Regenerative Meat Market Share, Size, Trends & Industry Analysis Report

By Product (Beef, Venison, Pork, Others); By Sales Channel; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 116

- Format: pdf

- Report ID: PM3021

- Base Year: 2024

- Historical Data: 2020-2023

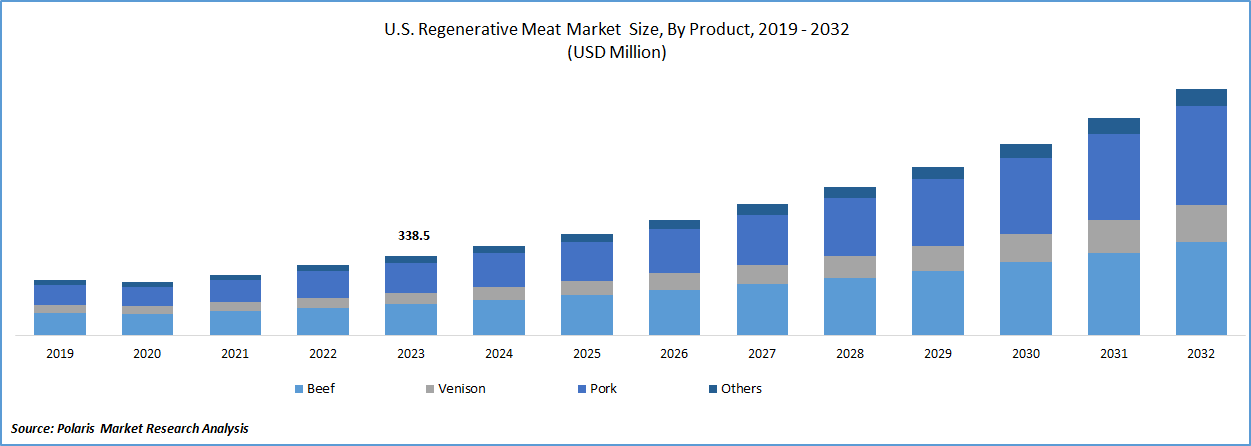

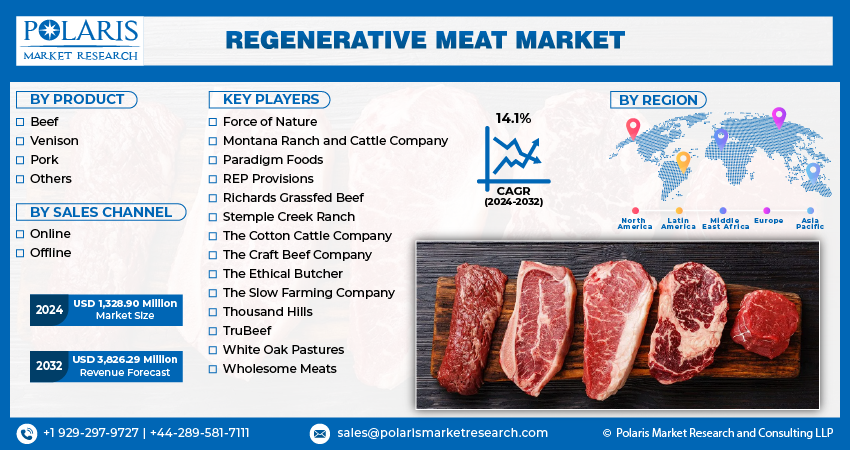

The global Regenerative Meat Market was valued at USD 1,236.9 million in 2024 and is expected to grow at a CAGR of 15.70% from 2025 to 2034. Consumer shift toward sustainable and ethically sourced protein sources is a major growth driver.

Industry Trend

The significant factors for the growth of regenerative meat farming contributed to the growing meat protein requirements across the globe and rising greenhouse gas emissions through traditional meat-producing methods.

The growing population across the globe requires abundant meat proteins, which forced cultivators to farm chickens, cows, and pork in an unsustainable way. Further, the availability of limited grazing lands and pastures has shifted the feeding patterns of animals towards artificially made feeds, increasing the carbon emissions to the environment. In the last decade, new agricultural practices like alternative proteins and regenerative meat farming have been practiced to create a sustainable food system globally. These practices aim to restore the ecosystem, enhance the soil organic matter and other depleting natural resources, and establish animal welfare.

To Understand More About this Research:Request a Free Sample Report

Regenerative practices allow livestock to graze upon green pasture land (regenerative ranching) instead of chemically composed feeds, making the meat more nutrient-rich. Regenerative meat farming is practiced on three broad principles: animal welfare, environment and soil health, and social fairness. Cultivators use rotational grazing and cover crop techniques to regenerate the beneficial microbes or biomass in soil and avoid using chemical-based fertilizers and genetically modified organisms to control weeds. For animal welfare, the cultivator must ensure a hygienic environment for rearing the farm animals.

The social fairness pillar provides the end consumers with good working conditions for producing meat for farm workers. Research shows that regenerative-farmed livestock lowers carbon emissions by drawing more carbon into the soil. For instance, as per the United States Environmental Protection Agency, around 24% of greenhouse gas emissions are contributed by the cultivation of crops and livestock. Further, estimates by the Food and Agricultural Organization (FAO) suggest that buffalo meat and beef meat are the major contributors of GHGs like CO2, with a value of approximately 404 kg and 295 kg of CO2-eq per kg of protein. Meat, milk from small ruminants, and buffalo milk remain in the following highest commodities for emissions for GHGs with averages of 201, 148, and 140 kg CO2-eq per kg of protein.

Further, grass-fed cows and beef meat provide excellent nutrients like vitamin E, vitamin B6, calcium, magnesium, iron, sodium selenium, and phosphorus and contain a good amount of brain-boosting omega-3 fatty acids. Force of Nature, a U.S.-based player, offers regenerative meat products of grass-fed beef, bison, elk, venison, chicken, wild boar, and pork. These animals are reared by feeding natural grasses without being given sub-therapeutic antibiotics and growth hormones. This regenerative rearing practice helps the soil to reabsorb the harmful carbons from the atmosphere and restores the nutrients in the meat products.

Key Takeaway

- North America dominated the largest market and contributed to more than 38% of the share in 2023.

- The Asia Pacific regenerative meat market is expected to be the fastest-growing CAGR during the forecast period.

- By product category, the beef segment accounted for the largest market share in 2024.

- By sales channel category, the online segment is projected to grow at the highest CAGR during the projected period.

What are the Market Drivers Driving the Demand for the Regenerative Meat Market?

Growing Consumer Demand for Sustainable and Ethically Produced Regenerative Meat.

Growing consumer demand for sustainable and ethically produced regenerative meat is one of the primary drivers of the regenerative meat market. Consumers are increasingly concerned about the environmental impact of traditional meat production and are seeking out meat products that are produced using sustainable and ethical practices. Regenerative meat, which is produced using practices that improve soil health, promote biodiversity, and support animal welfare, is seen as a more sustainable and ethical option. Consumers are becoming more aware of the environmental impact of industrial farming practices, including the use of synthetic fertilizers, pesticides, and antibiotics, which can lead to soil degradation, water pollution, and the development of antibiotic-resistant bacteria. As a result, there is a growing demand for meat products that are produced using regenerative agriculture practices, which prioritize soil health, biodiversity, and animal welfare. Regenerative agriculture practices involve a variety of techniques, such as rotational grazing, cover cropping, and composting that help to restore soil health and promote biodiversity. These practices also help to sequester carbon in the soil, which can help to mitigate climate change.

Additionally, regenerative meat producers often prioritize animal welfare, allowing animals to graze on pasture and live in natural environments, which is seen as more ethical by many consumers. Overall, the growing consumer demand for sustainable and ethically produced regenerative meat is driving innovation and growth in the regenerative meat market. As more consumers become aware of the benefits of regenerative agriculture and seek out regenerative meat products, we will likely see further growth and innovation in this market.

Which Factor is Restraining the Demand for the Regenerative Meat Market?

The High Cost of Regenerative Meat is Expected to Hinder the Growth of the Market.

Regenerative meat is often more expensive than conventionally produced meat due to the higher costs associated with sustainable and ethical farming practices. Regenerative agriculture practices, such as rotational grazing, cover cropping, and organic farming, require more labor and attention to detail than conventional farming methods. Additionally, regenerative farmers may pay higher prices for inputs such as organic feed and seeds and may need to invest in infrastructure such as fencing, watering systems, and soil amendments. These additional costs are passed on to the consumer, resulting in higher prices for regenerative meat products. While many consumers are willing to pay a premium for regenerative meat, the higher cost can be a barrier to entry for others. In order to make regenerative meat more accessible to a wider range of consumers, producers may need to explore ways to reduce costs without compromising on the principles of regenerative agriculture. This could include finding more efficient ways to distribute products, implementing technology to streamline farming operations, or exploring new business models such as direct-to-consumer sales.

Additionally, increased government support and subsidies for regenerative agriculture practices could offset some of the additional costs associated with sustainable and ethical farming. This could lead to lower costs for producers and consumers, making regenerative meat more accessible and affordable. Overall, reducing the cost of regenerative meat is an important challenge that must be addressed in order to promote the growth and expansion of the market.

Report Segmentation

The regenerative meat market is primarily segmented based on product, sales channel and region.

|

By Product |

By Sales Channel |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

Based on a product analysis, the regenerative meat market is segmented into beef, venison, pork, and others. The beef segment held the largest market share in 2023. Regenerative beef refers to beef produced through regenerative agriculture practices. Regenerative agriculture is an approach to farming that focuses on building and restoring soil health, increasing biodiversity, and reducing carbon emissions by mimicking natural ecosystems. Regenerative beef production involves raising cattle in a way that supports the health of the soil, grasses, and other plants, as well as the health and welfare of the animals. This typically includes practices such as rotational grazing, which involves moving cattle to different areas of the pasture to allow grasses to recover and prevent overgrazing, and avoiding the use of synthetic fertilizers and pesticides. The goal of regenerative beef production is to create a more sustainable and environmentally friendly food system while also producing high-quality beef that is rich in nutrients and free of harmful chemicals.

By Sales Channel Insights

Based on sales channel analysis, the regenerative meat market has been segmented on the basis of online, and offline. The online segment is expected to be the fastest-growing CAGR during the forecast period. There has been a significant growth in online sales of regenerative meat in recent years, as more consumers are seeking out sustainably and ethically produced meat products. Regenerative meat is produced using regenerative agriculture practices, which focus on improving soil health, promoting biodiversity, and reducing the environmental impact of meat production. Online sales platforms have made it easier for consumers to access regenerative meat products, as they can order directly from farms or from companies that specialize in regenerative meat. Many online retailers offer a wide range of regenerative meat products, including beef, pork, lamb, and poultry, which are produced using sustainable and ethical practices. One of the key benefits of online sales of regenerative meat is that it allows consumers to access meat products that may not be available in their local area. This is particularly important for consumers who are looking for specific types of meat, such as grass-fed beef or pasture-raised pork, which may be difficult to find in traditional grocery stores. Additionally, many online retailers offer detailed information about the farms and producers behind the regenerative meat products they sell. This can help consumers to make informed choices about the meat they are buying and to support farmers who are committed to sustainable and ethical practices.

Regenerative Meat Market Regional Insights

North America

The North American region accounted for the largest market share in 2023. North American consumers are increasingly aware of the impact of their food choices on the environment and are seeking out more sustainable options. This has led to an increased demand for regenerative meat products, particularly those produced using sustainable and ethical practices.

Many regenerative meat producers in North America are selling their products directly to consumers, either through farmers' markets, online sales, or on-farm sales. This allows consumers to learn more about the regenerative agriculture practices used to produce the meat and to support local farmers and food systems. Some regenerative meat producers are partnering with local retailers and restaurants to sell their products, which helps to increase the availability of regenerative meat products in local communities.

The North American regenerative meat market has seen increased investment and support from both government and private organizations. This has helped to fund research into regenerative agriculture practices and to support the growth of regenerative meat producers.

Asia Pacific

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The regenerative meat market in the Asia-Pacific (APAC) region is still in its early stages of development. Still, it is expected to grow in the coming years due to increasing consumer interest in sustainable and ethical food production. There is growing awareness among consumers in the APAC region about the environmental and social impacts of food production. Consumers are increasingly looking for meat products that are produced using sustainable and ethical farming practices. Several governments in the region, such as Australia and New Zealand, have implemented policies and initiatives to promote regenerative agriculture and sustainable food production. This support can incentivize farmers and producers to adopt regenerative practices and promote the growth of the regenerative meat market. There are several partnerships and collaborations between farmers, producers, and retailers in the APAC region that are aimed at promoting regenerative agriculture and sustainable food production. For example, some large retailers in Australia and New Zealand have partnered with farmers to develop regenerative meat supply chains.

Competitive Landscape

The regenerative meat market is an emerging sector within the broader food industry, characterized by its commitment to sustainable and environmentally friendly farming practices. The competitive landscape of this market is rapidly evolving as established meat producers, innovative startups, and technology companies vie for market share. Major players such as Tyson Foods and Cargill are investing heavily in regenerative agriculture techniques, recognizing the growing consumer demand for ethically produced meat.

Some of the major players operating in the global regenerative meat market include:

- Force of Nature

- Montana Ranch and Cattle Company

- Paradigm Foods

- REP Provisions

- Richards Grassfed Beef

- Stemple Creek Ranch

- The Cotton Cattle Company

- The Craft Beef Company

- The Ethical Butcher

- The Slow Farming Company

- Thousand Hills

- TruBeef

- White Oak Pastures

- Wholesome Meats

Recent Developments

- In May 2025, Hewitt Foods USA launched The Organic Meat Co., offering USDA-certified organic, grass-fed beef. Available in 193 GIANT Co. stores, the line supports health-conscious, sustainable, and regenerative farming practices.

- In January 2023, Thousand Hills Lifetime Grazed established two unique American Grassfed Association-certified, regenerative, completely cooked barbecue products.

- In March 2022, The Ethical Butcher launched a B2B wholesale business for the hospitality sector, which includes products such as beef, lamb, pork, poultry, and venison.

- In August 2021, Wholesome Foods expanded the regenerative meat portfolio to 14 H-E-B locations in San Antonio and Austin.

- In November 2020, Richards Grassfed Beef partnered with Country Archer Provisions, a grass-fed meat snack brand, to advance the impact of regenerative agriculture.

Report Coverage

The regenerative meat market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, sales channel, and their futuristic growth opportunities.

Regenerative Meat Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 1,431.00 million |

|

Revenue forecast in 2034 |

USD 5207.20 million |

|

CAGR |

15.70% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By Sales Channel and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key segments are form, product, application, and region.

Regenerative Meat Market Size Worth $ 5207.20 Million by 2034

The Regenerative Meat Market exhibiting a CAGR of 15.70% during the forecast period

North American is leading the global market.

Key driving factors regenerative meat market are Increasing government support for regenerative meat market