Refinery Catalyst Market Size, Share, Trends, & Industry Analysis Report

Product (Chemical Compounds, Zeolites), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 119

- Format: PDF

- Report ID: PM3230

- Base Year: 2024

- Historical Data: 2020-2023

What is the Refinery Catalyst Market Size?

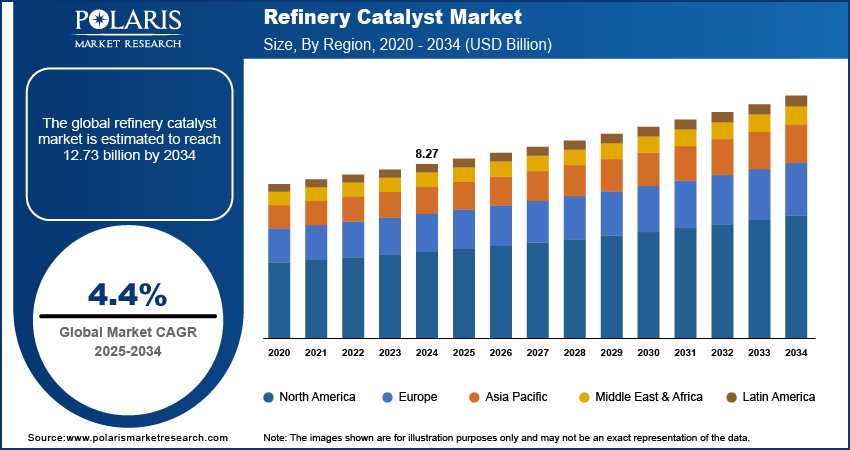

The global refinery catalyst market was valued at USD 8.27 billion in 2024 and is expected to grow at a CAGR of 4.4% during the forecast period. The growth is driven by increase in demand for fuel and chemical, and need for cleaner and more efficient refining processes.

Key Insights

- The zeolites segment is expected to witness significant growth during the forecast period due to its unique crystalline structure.

- The FCC catalysts dominated with largest share in 2024 due to the increasing demand from petroleum refining industry.

- Asia Pacific dominated with largest share in 2024 due to the rapid industrialization and urbanization.

- North America is projected to accounted for a significant share in the global market driven by increasing demand for cleaner and more efficient fuels.

Industry Dynamics

- The increase in demand for fuel and chemicals is fueling the industry growth.

- Rising need for cleaner and more efficient refining processes is driving the growth.

- The advancement in catalyst technology is boosting the industry growth.

- Increasing shift toward renewable energy and electric vehicles is limiting the long term growth.

Market Statistics

- 2024 Market Size: USD 8.27 Billion

- 2034 Projected Market Size: USD 12.73 Billion

- CAGR (2025-2034): 4.4%

- Largest Market: Asia Pacific

To Understand More About this Research: Request a Free Sample Report

Refinery catalysts are essential components used in the production of fuels and chemicals from crude oil. The primary function of these catalysts is to speed up the chemical reactions that occur during the refining process. Catalysts play a critical role in optimizing refinery processes, improving product quality, and reducing the environmental impact of refining operations. The use of refinery catalysts has become a common practice in the refining industry, and continuous innovations in this field have led to the development of new and improved catalysts.

One such new technology that has been developed in recent years is the use of nanotechnology in refinery catalysts. Nanotechnology refers to the manipulation and control of matter on a nanoscale, which is approximately one billionth of a meter. This technology has opened up new possibilities in the design and development of catalysts, allowing for the creation of highly efficient and selective catalysts with improved properties. One example of a nanotechnology-based catalyst is zeolite. Zeolites are a type of porous, crystalline material that has a wide range of industrial applications. They are commonly used in catalysis, adsorption, and separation processes in the refining industry. The use of nanoscale zeolites has been shown to improve the activity, selectivity, and stability of catalysts, leading to improved efficiency in refinery processes. Another application of nanotechnology in refinery catalysts is the development of bimetallic catalysts. Bimetallic catalysts are composed of two different metals that work together to enhance the performance of the catalyst. The use of nanotechnology in the synthesis of bimetallic catalysts has led to the creation of highly active and selective catalysts with improved properties such as increased surface area and better control of the reaction environment.

Industry Dynamics

What Factors are Driving the Refinery Catalyst?

Refinery catalysts have numerous industrial applications and are essential components of the refining process. The global market for refinery catalysts is expected to grow significantly in the coming years due to various growth drivers.

One of the primary growth drivers for the refinery catalyst market is the increasing demand for fuels and chemicals. The demand for energy and chemical products grows as the global population continues to grow. Refinery catalysts are used in the production of fuels and chemicals, making them a critical component in meeting this growing demand.

Another growth driver is the need for cleaner and more efficient refining processes. The use of catalysts in refining improves the efficiency of the process, leading to reduced energy consumption and lower emissions. Additionally, stricter environmental regulations are driving the adoption of cleaner technologies, such as the use of catalysts in refining operations.

Advancements in catalyst technology are further driving market growth. Continuous innovations in catalyst design and development have led to the creation of new and improved catalysts with improved properties such as higher activity, selectivity, and stability. These advanced catalysts help refineries to optimize their processes, reduce costs, and improve product quality.

The growing trend towards biofuels and renewable energy is also driving the demand for refinery catalysts. The production of biofuels requires the use of catalysts to convert raw materials into usable fuels. Catalysts are also used in the production of renewable chemicals and materials, making them an essential component of the growing renewable energy industry.

Report Segmentation

The market is primarily segmented based on Product, Application, and region.

|

By Product |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Which Segment by Product is Expected to Witness Fastest Growth?

The zeolites segment is expected to experience the fastest growth during the forecast period. Zeolites are microporous materials that have a unique crystalline structure, which makes them ideal for use in catalysts. The growth in demand for zeolites is attributed to their excellent catalytic properties, such as high activity, selectivity, and stability. The increasing demand for high-quality fuels and stricter regulations on emissions is driving the demand. The use of zeolites in refinery catalysts help reduce the emissions of pollutants such as sulfur and nitrogen oxides, which are harmful to the environment and human health. Furthermore, zeolites are more cost-effective compared to other catalysts, such as precious metals, which also makes them an attractive option for refineries. The growing demand for zeolites in the refining industry is also due to their ability to improve the yield of high-quality fuels while reducing the production of unwanted by-products, thereby driving the segment growth.

Why FCC Catalysts Accounted for Largest Market Share?

The FCC catalysts segment accounted for the largest market share in 2024. FCC (Fluid Catalytic Cracking) catalysts are widely used in the petroleum refining industry for the production of gasoline and other fuels. The growth in demand for FCC catalysts is attributed to their ability to improve the efficiency of the refining process and to produce higher quality fuels. The use of FCC catalysts in the petroleum refining industry has become increasingly important as the demand for cleaner and more efficient fuels continues to grow. FCC catalysts are used in the fluid catalytic cracking process, which is a crucial step in the production of gasoline from crude oil. This process helps to break down larger hydrocarbons into smaller ones that are more suitable for use in gasoline. The demand for FCC catalysts is also driven by the increasing demand for gasoline and other fuels in developing countries such as China and India. These countries are experiencing rapid economic growth and urbanization, which has led to an increase in the demand for transportation fuels. FCC catalysts help refineries meet this demand by producing higher yields of gasoline and other fuels. Furthermore, FCC catalysts are constantly being improved and developed to meet the changing demands of the petroleum refining industry. For example, there is a growing demand for low-sulfur fuels, which has led to the development of FCC catalysts that can produce fuels with lower sulfur content, thereby fueling the segment growth.

How Asia Pacific Dominated in 2024?

The Asia Pacific dominated with the largest share in 2024 due to rising industrialization and urbanization. The number of industries in developing countries such as India, Taiwan, and Philippines is rising rapidly due to less operational expenses and government support. This rise in the number is fueling the demand for the petroleum products. Consequently, driving the demand for the petroleum catalyst. Moreover, growing urbanization in the region is fueling the infrastructure growth and demand for personal vehicles, which in turn is driving the demand for the petroleum products for meet the energy needs. The integration of renewable energy and electric vehicles in traditional infrastructure and fleet is still less in the region due to which the demand for petroleum products in the region are consistently high, thereby driving the region’s dominance.

What is the Reason for North America's Significant Growth?

The North America is expected to witness significant growth during the forecast period. The growth in demand is attributed to the increasing demand for cleaner and more efficient fuels, as well as the expansion of the petroleum refining industry in the region. North America is one of the largest consumers of petroleum products, and the demand for high-quality fuels is expected to continue to grow in the region. Furthermore, the petroleum refining industry in North America is expanding, with several new refineries being constructed and existing refineries undergoing upgrades and modernization. This is expected to further drive the demand for refinery catalysts in the region. Moreover, the North American region has been witnessing stricter environmental regulations aimed at reducing emissions from the petroleum refining industry. The increasing regulatory pressure on the industry to reduce emissions is expected to further drive the demand for refinery catalysts in the region.

Competitive Insight

Some of the major players operating in the global market include Chevron Corporation; Exxon Mobil Corporation; Evonik Industries AG; DuPont; Haldor Topsoe A/S; Albemarle Corporation; BASF SE; Johnson Matthey Plc; W. R. Grace; Clariant International Ltd.; Arkema; Zeolyst International.

Recent Developments

- October 2025, Clariant launched its AddWorks titanium‑based catalyst for polyester production at K 2025, introducing a high‑performance, antimony‑free solution that cuts energy use and enhances sustainability across polyester manufacturing.

- April 2025, Clariant partnered with Technip Energies to launch the StyroMax UL-100 catalyst, enabling styrene producers to achieve unprecedented energy efficiency with ultra-low steam-to-oil ratios, significantly reducing energy use and emissions.

Global Refinery Catalyst Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.27 billion |

| Market size value in 2025 | USD 8.63 billion |

|

Revenue forecast in 2034 |

USD 12.73 billion |

|

CAGR |

4.4% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Chevron Corporation; Exxon Mobil Corporation; Evonik Industries AG; DuPont; Haldor Topsoe A/S; Albemarle Corporation; BASF SE; Johnson Matthey Plc; W. R. Grace; Clariant International Ltd.; Arkema; Zeolyst International |

FAQ's

The Global refinery catalyst market size is expected to reach USD 12.73 billion by 2034

Key players in the refinery catalyst market are Chevron Corporation; Exxon Mobil Corporation; Evonik Industries AG; DuPont; Haldor Topsoe A/S; Albemarle Corporation; BASF SE; Johnson Matthey Plc.

North America contribute notably towards the global refinery catalyst market.

The global refinery catalyst market expected to grow at a CAGR of 4.4% during the forecast period.

The refinery catalyst market report covering key segments are product, application, and region.