Redispersible Polymer Powder Market Size, Share, Trends, Industry Analysis Report: By Type, Application, End Use (Residential, Commercial, and Industrial), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 125

- Format: PDF

- Report ID: PM5481

- Base Year: 2024

- Historical Data: 2020-2023

Redispersible Polymer Powder Market Overview

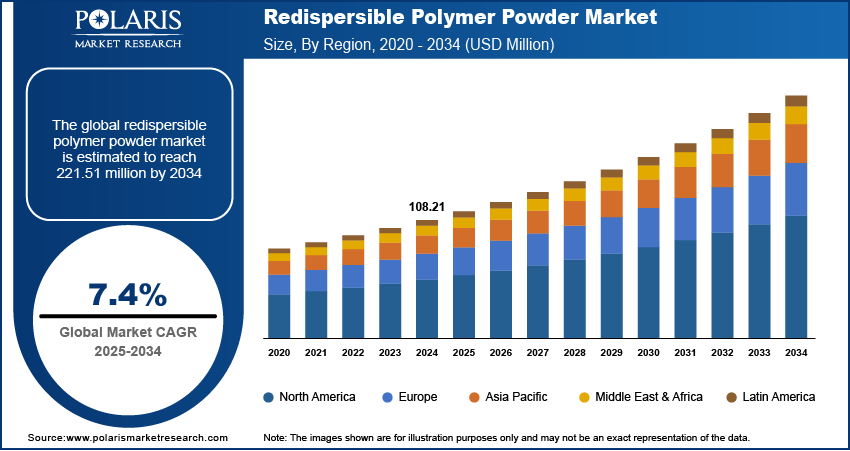

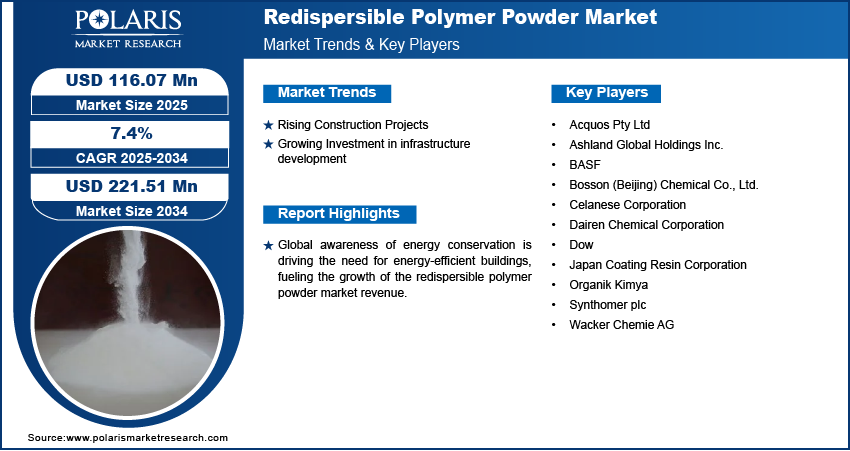

The global redispersible polymer powder market size was valued at USD 108.21 million in 2024. The market is projected to grow from USD 116.07 million in 2025 to USD 221.51 million by 2034, exhibiting a CAGR of 7.4% from 2025 to 2034.

Redispersible polymer powder is a dry, powdered form of a polymer that can be re-dispersed into water to form a liquid emulsion. It is commonly used in construction materials like adhesives, plasters, and coatings to enhance their performance and workability.

Energy efficiency has become a growing priority in modern construction, leading to increased demand for redispersible polymer powders. These powders are essential in thermal insulation systems (ETICS), which reduce energy consumption by enhancing insulation properties. Redispersible polymer powders improve the flexibility, adhesion, and water resistance of insulation materials, which are crucial for maintaining comfortable indoor temperatures and lowering heating and cooling costs. Additionally, global awareness of energy conservation is driving the need for energy-efficient buildings, fueling the growth of the redispersible polymer powder market revenue.

To Understand More About this Research: Request a Free Sample Report

Advancements in product formulations are driving the redispersible polymer powder market growth. Manufacturers are developing environmentally friendly versions of these powders, featuring benefits like low volatile organic compound (VOC) emissions and a reduced environmental impact. These innovations meet the growing demand for sustainable and eco-friendly construction materials. New formulations are also more cost-effective and deliver improved performance in specific applications, making them highly attractive to customers in the construction industry, thereby fueling the demand for redispersible polymer powder.

Redispersible Polymer Powder Market Dynamics

Rising Construction Projects

The growth of residential and commercial construction worldwide is driving the demand for redispersible polymer powders. According to the US Census Bureau, in January 2025, 1,651,000 new construction projects were completed in the US alone. These powders are incorporated into various construction materials, including adhesives, paints, and coatings, to improve their performance. They improve the bonding strength of tile adhesives, ensuring tiles stay firmly attached to surfaces. In commercial buildings, they help in the development of high-performance materials used in floors, walls, and facades. The demand for high-quality materials containing redispersible polymer powders is rising with the increase in both residential and commercial building projects, thereby fueling the redispersible polymer powders market expansion.

Growing Investment in Infrastructure Development

Rising investments in infrastructure development are fueling the need for redispersible polymer powders. Governments worldwide are investing in large-scale projects such as bridges, roads, railways, and airports, leading to increased demand for advanced construction materials that ensure durability and strength. For instance, according to the USAFacts, the US government invested USD 44.8 billion in infrastructure development in 2023. Redispersible polymer powders play a vital role in these projects by enhancing the adhesion, flexibility, and resistance of materials like cement and concrete. Thus, the rising infrastructure investment is driving the demand for redispersible polymer powders, thereby contributing to the redispersible polymer powder market development.

Redispersible Polymer Powder Market Segment Insights

Redispersible Polymer Powder Market Assessment by End Use Outlook

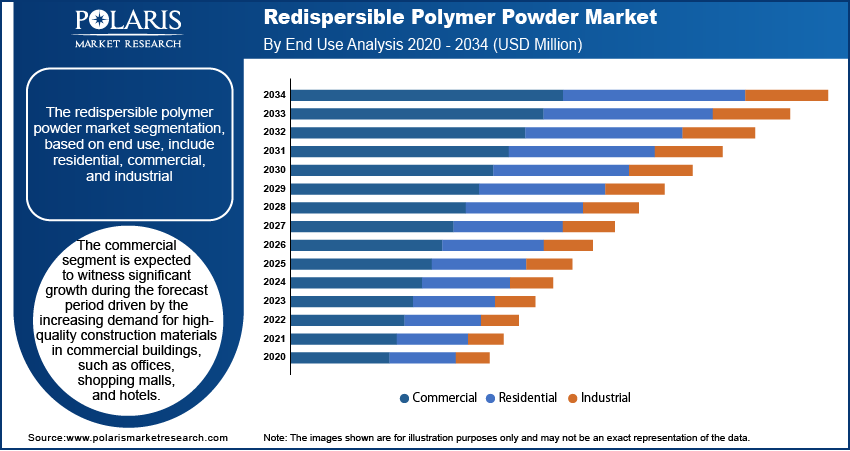

The redispersible polymer powder market assessment, based on end use, includes residential, commercial, and industrial. The commercial segment is expected to witness significant growth during the forecast period, driven by the increasing demand for high-quality construction materials in commercial buildings, such as offices, shopping malls, and hotels. Redispersible polymer powders are widely used in applications like flooring, wall coatings, and adhesives. As commercial construction projects continue to grow globally, there is a rising need for materials that provide superior performance, which is driving segmental growth in the global market.

Redispersible Polymer Powder Market Evaluation by Application Outlook

The redispersible polymer powder market evaluation, based on application, includes mortars & cement, tile adhesives & grouts, plasters, insulation systems, self-leveling underlayment, and others. The mortars & cement segment dominated the redispersible polymer powder market in 2024. Redispersible polymer powders play an important role in enhancing the performance of mortars and cement by improving their flexibility, adhesion, and water resistance. These powders are commonly used in applications such as tile adhesives, grouts, and plaster, where they help create durable and long-lasting surfaces. As the housing and infrastructure sectors continue to grow, the demand for high-performance cement and mortar products increases, thereby contributing to the segment’s leading position in the market.

Redispersible Polymer Powder Market Regional Analysis

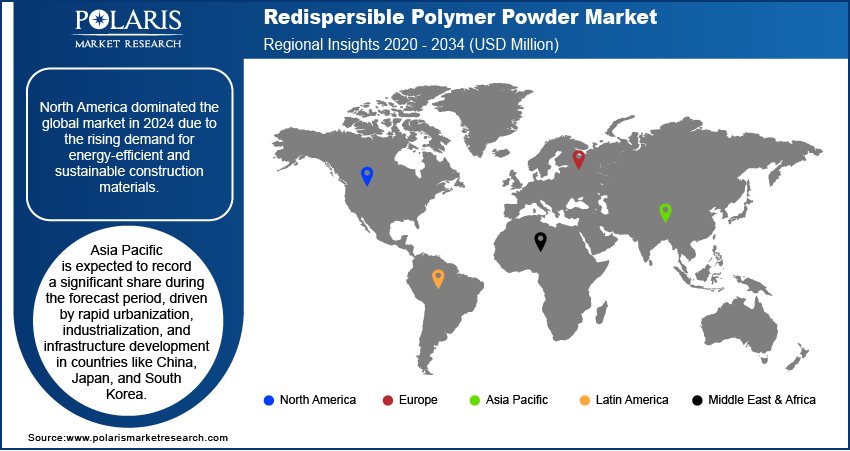

By region, the study provides the redispersible polymer powder market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the redispersible polymer powder market, driven by the rising demand for energy-efficient buildings and sustainable construction materials. The increasing focus on green building practices and infrastructure development is driving the demand for redispersible polymer powders. Additionally, the growing shift toward eco-friendly building solutions, coupled with stringent environmental regulations, has accelerated the adoption of redispersible polymer powders in North America, contributing to the regional market dominance.

Asia Pacific is expected to record a significant share during the forecast period. The rapid urbanization, industrialization, and infrastructure development in countries like China, Japan, and South Korea are driving the demand for these powders. Emerging economies in Southeast Asia, such as India and Indonesia, are investing heavily in construction projects, further boosting the demand for high-performance construction materials and thereby driving market growth in the Asia Pacific.

The India redispersible polymer powder market is experiencing substantial growth driven by the country's rapid infrastructure development and booming construction industry. The demand for advanced construction materials, including redispersible polymer powders, is on the rise, with significant investments in roads, bridges, and housing projects. These powders improve the strength, flexibility, and durability of mortars and cement used in construction. Additionally, the government’s push for affordable housing and urbanization has accelerated the demand for redispersible polymer powder, thereby driving the redispersible polymer powder market revenue in India.

Redispersible Polymer Powder Market – Key Players and Competitive Insights

The redispersible polymer powder market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative products to meet the demand of specific market sectors. According to the redispersible polymer powder market analysis, this competitive trend is amplified by continuous progress in product offerings. Major players in the redispersible polymer powder market include Acquos Pty Ltd; Ashland Global Holdings Inc.; BASF; Bosson (Beijing) Chemical Co., Ltd.; Celanese Corporation; Dairen Chemical Corporation; Dow; Japan Coating Resin Corporation; Organik Kimya; Synthomer plc; and Wacker Chemie AG.

BASF is a global chemical corporation that operates through seven segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. Petrochemicals and intermediates are provided in the chemicals segment. Advanced materials and their precursors for applications such as isocyanates and polyamides are available through the materials section, as well as inorganic basic products and specialties for the plastic and plastic processing industries. Polymer dispersions, resins, electronic materials, pigments, antioxidants, light stabilizers, oilfield chemicals, mineral processing, and hydrometallurgical chemicals are among the ingredients and additives developed and sold by the industrial solutions segment. Surface technologies provides chemical solutions and automotive OEM services to the automotive and chemical sectors, including refinishing coatings, surface treatment, catalysts, battery materials, and base metal services. The nutrition & care segment provides nutrition and care ingredients for pharmaceutical as well as food and feed producers, detergent, cleaner industries, and cosmetics. The agricultural solutions segment offers seeds and crop protection products, such as insecticides, herbicides, fungicides, biological crop production products, and seed treatment products. BASF provides Acronal P 5033, a re-dispersible polymer powder enhancing flexibility, adhesion, and water resistance in cement-based construction products, ideal for waterproofing applications.

Dow is a chemical manufacturing conglomerate with a wide range of products. Dow Inc. offers consumer care, construction, and industrial materials science solutions throughout the US, Canada, Latin America, Europe, Africa, India, the Middle East, and Asia Pacific. Dow maintains 113 production facilities in 31 countries. Coatings, durable goods, home and personal care, adhesives and sealants, and food and specialized packaging are among the applications served by the company. Dow's portfolio includes six global business divisions, structured into three functioning segments: industrial intermediates & infrastructure, packaging & specialty plastics, and performance material & coatings. The industrial intermediates & infrastructure segment offers propylene oxide, ethylene oxides, aromatic isocyanates, and polyurethane systems, propylene glycol, polyether polyols, coatings, sealants, adhesives, composites, elastomers caustic soda, vinyl chloride monomers, ethylene dichloride, cellulose ethers, silicones, acrylic emulsions, and redispersible latex powders. The packaging & specialty plastics segment offers ethylene, polyolefin elastomers, propylene and aromatics products, ethylene propylene diene monomer rubbers, polyethylene, and ethylene-vinyl acetate. The performance materials and coatings segment provides industrial coatings and architectural paints that are used in maintenance and protective industries, thermal paper, metal packaging, wood, traffic markings, leather, standalone silicones, performance monomers and silicones, and home and personal care solutions. DOW provides Latex Powder (DLP) 2025, which is a redispersible ethylene vinyl acetate copolymer powder. It enhances cementitious products for the construction industry, improving adhesion and workability in tile adhesives, mortars, and fillers.

List of Key Companies in Redispersible Polymer Powder Market

- Acquos Pty Ltd

- Ashland Global Holdings Inc.

- BASF

- Bosson (Beijing) Chemical Co., Ltd.

- Celanese Corporation

- Dairen Chemical Corporation

- Dow

- Japan Coating Resin Corporation

- Organik Kimya

- Synthomer plc

- Wacker Chemie AG

Redispersible Polymer Powder Industry Developments

April 2024: Celanese Corporation announced major developments at its Texas and China plants, including a new 1.3 million-ton acetic acid unit in Clear Lake and a 70,000-ton VAE expansion in Nanjing. These upgrades enhance cost competitiveness and regional supply capabilities for the Acetyl Chain business.

January 2020: Celanese completed the acquisition of Nouryon's redispersible polymer powders business, expanding its VAE emulsions portfolio and strengthening its position in the construction and building materials market.

Redispersible Polymer Powder Market Segmentation

By Type Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- Vinyl Acetate Ethylene

- Vinyl Ester of Versatic Acid

- Others

By Application Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- Mortars & Cement

- Tile Adhesives & Grouts

- Plasters

- Insulation Systems

- Self-leveling Underlayment

- Others

By End Use Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Redispersible Polymer Powder Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 108.21 million |

|

Market Size Value in 2025 |

USD 116.07 million |

|

Revenue Forecast by 2034 |

USD 221.51 million |

|

CAGR |

7.4% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Kilotons; Revenue in USD million; and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The redispersible polymer powder market size was valued at USD 108.21 million in 2024 and is projected to grow to USD 221.51 million by 2034.

The global market is projected to register a CAGR of 7.4% during the forecast period, 2025-2034.

North America had the largest share of the global market in 2024.

A few of the key players in the market are Acquos Pty Ltd; Ashland Global Holdings Inc.; BASF; Bosson (Beijing) Chemical Co., Ltd.; Celanese Corporation; Dairen Chemical Corporation; Dow; Japan Coating Resin Corporation; Organik Kimya; Synthomer plc; and Wacker Chemie AG.

The mortars & cement segment dominated the redispersible polymer powder market in 2024, as these powders play an important role in improving the performance of mortars and cement by improving their flexibility, adhesion, and water resistance.

The commercial segment is expected to witness significant growth in the forecast period driven by the increasing demand for high-quality construction materials in commercial buildings, such as offices, shopping malls, and hotels.