Rail Composites Market Size, Share, Trends, Industry Analysis Report: By Fiber Type, Resin Type, Manufacturing Process, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Oct-2024

- Pages: 119

- Format: PDF

- Report ID: PM5092

- Base Year: 2023

- Historical Data: 2019-2022

Rail Composites Market Overview

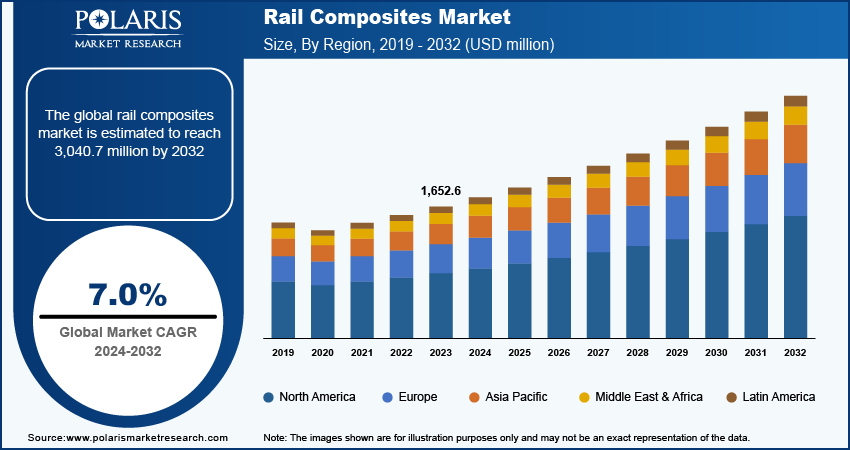

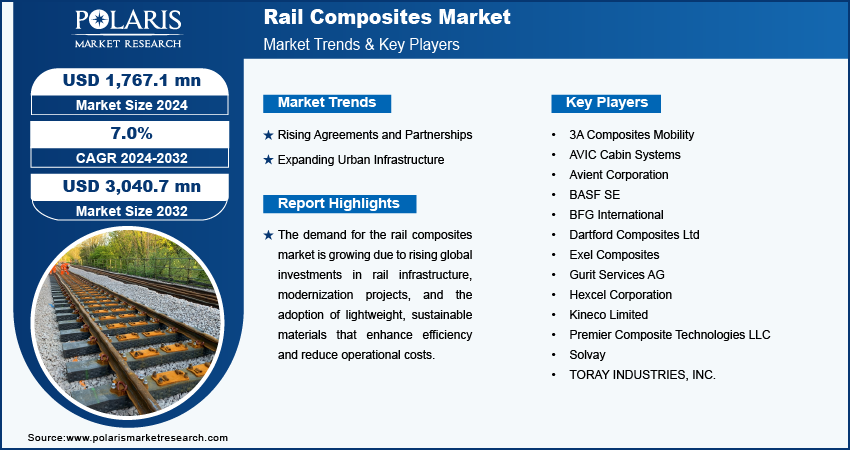

Global rail composites market size was valued at USD 1,652.6 million in 2023. The market is projected to grow from USD 1,767.1 million in 2024 to USD 3,040.7 million by 2032, exhibiting a CAGR of 7.0% during the forecast period.

Rail composites are advanced materials used in the construction and maintenance of rail vehicles and infrastructure, composed of a matrix material such as polymer and reinforced with fibers. The growth of the rail composites market is fueled by rising investments in the rail infrastructure by governments worldwide. Countries are prioritizing the modernization and expansion of their rail networks to meet the growing passenger and freight demands. Hence, the governments are allocating substantial amounts of funds to improve the rail infrastructure. For instance, in the Budget for 2024-25, the Indian government allocated a capital outlay of Rs. 2.52 lakh crore (USD 30.3 billion) for the Ministry of Railways to drive progress in rail infrastructure. Such investments in upgrading rail systems are driving the demand for rail composites and accelerating technological advancements, thereby driving the rail composite market growth.

To Understand More About this Research: Request a Free Sample Report

The increased utilization of rail composites by the rail industry is driving market growth. Manufacturers and researchers are incorporating composites into rail vehicles and infrastructure to leverage their lightweight properties, which improve fuel efficiency and reduce operational costs. For instance, in August 2023, a collaborative project between the University of Southern Queensland (UniSQ) and Austrak installed the first composite railway transoms, replacing traditional timber-based transoms in bridges. The innovative design of composite railway transoms featured a fiber composite and water-based material. These types of projects emphasize sustainability to reduce environmental impact and are creating the demand for recyclable railway composites that drive market growth.

Rail Composites Market Drivers and Trends

Rising Agreements and Partnerships

The increase in agreements and partnership activities to develop and expand production plants is significantly driving the rail composites market. Collaborations between rail operators, composite manufacturers, and research institutions enable the pooling of resources, expertise, and investments necessary for building production facilities. For instance, in July 2024, K&R Rail Engineering Ltd, a company specializing in railway infrastructure, entered into a Memorandum of Understanding (MOU) with UNECO Co. Ltd, a South Korea-based industrial machinery manufacturer, to establish a composite sleeper plant in India. Such partnerships assist in accelerating the development of innovative composite materials and manufacturing processes, making them more efficient and cost-effective. Thus, this collaborative approach to foster innovation is leading to significant growth in the rail composites market.

Expanding Urban Infrastructure

The rapid expansion of urban infrastructure and the growing need for modern, efficient rail systems are significantly boosting the demand for advanced materials, particularly rail composites. The countries around the world are experiencing growth in urbanization. For instance, according to the World Bank, approximately 56% of the world population, totaling 4.4 billion individuals, resides in metropolitan areas. This urbanization trend is projected to continue, with the urban population anticipated to exceed twice its current size by 2050, leading to nearly 70% of the world's population living in cities. As a result, the countries are focusing on upgrading rail networks to address increasing passenger and freight demands. This focus on upgrading rail networks has heightened the demand for advanced materials that offer superior performance and sustainability, thereby driving significant growth in the rail composites market.

Rail Composites Market Segment Insights

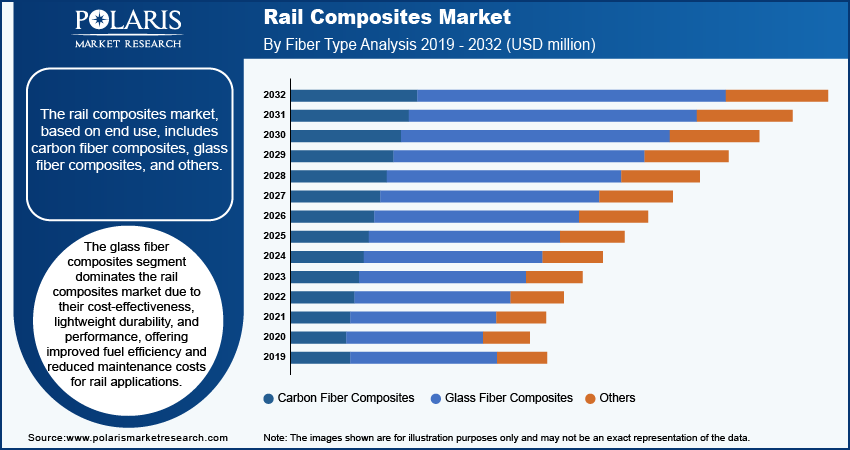

Rail Composites Market Breakdown by Fiber Type Insights

The global rail composites market segmentation, based on fiber type, includes carbon fiber composites, glass fiber composites, and others. In 2023, the glass fiber composites segment accounted for the largest revenue share in the rail composites market due to their exceptional cost-effectiveness compared to other advanced materials. Glass fiber composites offer a highly advantageous balance between performance and price, making them a popular option for rail applications. The affordability of glass fiber, along with its lightweight, strong, and durable properties, allows rail manufacturers to benefit from improved fuel efficiency, reduced maintenance costs, and enhanced structural integrity without the higher expense associated with alternative materials. Thus, this cost-effectiveness has driven the adoption of glass fiber composites, contributing to its dominance in the global rail composites market.

Rail Composites Market Breakdown by Application Insights

The global rail composites market segmentation, based on application, includes exterior components, interior components, and others. The exterior components segment dominated the market due to the essential role of these components in enhancing the overall performance and longevity of rail vehicles. Exterior components such as doors, front noses, cladding, and panels benefit significantly from the lightweight and durable properties of composites. Composites used in exterior applications are highly resistant to environmental factors such as corrosion, weathering, and impact, ensuring that rail vehicles maintain structural integrity over time. Such advantages of composites are contributing to the dominance of the exterior components segment in the rail composites market.

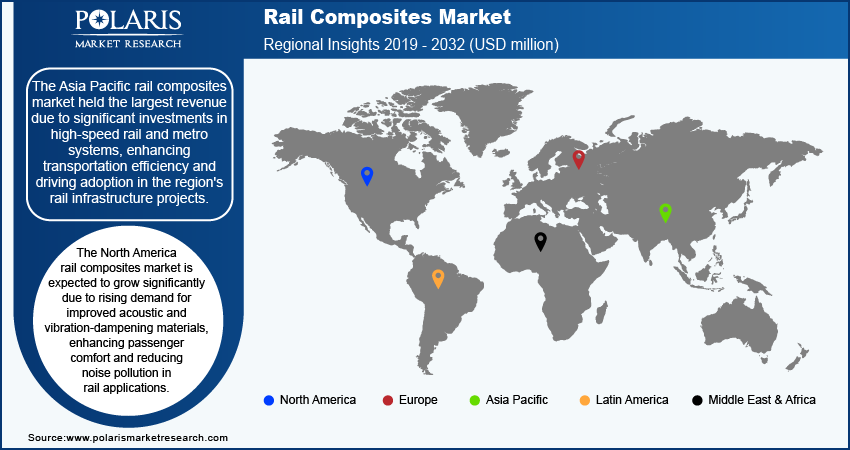

Rail Composites Market Breakdown by Regional Insights

By region, the study provides the rail composites market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific rail composites market held the highest revenue share due to the rapid expansion and modernization of rail infrastructure across the region. The countries are heavily investing in high-speed rail networks, metro systems, and inter-city rail projects to enhance transportation efficiency. The adoption of rail composites in high-speed trains and urban transit systems supported the region's goal of enhancing transportation efficiency, driving a substantial market share of Asia Pacific in the global rail composites market.

Rail composites market in China is expected to grow significantly due to the country's focus on developing an extensive and high-performance rail network. For instance, the country has constructed a network covering approximately 40,000 kilometers, making it the world's largest high-speed train capable of reaching speeds of up to 350 km/h (220 mph). The network is undergoing expansion, with projections to increase its reach to 50,000 kilometers by 2025 and 200,000 kilometers by 2035. Thus, the country's commitment to expanding rail infrastructure is creating demand for advanced materials, thereby fuelling the market for rail composites.

North America rail composites market is anticipated to grow with a significant CAGR over the forecast period due to the increasing need for enhanced acoustic and vibration-dampening. Rail operators within the region are seeking to improve passenger comfort and reduce noise pollution. Hence, rail composites are gaining traction as they offer superior acoustic and vibration damping compared to traditional materials. Thus, this performance enhancement is driving the adoption of rail composites in various rail applications, contributing to the market's significant growth in North America.

Rail Composites Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their offerings, which will help the rail composites market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative product launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market climate, the rail composites market must offer cost-effective solutions.

Key manufacturers and rail infrastructure firms invest heavily in research and development to enhance product performance and reduce costs. Additionally, emerging companies and specialized firms are making significant strides by developing innovative composite solutions and forging strategic partnerships. Major companies dominate the market by leveraging extensive experience, technological advancements, and broad distribution networks. Major players in the rail composites market include 3A Composites Mobility; AVIC Cabin Systems; Avient Corporation; BASF SE; BFG International; Dartford Composites Ltd; Exel Composites; Gurit Services AG; Hexcel Corporation; Kineco Limited; Premier Composite Technologies LLC; Solvay; and TORAY INDUSTRIES, INC.

Gurit Services AG is a manufacturer and supplier of advanced composite materials and engineering solutions, specializing in various applications across global growth markets. The company offers a comprehensive range of products, including structural core materials, prepregs, laminating resins, and adhesives. The company specializes in manufacturing solutions for the wind energy sector and offers plugs and molds for wind turbine blades worldwide. Gurit’s manufacturing solutions division provides advanced tooling automation, engineering services, and manufacturing intelligence, enabling clients to enhance production efficiency and reduce costs. In April 2022, Gurit acquired a 60% stake in Fiberline Composites A/S located in Middelfart, Denmark. Fiberline Composites A/S specializes in the production of pultruded carbon and glass fiber products.

Hexcel Corporation is an advanced lightweight composites technology company that serves international markets through manufacturing facilities, sales offices, and representatives in Asia Pacific, Americas, Europe, India, and Africa. The company's composite materials segment produces and markets specialty reinforcements, carbon fibers, fabrics, prepregs, polyurethane systems, structural adhesives, tooling materials, honeycomb, molding compounds, and laminates for various applications such as automotive, marine, commercial, and military aircraft, rail, wind turbine blades, and industrial applications. The engineered products segment focuses on manufacturing and marketing composite structures and precision-machined honeycomb parts, especially for the aerospace industry. In December 2021, Hexcel Corporation collaborated with Metyx, a producer of high-performance non-crimp fabric and woven glass and carbon materials for various industries such as marine, rail, automotive, wind energy, and construction. The collaboration aimed to produce high-performance carbon pultruded profiles using unidirectional carbon fiber and polyurethane (PU) resin.

List of Key Companies in Rail Composites Market

- 3A Composites Mobility

- AVIC Cabin Systems

- Avient Corporation

- BASF SE

- BFG International

- Dartford Composites Ltd

- Exel Composites

- Gurit Services AG

- Hexcel Corporation

- Kineco Limited

- Premier Composite Technologies LLC

- Solvay

- TORAY INDUSTRIES, INC.

Rail Composites Industry Developments

December 2019: ELG Carbon Fibre, a British company, in partnership with the University of Huddersfield’s Institute for Railway Research, introduced the carbon fiber bogie known as CAFIBO.

October 2023: Granite Peak Plastics, a plastic recycling company based in St. Louis, introduced Triton Ties, a series of fiber-reinforced polymer composite railroad ties.

June 2022: Kineco Ltd., a company based in Goa, delivered the composite train front (train nose) for the Vande Bharat Express, which is India's first semi-high-speed train. The train front was manufactured at the company's factory in Pilerne industrial estate and was delivered through Integral Coach Factory, Chennai.

Rail Composites Market Segmentation

By Fiber Type Outlook

- Carbon Fiber Composites

- Glass Fiber Composites

- Others

By Resin Type Outlook

- Epoxy

- Phenolic

- Polyester

- Vinyl Ester

- Others

By Manufacturing Process Outlook

- Compression Molding

- Filament Winding

- Injection Molding

- Lay-up

- Pultrusion

- RTM

- Others

By Application Outlook

- Exterior Components

- Interior components

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Rail Composites Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 1,652.6 million |

|

Market Size Value in 2024 |

USD 1,767.1 million |

|

Revenue Forecast in 2032 |

USD 3,040.7 million |

|

CAG |

7.0% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global rail composites market size was valued at USD 1,652.6 million in 2023 and is projected to grow to USD 3,040.7 million by 2032.

The global market registers a CAGR of 7.0% during the forecast period, 2024-2032.

North America had the largest share of the global market

The key players in the market are 3A Composites Mobility; AVIC Cabin Systems; Avient Corporation; BASF SE; BFG International; Dartford Composites Ltd; Exel Composites; Gurit Services AG; Hexcel Corporation; Kineco Limited; Premier Composite Technologies LLC; Solvay; and TORAY INDUSTRIES, INC.

The glass fiber composites segment held the highest share in the rail composites market in 2023.

The exterior components segment dominated the global market.