Rabies Veterinary Vaccines Market Share, Size, Trends, Industry Analysis Report

By Application (Companion Animals, Livestock Animals, Wildlife Animals); By Region; Segment Forecast, 2023 - 2032

- Published Date:Jan-2023

- Pages: 115

- Format: PDF

- Report ID: PM2968

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

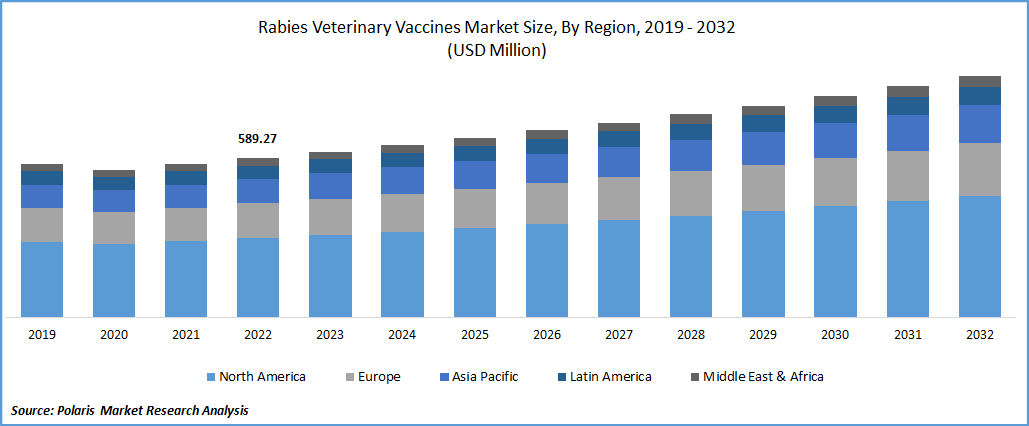

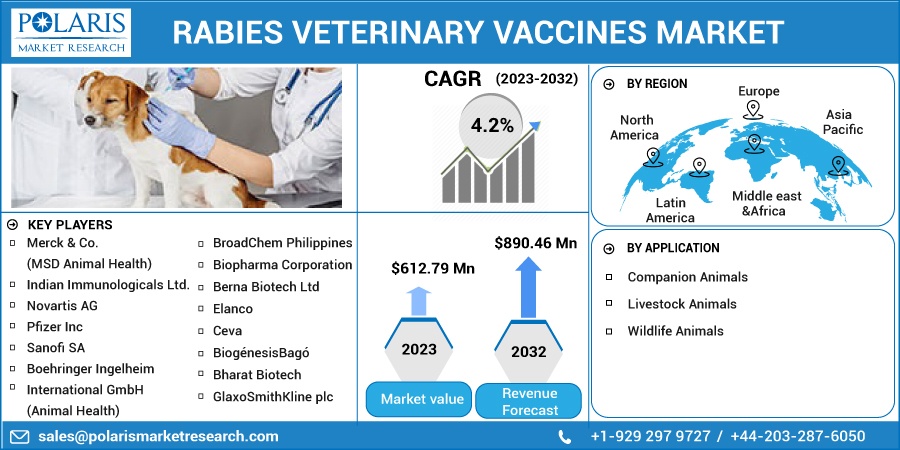

The global rabies veterinary vaccines market was valued at USD 589.27 million in 2022 and is expected to grow at a CAGR of 4.2% during the forecast period.

Growing awareness about the zoonotic disease, continuous development of veterinary vaccines & insurance coverage for rabies vaccination drives the market of rabies veterinary vaccines during the forecast period. Moreover, increasing government initiatives to contain the virus, rising wildlife rabies-eradication bait programs, mass dog vaccination campaigns, & significantly rising pet ownership rates in developing nations boost the market growth.

Know more about this report: Request for sample pages

Rabies is a viral illness that affects the central nervous system of animals (dogs, cats, foxes, and so on), including humans. The rabies virus is found in high concentrations in the saliva and brains of infected animals, most often dogs, and is spread through bites. In other areas, bats are a significant reservoir as well. A significant population of wildlife species can generate several chances for cross-species transmission, impacting primarily domestic animals and people. According to the World Organization for Animal Health, Rabies is a global danger, killing roughly 59,000 people each year, with a mortality rate of nearly 100% in humans and animals alike.

Rabies is a zoonotic virus because it spread between animals & humans. The incubation period Animal vaccinations limit disease transmission, protecting both animal & human health, critical given the public's reliance on such animals.

The pandemic of COVID-19 has had a huge impact on the market. The pandemic influenced many aspects of veterinary medicine, including immunizations. The 2020 dog vaccination program in Haiti has been suspended, and money has been moved to help the COVID-19 response. Research further said that COVID-19-related delays in dog vaccination efforts had been documented in other nations. However, the sector is gaining pace as veterinary care services resume throughout the world and rabies cases are rising amid the pandemic.

For example, during the COVID-19 pandemic, the Food and Agriculture Organization (FAO) announced a new policy on livestock production & the supply chain of animal products, in April 2020. As a result of lockdowns, virus-control measures, and general disregard for the animal industry, the initial impact of COVID-19 on market growth was negative; nevertheless, changes are projected to improve market growth in the coming years.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Market expansion will be aided by an increase in cases of rabies infection in people, coming from domestic dogs or other wild animals, or by close encounters with them when hiking and camping. The annual worldwide disease is estimated to be around USD 8.6 Bn. The Centers for Disease Control and Prevention (CDC) reported that wild animals and accounted for 92.4% of rabies cases in the U.S., while domestic animals accounted for approximately 48.7%.

Report Segmentation

The market is primarily segmented based on application, and region.

|

By Application |

By Region |

|

|

Know more about this report: Request for sample pages

The companion Animal segment is expected to witness the fastest growth

The Companion Animal segment is expected to dominate the market in the forecast period. The increasing number of people having pets is likely to augment the growth of the market. According to the American Veterinary Medical Association, In the US, Dog & cat numbers, as well as the percentages of homes owning dogs/cats, have climbed in recent years. Shelters have enabled pet acquisition, accounting for the 40% of cats & 38% of dogs, in 2020. Dogs will be owned by 45% of households, in 2020, up from 38%, in 2016. In 2020, the pet dog population was expected to be between 83.7 million & 88.9 million, rising 9%-16% from the previous year's estimation.

Cats will be owned by 26% of households in 2020, up from 25% at the end of 2016. That huge increase in pets in households boosts the market growth. Additionally, this deadly viral infection produces significant inflammation in the brain, which typically results in death. The only way to safeguard pets and their owners is to receive regular rabies vaccinations and boosters. Given the significant effect of this zoonotic neuroinvasive virus, several governments have enforced rabies vaccination for companion animals, supporting the rising rabies veterinary vaccines market revenue.

Due to expanding wildlife rabies vaccination programs in developed nations, the wildlife animal category is expected to grow at the fastest CAGR during the projected period. According to the Centers for Disease Control, approx. 5000 animal rabies cases are reported each year, 90% of those caused by wild animals. Rabid bats, for example, were documented in every state in the United States except Hawaii between 2013 and 2022.

The demand in North America is expected to witness significant growth

North America is expected to dominate the market. In 2022, North America led the market with a considerable revenue share. This is due to the existence of a big pet population, which results in high veterinary healthcare costs. According to CDC, anticipated yearly public health expenses in the United States for rabies disease diagnoses, prevention, and control range from USD 245 to USD 510 million.

Furthermore, private chains of veterinary practitioners & government organizations are working to expand the use of mass vaccination programs & oral wild-life rabies bait-vaccine campaigns to supplement the rabies eradication efforts which overall help in the growth of the market.

In 2022, Asia Pacific had the second-largest share and is expected to grow at the fastest rate throughout the forecast period. Rabies is one of Southeast Asia's biggest public health issues. China, India, and the majority of ASEAN nations are considered to have canine rabies endemic, with considerably more rabies-related cases each year. The high stray dog population is a key contributor to Asia's illness load.

Recently, the area has launched many plans to eradicate rabies by 2030, including mass dog vaccination campaigns implemented in conjunction with major players and government agencies. For example, as part of the rabies control implementation strategy, the Global Alliance for Rabies Control (GARC) & Boehringer Ingelheim have planned a mass-rabies vaccination campaign for 12,000 animals in the Philippines, Indonesia, Vietnam, & Malaysia, in April 2022. These variables are substantially influencing the market growth.

Competitive Insight

Some of the major players operating in the global market include Merck & Co. (MSD Animal Health), Indian Immunologicals Ltd., Novartis AG, Pfizer Inc, Sanofi SA, Boehringer Ingelheim International GmbH (Animal Health), BroadChem Philippines Biopharma Corporation, Berna Biotech Ltd, Elanco, Ceva, BiogénesisBagó, Bharat Biotech, GlaxoSmithKline plc.

Recent Developments

In June 2022, Ceva Sante Animale acquired Artemis Technologies, a Canadian maker of oral rabies vaccines. With ONRAB, which demonstrated favorable trial results for skunks & raccoons in the U.S., the business extended its veterinary vaccine offerings.

In August 2020, Bavarian Nordic announced the debut of Robert’s distribution & marketing in the U.S.

Rabies Veterinary Vaccines Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 612.79 million |

|

Revenue forecast in 2032 |

USD 890.46 million |

|

CAGR |

4.2% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Merck & Co. (MSD Animal Health), Indian Immunologicals Ltd., Novartis AG, Pfizer Inc, Sanofi SA, Boehringer Ingelheim International GmbH (Animal Health), BroadChem Philippines Biopharma Corporation, Berna Biotech Ltd, Elanco, Ceva, BiogénesisBagó, Bharat Biotech, GlaxoSmithKline plc. |

FAQ's

key companies are Merck & Co. (MSD Animal Health), Indian Immunologicals Ltd., Novartis AG, Pfizer Inc, Sanofi SA, Boehringer Ingelheim International GmbH (Animal Health), BroadChem Philippines Biopharma Corporation, Berna Biotech Ltd, Elanco, Ceva, BiogénesisBagó, Bharat Biotech

The global rabies veterinary vaccines market expected to grow at a CAGR of 4.2% during the forecast period.

key segments are application, and region.

key driving factor are Rising cases of rabies infection in people.

Rabies Veterinary Vaccines Market Size Worth $890.46 Million By 2032