Rare Disease Genetic Testing Market Size, Share, Trends, Industry Analysis Report: By Technology, Speciality (Molecular Genetic Tests, Chromosomal Genetic Tests, and Biochemical Genetic Tests), Disease Type, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 180

- Format: PDF

- Report ID: PM1772

- Base Year: 2024

- Historical Data: 2020-2023

Rare Disease Genetic Testing Market Overview

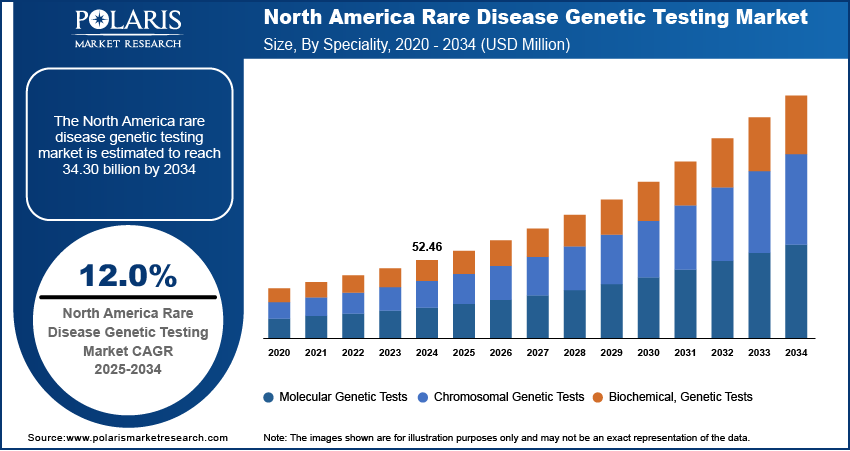

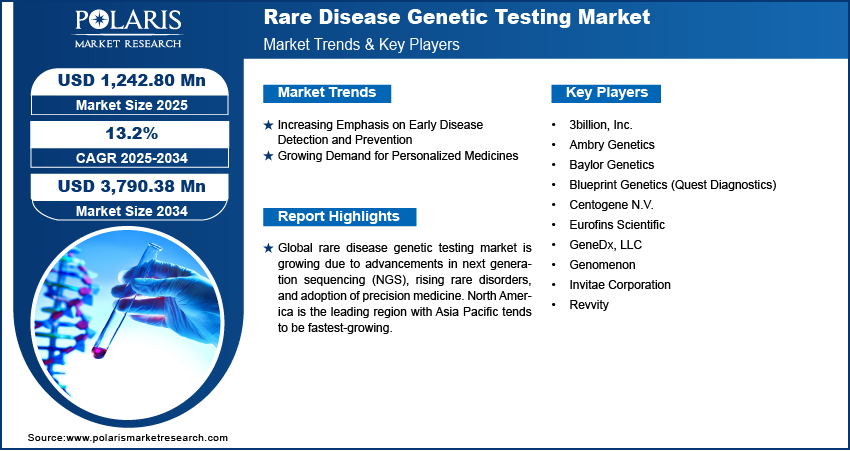

The global rare disease genetic testing market size was valued at USD 1,106.88 million in 2024 and is expected to reach USD 1,242.80 million by 2025 and 3,790.38 million by 2034, exhibiting a CAGR of 13.2% during 2025–2034.

The rare disease genetic testing market growth is attributed to factors such as rising technological advancements, the increasing prevalence of chronic disorders, and the development of customized testing kits designed to treat specific therapeutics. Moreover, with the growing number of clinical studies, a large number of testing practices are performed annually, which is promoting the demand for rare disease genetic testing. For instance, Centogene N.V. integrates genetic testing with metabolomics and proteomics to improve data analysis precision. Furthermore, the launch of new systems has made sample collection easy, thereby leveraging convenience and encouraging broader adoption of genetic tests, ultimately driving market revenue.

Governments in emerging economies are offering and supporting research institutes by providing funding and incentives to conduct studies on rare diseases. For instance, India’s National Policy for Rare Diseases (NPRD), launched in March 2021, provides financial assistance of up to USD 0.066 million for patients diagnosed with rare conditions listed under the Centre of Excellence (COE). Therefore, such initiatives from governments are expected to create new rare disease genetic testing market opportunities during the forecast period. Moreover, in the oncology segment, genetic testing plays a crucial role in identifying tumor-driving mutations, which enhances the development of targeted therapies. The early and accurate identification of specific genetic markers helps the patients undergo better treatment and enables precision medicine.

To Understand More About this Research: Request a Free Sample Report

Another driving force behind the rare disease genetic testing market expansion is the role of genetic testing in early cancer detection and risk assessment. According to the National Cancer Institute, ∼1,777,566 new cancer cases were diagnosed in the US in 2021, with genetic mutations accounting for 5% to 10% of all cancer cases. The growing incidence of cancer worldwide has prompted healthcare providers to adopt advanced screening techniques, thereby increasing market demand for genetic testing solutions. Moreover, the integration of genetic testing into routine clinical workflows enhances disease prediction and significantly improves morbidity and mortality rates. Consequently, as the prevalence of genetic-linked disorders keeps rising, the demand for genetic diagnostics will fuel market growth and revenue expansion in the coming years.

Rare Disease Genetic Testing Market Dynamics

Increasing Emphasis on Early Disease Detection and Prevention

Early detection of diseases allows for timely treatment and intervention, which helps manage conditions or improve a patient’s life. Early diagnosis allows individuals to initiate medical treatment at the initial stage, potentially preventing the development of diseases. Also, technological advancements in genetic testing have significantly improved disease detection, particularly for conditions such as cancer and rare genetic disorders. Therefore, genetic testing plays a crucial role in addressing this challenge by identifying disease risks early, enabling better medical planning and preventive measures.

In February 2023, Minnesota became the first US state to implement universal newborn screening for congenital cytomegalovirus (cCMV). Upon the implementation of screening, the Minnesota Department of Health screened 60,115 infants, out of which 184 cases (0.31%) of cCMV were detected at the initial stage. Thus, early detection through this program has proved to be beneficial in initiating timely interventions, thereby preventing potential long-term health issues in affected infants. Hence, increasing emphasis on early disease detection and prevention boosts the rare disease genetic testing market growth.

Growing Demand for Personalized Medicines

Over the past decade, scientific advancements have significantly improved the early diagnosis and treatment of numerous diseases, particularly cancers. These developments have helped doctors to customize therapies, enhancing drug effectiveness and reducing side effects. Therefore, by identifying specific genetic variations based on an individual's unique biology, personalized medicine can be initiated, leading to better patient results. In October 2023, the UK's National Health Service (NHS) began utilizing liquid biopsies, ultra-sensitive blood tests that can detect tiny fragments of tumor DNA, which is useful for monitoring breast cancer mutations. Thus, this approach has enabled healthcare providers to provide more precise treatments to the patient, ultimately improving patient care.

Factors such as the increasing prevalence of genetic diseases and cancer have necessitated the demand for personalized therapies, which drives the rare disease genetic testing market expansion. Factors including expanding access to genetic testing and advancements in personalized medicine will enable more patients to receive targeted and effective treatments. For instance, companies such as GeneDx are working to make genetic testing more accessible, aiming to offer tests for every newborn to promptly identify and treat potential diseases before symptoms arise. This proactive approach will lead to early, accurate diagnoses, significantly improving patient outcomes and potentially reducing healthcare costs.

Rare Disease Genetic Testing Market Segment Insights

Rare Disease Genetic Testing Market Assessment by Technology Outlook

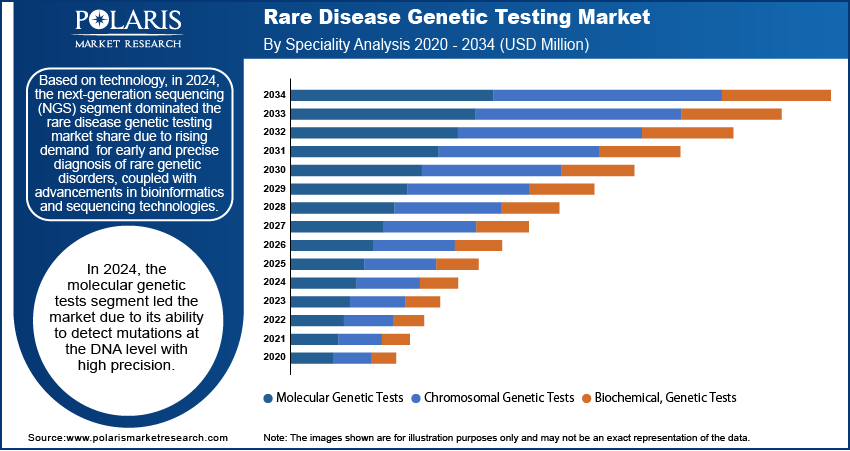

The global rare disease genetic testing market segmentation, by technology, includes next-generation sequencing, array technology, PCR-based testing, FISH, sanger sequencing, and karyotyping. In 2024, the next-generation sequencing (NGS) segment held the largest market share due to its widespread adoption in diagnosing various conditions, including cancer, neurological diseases, cardiovascular disorders, pediatric conditions, and psychiatric disorders. The segment's growth is being propelled by the increasing availability of NGS-based gene panels, which enable rapid and precise genetic testing. Additionally, strategic collaborations among key industry players have contributed to the expansion of NGS applications. In June 2022, Avesthagen Ltd. partnered with Wipro Ltd. to commercialize its genetic testing offerings, further accelerating the adoption of NGS technology in clinical diagnostics.

The market for NGS-based rare disease diagnostics is witnessing growth due to the declining costs of sequencing technologies, allowing these tests to be more accessible for patients. Continuous advancements in NGS platforms have improved efficiency, accuracy, and throughput, enabling the detection of rare genetic variants with greater precision. As a result, healthcare providers are increasingly integrating genetic testing into diagnostics to identify rare disorders at early stage and initiate personalized treatment approaches. Increasing global research efforts, such as collaborations between academic institutions, biotech firms, and patient advocacy groups, have accelerated gene discovery, driving the demand for NGS-based solutions.

Rare Disease Genetic Testing Market Evaluation by Speciality Outlook

The global rare disease genetic testing market, based on speciality, is divided into molecular genetic tests, chromosomal genetic tests, and biochemical genetic tests. In 2024, the molecular genetic tests segment held a significant market share due to the rising adoption of advanced diagnostic techniques, increasing awareness of genetic disorders, and the growing application of precision medicine in healthcare.

Molecular genetic tests have become an essential component of modern diagnostics, providing critical insights into genetic variations and disease inclinations. These tests analyze DNA, RNA, or proteins at a molecular level, enabling the detection of inherited disorders, mutations, and responses to medications. One of the key drivers of market growth is the rapid advancement of sequencing technologies, particularly next-generation sequencing (NGS), which offers high accuracy at a reduced cost. Additionally, the availability of unbiased testing methods, such as genome sequencing, has been widely in use in both clinical and research sectors, further fueling market expansion. Therefore, the decreasing costs of sequencing tests have led to the easy availability of molecular genetic testing, allowing for broader application in diagnosing rare and ultra-rare diseases.

Rare Disease Genetic Testing Market Outlook by End Use Outlook

The global rare disease genetic testing market, based on end use, is segregated into research laboratories & CROs, hospitals & clinics, and diagnostic laboratories. The diagnostic laboratories segment is expected to witness the highest growth rate during the forecast period due to advancements in genetic sequencing technologies, growing awareness among healthcare professionals, and supportive government initiatives. These laboratories are equipped with specialized tools to conduct molecular, chromosomal, and biochemical genetic tests, allowing them to treat rare diseases. Moreover, the growing demand for precise and early detection of genetic disorders has fueled the rare disease genetic testing market development within diagnostic laboratories.

The rise in research and development investments in rare disease genetic testing has accelerated market growth. Governments across the globe are implementing policies to support genetic research, making testing more accessible and cost-effective. Additionally, increased patient awareness and the need for personalized medicine have contributed to the expansion of the segment. As genetic testing is becoming more important in rare disease diagnosis, diagnostic laboratories are set to experience substantial growth during the forecast period.

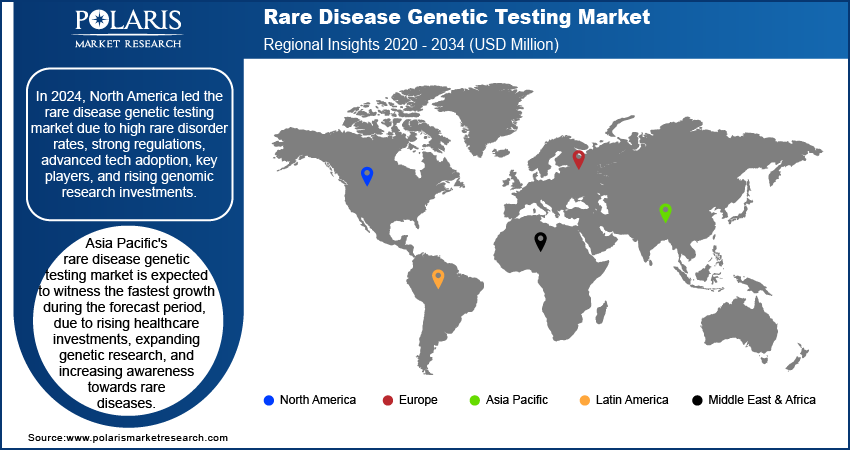

Rare Disease Genetic Testing Market Regional Analysis

By region, the study provides rare disease genetic testing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share of the global rare disease genetic testing market revenue. This dominance is attributed to the increasing demand for personalized genetic testing services and the rising prevalence of chronic and genetic disorders. Further, the rising role of government agencies such as the US Food and Drug Administration, which is actively participating in providing approval and launch of new genetic testing products, is fueling the regional market growth. In December 2023, the FDA approved Guardant Health’s Shield blood test, a multi-cancer early detection (MCED) test, which enables the detection of various cancers through a blood sample, thus allowing early diagnosis and treatment results.

The US dominates the North America rare disease genetic testing market share due to its advanced healthcare infrastructure, strong government support, and extensive FDA approvals for innovative genetic tests. The increasing prevalence of rare genetic disorders and initiatives such as the All of Us Research Program, initiated in 2015, help promote precision medicine.

In Canada, the rare disease genetic testing market demand is growing due to increased federal investments and initiatives such as the National Strategy for Drugs for Rare Diseases, which funds research and improves access to genetic diagnostics. Moreover, with expanding genomic research programs and collaborations between universities and biotech firms, Canada is enhancing genetic screening capabilities and improving early detection and treatment of rare disorders.

Europe held the second-largest position in the rare disease genetic testing market, driven by rising chronic disease prevalence and an aging population. The regional market growth is driven by rising R&D activities, government initiatives, and strategic collaborations among key players. Countries such as the UK are witnessing a surge in clinical trials and technological advancements, enhancing market expansion. The European Commission's initiatives, announced in 2022, aim to improve cancer screening, further boosting genetic testing demand. Additionally, product launches and partnerships, such as Blueprint Genetics and BioMarin’s skeletal dysplasia program, are propelling the rare disease genetic testing market growth.

Rare Disease Genetic Testing Market – Key Players and Competitive Analysis Report

The rare disease genetic testing market features a competitive landscape with a mix of established companies and emerging players aiming to strengthen their market presence. Leading firms focus on product innovation, strategic partnerships, and R&D investments to expand their genetic testing solutions and meet evolving consumer needs. However, the market remains highly competitive, with new entrants introducing advanced genetic testing technologies and leveraging breakthroughs in genomic sequencing and bioinformatics. The sector presents significant growth opportunities and challenges such as strict regulatory frameworks. Owing to competition from alternative diagnostic methods, market players focus on innovating and enhancing their testing capabilities to gain revenue shares.

3billion, Inc. is a biotechnology research company specializing in rare disease genetic testing and diagnostics. The company offers comprehensive genetic solutions for patients, healthcare providers, and pharmaceutical partners worldwide, focusing on the early and accurate detection of rare genetic disorders. 3billion, Inc. offers advanced genetic tests, including whole genome sequencing (WGS), whole exome sequencing (WES), and targeted variant analysis, specifically designed to identify mutations linked to rare diseases. Utilizing next-generation sequencing (NGS) and AI-driven variant interpretation, 3billion ensures precise and rapid diagnoses.

GeneDx, headquartered in Connecticut, US, is a provider of genomics-based diagnostic and information services. The company specializes in rare disease testing, pediatric genetic conditions, and hereditary cancer screening, offering comprehensive genetic insights to improve patient care. The company’s AI-driven platform, Centrellis, integrates clinical and genomic data to deliver personalized health insights that support diagnosis, treatment decisions, and drug discovery. GeneDx also provides genome and exome testing, along with genetic counseling services, making precision medicine more accessible.

List of Key Companies in Rare Disease Genetic Testing Market

- 3billion, Inc.

- Ambry Genetics

- Baylor Genetics

- Blueprint Genetics (Quest Diagnostics)

- Centogene N.V.

- Eurofins Scientific

- GeneDx, LLC

- Genomenon

- Invitae Corporation

- Revvity

Rare Disease Genetic Testing Industry Developments

January 2024: Invitae partnered with BridgeBio Pharma to advance genetics-based drug discovery for rare diseases, leveraging combined expertise.

April 2023: Centogene N.V. launched NEW CentoGenome, an advanced whole genome sequencing test, offering comprehensive diagnostic information for rare and neurodegenerative diseases.

October 2022: Ambry Genetics (Ambry) launched a new reproductive health program that is driven by its CARE ProgramTM (Comprehensive Assessment Risk and Education), a digital platform that enhances the patient and provider experience through easier access to genetic education, testing, reporting, and counseling.

Rare Disease Genetic Testing Market Segmentation

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Next-Generation Sequencing

- Array Technology

- PCR-Based Testing

- FISH

- Sanger Sequencing

- Karyotyping

By Speciality Outlook (Revenue, USD Million, 2020–2034)

- Molecular Genetic Tests

- Chromosomal Genetic Tests

- Biochemical Genetic Tests

By Disease Type Outlook (Revenue, USD Million, 2020–2034)

- Neurological Disease

- Immunological Disorders

- Hematology Diseases

- Endocrine & Metabolism Diseases

- Cancer

- Musculoskeletal Disorders

- Cardiovascular Disorders

- Dermatology Disease

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Research Laboratories & CROs

- Hospitals & Clinics

- Diagnostic Laboratories

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Rare Disease Genetic Testing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,106.88 million |

|

Market Size Value in 2025 |

USD 1,242.80 million |

|

Revenue Forecast by 2034 |

USD 3,790.38 million |

|

CAGR |

13.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global rare disease genetic testing market size was valued at USD 1,106.88 million in 2024 and is projected to grow to USD 3,790.38 million by 2034.

The global market is projected to register a CAGR of 13.2% during the forecast period.

In 2024, North America accounted for the largest market share, driven by rising demand for advanced genetic testing solutions, early disease detection, and personalized medicine.

A few of the key players in the market are Centogene N.V.; 3billion, Inc.; Ambry Genetics; GeneDx, LLC; Blueprint Genetics (Quest Diagnostics); Invitae Corporation; Baylor Genetics; Eurofins Scientific; Genomenon; and Revvity.

In 2024, the next-generation sequencing segment held the largest market share due to its high accuracy, cost-effectiveness, and ability to analyze multiple genes simultaneously.

The chromosomal genetic tests segment is expected to witness significant market growth during 2025–2034 due to advancements in cytogenetic technologies, increasing prevalence of chromosomal disorders, and rising demand for early and accurate diagnosis.