Refractory Gout Market Size, Share, Trends, Industry Analysis Report: By Treatment Type (Biological and Non-Biological Treatments), Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 117

- Format: PDF

- Report ID: PM5327

- Base Year: 2024

- Historical Data: 2020-2023

Refractory Gout Market Overview

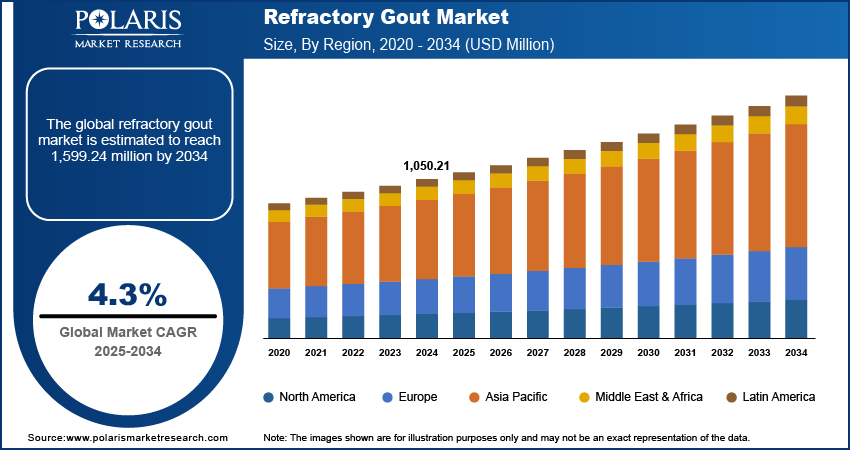

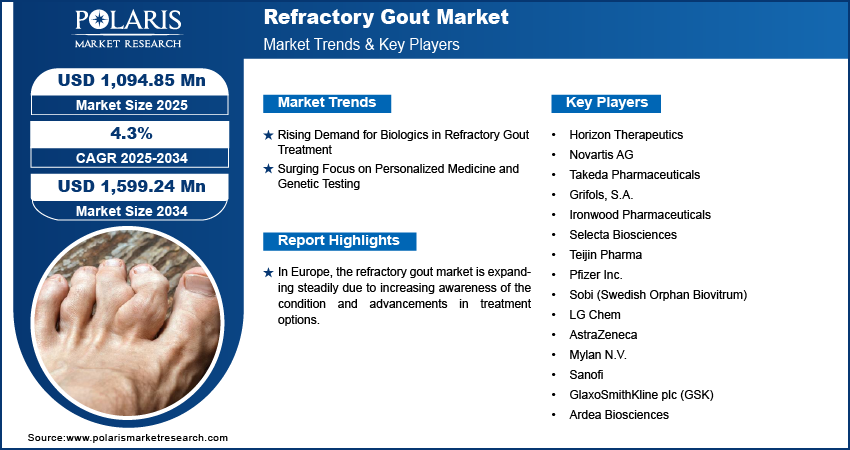

The global refractory gout market size was valued at USD 1,050.21 million in 2024. The market is projected to grow from USD 1,094.85 million in 2025 to USD 1,599.24 million by 2034, exhibiting a CAGR of 4.3% during 2025–2034.

The global refractory gout market, a segment of the pharmaceutical industry, focuses on treatments for gout that do not respond to conventional therapies. Gout, a form of inflammatory arthritis, becomes refractory when patients fail to achieve adequate symptom relief with standard urate-lowering medications. The increasing prevalence of gout due to lifestyle changes and aging populations and rising advancements in novel biologics and anti-inflammatory therapies drive the market growth. Future trends in the market are the growing demand for targeted treatments and the development of combination therapies aimed at addressing the unmet needs of patients affected by refractory gout.

To Understand More About this Research: Request a Free Sample Report

Refractory Gout Market Drivers and Trends

Rising Demand for Biologics in Refractory Gout Treatment

Biologics, such as IL-1 inhibitors and monoclonal antibodies, have emerged as effective treatment options for gout patients who do not respond to traditional urate-lowering therapies. These drugs target specific inflammatory pathways associated with gout, offering targeted relief. According to a study by the American College of Rheumatology, biologics have shown improved outcomes in managing gout flares and reducing uric acid levels in refractory patients. As the efficacy of these biologics becomes more evident, their demand in the refractory gout treatment market continues to grow.

Surging Focus on Personalized Medicine and Genetic Testing

The shift toward personalized medicine is gaining traction in the refractory gout market, driven by advancements in genetic testing and biomarker identification. According to the National Library of Medicine, research indicated that genetic variations, particularly in the urate transporter genes, play a crucial role in patients’ responses to gout medications. Identifying these genetic markers, healthcare providers tailor treatments to individual patients, improving the success rates of therapies. A study published in The Lancet highlights the role of genetic profiling in improving patient outcomes by matching the most appropriate treatment strategies to their genetic predispositions. This trend is expected to continue as personalized medicine evolves.

Growing Research in Combination Therapies

The development of combination therapies helps address the complex nature of refractory gout. Combination therapies aim to manage inflammation and uric acid levels, offering a multifaceted approach for patients who have failed to respond to monotherapies. Researchers are focusing on the simultaneous use of anti-inflammatory drugs alongside traditional urate-lowering agents to achieve better control over gout flares. According to the National Institute of Health, combination therapy approaches have shown positive results in reducing treatment resistance and improving patient outcomes, making them a focus of ongoing clinical trials and drug development. Therefore, the growing research in combination therapies is expected to emerge as a key future trend in the market.

Refractory Gout Market Segment Insights

Refractory Gout Market Assessment by Treatment Type Outlook

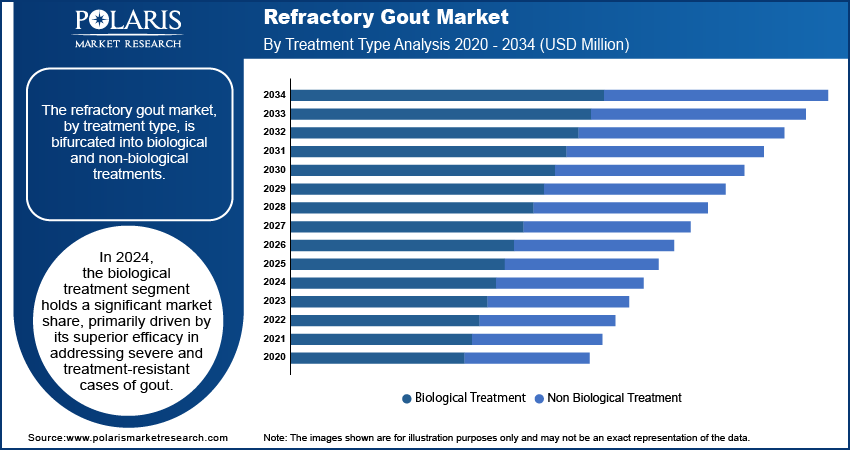

The refractory gout market, by treatment type, is bifurcated into biological and non-biological treatments. In 2024, the biological treatment segment holds a significant market share, primarily driven by its superior efficacy in addressing severe and treatment-resistant cases of gout, advancements in biologic therapies, and increasing acceptance among healthcare providers and patients. These treatments often target specific pathways of inflammation and uric acid regulation, making them a preferred choice for more complex cases.

Refractory Gout Market Evaluation by Distribution Channel Outlook

The refractory gout market, in terms of distribution channel, is segmented into hospitals and specialty clinics, retail pharmacies, and online pharmacies. The hospitals and specialty clinics segment is expected to witness significant growth over the forecast period, driven by the increasing prevalence of complex gout cases requiring specialized care, the availability of advanced treatment options in these settings, and a growing preference for professional medical management. Additionally, the integration of advanced technologies and a focus on improving patient outcomes further enhance the segment's appeal.

Refractory Gout Market Share, by Region

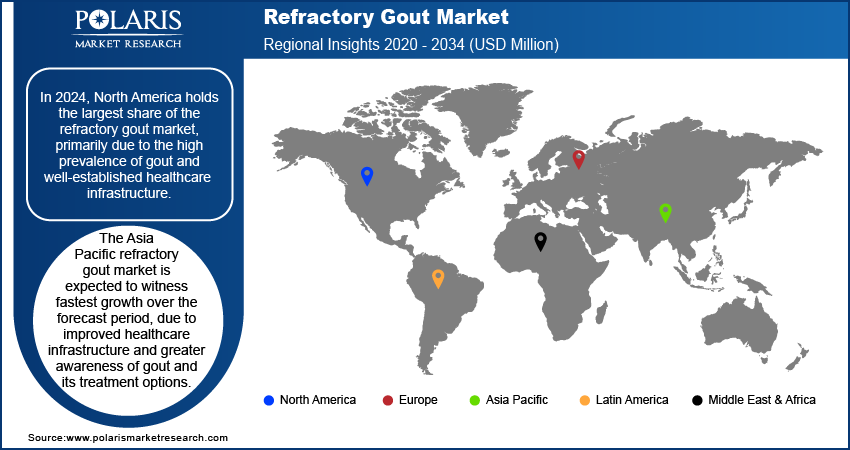

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America holds the largest share of the refractory gout market, primarily due to the high prevalence of gout and well-established healthcare infrastructure. The region’s advanced medical facilities, coupled with the availability of innovative biological therapies and strong research activities, drive its dominance. The US, in particular, has seen rising incidences of gout, driven by the adoption of unhealthy lifestyles and a rising aging population, which has led to increased demand for effective treatments. Europe follows closely, with a growing focus on personalized medicine and biological therapies, whereas the market in Asia Pacific is witnessing rapid growth due to improving healthcare systems and rising awareness of gout management.

In Europe, the refractory gout market is expanding steadily due to increasing awareness of the condition and advancements in treatment options. Countries such as Germany, France, and the UK are at the forefront of this growth, driven by their robust healthcare systems and increasing focus on research and development in biologics and anti-inflammatory therapies. Additionally, the rising prevalence of gout, especially among the aging population, has created a higher demand for specialized treatments in the region. The emphasis on personalized medicine and tailored therapeutic approaches is also fueling market expansion in Europe.

The Asia Pacific refractory gout market is expected to witness fastest growth over the forecast period, due to improved healthcare infrastructure and greater awareness of gout and its treatment options. Countries such as China, Japan, and India are seeing a rising number of gout cases, influenced by changes in diet and lifestyle, along with an aging demographic. Governments of the region are increasingly focusing on improving access to healthcare and modern therapies, which is contributing to the market’s growth. Asia Pacific also benefits from a growing middle-class population, which is driving demand for better medical treatments and innovative therapeutic options for refractory gout.

Refractory Gout Market – Key Players and Competitive Analysis Report

Key players active in the refractory gout market include Horizon Therapeutics; Novartis AG; Takeda Pharmaceuticals; Grifols, S.A.; Ironwood Pharmaceuticals; Selecta Biosciences; and Teijin Pharma. Other significant players are Pfizer Inc., Sobi (Swedish Orphan Biovitrum), LG Chem, AstraZeneca, Mylan N.V., Sanofi, GlaxoSmithKline plc (GSK), and Ardea Biosciences. These companies are involved in the development and distribution of advanced gout treatments, particularly biologics and novel anti-inflammatory therapies targeting refractory cases.

Horizon Therapeutics has a strong presence with its innovative biologic, Krystexxa, designed for patients suffering from uncontrolled gout, contributing to its active participation in this space. Novartis and AstraZeneca are making strides in anti-inflammatory treatments for refractory gout, while companies such as Sobi and Selecta Biosciences are focusing on developing new therapeutic options for patients who have not responded to conventional treatments. Their advancements in biologics and targeted therapies have allowed them to capture substantial market attention, driving competition.

The competition in the market revolves around the development of innovative treatments that can provide more effective management of refractory gout. Companies are increasingly investing in R&D to address the unmet needs of patients, particularly with biologic therapies that target specific pathways of inflammation. The market sees competition primarily in drug efficacy, safety profiles, and patient outcomes, with firms striving to differentiate their products through clinical trials and improved therapeutic results. This ongoing competition is expected to drive innovation and advancements in refractory gout management.

Horizon Therapeutics, a player in the refractory gout market, is particularly known for its biologic therapy, Krystexxa. The therapy is designed to treat patients affected by uncontrolled gout. The company focuses on research and development to improve therapeutic options for individuals who do not respond to traditional treatments.

Novartis AG is another global company in the market with a broad portfolio of treatments for various inflammatory diseases, including refractory gout. The company has been focusing on developing therapies that target specific inflammatory pathways, improving outcomes for gout patients.

Key Companies in Refractory Gout Market

- Horizon Therapeutics

- Novartis AG

- Takeda Pharmaceuticals

- Grifols, S.A.

- Ironwood Pharmaceuticals

- Selecta Biosciences

- Teijin Pharma

- Pfizer Inc.

- Sobi (Swedish Orphan Biovitrum)

- LG Chem

- AstraZeneca

- Mylan N.V.

- Sanofi

- GlaxoSmithKline plc (GSK)

- Ardea Biosciences

Refractory Gout Industry Developments

- In August 2023, Novartis announced the expansion of its clinical trials for its IL-1β inhibitor, Canakinumab, which has shown promise in managing gout and other inflammatory conditions, further advancing its position in the market.

- In May 2023, Horizon Therapeutics announced positive results from its MIRROR study, highlighting the efficacy of Krystexxa in combination with immunomodulation for refractory gout patients.

Refractory Gout Market Segmentation

By Treatment Type Outlook (Revenue USD Million, 2020–2034)

- Biologics

- Pegloticase (Krystexxa)

- Canakinumab

- Non-Biologics

- NSAIDs

- Corticosteroids

- Colchicine

- Uricosurics (e.g., probenecid)

By Distribution Channel Outlook (Revenue USD Million, 2020–2034)

- Hospitals and Specialty Clinics

- Retail Pharmacies

- Online Pharmacies

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Refractory Gout Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,050.21 million |

|

Market Size Value in 2025 |

USD 1,094.85 million |

|

Revenue Forecast by 2034 |

USD 1,599.24 million |

|

CAGR |

4.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global refractory gout market size was valued at USD 1,050.21 million in 2024 and is projected to grow to USD 1,599.24 million by 2034.

The global market is projected to register a CAGR of 4.3% during the forecast period.

In 2024, North America accounted for the largest share of the global market due to the high prevalence of gout and well-established healthcare infrastructure.

Key players active in the refractory gout market are Horizon Therapeutics; Novartis AG; Takeda Pharmaceuticals; Grifols, S.A.: Ironwood Pharmaceuticals; Selecta Biosciences; and Teijin Pharma. Other significant players are Pfizer Inc., Sobi (Swedish Orphan Biovitrum), LG Chem, AstraZeneca, Mylan N.V., Sanofi, GlaxoSmithKline plc (GSK), and Ardea Biosciences.

In 2024, the biological treatment segment accounted for the significant share in the refractory gout market, driven by its superior efficacy in addressing severe and treatment-resistant cases of gout.

The hospitals and specialty clinics segment is expected to witness significant growth over the forecast period, driven by the increasing prevalence of complex gout cases requiring specialized care.

Refractory gout is a severe form of gout where patients do not respond adequately to standard treatments, such as urate-lowering medications and anti-inflammatory drugs. This condition results in persistent inflammation and pain despite conventional therapy, requiring alternative or more advanced treatment options to manage symptoms effectively.

A few key trends in the refractory gout market are described below: Increasing Adoption of Biologics: The use of biologic therapies, such as IL-1 inhibitors and monoclonal antibodies, is rising due to their effectiveness in managing refractory gout. Growth in Personalized Medicine: Advances in genetic testing and biomarker identification are leading to more personalized and targeted treatment approaches for refractory gout. Development of Combination Therapies: There is a growing focus on combining anti-inflammatory drugs with urate-lowering therapies to address refractory gout more effectively. Expansion of Patient Access Programs: Companies are enhancing patient access through support programs and favorable reimbursement policies to improve treatment adherence and outcomes.

A new company entering the refractory gout market must focus on developing innovative therapies that address unmet needs, particularly by leveraging advances in biologics and targeted treatments. Investing in research to create combination therapies that offer improved efficacy and safety profiles could provide a competitive edge. Additionally, prioritizing personalized medicine through genetic testing and biomarker-driven approaches can enhance treatment precision.

Companies offering refractory gout treatment solutions and other related offerings, healthcare providers, and other consulting firms must buy the report.