Reclaimed Rubber from Devulcanization Market Size, Share, Trends, Industry Analysis Report: By Type, Form (Powder, Sheets and Others), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 125

- Format: PDF

- Report ID: PM5321

- Base Year: 2024

- Historical Data: 2020-2023

Reclaimed Rubber from Devulcanization Market Overview

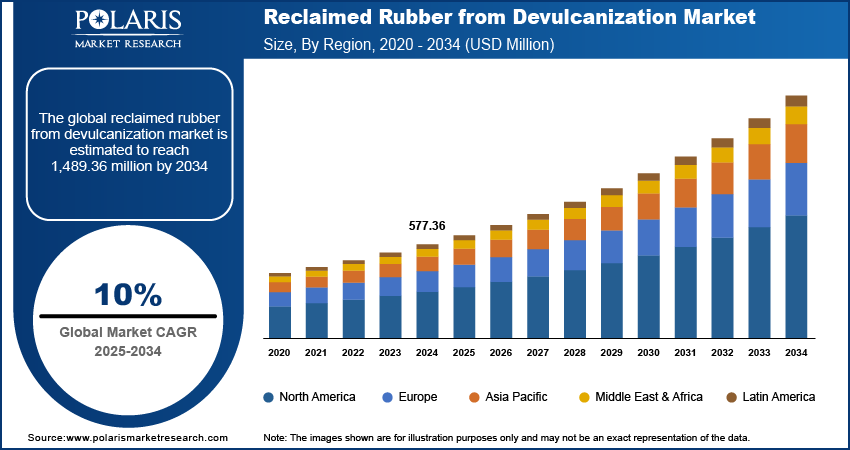

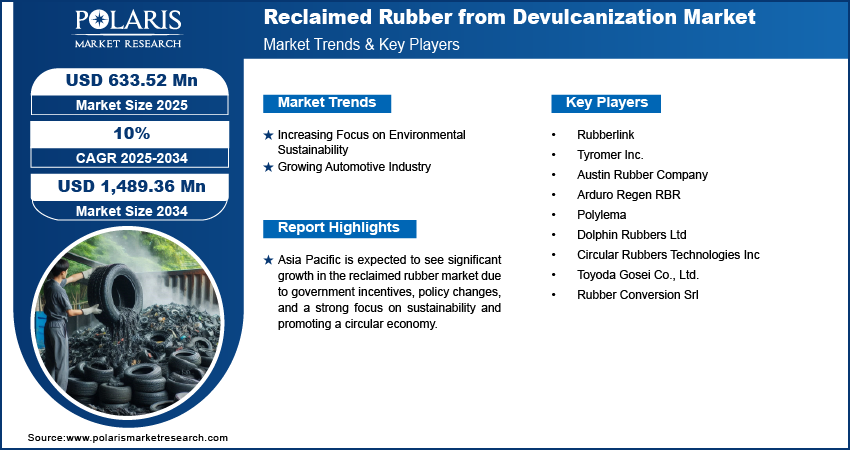

The reclaimed rubber from devulcanization market size was valued at USD 577.36 million in 2024. The market is projected to grow from USD 633.52 million in 2025 to USD 1,489.36 million by 2034, exhibiting a CAGR of 10.0% during 2025–2034.

Devulcanization is the reverse process of vulcanization of rubber in which bonds in vulcanized rubbers are broken and allowed to be recycled and used again. The reclaimed rubber from devulcanization market growth is attributed to continuous technological advancements in devulcanization machinery and processes. New technologies and processes help make recycling of rubber more affordable, which is expected to increase the sales of reclaimed rubber. For instance, REP launched high shear mixer for the devulcanization of rubber as well as the production of any rubber from uncontaminated rubber waste. The machine has numerous benefits such as less production cost, no logistics and waste collection cost, and reduced cost of rubber raw material produced per kg. Such advantages positively benefit the target market. Thus, new technologies with high manufacturing capacity and reduced time and energy consumption are expected to increase the number of new players and simultaneously accelerate the reclaimed rubber from devulcanization market growth during the forecast period.

To Understand More About this Research: Request a Free Sample Report

The reclaimed rubber from devulcanization market is expected to grow in the coming years due to the stringent government regulations on waste management globally. Governments worldwide have begun to impose strict regulations on the management of nonbiodegradable waste and recycling guidelines to address environmental impact. In some regions, governments are providing incentives for recycling nonbiodegradable items and setting rewards for waste processors and recycling businesses. For example, the California State Government initiated a Tire Incentive Program to manage and regulate the 60 million tires discarded each year. Under this program, eligible recyclers will receive USD 25,000–USD 650,000. Therefore, various government incentives for waste product recyclers are expected to attract new players with innovative technologies and drive the growth of the reclaimed rubber from devulcanization market in the coming years.

Reclaimed Rubber from Devulcanization Market Drivers

Increasing Focus on Environmental Sustainability

The reclaimed rubber from the devulcanization market growth is driven by an increase in environmental sustainability practices by major players and regulating bodies of major countries. The recycling of rubber aligns with this practice as it avoids the entry of new nonbiodegradable forms and uses the existing rubber waste. Additionally, governments of many countries support the devulcanization of rubber as it promotes the circular economy, ends the life cycle of rubber products, and decreases the overall impact on the environment associated with rubber production, which drives market growth. Moreover, increasing consumer preference toward sustainable products fuels the reclaimed rubber from devulcanization market growth.

Growing Automotive Industry

The automotive industry across the world is growing owing to the increasing disposable income of the general population. The industry is a major consumer of rubber, particularly for the production of various components such as tires. Due to the rising costs of new rubber materials, the industry is shifting its preference toward recycled rubber. According to Invest India, India manufactured a total of 28.43 million vehicles, including two-wheelers and four-wheelers, during 2023–2024, with 4.5 million of these vehicles being exported during the same period. Moreover, the export of passenger vehicles increased from 6.2 million to 6.7 million between March 2023 and March 2024. Increasing production and exports of the automotive propel the demand for raw materials, including rubber, which fuels the reclaimed rubber from the devulcanization market growth.

Reclaimed Rubber from Devulcanization Market Segment Insights

Reclaimed Rubber from Devulcanization Market Breakdown – by Form Insights

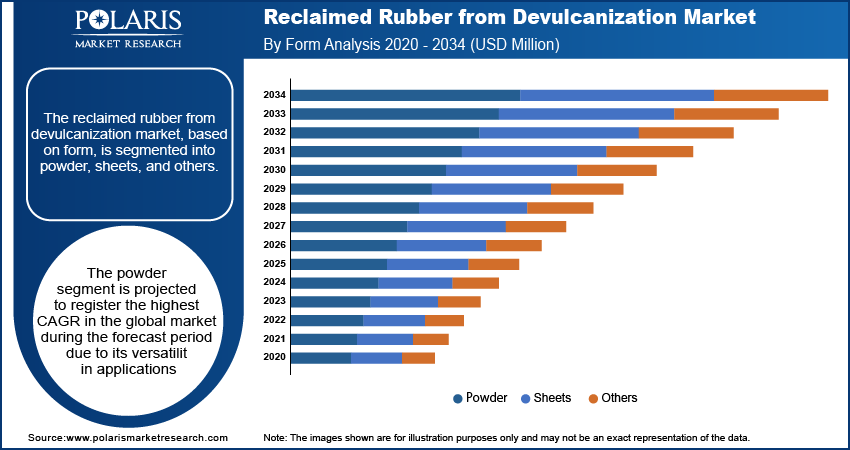

The reclaimed rubber from devulcanization market, based on form, is segmented into powder, sheets, and others. The powder segment is projected to register the highest CAGR in the global market during the forecast period due to its versatility in applications. The powder form of rubber is shaped easily and does not need more procedures to follow. The powder form enables better distribution within matrices, which enhances the performance traits of end products, such as elasticity and durability. Additionally, the demand for rubber powder obtained from devulcanization is anticipated to increase during 2024–2032 due to its cost-effectiveness compared to newly processed rubber powder.

Reclaimed Rubber from Devulcanization Market Breakdown – by Application Insights

The reclaimed rubber from devulcanization market, by application, is segmented into automotive and aircraft tires, cycle tires, retreading, belts and hoses, footwear, molded rubber goods, and others. The automotive and aircraft tires segment is expected to dominate the market during the forecast period. The automotive and aviation industries are the biggest consumers of rubber materials for the manufacturing of tires and shock-absorbing components. Additionally, tire manufacturers partnered with the automotive and aviation industries are one of the major consumers of rubber materials. Due to the increase in the cost of newly formed synthetic rubber raw materials, major players in tire manufacturing have started focusing on recycled raw materials to meet the high demand for tires for the smooth operations of those consumers. For instance, according to the Department of Scientific and Industrial Research India, the Indian automotive tire sector is the single largest consumer of all types of rubber material produced in the country. Also, 50% of the produced rubber is utilized by automotive tire sector, and the other half is divided into small sectors, which are named non-tire sectors.

Reclaimed Rubber from Devulcanization Market Regional Insights

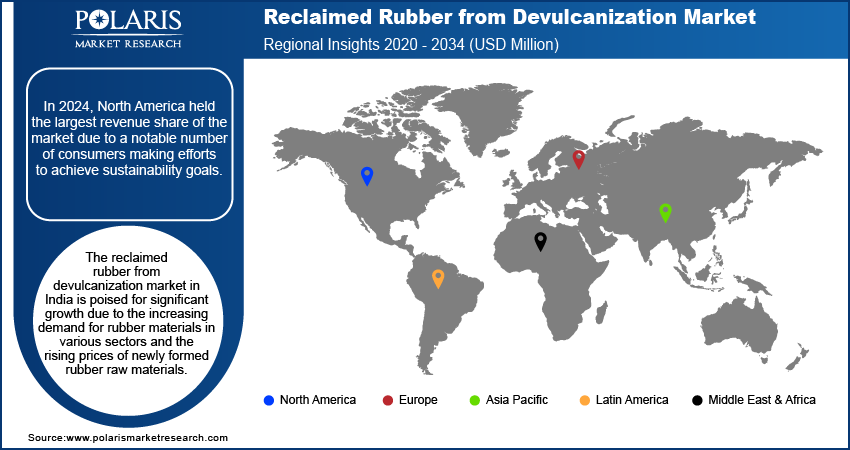

By region, the study provides the reclaimed rubber from devulcanization market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest revenue share of the market due to a notable number of consumers making efforts to achieve sustainability goals. North America is one of the largest recyclers of rubber materials, particularly tires. For example, the United States Environmental Protection Agency reported a substantial increase in waste production and recycling of rubber materials from 1960 to 2020. The amount of waste generated rose from 1,840 items to 10,000, while the recycled material increased from 330 items to 2,000 during the same period, marking an 83.5% increase. Additionally, governments of North American countries offer various incentives and grants for recycling waste material, further boosting the number of companies involved in the reclaimed rubber from the devulcanization market in North America.

Asia Pacific is projected to register a substantial CAGR during the forecast period due to the Asian Nation's combined efforts to promote the recycling of various types of waste, including synthetic rubbers, by changing policies and granting incentives to operate in the business. According to Asia Pacific Economic Cooperations, local government will provide tax incentives to companies operating in recycling and an easy approval process for new players to enter. The corporation also planned for global players to enter and operate in the industry by establishing special economic corridors and other types of incentives. Additionally, the increasing focus on sustainability goals and promoting a circular economy is anticipated to drive the reclaimed rubber from the devulcanization market in Asia Pacific.

The reclaimed rubber from devulcanization market in India is poised for significant growth due to the increasing demand for rubber materials in various sectors and the rising prices of newly formed rubber raw materials. According to scientific and industrial research, India is the fourth largest consumer of rubber globally. Rubber is mainly used by different industrial sectors, such as 15% of the material consumed by bicycle tires and tubes, 12% by footwear industries, and 6% by the belts and hoses industry. Additionally, the rising price of newly formed synthetic and natural rubber material is anticipated to fuel reclaimed rubber from the devulcanization market in India as demand for rubber in the country is high. According to Trading Economics, the price of newly formed rubber was USD 129.5/kg in 2019, which reached USD 175.68/kg in 2024. The increasing price of raw materials has shifted consumer preference toward recycled materials, including reclaimed rubber.

Reclaimed Rubber from Devulcanization Market – Key Players and Competitive Insights

The reclaimed rubber from devulcanization market is always evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, advanced manufacturing technologies, and significant capital to maintain a competitive edge. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative devulcanization processes and machinery and meeting the needs of specific market sectors. This competitive environment is amplified by continuous progress in product offerings and new forms, greater emphasis on sustainability, and the rising requirement for tailor-made single-use products in diverse industries. Major players in the reclaimed rubber from devulcanization market are Rubberlink; Tyromer Inc.; Austin Rubber Company; Arduro Regen RBR; Polylema; Dolphin Rubbers Ltd; Circular Rubbers Technologies Inc; Toyoda Gosei Co., Ltd.; and Rubber Conversion Srl.

Rubberlink is a specialized company in the processing and reclamation of rubber under Bolflex group, majorly focused on transforming scrap into high-quality durable materials. Founded in 2013, Rubberlink scaled its operations into various sectors, including automotive, construction, and manufacturing, providing solutions that enhance product performance while promoting environmental stewardship. Rubberlink has been licensed by the Portuguese Environment Agency as a General Waste Operator (OGR), which is dedicated to the global management of rubber waste. The company’s processing capacity has reached up to 4,000 tons of rubber annually. Rubberlink receives 200 tons of waste annually, out of which 0.02% is back to the landfill, and the majority of the waste is recycled into high-value rubber raw material. The company supplies devulcanized rubbers in the form of powder or blanket and is authorized with REACH Compliance certification. In 2021, it partnered with French sports company Decathlon for the production of sports shoes from rubber raw material acquired from discarded tires.

Tyromer Inc. operates in the field of sustainable rubber recycling, specializing in the development and commercialization of advanced technologies for reclaiming and repurposing used tires. Based in Canada, the company utilizes its proprietary Tyromer TDP (Tire Devulcanization Process) to transform end-of-life tires into high-quality, reusable rubber materials. This process enhances the performance characteristics of the reclaimed rubber and significantly reduces environmental impact by diverting tires from landfills and minimizing the need for new raw materials. Tyromer’s solutions are designed to support various industries, including automotive and manufacturing, offering a cost-effective and eco-friendly alternative to virgin rubber. The company is committed to advancing sustainable practices and driving innovation in the circular economy, making Tyromer Inc. a key player in the transition toward more sustainable and responsible rubber management.

Key Companies in Reclaimed Rubber from Devulcanization Market

- Rubberlink

- Tyromer Inc.

- Austin Rubber Company

- Arduro Regen RBR

- Polylema

- Dolphin Rubbers Ltd

- Circular Rubbers Technologies Inc

- Toyoda Gosei Co., Ltd.

- Rubber Conversion Srl

Reclaimed Rubber from Devulcanization Market Industry Developments

January 2020: Quercus, marking World Earth Day emphasized reducing waste, recycling, and minimizing fossil fuel use. Events included workshops on wild herbs and eco-friendly activities in various cities.

Reclaimed Rubber from Devulcanization Market Segmentation

By Type Outlook (USD million, 2020–2034)

- Synthetic Rubber

- Natural Rubber

By Form Outlook (USD million, 2020–2034)

- Powder

- Sheet

- Other

By Application Outlook (USD million, 2020–2034)

- Automotive & Aircraft Tires

- Cycle Tires

- Retreading

- Belts & Hoses

- Footwear

- Molded Rubber Goods

- Others

By Regional Outlook (USD million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Reclaimed Rubber from Devulcanization Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 577.36 million |

|

Market Size Value in 2025 |

USD 633.52 million |

|

Revenue Forecast by 2034 |

USD 1,489.36 million |

|

CAGR |

10% from 2024 to 2032 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The reclaimed rubber from devulcanization market size was valued at USD 577.36 million in 2024 and is projected to grow to USD 1,489.36 million by 2034.

The global market is projected to record a CAGR of 10.0% during the forecast period.

North America accounted for the largest share of the global market.

A few key players in the market are Rubberlink; Tyromer Inc.; Austin Rubber Company; Arduro Regen RBR; Polylema; Dolphin Rubbers Ltd; Circular Rubbers Technologies Inc; Toyoda Gosei Co., Ltd.; and Rubber Conversion Srl

The powder segment is anticipated to experience substantial growth at a significant CAGR in the global market. This growth is attributed to the versatility of application and price effectiveness.

The automotive and aircraft tires segment accounted for the largest revenue share of the market in 2024 due to an increase in automotive demands due to rising disposable income and increasing flights operations