Recycled PET Flakes Market Size, Share, Trends, Industry Analysis Report

By Product (Clear, Colored), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: pdf

- Report ID: PM3037

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

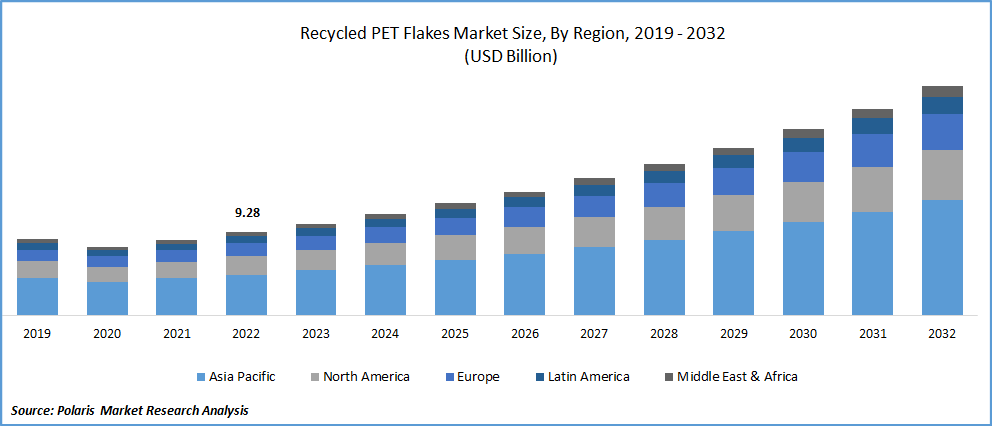

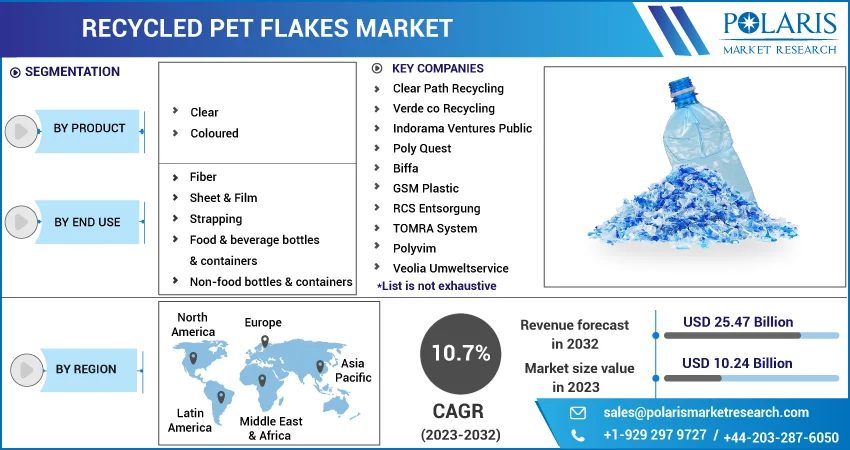

The global recycled polyethylene terephthalate (rPET) flakes market was valued at USD 9.37 billion in 2024 and is expected to register a CAGR of 8.2% from 2025 to 2034. The market growth is driven by government initiatives, advancements in recycling technology, and increasing awareness and focus on environmental sustainability.

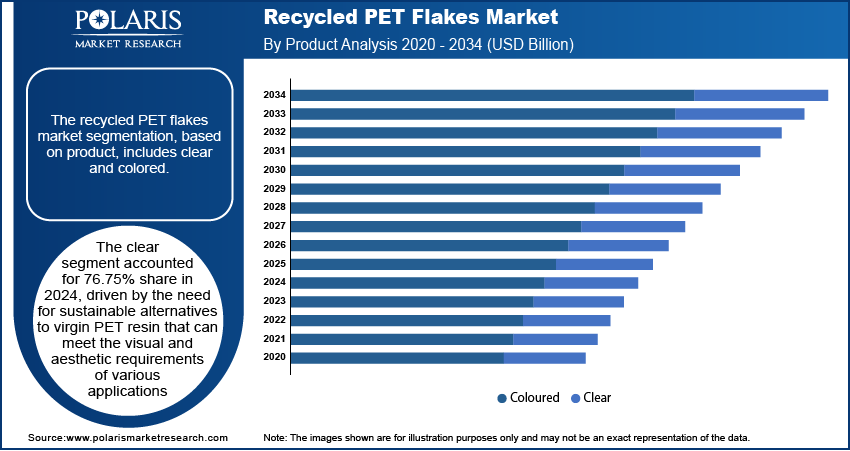

- The clear segment accounted for a 76.75% share in 2024, driven by the need for sustainable alternatives to virgin PET resin that can meet the visual and aesthetic requirements of various applications.

- The colored segment recorded USD 2.14 billion in 2024.

- The fiber segment accounted for 13.42% share in 2024. It refers to the application of PET flakes in the production of fibers that are used in various textile and non-textile applications.

- The Food & beverage bottles & containers segment accounted for USD 2.19 billion revenue in 2024. It refers to the application of PET flakes in the production of new bottles and containers that are specifically designed for packaging food and beverage products.

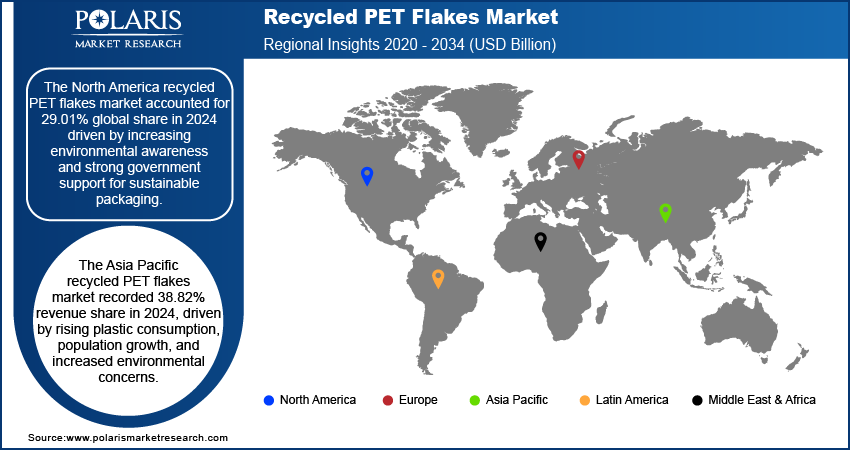

- North America accounted for 29.01% global share in 2024, driven by increasing environmental awareness and strong government support for sustainable packaging.

- The U.S. recycled PET flakes market is projected to reach 78.42% revenue share in 2024, driven by rising demand for sustainable packaging and pressure from both regulators and consumers.

- Asia Pacific recorded a 38.82% revenue share in 2024, driven by rising plastic consumption, population growth, and increasing environmental concerns.

The recycled PET flakes market is a dynamic and rapidly evolving sector within the global plastics industry. PET, or polyethylene terephthalate, is a versatile and widely used thermoplastic polymer that is commonly used in the production of bottles, packaging materials, textiles, carpets, automotive parts, and other consumer goods. However, with the increasing concern over environmental sustainability and plastic waste management, there has been a growing demand for recycled PET flakes as an alternative to virgin PET resin.

Recycled PET (rPET) flakes are obtained through a series of processing steps that involve shredding, washing, and refining PET bottles or other PET products that have reached the end of their useful life. The resulting flakes are then used as a raw material in the production of various applications, ranging from packaging materials, textiles, and carpets to automotive parts and more. The use of rPET flakes offers several environmental benefits, including reducing the consumption of fossil fuels, conserving natural resources, reducing greenhouse gas emissions, and minimizing plastic waste in landfills and oceans.

One of the key drivers of the recycled PET flakes market is the increasing awareness and focus on environmental sustainability. Consumers, governments, and businesses are increasingly recognizing the negative environmental impacts of plastic waste, including pollution of land, air, and water bodies, and its harmful effects on marine life. This has led to a growing demand for sustainable alternatives to virgin plastics, such as recycled PET flakes, which can help reduce the environmental footprint of plastic consumption.

Industry Dynamics

- Government Initiatives are promoting recycling and circular economy principles, thereby fueling the industry growth.

- Advancements in recycling technology is improving the appeal of the product, fueling its adoption.

- Rising focus on environmental sustainability is boosting the industry growth.

- Inconsistent quality and contamination of collected PET waste hampers efficient recycling and limits end-use applications.

Government Initiatives: Government initiatives and regulations aimed at promoting recycling and circular economy principles are driving the demand for recycled PET flakes. Many countries around the world have implemented policies and regulations to encourage the recycling of PET bottles and containers, including collection and recycling targets, extended producer responsibility (EPR) programs, and incentives for using recycled materials in manufacturing. These initiatives incentivize the use of recycled materials and promote sustainable practices, thereby driving the growth.

Advancement in Recycling Technology: Continuous advancements in recycling technologies such as optical sorting technologies, and other innovations have significantly enhanced the efficiency and effectiveness of PET flakes recycling processes. These innovations have led to improved sorting, cleaning, and processing methods, which produce higher yields of high-quality recycled PET flakes. As a result, recycled PET (rPET) is more consistent in quality and better suited for a wider range of applications, including food-grade packaging and textiles. This technological progress has expanded the availability of rPET, making it a more viable and attractive alternative to virgin PET. Consequently, rPET is gaining competitiveness in terms of cost and performance.

Segmental Insights

Product Analysis

The clear segment accounted for 76.75% share in 2024. Clear product refers to PET flakes that have been processed and refined to a high degree of transparency or clarity, similar to virgin PET resin. Clear PET flakes are often sought after for use in applications where optical clarity and aesthetics are important, such as in the production of packaging materials, bottles, and other consumer goods where the visual appearance of the end product is crucial. The demand for clear PET flakes is driven by the need for sustainable alternatives to virgin PET resin that can meet the visual and aesthetic requirements of various applications. Clear rPET flakes offer several advantages, including reducing the environmental footprint of plastic production, conserving natural resources, and minimizing plastic waste. They are widely used in the production of packaging materials, bottles, and other consumer goods where transparency and visual appeal are critical, while also addressing the growing concerns about plastic waste and environmental sustainability.

The colored segment recorded USD 2.14 billion in 2024. "Colored product" term refers to PET flakes that have been processed and refined to have a specific color or hue, typically different from the natural transparent or clear color of virgin PET resin. Colored rPET flakes are obtained through a series of processing steps that involve sorting, washing, and refining PET bottles or other PET products, followed by the addition of colorants or pigments during the refining process to achieve the desired color. The demand for colored rPET flakes is driven by the need for environmentally responsible options that can meet the visual and aesthetic requirements of different applications. Colored rPET flakes are widely used in the production of packaging materials for various industries, including food and beverage, personal care, household products, and more. They are also used in the manufacturing of fibers for textiles, carpets, and other applications where color is a key factor.

By End Use Analysis

The fiber segment accounted for 13.42% share in 2024. It refers to the application of PET flakes in the production of fibers that are used in various textile dyes and non-textile applications. PET flakes can be processed and converted into fibers through a series of spinning and extrusion processes, which results in PET fibers that can be used for a wide range of applications. The use of recycled fibers from recycled PET flakes in various end-use applications contributes to sustainability efforts by reducing the environmental impact of PET waste and conserving natural resources. It further helps to reduce the dependence on virgin PET resin, which is derived from fossil fuels, and promotes the circular economy by recycling PET bottles into valuable fibers for a wide range of applications, thereby driving its adoption.

The food & beverage bottles & containers segment accounted USD 2.19 billion in revenue in 2024. It refers to the application of PET flakes in the production of new bottles and containers that are specifically designed for packaging food and beverage products. PET flakes can be processed and converted into preforms or pellets, which are then used to manufacture bottles or containers through blow molding or injection molding processes. PET bottles and containers made from recycled PET flakes offer properties such as transparency, lightweight, shatter resistance, and recyclability, which make them suitable for packaging food and beverage products. They are also considered a sustainable packaging option as they help reduce the reliance on virgin PET resin, conserve natural resources, and reduce the environmental impact of PET waste.

Regional Analysis

North America Recycled PET Flakes Market Trends

North America accounted for 29.01% global share in 2024, driven by increasing environmental awareness and strong government support for sustainable packaging. Many brands are committing to using recycled materials in their products, especially in the food & beverage industry. The region benefits from established recycling infrastructure and growing consumer demand for eco-friendly products. However, challenges such as inconsistent collection systems and contamination in waste streams still exist. Despite this, ongoing investments in recycling technology and rising corporate sustainability goals are expected to drive continued growth in recycled PET usage across North America.

U.S. Recycled PET Flakes Market Overview

The U.S. market reached USD 2.10 billion in 2024, driven by rising demand for sustainable packaging and pressure from both regulators and consumers. The U.S. companies are increasingly incorporating recycled PET into their products. Several major beverage and consumer goods brands have pledged to use more recycled content, further boosting demand. Advanced recycling facilities and technological improvements are helping improve the quality and supply of recycled PET. Still, variations in state-level recycling policies and collection rates present challenges. Continued efforts toward a national recycling framework may enhance long-term market stability and growth.

Asia Pacific Recycled PET Flakes Market Insights

The Asia Pacific market recorded a 38.82% revenue share in 2024, driven by rising plastic consumption, population growth, and increased environmental concerns. Countries such as India, Japan, and South Korea are making efforts to improve recycling infrastructure and reduce plastic waste. Many global manufacturers also source recycled PET from Asia due to its large-scale recycling operations and lower processing costs. However, the region faces challenges such as inconsistent regulations and quality standards. As more companies and governments in Asia commit to circular economy goals, the demand for high-quality rPET flakes is expected to grow significantly in the coming years.

China Recycled PET Flakes Market Outlook

The China market accounted for 28.71% regional share in 2024, as China plays a key role in the global recycled PET flakes market, both as a major producer and consumer. After implementing strict waste import bans in recent years, the country has invested heavily in developing its domestic recycling capabilities. It has built advanced recycling facilities and is promoting the use of recycled materials in textiles, packaging, and manufacturing. With strong government support and rising environmental awareness, China is shifting toward a more circular economy. While quality and contamination issues remain a challenge, technological progress and policy support are helping increase the supply and demand for high-grade recycled PET flakes.

Europe Recycled PET Flakes Market Trends

Europe accounted for 21.95% share in 2024, driven by strong environmental regulations, ambitious recycling targets, and a well-developed waste management infrastructure. The European Union’s Circular Economy Action Plan and Single-Use Plastics Directive have pushed manufacturers to adopt more sustainable materials, including recycled PET. Many European brands in the food, beverage, and fashion industries are shifting toward rPET to meet sustainability goals. Additionally, consumer awareness of plastic pollution is high, boosting demand for recycled products. Technological innovation, policy support, and corporate responsibility together position Europe as a mature and influential market for high-quality recycled PET flakes.

Germany Recycled PET Flakes Market Analysis

Germany recorded a 25.40% revenue share in Europe in 2024, as it has one of the most efficient recycling systems in the world. The country’s deposit return scheme (DRS) for plastic bottles ensures high collection rates and cleaner feedstock for recycling. As a result, Germany produces a large volume of high-quality PET flakes, widely used in packaging, textiles, and automotive applications. Strong government regulations and consumer support for sustainable products further drive demand for rPET. Leading German companies are also investing in closed-loop recycling and eco-friendly packaging, reinforcing Germany’s position as a key player in Europe’s recycled PET flakes market.

Key Players and Competitive Analysis

The global rPET flakes market is competitive, with key players operating across North America, Europe, and Asia. Leading companies such as Indorama Ventures and Veolia leverage strong recycling infrastructure and global presence to supply high volumes of high-quality rPET. Firms such as Clear Path Recycling, Verdeco Recycling, and PolyQuest dominate the U.S. market through advanced processing and long-standing industry relationships. In Europe, Biffa PLC and RCS Rohstoffverwertung GmbH stand out with integrated waste management and bottle-to-bottle recycling capabilities. Asian players such as Pashupati Polytex, Amaani Polyflakes, and Langgeng Jaya Group offer competitive pricing and expanding capacities, catering to both domestic and export markets. With rising demand for sustainable packaging, companies are investing in advanced sorting, decontamination, and circular economy practices to enhance quality and meet regulatory standards. Strategic partnerships, vertical integration, and technology-driven efficiency are key to gaining market share in this evolving industry.

Key Players

- Alen USA

- Amaani Polyflakes

- Biffa PLC

- Clear Path Recycling

- GSM Plastic

- Indorama Ventures

- Langgeng Jaya Group

- Pashupati Polytex

- PolyQuest, Inc.

- Polyvim

- RCS Rohstoffverwertung GmbH

- Veolia

- Verdeco Recycling

Industry Developments

May 2025: Chemco Group and Kandoi Group launched a ₹450-crore joint venture to produce rPET-based FIBC bags in Gujarat, India. The project aimed to recycle 10 million PET bottles daily and generate 2,500 jobs while promoting sustainable, industrial packaging solutions.

December 2024: Indorama Ventures launched the RECO Collective 2025 initiative to empower SMEs in fashion and furniture to use recycled PET. The program educated participants on sustainable design, promoted rPET innovation, and fostered partnerships to advance the circular economy.

Recycled PET Flakes Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Clear

- Colored

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Fiber

- Sheet & Film

- Strapping

- Food & Beverage Bottles & Containers

- Non-Food Bottles & Containers

- Other

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Recycled PET Flakes Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 9.37 Billion |

|

Market Size in 2025 |

USD 10.12 Billion |

|

Revenue Forecast by 2034 |

USD 20.62 Billion |

|

CAGR |

8.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 9.37 billion in 2024 and is projected to grow to USD 20.62 billion by 2034.

The global market is projected to register a CAGR of 8.2% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Alen USA; Amaani Polyflakes; Biffa PLC; Clear Path Recycling; GSM Plastic; Indorama Ventures; Langgeng Jaya Group; Pashupati Polytex; PolyQuest, Inc.; Polyvim; RCS Rohstoffverwertung GmbH; Veolia; and Verdeco Recycling.

The clear segment dominated the market share in 2024.

The fiber segment is expected to witness the fastest growth during the forecast period.