Real World Evidence Solutions Market Share, Size, Trends, Industry Analysis Report, By Component (DataSets, Consulting and Analytics); By Therapeutic Areas (Oncology, Cardiovascular, Neurology, Immunology, Others): By End-User; By Region; Segment Forecast, 2022 - 2030

- Published Date:Mar-2022

- Pages: 118

- Format: PDF

- Report ID: PM2339

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

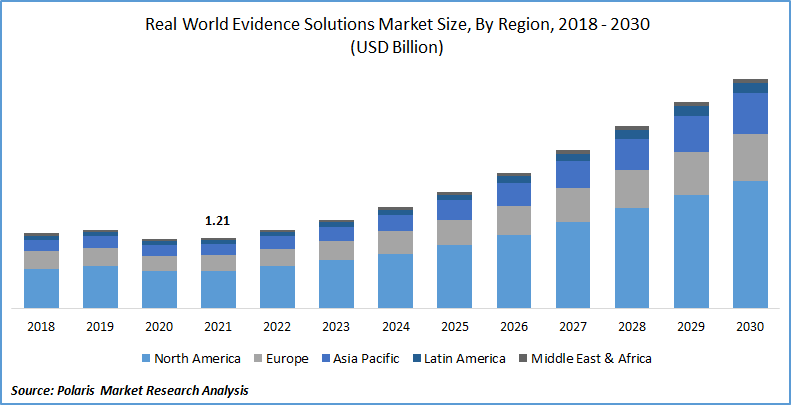

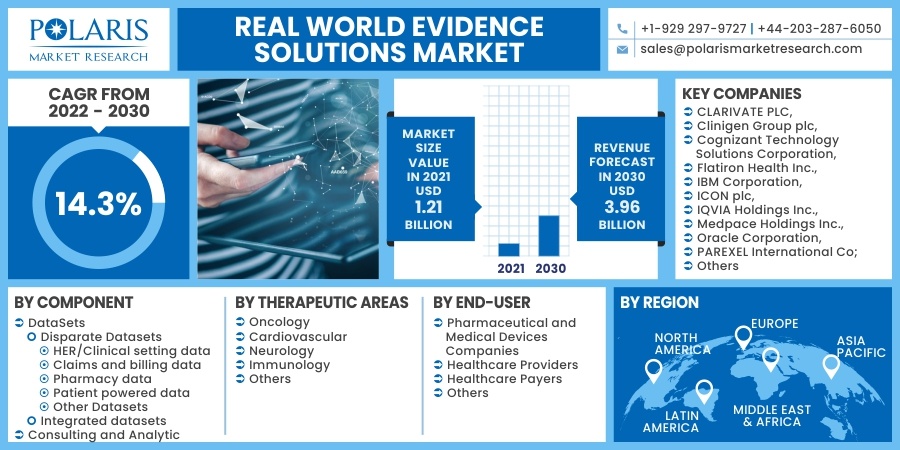

The global real world evidence solutions market was valued at USD 1.21 billion in 2021 and is expected to grow at a CAGR of 14.3% during the forecast period. Factors such as benefits of RWE along with its adoption in the healthcare and pharmaceutical sector. Real world evidence (RWE) is published evidence derived from real world facts on the use of a pharmaceutical drug and its potential benefits or risks. It is evidence derived from real world data (RWD).

Know more about this report: request for sample pages

Based on observational data, RWD generates insights, extrapolative outcomes, and predictions on diseases, medical equipment, unmet patient requirements, the cost of the goods to subpopulations, and patient information.

Real world data is also utilized to analyze patient outcomes and help patients get the best care possible. RWE is developed by analyzing electronic health records (EHR), healthcare claims and billing operation systems, registries, patient-provided data, mobile devices, and other resources. It can originate from both observational and experimental studies and databases. Real world evidence solutions is used when clinical evaluations have not accounted for the entire patient group of disease. Real world evidence provides solutions to these problems and a longer-term assessment of pharmacological effects.

Further, the rising market demand for EHR is also driving the growth of real world evidence solutions market. EHRs are the most frequent type of healthcare information that aids in executing outcome-based investigations. EHR data is becoming increasingly important in the FDA's collection and generation of useful knowledge. Governments throughout the globe are launching programs to increase EHR/EMR data use. For example, in September 2020, the Ministry of Health and Family Welfare (MoHFW) produced a draught policy called the Health Data Management Policy to digitalize India's whole healthcare ecosystem.

Also, the Australian Digital Health Agency was founded by the Australian government to evolve digital health competence through creativity, cooperation, and leadership in the health system. After significant engagement with the Australian community, the Agency produced the National Digital Health Strategy and thoroughly reviewed the evidence solutions. The Strategy offers seven strategic priority objectives that must be met by 2022.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Various countries across the globe have a population that is majorly comprised of older adults. The aging populace needs constant care on a long-term basis and thus market demands more medical devices for healthcare. With the increasing prevalence of the senior population and their changing lifestyle, the aged ones majorly suffer from various chronic diseases such as diabetes; hence, the market demand for advanced medical healthcare devices and therapies increases. This has risen the growth of the real world evidence solutions market.

Further, with the increases in the incidence of rare diseases and the tendency toward personalized healthcare, universal health care and research organizations are likely to experience challenges such as high costs, lengthy timelines for providing treatments to patients, and the time-consuming, costly, and risky process of creating new pharmaceutical entities. During the projection period, the increased prevalence of chronic diseases such as cancer and diabetes, among others, would drive real world evidence solutions market expansion.

Report Segmentation

The market is primarily segmented based on components, end-user, therapeutic areas, and region.

|

By Component |

By Therapeutic Areas |

By End-User |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Therapeutic Areas

Based on the therapeutic areas segment, the oncology segment is the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance in the foreseen period. The considerable share of this segment can be attributable to a large number of oncology clinical trials done and the rising prevalence of cancer globally.

Geographic Overview

In terms of geography, North America had the largest share. The favorable regulatory environment, an increasing percentage of payers utilizing RWD, an expanding number of real world evidence solutions providers, RWE for drug approvals are driving the region’s growth.

Moreover, Asia Pacific is expected to witness a high CAGR in the global real world evidence solutions industry in 2021. The region is expanding due to rising government schemes to implement RWE studies and the presence of several Contract Research Organizations (CROs) and manufacturing firms in nations such as China and India.

Rising market demand for better medical care is also expected to drive market expansion. The increasing government initiatives for RWE study implementation, the rising impact of chronic illnesses, the rising need for better healthcare services, and the growing elderly population are propelling the development of the Asia Pacific RWE solutions.

Competitive Insight

Some of the major players operating in the global real world evidence solutions market include CLARIVATE PLC, Clinigen Group plc, Cognizant Technology Solutions Corporation, Flatiron Health Inc., IBM Corporation, ICON plc, IQVIA Holdings Inc., Medpace Holdings Inc., Oracle Corporation, PAREXEL International Corporation, PerkinElmer Inc., PPD Inc., SAS Institute Inc., Symphony Innovation LLC, SYNEOS HEALTH Inc., and UnitedHealth Group Incorporated.

Real World Evidence Solutions Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.21 billion |

|

Revenue forecast in 2030 |

USD 3.96 billion |

|

CAGR |

14.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Therapeutic Area, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

CLARIVATE PLC, Clinigen Group plc, Cognizant Technology Solutions Corporation, Flatiron Health Inc., IBM Corporation, ICON plc, IQVIA Holdings Inc., Medpace Holdings Inc., Oracle Corporation, PAREXEL International Corporation, PerkinElmer Inc., PPD Inc., SAS Institute Inc., Symphony Innovation LLC, SYNEOS HEALTH Inc., and UnitedHealth Group Incorporated. |