Railing Market Size, Share, Trends, Industry Analysis Report: By Material; Application (Interior and Exterior); Installation; Railing Style; Distribution Channel; End Use; and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Oct-2024

- Pages: 117

- Format: PDF

- Report ID: PM5130

- Base Year: 2023

- Historical Data: 2019-2022

Railing Market Overview

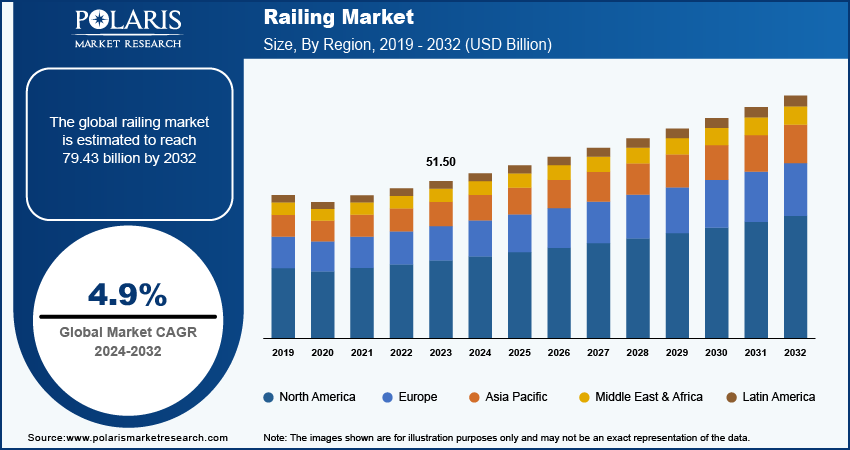

Railing Market size was valued at USD 51.50 billion in 2023. The market is projected to grow from USD 54.02 billion in 2024 to USD 79.43 billion by 2032, exhibiting a CAGR of 4.9% during the forecast period.

The global railing market is experiencing rapid growth, driven by increasing construction activities across residential, commercial, and public infrastructure sectors. Railings play a crucial role in ensuring safety, providing structural support, and improving the aesthetics of buildings, bridges, staircases, and balconies. The demand is boosted by urbanization, rising disposable incomes, and the growing focus on architectural design and home improvement. Additionally, advancements in materials such as stainless steel, glass, and composite materials are contributing to the development of more durable, cost-effective, and visually appealing railing solutions. The market is also witnessing a shift toward customized and smart railings, integrating technology for added functionality.

The trends that are driving market growth include infrastructure development, safety regulations, and the increasing popularity of DIY installations, especially for home renovations. Moreover, with ongoing innovations and a diverse range of applications, the railing market is poised for sustained growth globally. For instance, CRL's latest adjustable standoff railing system offers glass professionals greater control during the installation of glass railings and windscreens. The system allows for up to ½-inch (12 mm) glass projection adjustment and is compatible with glass ranging from ¾-inch (19 mm) to 27/32-inch (21 mm). It features hidden threads for a sleek appearance and sticks to maximum glass height specifications for added safety and performance.

To Understand More About this Research: Request a Free Sample Report

Railing Market Drivers and Trends

Increasing Urbanization and Infrastructure Development

Rapid urbanization and the continuous expansion of residential, commercial, and public infrastructure are major reasons for demand in the railing market. As cities grow, there is an increased need for safe and aesthetically pleasing solutions in new buildings, bridges, staircases, and other urban structures. Urban development requires railings for safety purposes and for enhancing the visual appeal and functionality of spaces. Furthermore, government investments in infrastructure, including public transport systems and recreational facilities, have strengthened the demand for durable and high-quality railing systems that meet both safety and design standards. As a result, the adoption of railing in the urban sector is a significant factor behind the expansion of the market.

For instance, the Amritsar Smart City project, launched under the Smart Cities Mission by the Indian government in 2023, the project focused on improving infrastructure, including the construction of pedestrian walkways, bridges, and public transport systems. These developments require the installation of railings for both safety and aesthetic purposes.

Advances in Manufacturing Technologies and Materials

Technological innovations in the railing market have significantly improved both functionality and aesthetics. Advances in manufacturing technologies have led to the development of corrosion-resistant metals, such as stainless steel and aluminum alloys, which offer increased durability and longer lifespans, especially in harsh weather conditions. Additionally, the integration of smart technologies in railings is gaining traction. The smart railings can be equipped with features such as LED lighting for improved visibility and safety or sensors to monitor movement, detect obstacles, or even control access in secure areas. The innovations not only improve safety but also offer greater design flexibility, enabling manufacturers to create railings that are both visually appealing and highly functional for driving further market growth.

For instance, in October 2022, Singapore's Marina Bay Sands SkyPark, smart railings with integrated lighting and motion sensors were implemented. These railings provide safety and aesthetic appeal but also feature automated lighting that adjusts based on the time of day, improving visibility and energy efficiency.

Railing Market Segment Insights

Railing Market Breakdown by Application Outlook

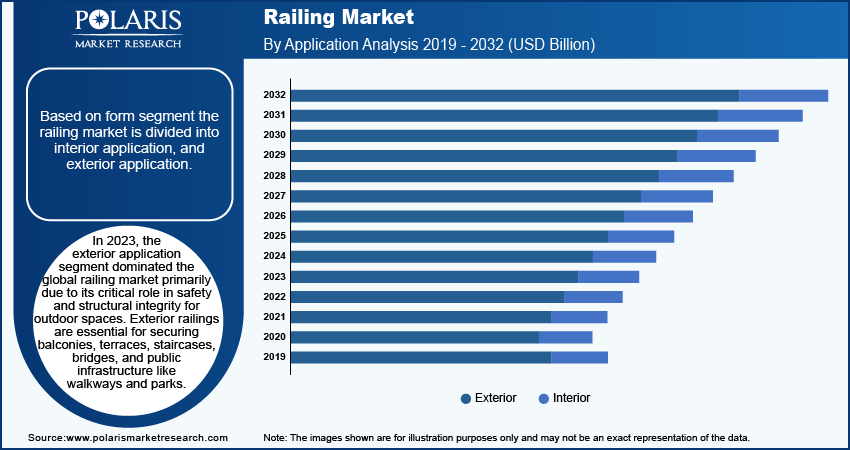

The railing market segmentation, based on application, includes interior application and exterior application. In 2023, the exterior application segment dominated the market primarily due to its critical role in safety and structural integrity for outdoor spaces. Exterior railings are essential for securing balconies, terraces, staircases, bridges, and public infrastructure such as walkways and parks. Additionally, exterior railings are often designed to resist harsh environmental conditions, including weather resistance and durability, making them essential for outdoor construction projects. The demand for exterior railings is further driven by the growing number of infrastructure projects and the need for urban beautification, ensuring their continued dominance in the market.

The interior application segment is also experiencing rapid growth due to the increasing focus on aesthetic appeal and customization in modern interior design and architecture. The demand for stylish and innovative interior railings made of materials such as glass, wood, or stainless steel is rising, driven by the trend of open spaces and multi-level buildings. Also, interior railings enhance safety and act as design elements, contributing to the overall look of interiors.

Railing Market Breakdown by Installation Outlook

The railing market segmentation, based on installation, includes professional installation and do-it-yourself (DIY) installation. In 2023, the professional installation segment dominated the market due to the need for expertise, precision, and compliance with safety standards, especially in large-scale projects. Professional installers ensure that railings are securely fitted, structurally sound, and meet local building codes, which is critical for safety, particularly in commercial and public infrastructure projects. Additionally, professional installation is preferred for complex designs and materials such as glass or stainless steel, which require specialized tools and skills to handle. Large construction firms and commercial developers often rely on professional services to guarantee the longevity and safety of railing systems, solidifying this segment’s dominance in the market.

The DIY installation segment is also growing rapidly due to rising demand from homeowners and small-scale developers seeking cost-effective solutions. The availability of easy-to-install railing kits, along with online tutorials, has empowered individuals to handle their projects, especially for smaller, simpler tasks including patios, decks, or staircases. Additionally, the growing trend in home renovation and personalization has boosted interest in DIY options, offering affordability and flexibility without the need for professional services. Thus, this has made DIY installations increasingly popular among cost-conscious consumers.

By Regional Outlook

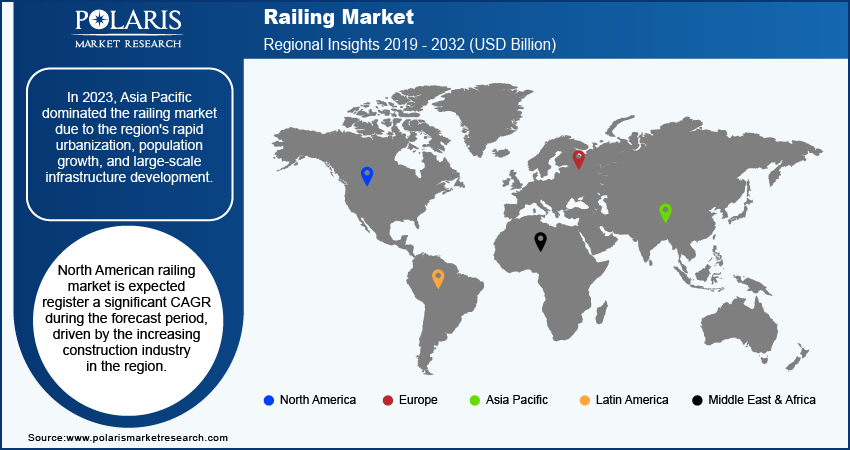

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2023, Asia Pacific dominated the railing market due to the region's rapid urbanization, population growth, and large-scale infrastructure development. Countries such as China, India, and Japan are experiencing significant construction activities, including residential, commercial, and public infrastructure projects, thus driving the demand for railings. Government initiatives to improve urban infrastructure, such as smart city projects and housing developments, have further fueled this demand. Additionally, the growing middle-class population and rising disposable incomes in the region are leading to increased investments in both new construction and home renovation projects, boosting the need for railings in interior and exterior applications. The availability of cost-effective materials and labor in the region also makes Asia Pacific a key player in the global railing market.

For instance, The Smart Cities Mission in India, launched in 2015, has seen significant progress, with 90% of its 8,000+ projects completed by July 2024, totaling 171,972 USD. The remaining 10% of projects, delayed due to on-ground conditions, which are expected to be completed by March 2025. The Government of India has extended the Mission's timeline to ensure project completion without additional financial costs.

North American railing market is expected to grow at a CAGR during the forecast period, driven by the increasing construction industry in the region. The demand for residential and commercial spaces is rising due to population growth and increasing purchasing power in countries such as Canada and Mexico. Additionally, modern architectural trends, such as open floor plans and glass facades, are boosting the need for durable and visually appealing railing solutions to complement contemporary designs.

Railing Key Market Players & Competitive Insights

The competitive landscape of the railing market includes a mix of regional and global players striving to capture market share through innovation, strategic partnerships, and geographical expansion. Leading companies leverage their strong R&D capabilities and extensive distribution networks to offer advanced railing solutions tailored for applications across residential, commercial, and industrial sectors. These industry leaders focus on product innovation, improving durability, aesthetics, and cost-efficiency to meet evolving consumer needs. Meanwhile, smaller regional firms are emerging with specialized railing products that cater to specific local markets. Common competitive strategies in the railing market include mergers and acquisitions, collaborations with construction firms, and investments in emerging markets to expand their product portfolios and strengthen their market presence. Major players include, Viewrail; Regal Ideas, Inc.; IG Railing; The Azek Company, Inc.; BOL (Barrette Outdoor Living); Deckorators, Inc.; Trex Company, Inc.; INVISIRAIL; Digger Specialties, Inc.; Peak Products; RailFX; Glassupply.com; Century Aluminum Railings; Atlantis Rail System; Superior Outdoor Product; and Gladstone Capital Corporation.

Barrette Outdoor Living, a division of Oldcastle APG based in Middleburg, Ohio, offers a wide range of outdoor living solutions designed to advance home outdoor spaces with durable and aesthetically pleasing products. In February 2024, the company launched EncloSure, an aluminum screen DIY-friendly enclosure for terraces and balconies, protecting from elements and insects. It features advanced powder coating and flat spline technology for improved durability in challenging weather. Additionally, Barrette introduced a 42 panel for its Elevation Rail and added a Satin Black option to its Transform Composite Railing, improving the product’s appeal for commercial applications.

Trex Company, Inc., based in Winchester, Virginia, is known for producing eco-friendly composite decking, railing, and other outdoor products made from recycled materials. In July 2024, Trex expanded its Signature Railing line with the opening of the Trex Signature X-Series Railing. This new offering includes the X-Series Frameless Glass Rail and X-Series Cable Rail, designed to streamline installation while providing greater versatility for users. These updates offer consumers more aesthetic options, allowing for easy customization of outdoor spaces with either a cable or glass railing solution.

List of Key Companies in Railing Market

- Atlantis Rail System

- BOL (Barrette Outdoor Living)

- Century Aluminum Railings

- Deckorators, Inc.

- Digger Specialties, Inc.

- Glassupply.com

- IG Railing

- INVISIRAIL

- Peak Products

- RailFX

- Regal Ideas, Inc.

- Superior Outdoor Products

- The Azek Company, Inc.

- Trex Company, Inc.

- Viewrail

- Gladstone Capital Corporation

Railing Industry Developments

July 2024: Atlantis Rail Systems launched its latest offering, the ORION 1 cable railing system. This innovative solution combines a powder-coated aluminum framework with a stainless steel horizontal cable infill. The framework features 3 x 3 posts and a continuous flat top rail. At the same time, the cable includes HandiSwage fittings and 1/8 cable, ensuring durability and ease of installation for a sleek, modern railing design.

February 2024: Superior Outdoor Products introduced its 100 Series railing, the latest addition to its premium vinyl railing collection. Designed with efficiency in mind for volume builders, the 100 Series is easy to install, offering a modern, clean look that enhances the appeal of any outdoor space. This new system provides both functionality and style, making it an ideal choice for large-scale residential projects.

July 2022: Gladstone Capital Corporation partnered with Bennett Capital Partners and Viva Railings, LLC, providing senior debt investment alongside follow-on growth capital. This partnership will empower Viva Railings to explore new growth opportunities and increase its expansion efforts, improving the company's market presence and operational capacity.

Railing Market Segmentation

By Material Outlook (Volume, million Linear Foot; Revenue, USD billion, 2019 - 2032)

- Wood

- Metal

- Aluminum

- Steel

- Iron

- Others

- Composites

- Vinyl

- Glass

- Others

By Application Outlook (Volume, million Linear Foot; Revenue, USD billion, 2019 - 2032)

- Interior Application

- Exterior Application

By Installation Outlook (Volume, million Linear Foot; Revenue, USD billion, 2019 - 2032)

- Professional Installation

- Do-It-Yourself (DIY)

By Railing Style Outlook (Volume, million Linear Foot; Revenue, USD billion, 2019 - 2032)

- Glass Panel

- Baluster

- Others

By Distribution Channel Outlook (Volume, million Linear Foot; Revenue, USD billion, 2019 - 2032)

- Direct

- Indirect

By End-Use Outlook (Volume, million Linear Foot; Revenue, USD billion, 2019 - 2032)

- Residential

- Single-Family

- Multifamily

- Non-Residential

By Regional Outlook (Volume, million Linear Foot; Revenue, USD billion, 2019 – 2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Railing Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 51.50 billion |

|

Market Size Value in 2024 |

USD 54.02 billion |

|

Revenue Forecast in 2032 |

USD 79.43 billion |

|

CAGR |

4.9% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Volume, million Linear Foot; Revenue in USD billion, and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global railing market size was valued at USD 51.50 billion in 2023 and is projected to grow to USD 79.43 billion by 2032

The global market is projected to grow at a CAGR of 4.9% during the forecast period.

In 2023, Asia Pacific dominated the railing market due to the region's rapid urbanization, population growth, and large-scale infrastructure development.

The key players in the market Viewrail; Regal Ideas, Inc.; IG Railing; The Azek Company, Inc.; BOL (Barrette Outdoor Living); Deckorators, Inc.; Trex Company, Inc.; INVISIRAIL; Digger Specialties, Inc.; Peak Products; RailFX; Glassupply.com; Century Aluminum Railings; Atlantis Rail System; Superior Outdoor Product; Gladstone Capital Corporation

In 2023, the exterior application segment dominated the global railing market primarily due to its critical role in safety and structural integrity for outdoor spaces.

In 2023, The professional installation segment dominated the global railing market due to the need for expertise, precision, and compliance with safety standards, especially in large-scale projects.