Refurbished Medical Imaging Equipment Market Size, Share, Trends, Industry Analysis Report: By Product (X-Ray Machines, MRI Systems, Ultrasound Systems, CT Scanners, and Nuclear Imaging), End-Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 118

- Format: PDF

- Report ID: PM1728

- Base Year: 2024

- Historical Data: 2020-2023

Refurbished Medical Imaging Equipment Market Overview

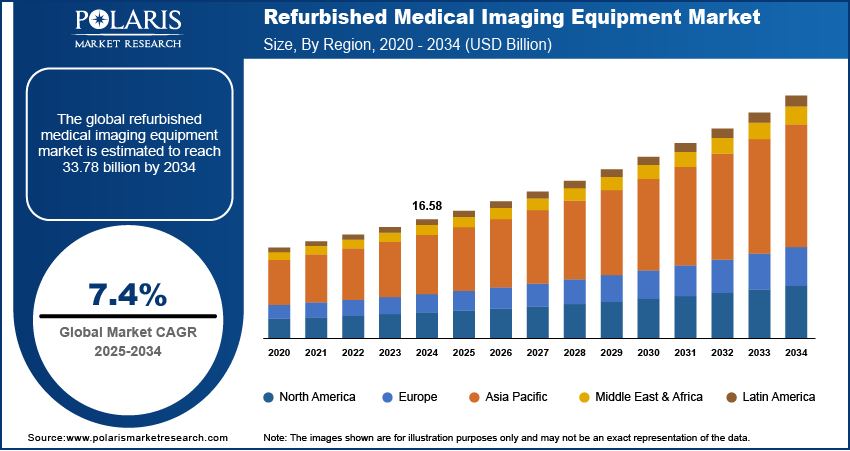

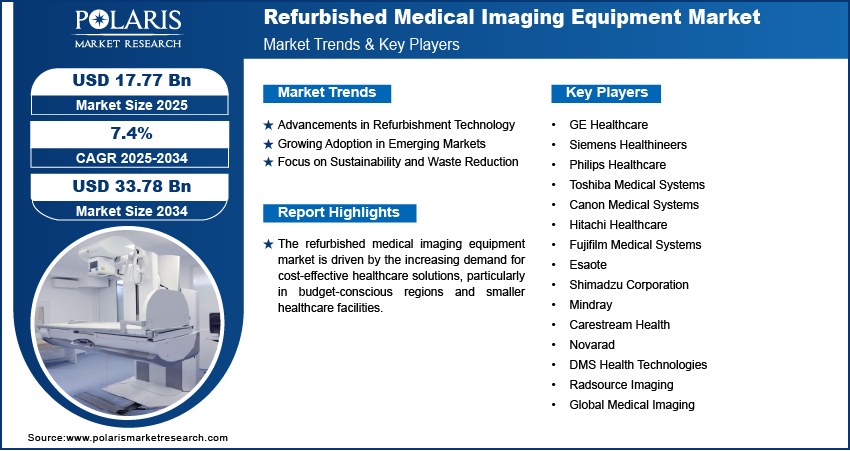

The global refurbished medical imaging equipment market size was valued at USD 16.58 billion in 2024. The market is projected to grow from USD 17.77 billion in 2025 to USD 33.78 billion by 2034, exhibiting a CAGR of 7.4% from 2025 to 2034.

The refurbished medical imaging equipment market involves the buying, selling, and use of pre-owned medical imaging devices that have been restored to a functional state. Refurbished equipment offers hospitals and healthcare providers a more budget-friendly alternative to purchasing new devices without compromising on quality. The refurbished medical imaging equipment market growth is driven by factors such as growing emphasis on cost-efficiency, the rising demand for affordable healthcare solutions, and the need to extend the lifespan of medical equipment. Key trends include advancements in refurbishment technology, increased adoption of refurbished equipment in emerging markets, and a rising focus on sustainability and reducing electronic waste. Additionally, regulatory standards and certifications play a crucial role in ensuring the safety and effectiveness of refurbished imaging equipment.

To Understand More About this Research: Request a Free Sample Report

Refurbished Medical Imaging Equipment Market Dynamics

Advancements in Refurbishment Technology

One of the major trends in the refurbished medical imaging equipment market is the continuous improvement in refurbishment technology. The process of restoring used equipment to its original functionality has advanced, with the integration of newer diagnostic capabilities and enhanced imaging features. These improvements allow refurbished equipment to provide near-new performance levels, making it more attractive to healthcare providers. Modern diagnostic imaging devices such as MRI machines, CT scanners, and ultrasound equipment are now refurbished using cutting-edge tools and technologies, ensuring reliability and accuracy. These technological advancements have led to the increasing acceptance of refurbished equipment in clinical settings, as it can meet the high standards required for patient care. Hospitals and diagnostic centers can now rely on refurbished devices that offer similar capabilities as new ones, at a fraction of the cost.

Growing Adoption in Emerging Markets

The adoption of refurbished medical imaging equipment has been particularly strong in emerging markets due to the increasing demand for affordable healthcare solutions. Countries in regions like Africa, Latin America, and parts of Asia face financial constraints in acquiring new medical technology, and refurbished devices present a cost-effective alternative. For instance, the healthcare systems in India, Brazil, and South Africa have witnessed a rise in the use of refurbished imaging equipment, driven by budget limitations and the need for high-quality diagnostic tools. These markets have also seen an increase in the establishment of local refurbishing centers, improving the availability and quality of refurbished products.

Focus on Sustainability and Waste Reduction

Another significant trend driving the refurbished medical imaging equipment market expansion is the growing emphasis on sustainability and reducing electronic waste. With increasing awareness of environmental concerns, hospitals and healthcare providers are turning to refurbished equipment as a means to minimize their carbon footprint. The medical industry is one of the largest consumers of electronic devices, and the disposal of outdated imaging equipment contributes to significant electronic waste. Refurbishing medical devices reduces the need for new manufacturing, conserving resources and reducing environmental impact. A report by the World Health Organization (WHO) highlights the importance of sustainable healthcare practices, noting that the reuse and refurbishment of medical equipment can play a critical role in addressing both financial and environmental challenges. Additionally, healthcare organizations are increasingly committed to corporate social responsibility (CSR) initiatives that include adopting eco-friendly practices, which further drive the demand for refurbished equipment.

Refurbished Medical Imaging Equipment Market Segment Insights

Refurbished Medical Imaging Equipment Market Evaluation Based on Product

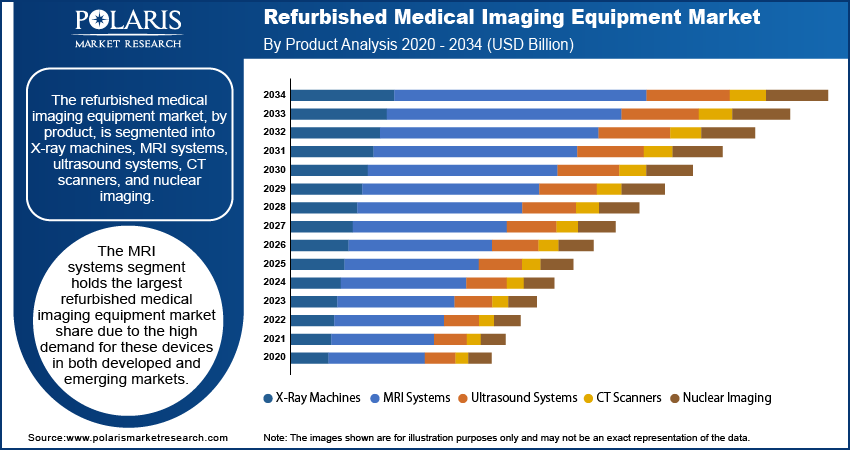

The refurbished medical imaging equipment market, by product, is segmented into X-ray machines, MRI systems, ultrasound systems, CT scanners, and nuclear imaging. The MRI systems segment holds the largest market share in the refurbished medical imaging equipment market due to the high demand for these devices in both developed and emerging markets. MRI systems are essential for diagnosing a wide range of conditions, including neurological disorders, musculoskeletal injuries, and cardiovascular diseases, making them a critical component in healthcare facilities. The significant cost reduction offered by refurbished MRI systems makes them highly attractive to hospitals and diagnostic centers looking to maintain advanced diagnostic capabilities while managing budgets. Additionally, advancements in MRI technology, coupled with improvements in the refurbishment process, have boosted the adoption of these systems. This segment is also witnessing the highest growth, driven by the growing prevalence of chronic diseases and the need for high-quality imaging in diagnostics.

The X-ray machines and ultrasound systems segments, while important, are growing at a relatively steady pace compared to MRI systems. X-ray machines, due to their fundamental role in medical imaging, continue to see consistent demand, particularly in emergency rooms, orthopedics, and dental clinics. Ultrasound systems, with their non-invasive nature and ability to perform real-time imaging, are widely used in obstetrics, gynecology, and cardiology. Although these segments remain vital, MRI systems are registering the highest growth due to their advanced capabilities, expanded use cases, and improvements in their refurbishment processes. Nuclear imaging and CT scanners are also witnessing moderate growth but do not yet match the rapid expansion seen in the MRI segment, partly due to higher costs associated with these systems, even when refurbished.

Refurbished Medical Imaging Equipment Market Assessment Based on End-Use

The refurbished medical imaging equipment market, by end-use, is segmented into hospitals and diagnostics imaging centers. The hospitals segment holds the largest market share in the refurbished medical imaging equipment market, driven by the high volume of diagnostic imaging procedures performed in hospital settings. Hospitals often have larger budgets for medical equipment, and refurbished imaging devices provide a cost-effective solution without compromising on the quality or performance needed for accurate diagnostics. The growth of this segment is also supported by the increasing number of hospitals upgrading their imaging technology to meet the demands of a growing patient base, especially in regions with expanding healthcare infrastructures. As hospitals focus on maintaining operational efficiency and controlling costs, they are turning to refurbished equipment as a way to reduce capital expenditure while preserving the accuracy and reliability of their diagnostic services.

The diagnostic imaging centers segment is registering the fastest growth in the market, driven by the increasing demand for specialized imaging services outside of hospital settings. These centers often focus on providing advanced imaging procedures, such as MRI, CT scans, and X-rays, on an outpatient basis. The growing preference for outpatient services, coupled with the rising demand for affordable diagnostic options, is fueling the adoption of refurbished medical imaging equipment in imaging centers. Additionally, due to their smaller size as compared to hospitals, imaging centers are more likely to opt for refurbished equipment to minimize initial investment costs while still offering high-quality services. This trend is particularly pronounced in emerging markets, where diagnostic imaging centers are proliferating to meet the healthcare needs of underserved populations.

Refurbished Medical Imaging Equipment Market Regional Analysis

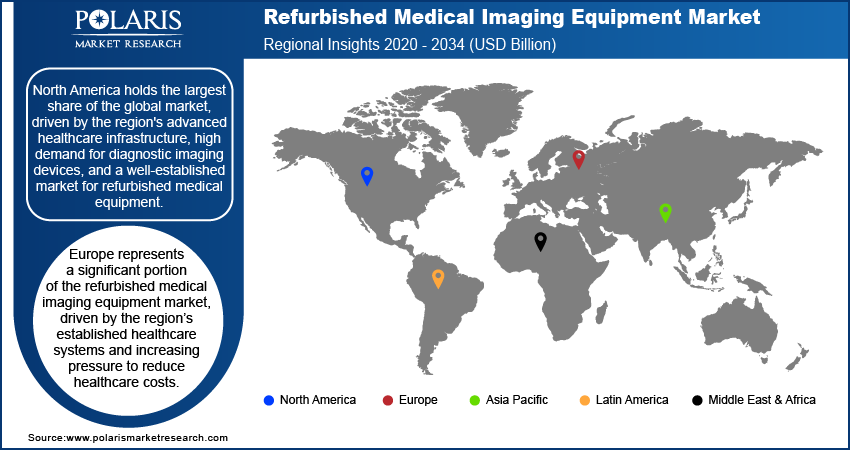

By region, the study provides the refurbished medical imaging equipment market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest refurbished medical imaging equipment market share, primarily due to the region's advanced healthcare infrastructure, high demand for diagnostic imaging devices, and a well-established market for refurbished medical equipment. The US, in particular, has a significant presence in the market, driven by the country's large number of healthcare facilities, stringent regulations ensuring the quality and safety of refurbished equipment, and cost-consciousness among hospitals seeking to reduce expenditures. Additionally, the adoption of refurbished imaging devices is supported by the increasing emphasis on sustainability and waste reduction in the healthcare sector. While Europe and Asia Pacific also exhibit considerable growth, North America's mature healthcare systems and high acceptance of refurbished equipment continue to position it as the leading region in the market.

Europe represents a significant portion of the refurbished medical imaging equipment market, driven by the region’s established healthcare systems and increasing pressure to reduce healthcare costs. Countries such as Germany, the UK, and France are key markets for refurbished medical imaging devices, where healthcare providers are seeking cost-effective solutions without compromising on the quality of diagnostic imaging. Europe’s strong regulatory framework, which ensures the safety and reliability of refurbished devices, further boosts market growth. In addition, the growing focus on sustainability and the need for medical equipment with lower environmental impact are contributing factors, as healthcare facilities aim to reduce electronic waste. The demand for refurbished equipment in Europe is also supported by the need for advanced imaging systems in regions with aging populations and rising chronic disease rates.

Asia Pacific is experiencing robust growth in the refurbished medical imaging equipment market, particularly in countries such as China, India, and Japan. This growth is primarily driven by the increasing healthcare demand, rising healthcare expenditure, and the need for cost-effective solutions in developing nations. The affordability of refurbished medical equipment makes it an attractive option in emerging markets like India, where budget constraints often limit access to new imaging devices. In developed markets such as Japan and Australia, refurbished equipment is gaining traction due to technological advancements in refurbishment processes and a focus on maintaining high-quality standards. Additionally, the region benefits from an expanding healthcare infrastructure, which includes hospitals and diagnostic centers that are increasingly adopting refurbished imaging equipment as a viable alternative to new devices.

Refurbished Medical Imaging Equipment Market – Key Players and Competitive Insights

Key players in the refurbished medical imaging equipment market include companies such as GE Healthcare, Siemens Healthineers, Koninklijke Philips N.V., Atlantis Worldwide, Block Imaging, Soma Technology, Integrity Medical Systems, Radiology Oncology Systems (ROS), EverX, and Avante Health Solutions. These companies are actively involved in the market, offering a variety of refurbished medical imaging equipment, including MRI machines, CT scanners, ultrasound systems, and X-ray machines. Some of these companies also provide comprehensive refurbishing services, ensuring that the equipment meets stringent safety and performance standards. Notably, companies like Carestream Health and Global Medical Imaging focus primarily on the refurbishment and resale of medical imaging equipment, while larger corporations such as Siemens Healthineers and GE Healthcare engage in both manufacturing and refurbishing operations.

The competitive landscape in the refurbished medical imaging equipment market is shaped by a mix of large manufacturers and specialized refurbishers. Large companies like GE Healthcare and Siemens Healthineers have a strong market presence due to their established brand reputation, extensive service networks, and ability to offer a wide range of imaging devices, both new and refurbished. On the other hand, specialized companies focusing solely on refurbished equipment, such as DMS Health Technologies and Radsource Imaging, cater to a specific niche, often providing more customized solutions and more affordable alternatives to larger hospital systems. These companies typically excel in offering comprehensive refurbishment services, including updates to older models to meet newer technological standards. Additionally, smaller refurbishers can often provide faster turnaround times and cost-effective pricing, making them competitive in emerging markets and regions with budget constraints.

In terms of market dynamics, the competition is driven by factors such as pricing, the quality of refurbished equipment, and after-sales support. Companies that offer transparent certification processes and adhere to regulatory standards gain a competitive edge. Moreover, players that can streamline the refurbishment process, reduce downtime for hospitals, and provide excellent customer support are well-positioned to attract repeat customers. The market is also evolving due to increasing demand from emerging economies, which has led to the expansion of refurbishing centers in regions like Asia Pacific and Latin America. In this context, companies that can effectively balance quality, cost, and geographic reach will be able to maintain a strong position in the market.

GE Healthcare is a significant player in the refurbished medical imaging equipment market. The company offers a wide range of refurbished devices, including MRI systems, CT scanners, and ultrasound machines, all of which undergo comprehensive testing and refurbishment to meet safety and performance standards. GE Healthcare has a well-established reputation for providing both new and refurbished equipment to healthcare facilities worldwide. The company also offers maintenance and technical support services for its refurbished devices.

Siemens Healthineers is another key player in the market, providing a broad portfolio of refurbished medical imaging equipment. Siemens Healthineers refurbishes products like MRI machines, CT scanners, and X-ray devices, ensuring they meet strict quality standards. The company is also focused on improving the accessibility of advanced imaging technology through cost-effective refurbished solutions.

List of Key Companies in Refurbished Medical Imaging Equipment Market

- GE Healthcare (GoldSeal program)

- Siemens Healthineers

- Koninklijke Philips N.V.

- Atlantis Worldwide

- Block Imaging

- Soma Technology

- Integrity Medical Systems

- Radiology Oncology Systems (ROS)

- EverX

- Avante Health Solutions

Refurbished Medical Imaging Equipment Industry Developments

- In October 2023, GE Healthcare announced an investment to expand its refurbishment facilities to meet the increasing demand for affordable medical imaging equipment in underserved regions, particularly in developing markets. This initiative is part of GE HealthCare's broader strategy to enhance access to quality healthcare through sustainable practices and support a circular economy in medical imaging.

- In September 2023, Siemens Healthineers launched a program aimed at increasing the availability of refurbished imaging equipment for smaller healthcare providers in Europe, helping them manage budget constraints while maintaining high-quality patient care.

Refurbished Medical Imaging Equipment Market Segmentation

By Product Outlook

- X-Ray Machines

- MRI Systems

- Ultrasound Systems

- CT Scanners

- Nuclear Imaging

By End-Use Outlook

- Hospitals

- Diagnostics Imaging Centers

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Refurbished Medical Imaging Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 16.58 billion |

|

Market Size Value in 2025 |

USD 17.77 billion |

|

Revenue Forecast by 2034 |

USD 33.78 billion |

|

CAGR |

7.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The refurbished medical imaging equipment market has been segmented into detailed segments of product and end-use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The growth and marketing strategy in the refurbished medical imaging equipment market focuses on offering cost-effective solutions without compromising quality, catering to budget-conscious healthcare providers. Companies are investing in advanced refurbishment technologies to enhance the performance and lifespan of devices, ensuring they meet high safety standards. Additionally, expanding service networks and providing comprehensive after-sales support help build customer trust and retention. The market is also shifting towards digital marketing and online platforms to reach healthcare providers in emerging markets, where affordability and accessibility are key drivers. Partnerships with local refurbishing centers and hospitals further strengthen market presence and improve distribution channels.

FAQ's

? The refurbished medical imaging equipment market size was valued at USD 16.58 billion in 2024 and is projected to grow to USD 33.78 billion by 2034.

? The market is projected to register a CAGR of 7.4% from 2025 to 2034.

? North America had the largest share of the market in 2024.

? Key players in the refurbished medical imaging equipment market include companies such as GE Healthcare, Siemens Healthineers, Koninklijke Philips N.V., Atlantis Worldwide, Block Imaging, Soma Technology, Integrity Medical Systems, Radiology Oncology Systems (ROS), EverX, and Avante Health Solutions.

? The MRI segment accounted for the largest market share in 2024.

? The hospitals segment accounted for the largest share of the market in 2024.

? Refurbished medical imaging equipment refers to pre-owned medical devices, such as MRI machines, CT scanners, X-ray machines, and ultrasound systems, that have been restored to a like-new condition. These devices undergo a thorough process of inspection, repair, and replacement of worn-out parts to meet strict safety, performance, and regulatory standards. After refurbishment, the equipment is tested to ensure it functions properly and is safe for use in medical settings. Refurbished medical imaging equipment offers a cost-effective alternative to purchasing new devices, while still providing reliable performance for hospitals and healthcare facilities.

? A few key trends in the refurbished medical imaging equipment market are described below: Advancements in Refurbishment Technology: Continuous improvements in refurbishment processes ensure that devices perform like new, enhancing their reliability and safety. Growing Adoption in Emerging Markets: Expansion of healthcare infrastructure in developing regions, coupled with budget constraints, drives demand for cost-effective refurbished equipment. Focus on Sustainability: Rising awareness of environmental concerns encourages the reuse and refurbishment of medical devices to reduce electronic waste. Regulatory Standards and Certification: Stringent regulations for refurbished equipment enhance their acceptance and ensure they meet safety and quality standards.

? A new company entering the refurbished medical imaging equipment market could focus on providing high-quality, cost-effective solutions by emphasizing stringent refurbishment processes and obtaining relevant certifications to build trust. It could differentiate itself by specializing in niche segments, such as offering customized upgrades or focusing on specific types of equipment like MRI or ultrasound systems. Additionally, investing in digital platforms for easy purchasing and after-sales support, along with expanding into emerging markets where demand for affordable healthcare solutions is rising, could help the company stay ahead of competitors. Offering fast turnaround times and robust customer service would further enhance its competitive edge.

? Companies distributing or purchasing refurbished medical imaging equipment and related products, and other consulting firms must buy the report.