. The updated platform now incorporates advanced AI-driven threat detection and real-time monitoring capabilities to more effectively identify and mitigate potential risks associated with cyber threats. Thus, increasing cybersecurity threats highlight the critical role of advanced technology in managing and mitigating cybersecurity risks, which propels the RegTech market size.

RegTech Market - Segment Insights

RegTech Market Breakdown – By Deployment Type

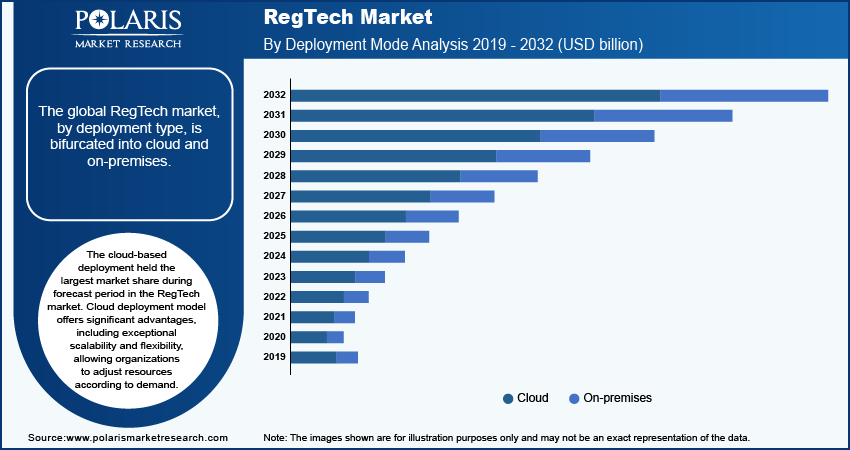

The global RegTech market, by deployment type, is bifurcated into cloud and on-premises.

The cloud-based deployment held the largest market share during forecast period in the RegTech market. Cloud deployment model offers significant advantages, including exceptional scalability and flexibility, allowing organizations to adjust resources according to demand. The cost-efficiency of cloud-based solutions is notable, as they eliminate the need for substantial upfront investments in hardware and shift to a subscription-based pricing model that aligns costs with usage. Furthermore, the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) with cloud-based solutions enables sophisticated features, including real-time risk monitoring and predictive analytics.

On-premises deployment involves running solutions on an organization's servers, providing greater control, customization, and enhanced data security. This segment remains relevant, especially for enterprises with specific security needs. However, its growth is slower than the cloud-based model, reflecting a shift toward more flexible and cost-effective cloud solutions.

In 2023, the RegTech market for the cloud segment experienced rapid growth. The market for the segment would grow at a significant compound annual growth rate (CAGR), reflecting its increasing adoption across various sectors, particularly in financial services where regulatory requirements are strict.

RegTech Market Breakdown – By Application

The RegTech market, by application, is bifurcated into risk & compliance, identity management, regulatory reporting, regulatory intelligence, AML and fraud management. The global RegTech market is divided into key application areas, each addressing specific regulatory and compliance needs. Risk and compliance solutions help organizations manage regulatory risks and ensure adherence to legal requirements by providing tools for monitoring and reporting risk exposures. Identity management focuses on verifying and managing identities to comply with Know Your Customer (KYC) and anti-fraud regulations, a segment experiencing rapid growth due to rising security demands. Regulatory Reporting automates the process of reporting to regulatory authorities, reducing complexity and costs for industries such as finance and healthcare. Regulatory intelligence offers up-to-date information on changes in laws and standards, helping businesses stay compliant by providing timely insights into new regulations and enforcement trends. Anti-money laundering (AML) and fraud management utilize advanced analytics and AI to detect suspicious activities and ensure compliance with AML regulations.

The risk & compliance segment dominated the market in 2023, with significant market revenue due to the growing need to manage complex procedures in the banking sector for the better execution of compliance management & high rate of adoption in developed countries such as the US, the UK, France, Germany, and Canada. In addition, the rising frequency of adoption of RegTech solutions into the existing technology platforms is projected to improve operational efficiency, financial transparency, and agility and lower the overall compliance costs of financial institutions.

The regulatory intelligence segment is likely to register the highest growth rate during the forecast period owing to a rapid increase in adoption across various fields such as banking, financial services, and insurance as it helps in monitoring, gathering, and analyzing and ease of tracking down the developments in a rapidly changing environment.

RegTech Market – By Organization Size

The RegTech market, by organization size, is bifurcated into large enterprises and small and medium-sized enterprises (SMEs). Large enterprises, in highly regulated sectors such as banking, financial services, and insurance, are the dominant adopters of RegTech solutions. These organizations face complex regulatory requirements due to their scale and international operations, driving the need for comprehensive compliance and risk management systems. By leveraging RegTech, large enterprises can automate compliance processes, reduce the risk of regulatory breaches, and improve operational efficiency with significant resources available. Large organizations are often early adopters of advanced technologies, including AI, ML, and cloud-based RegTech platforms.

SMEs are increasingly adopting RegTech solutions to address regulatory demands while minimizing costs. Many SMEs need more internal resources to manage compliance effectively and benefit from scalable, cloud-based solutions that offer affordability and ease of use. RegTech platforms provide these smaller organizations with the tools they need to remain compliant without the need for extensive in-house compliance teams. While large enterprises dominated the market in 2023, the adoption rate among SMEs is steadily increasing driven by the growing need for cost-effective, accessible compliance solutions.

RegTech Regional Insights

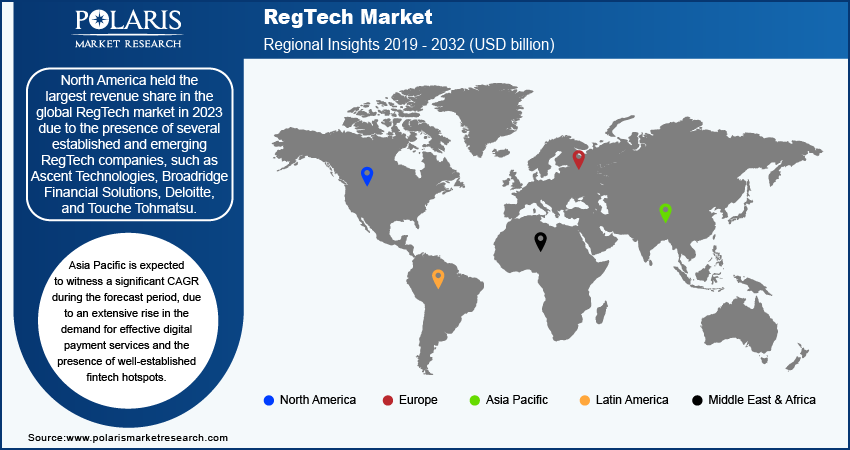

By region, the study provides the RegTech market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest revenue share in the global market due to the presence of several established and emerging RegTech companies. Also, the large number of financial institutions and regulatory bodies in the region creates a high demand for advanced regulatory technology solutions. The strict compliance requirements from agencies such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) have led to a widespread adoption of RegTech solutions in the US.

Goldman Sachs & Co. has settled charges with the Securities and Exchange Commission (SEC) for failing to provide complete and accurate securities trading information, also known as blue sheet data. The prominent financial institution has agreed to pay a USD 6 million penalty to resolve the SEC's allegations. Thus, the region's well-developed infrastructure that promotes technological advancements contributed to the dominance of North America in the global RegTech market.

Asia Pacific is expected to witness significant growth at the highest CAGR during the forecast period. An extensive rise in the demand for effective digital payment services, the presence of well-established fintech hotspots, and a growing emphasis on virtual currencies such as cryptocurrency mainly drive regional market growth.

In 2024, Fano Labs, a language AI solution provider, announced the successful closure of its series B funding round with HSBC for utilizing language AI to enhance compliance and customer experiences. Thus, the Asia Pacific RegTech market is anticipated to grow significantly over the next ten years.

RegTech Market – Key Players and Competitive Insights

The competitive landscape of the RegTech market is characterized by a diverse array of global and regional players striving to capture market share through innovation, strategic partnerships, and geographic expansion. Major players in the RegTech market include IBM, MetricStream, Thomson Reuters, and Broadridge Financial Solutions. The companies are developing innovative solutions that integrate AI, ML, and cloud technologies to streamline regulatory processes such as compliance management, risk management, and fraud prevention.

Competitive strategies often include mergers & acquisitions that are shaped by innovations in AI, ML, and blockchain technology, which streamline regulatory processes, risk management, and fraud detection. Major players in the RegTech market include ACTICO, Ascent Technologies, Broadridge Financial Solutions, Deloitte Touche Tohmatsu, London Stock Exchange, IBM, Jumio Corporation, Pole Star Space, Thomson Reuters, REGnosys, MindBridge, Coryltics, Ayasdi AI LLC., and Chainalysis.

Adenza, a software application provider based in the US and the UK, specializes in capital markets, investment management, central banking, risk management, clearing, collateral, and treasury and liquidity solutions. Previously known as AxiomSL and Calypso Technology, Adenza was acquired by Nasdaq Inc. in a $10.5 billion cash-and-stock deal in 2023. Following the acquisition, Adenza's management and sales team will be integrated into a newly formed financial technology division, which will join the market services and capital access platforms divisions as part of a restructured organization.

In a related development, the London Stock Exchange, a global provider of financial markets data and infrastructure, welcomed RegTech Open Project plc (RTOP) to its main market through a direct listing in August 2023. Founded in 2017, RTOP specializes in automating and optimizing regulatory compliance operations. Its SaaS-based Orbit Open Platform is widely utilized across sectors such as financial services, insurance, and telecommunications, boasting over 1,000 daily users. The listing is expected to facilitate RTOP's global expansion and enable investment in new markets, including the UK.

Key Companies in RegTech Market

- ACTICO

- Ascent Technologies

- Broadridge Financial Solutions

- Deloitte Touche Tohmatsu

- London Stock Exchange

- IBM

- Adenza

- Jumio Corporation

- Pole Star Space

- Thomson Reuters

- REGnosys

- MindBridge

- Coryltics

- Ayasdi AI LLC

- Chainalysis

RegTech Industry Developments

August 2024: Fortifai, a startup focused on automating and accelerating Environmental, Social, and Governance (ESG) regulatory compliance, announced its arrival with a USD 0.537 million funding round. It offers a continuous, real-time compliance management system that transforms sustainability into a strategic advantage rather than an annual checklist.

September 2024: Upsolve, a nonprofit financial education platform, secured USD 4.2 million Gates Foundation grant to launch financial counseling AI for low-income Americans. The aim is to revolutionize how financial guidance is delivered by analyzing individual user profiles to offer personalized advice on debt management, credit improvement, and accessing essential financial resources by integrating advanced AI technologies.

May 2023: ComplyAdvantage, a forerunner in financial crime intelligence, stepped up the fight against payment fraud with the launch of its novel AI-powered solution, Fraud Detection.

RegTech Market Segmentation

By Deployment Type Outlook, 2019–2032 (USD billion)

- Cloud

- On-Premises

By Application Type Outlook, 2019–2032 (USD billion)

- Risk & Compliance

- Identity Management

- Regulatory Reporting

- Regulatory Intelligence

- AML and Fraud Management

By Organization Size Outlook, 2019–2032 (USD billion)

- Large Enterprises

- SMEs

By Component Outlook, 2019–2032 (USD billion)

- Solution

- Services

By Region Outlook, 2019–2032 (USD billion)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

RegTech Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 11.62 billion |

|

Market Size Value in 2024 |

USD 14.08 billion |

|

Revenue Forecast in 2032 |

USD 66.15 billion |

|

CAGR |

21.3% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global RegTech market size was valued at USD 11.62 billion in 2023. The market is anticipated to grow from USD 14.08 billion in 2024 to USD 66.15 billion by 2032.

The global market is projected to register a CAGR of 21.3% during the forecast period.

North America accounted for the largest market share in 2023.

ACTICO, Ascent Technologies, Broadridge Financial Solutions, Deloitte Touche Tohmatsu, London Stock Exchange, IBM, Jumio Corporation, Pole Star Space, Thomson Reuters, REGnosys, MindBridge, Coryltics, Ayasdi AI LLC., and Chainalysis are a few key players in the market.

The risk & compliance management segment would record a significant CAGR in the market during the forecast period.